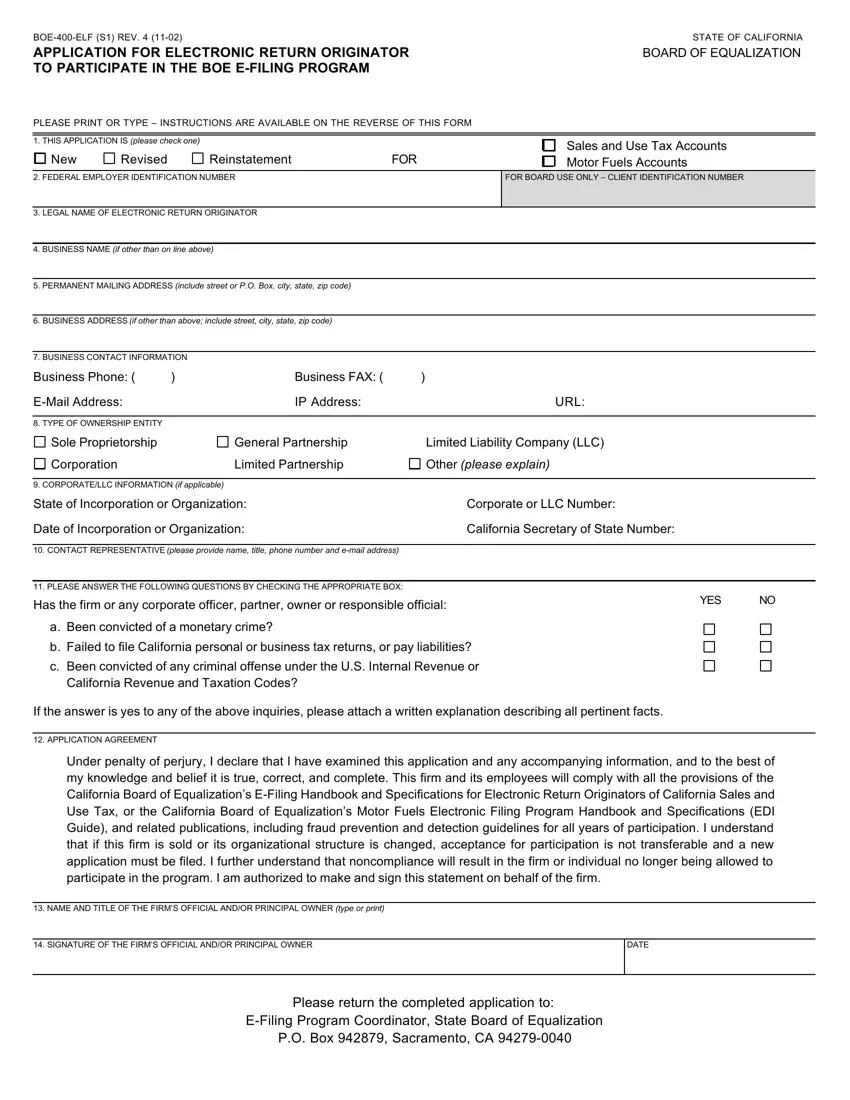

BOE400ELF (S1) REV. 4 (1102) |

STATE OF CALIFORNIA |

APPLICATION FOR ELECTRONIC RETURN ORIGINATOR |

BOARD OF EQUALIZATION |

TO PARTICIPATE IN THE BOE EFILING PROGRAM |

|

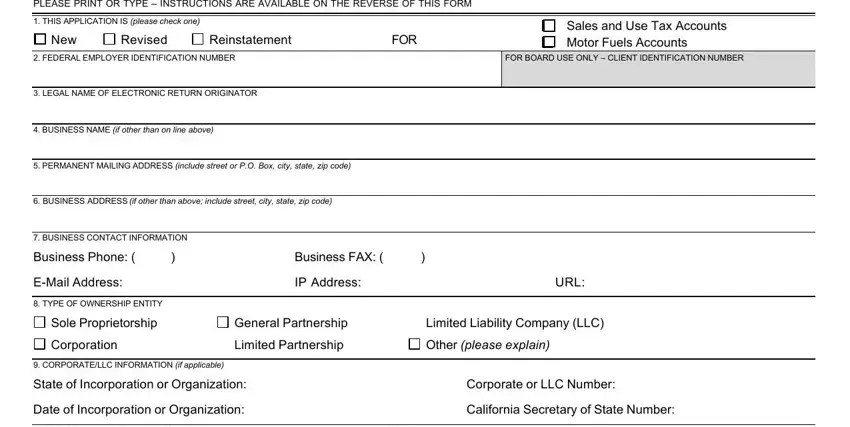

PLEASE PRINT OR TYPE – INSTRUCTIONS ARE AVAILABLE ON THE REVERSE OF THIS FORM |

|

1. THIS APPLICATION IS (please check one)

Sales and Use Tax Accounts Motor Fuels Accounts

2. FEDERAL EMPLOYER IDENTIFICATION NUMBER |

FOR BOARD USE ONLY – CLIENT IDENTIFICATION NUMBER |

|

|

3.LEGAL NAME OF ELECTRONIC RETURN ORIGINATOR

4.BUSINESS NAME (if other than on line above)

5.PERMANENT MAILING ADDRESS (include street or P.O. Box, city, state, zip code)

6.BUSINESS ADDRESS (if other than above; include street, city, state, zip code)

7.BUSINESS CONTACT INFORMATION

Business Phone: ( |

) |

Business FAX: ( |

) |

EMail Address: |

|

IP Address: |

URL: |

|

|

|

|

8. TYPE OF OWNERSHIP ENTITY |

|

|

|

Sole Proprietorship

Corporation

General Partnership Limited Partnership

Limited Liability Company (LLC)

Other (please explain)

9. CORPORATE/LLC INFORMATION (if applicable) |

|

|

State of Incorporation or Organization: |

Corporate or LLC Number: |

|

Date of Incorporation or Organization: |

California Secretary of State Number: |

|

|

|

|

10. CONTACT REPRESENTATIVE (please provide name, title, phone number and email address) |

|

|

|

|

|

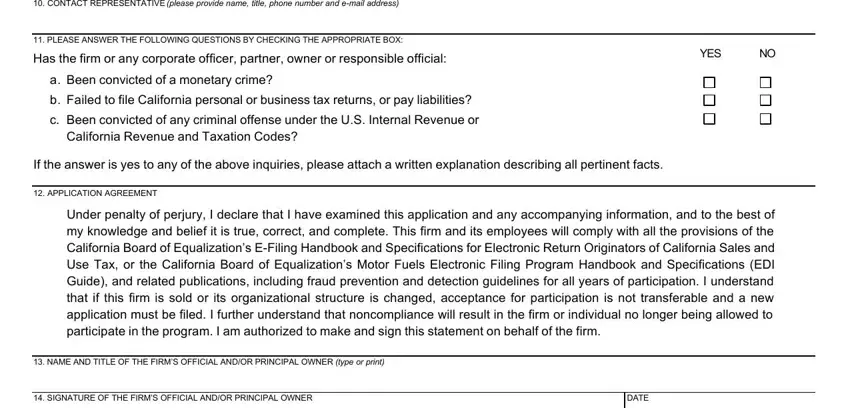

11. PLEASE ANSWER THE FOLLOWING QUESTIONS BY CHECKING THE APPROPRIATE BOX: |

|

|

Has the firm or any corporate officer, partner, owner or responsible official: |

YES |

NO |

|

|

a. Been convicted of a monetary crime?

b. Failed to file California personal or business tax returns, or pay liabilities? c. Been convicted of any criminal offense under the U.S. Internal Revenue or

California Revenue and Taxation Codes?

If the answer is yes to any of the above inquiries, please attach a written explanation describing all pertinent facts.

12. APPLICATION AGREEMENT

Under penalty of perjury, I declare that I have examined this application and any accompanying information, and to the best of my knowledge and belief it is true, correct, and complete. This firm and its employees will comply with all the provisions of the California Board of Equalization’s EFiling Handbook and Specifications for Electronic Return Originators of California Sales and Use Tax, or the California Board of Equalization’s Motor Fuels Electronic Filing Program Handbook and Specifications (EDI Guide), and related publications, including fraud prevention and detection guidelines for all years of participation. I understand that if this firm is sold or its organizational structure is changed, acceptance for participation is not transferable and a new application must be filed. I further understand that noncompliance will result in the firm or individual no longer being allowed to participate in the program. I am authorized to make and sign this statement on behalf of the firm.

