Using PDF documents online is simple with this PDF tool. You can fill in c declaration c3 form here effortlessly. To retain our tool on the forefront of convenience, we work to adopt user-oriented capabilities and improvements regularly. We're at all times thankful for any suggestions - join us in remolding how we work with PDF files. Getting underway is effortless! All you need to do is take these easy steps below:

Step 1: First, open the editor by clicking the "Get Form Button" above on this webpage.

Step 2: With the help of our handy PDF file editor, you could do more than simply fill out blank form fields. Try all the features and make your documents seem professional with custom textual content incorporated, or adjust the file's original input to excellence - all accompanied by an ability to insert any type of pictures and sign it off.

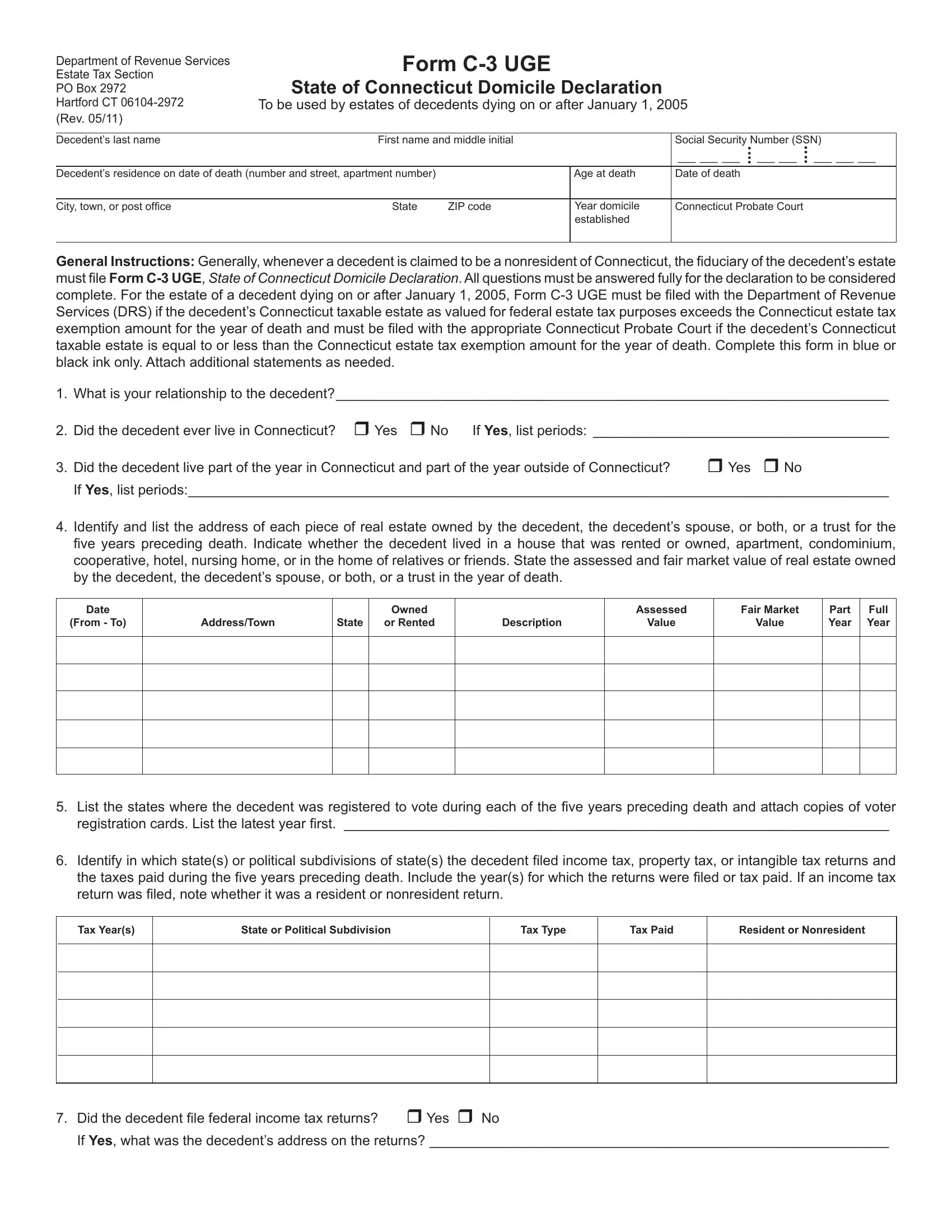

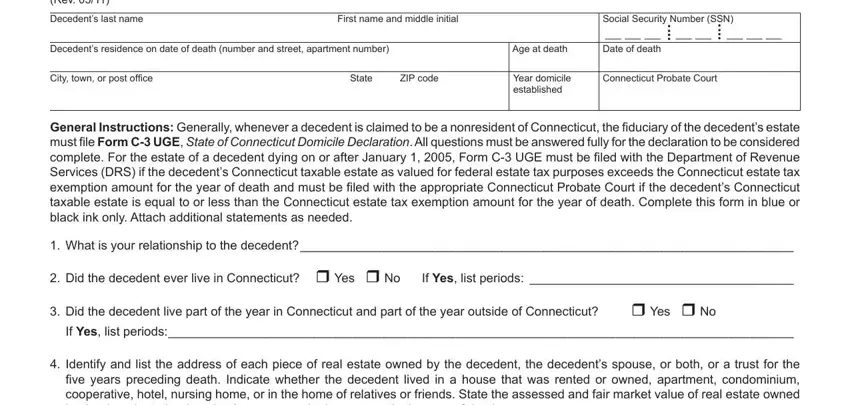

With regards to the fields of this precise form, here's what you need to know:

