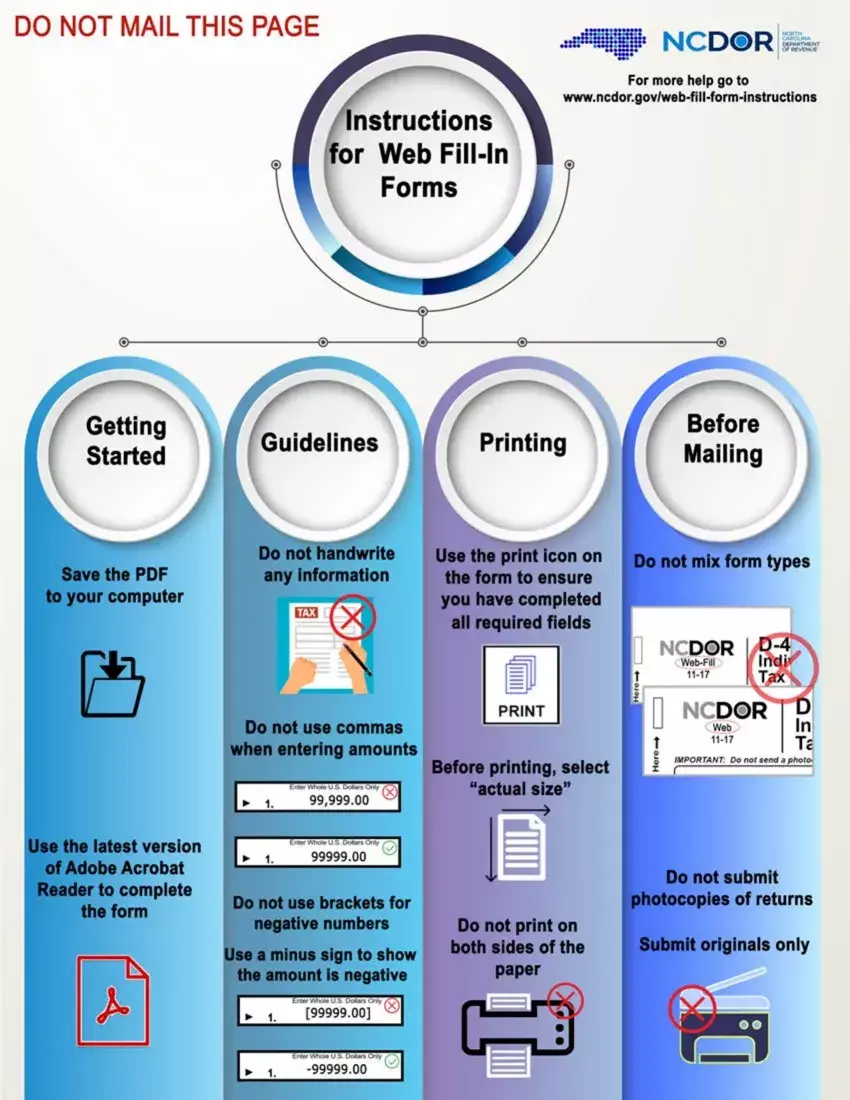

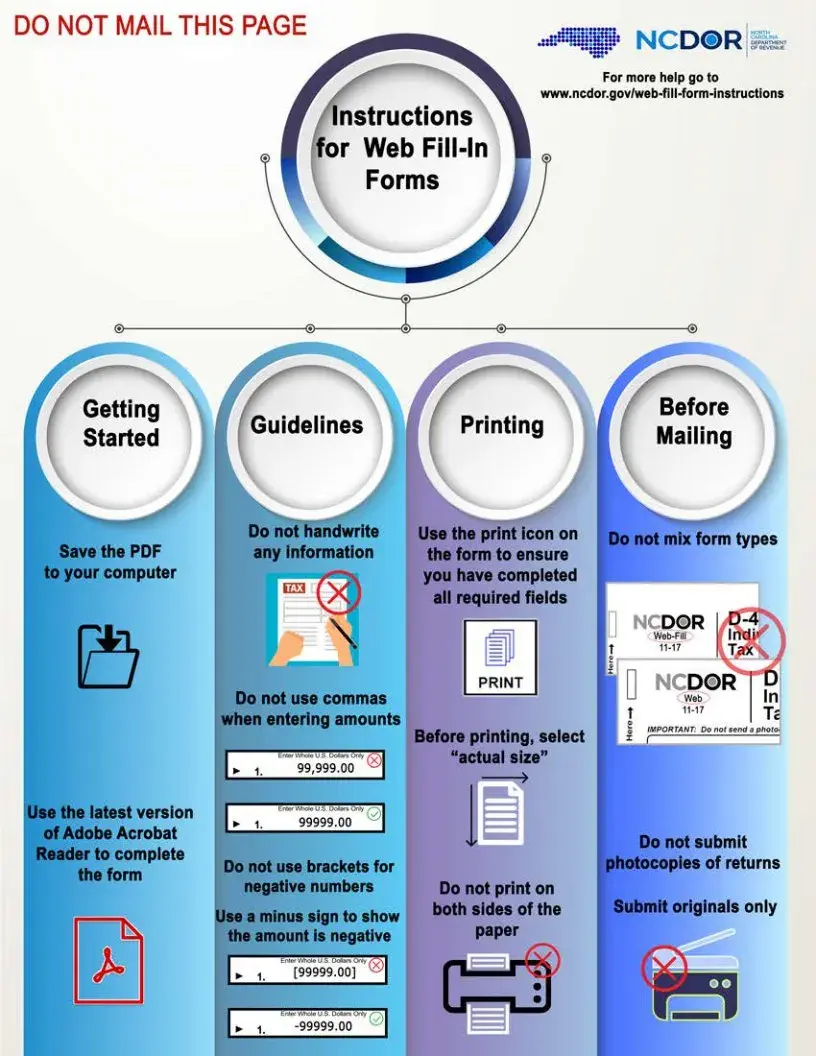

The ncdor form d 400 completing process is effortless. Our PDF tool allows you to use any PDF file.

Step 1: Look for the button "Get Form Here" on the webpage and select it.

Step 2: Now you are on the file editing page. You may enhance and add text to the form, highlight specified content, cross or check specific words, include images, put a signature on it, delete unneeded areas, or remove them completely.

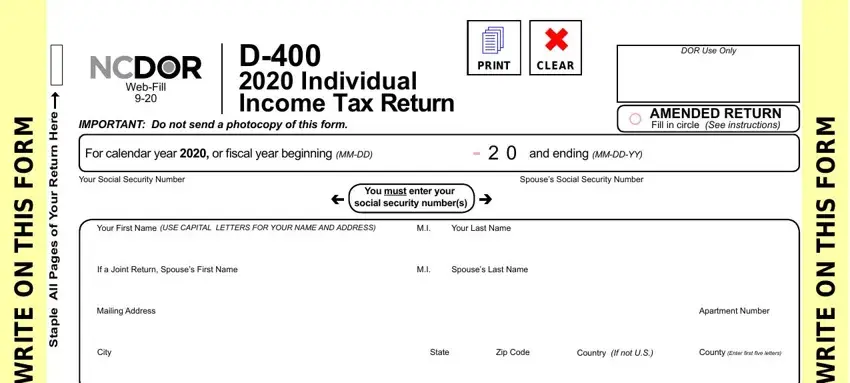

