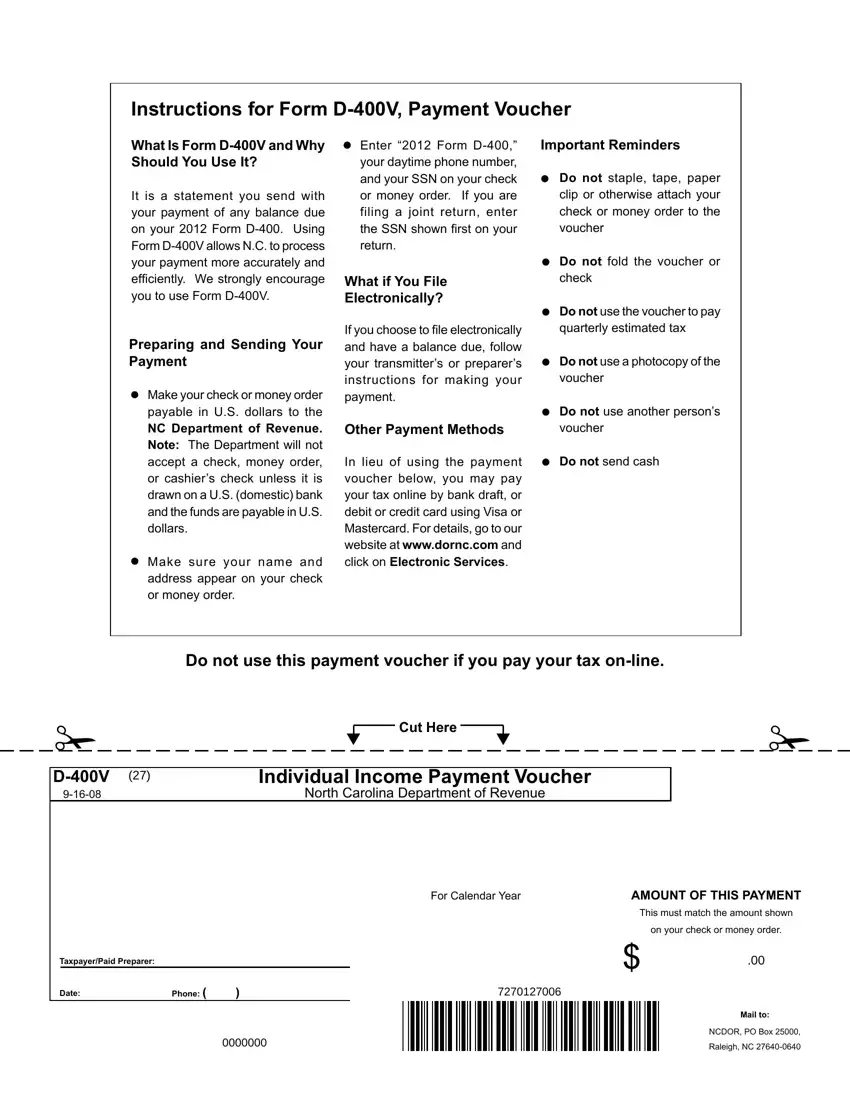

Our leading developers worked hard to implement the PDF editor we're happy to present to you. Our app enables you to instantly create ncdor d 400v payment voucher and will save you your time. You just need to comply with the following guide.

Step 1: Click the orange button "Get Form Here" on the webpage.

Step 2: Now you are on the file editing page. You can edit, add text, highlight specific words or phrases, put crosses or checks, and include images.

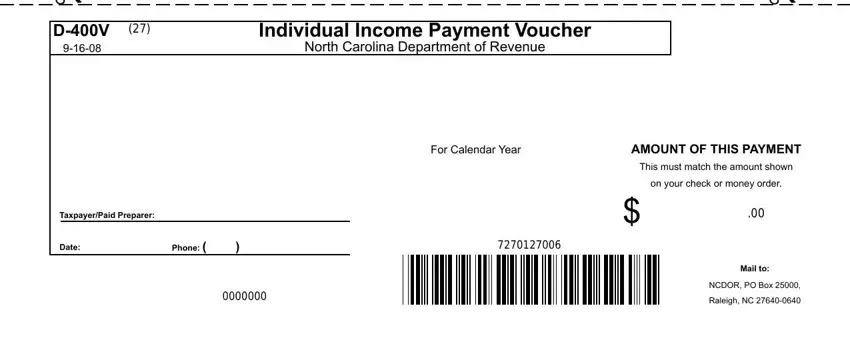

Feel free to enter the following information to create the ncdor d 400v payment voucher PDF:

Step 3: Hit the Done button to save your form. So now it is obtainable for upload to your gadget.

Step 4: To prevent yourself from probable upcoming problems, make sure you obtain at the very least a few copies of any file.