1. To begin with, once filling out the c declaration c3 form, start with the area that has the subsequent fields:

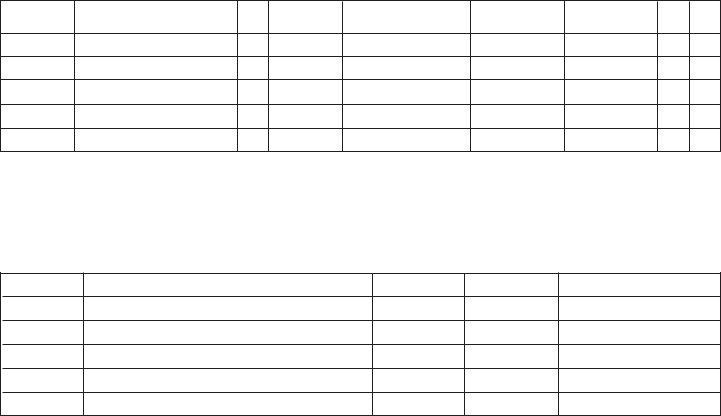

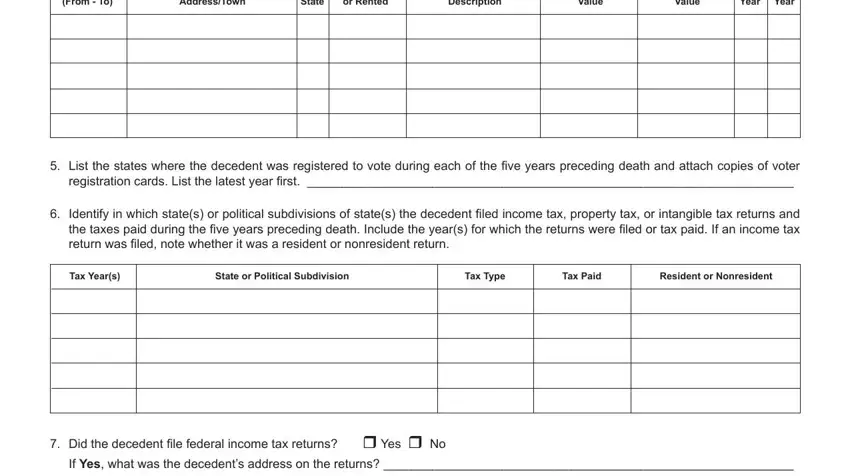

2. After finishing the last step, go to the subsequent step and fill out all required details in these blanks - From To, AddressTown, State, or Rented, Description, Value, Value, Part Full Year Year, List the states where the, registration cards List the latest, Identify in which states or, Tax Years, State or Political Subdivision, Tax Type, and Tax Paid.

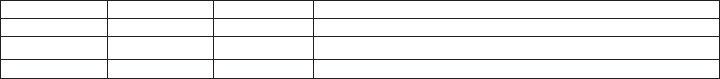

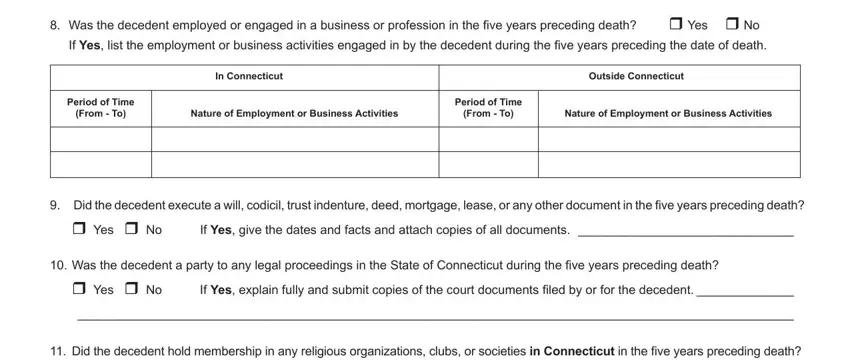

3. In this stage, take a look at Was the decedent employed or, In Connecticut, Outside Connecticut, Period of Time, From To, Nature of Employment or Business, Period of Time, From To, Nature of Employment or Business, Did the decedent execute a will, If Yes give the dates and facts, Was the decedent a party to any, and Did the decedent hold membership. Every one of these have to be filled out with greatest accuracy.