Create the ncdor form d 400 PDF and enter the information for each section:

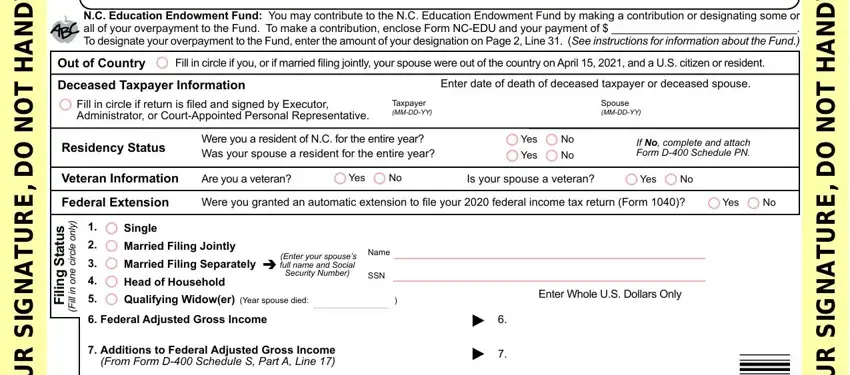

You should submit the NC Education Endowment Fund You, Out of Country, Fill in circle if you or if, Deceased Taxpayer Information, Enter date of death of deceased, Fill in circle if return is filed, Taxpayer MMDDYY, Spouse MMDDYY, Residency Status, Were you a resident of NC for the, Yes, Yes, If No complete and attach Form D, Veteran Information, and Are you a veteran area with the required information.