13. NAME AND TITLE OF THE FIRM’S OFFICIAL AND/OR PRINCIPAL OWNER (type or print)

14. SIGNATURE OF THE FIRM’S OFFICIAL AND/OR PRINCIPAL OWNER |

DATE |

|

|

Please return the completed application to:

EFiling Program Coordinator, State Board of Equalization

P.O. Box 942879, Sacramento, CA 942790040

BOE400ELF (S2) REV. 4 (1102) |

STATE OF CALIFORNIA |

APPLICATION FOR ELECTRONIC RETURN ORIGINATOR |

BOARD OF EQUALIZATION |

TO PARTICIPATE IN THE BOE EFILING PROGRAM |

|

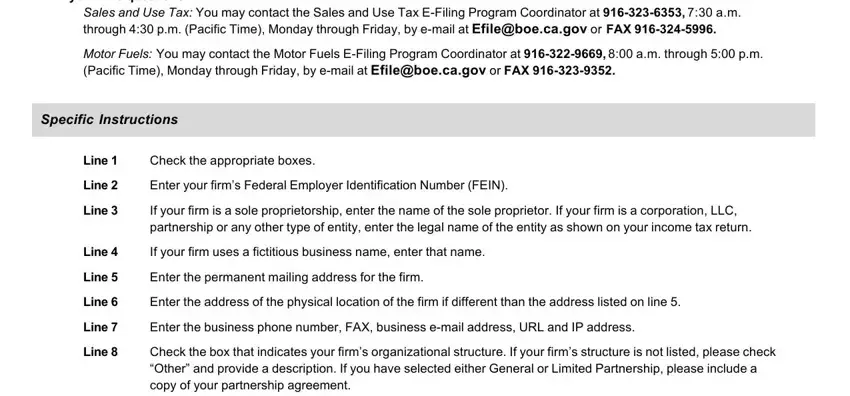

INSTRUCTIONS

General Information

Who needs to file

To become an Electronic Return Originator as defined in the California Board of Equalization’s EFiling publications, you must submit your application and complete system testing prior to transmitting your first transaction.

Where to file |

|

Send your completed application to: |

EFiling Program Coordinator |

|

State Board of Equalization |

|

P.O. Box 942879 |

|

Sacramento, CA 942790040 |

If you have questions

Sales and Use Tax: You may contact the Sales and Use Tax EFiling Program Coordinator at 9163236353, 7:30 a.m. through 4:30 p.m. (Pacific Time), Monday through Friday, by email at Efile@boe.ca.gov or FAX 9163245996.

Motor Fuels: You may contact the Motor Fuels EFiling Program Coordinator at 9163229669, 8:00 a.m. through 5:00 p.m. (Pacific Time), Monday through Friday, by email at Efile@boe.ca.gov or FAX 9163239352.

Specific Instructions

Line 1 Check the appropriate boxes.

Line 2 Enter your firm’s Federal Employer Identification Number (FEIN).

Line 3 If your firm is a sole proprietorship, enter the name of the sole proprietor. If your firm is a corporation, LLC, partnership or any other type of entity, enter the legal name of the entity as shown on your income tax return.

Line 4 If your firm uses a fictitious business name, enter that name.

Line 5 Enter the permanent mailing address for the firm.

Line 6 Enter the address of the physical location of the firm if different than the address listed on line 5. Line 7 Enter the business phone number, FAX, business email address, URL and IP address.

Line 8 Check the box that indicates your firm’s organizational structure. If your firm’s structure is not listed, please check “Other” and provide a description. If you have selected either General or Limited Partnership, please include a copy of your partnership agreement.

Line 9 If your firm is a corporation or LLC, please enter the state in which you are incorporated or formed the LLC, the date it became effective and your corporate or LLC number. Corporations doing business in California are required to register with the California Secretary of State. Please provide the number assigned by them.

Line 10 Enter the name, title, phone number and email address of the person you have designated as the contact for this program .

Line 11 Answer “Yes” or “No” as appropriate. If “Yes,” please provide a written explanation. Monetary crimes include, but are not limited to: money laundering, embezzlement, stock fraud, etc.

Line 12 No additional information is required. Please read this section carefully prior to signing this application.

Lines 13 The person authorized to act and sign for the firm in legal matters should complete these lines. An and 14 original signature is required to complete this application.