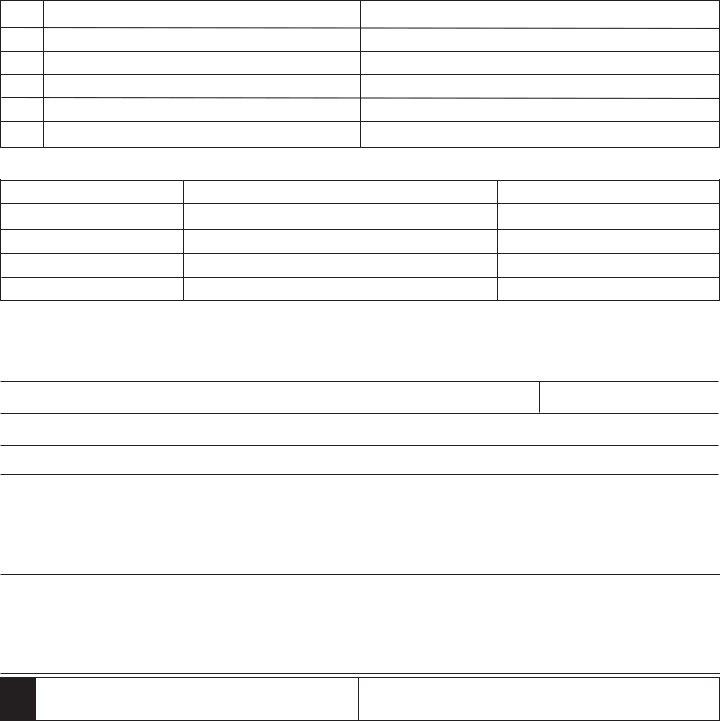

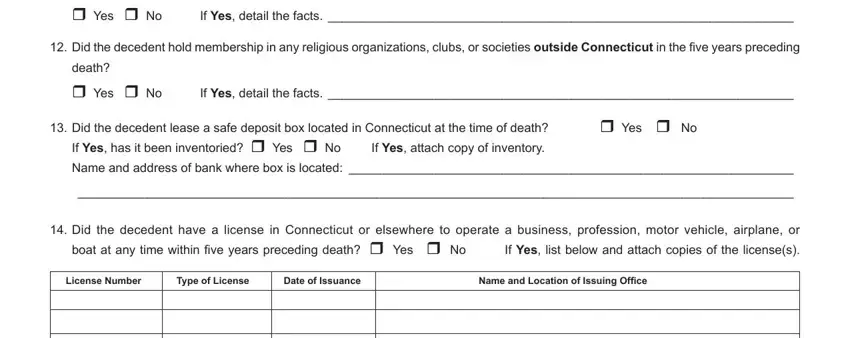

4. This fourth section comes next with the following blanks to look at: Did the decedent hold membership, If Yes detail the facts, Did the decedent hold membership, death, Yes No, If Yes detail the facts, Did the decedent lease a safe, If Yes has it been inventoried, Did the decedent have a license, License Number, Type of License, Date of Issuance, and Name and Location of Issuing Offi ce.

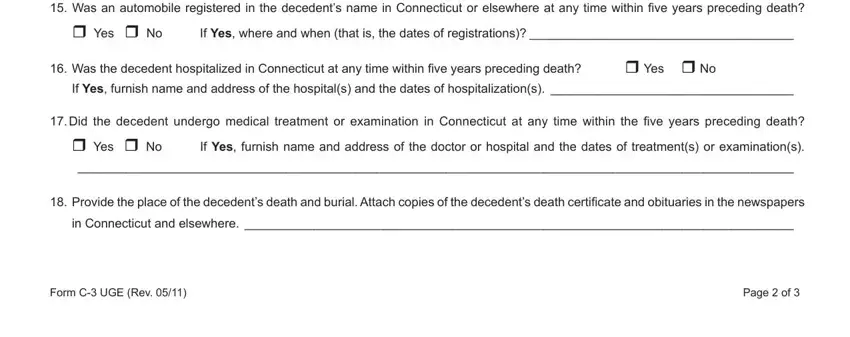

5. This very last step to conclude this document is pivotal. Make certain you fill in the required fields, and this includes Was an automobile registered in, If Yes where and when that is the, Was the decedent hospitalized in, If Yes furnish name and address of, Did the decedent undergo medical, If Yes furnish name and address of, Provide the place of the, in Connecticut and elsewhere, Form C UGE Rev, and Page of, prior to finalizing. Neglecting to accomplish that can end up in a flawed and probably unacceptable form!

Be very attentive while filling in If Yes furnish name and address of and in Connecticut and elsewhere, as this is the section where most people make errors.

Step 3: You should make sure your information is accurate and then click on "Done" to continue further. Sign up with FormsPal now and instantly access c declaration c3 form, available for downloading. All modifications you make are saved , so that you can change the file at a later stage if needed. FormsPal is invested in the personal privacy of our users; we make certain that all personal data processed by our system remains secure.