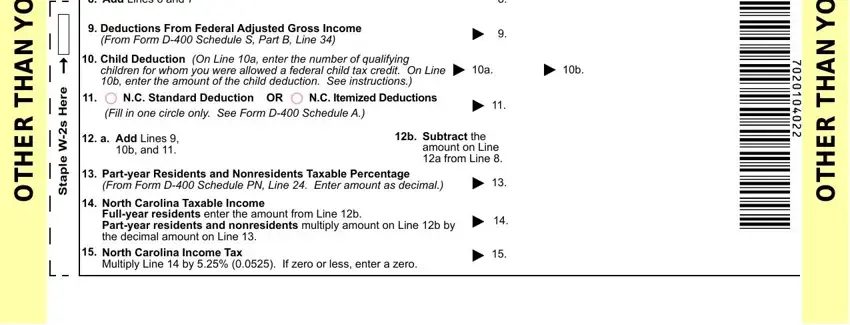

It's essential to note specific data in the field Add Lines and, Deductions From Federal Adjusted, From Form D Schedule S Part B Line, Child Deduction On Line a enter, NC Standard Deduction OR, NC Itemized Deductions, Fill in one circle only See Form D, a Add Lines b and, b Subtract the, amount on Line a from Line, Partyear Residents and, North Carolina Taxable Income, North Carolina Income Tax, Multiply Line by If zero or, and e r e H s W e l p a t S.

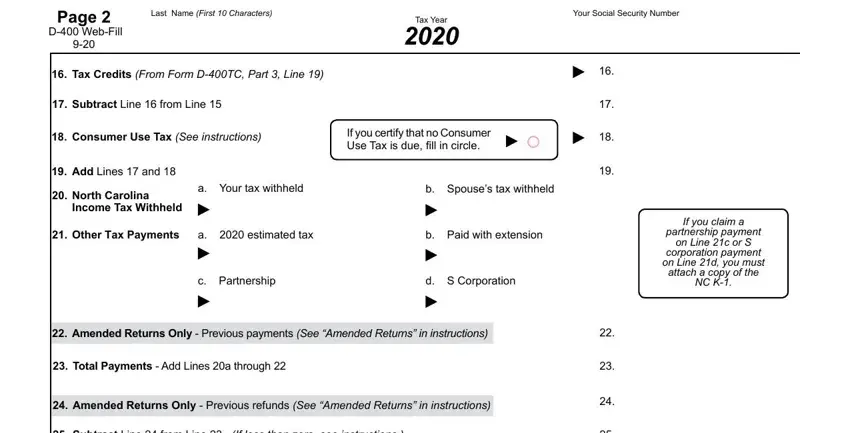

The Page D WebFill, Last Name First Characters, Tax Year, Your Social Security Number, If you claim a partnership payment, Tax Credits From Form DTC Part, Subtract Line from Line, Consumer Use Tax See instructions, If you certify that no Consumer, Add Lines and, North Carolina Income Tax Withheld, a Your tax withheld, b Spouses tax withheld, Other Tax Payments, and a estimated tax segment will be applied to list the rights or responsibilities of both sides.

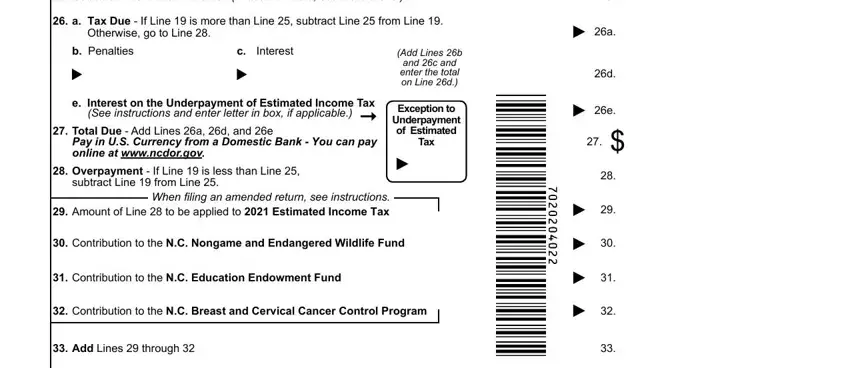

Finalize by taking a look at the following sections and completing them accordingly: Subtract Line from Line If less, a Tax Due If Line is more than, b Penalties, c Interest, e Interest on the Underpayment of, Overpayment If Line is less than, When filing an amended return see, Add Lines b and c and enter the, Exception to Underpayment of, Contribution to the NC Nongame, Contribution to the NC Education, Contribution to the NC Breast and, and Add Lines through.

Step 3: Select the Done button to make sure that your completed document can be transferred to any gadget you pick out or delivered to an email you indicate.

Step 4: It could be safer to maintain duplicates of the document. You can rest easy that we won't share or see your data.

10a.

10a. 10b.

10b.

When filing an amended return, see instructions.

When filing an amended return, see instructions.