When you run a business, it is important to take advantage of every possible opportunity to save money. One way to do this is by using tax deductions. There are many different types of tax deductions available, and one of them is the form ol 3 deduction. This article will explain what the form ol 3 deduction is, how it works, and who can claim it. It will also provide some tips on how to make the most of this deduction. So if you are looking for ways to save money on your taxes, be sure to read this article!

| Question | Answer |

|---|---|

| Form Name | Form Ol 3 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | louisville form ol 3, ol 3 ez, louisville ol 3, louisville metro form ol 3 |

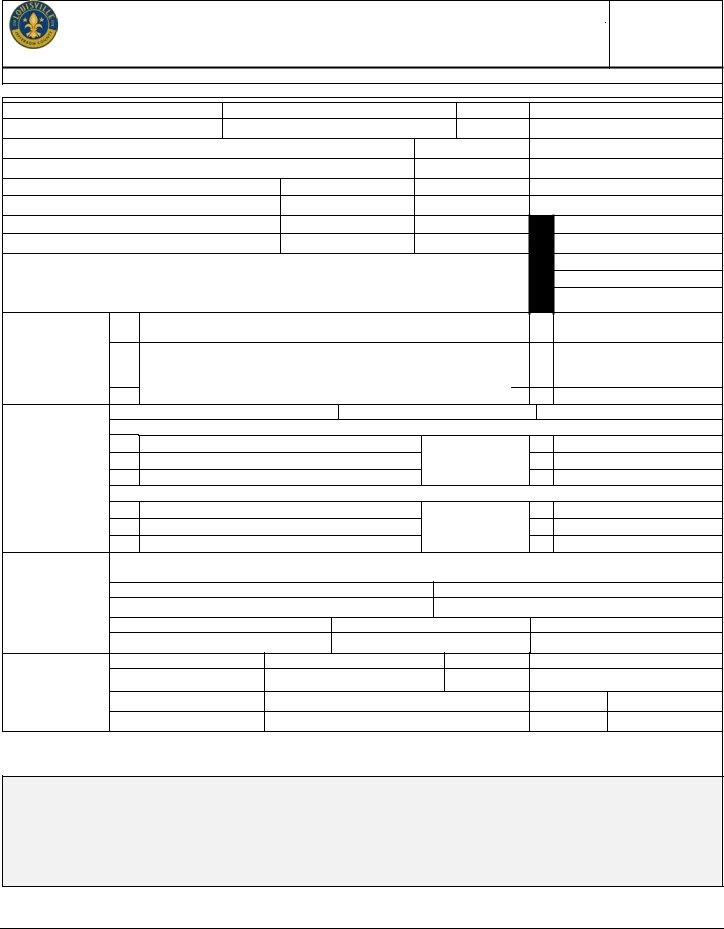

Louisville Metro Revenue Commission

Occupational License Tax Return

CHECK IF CHANGE IN ADDRESS IS BELOW

Last name |

First name |

|

MI |

Address (number and street) |

|

|

Unit/Apt. no. |

City, town or post office |

|

State |

Zip code |

|

Phone no. |

Ext. |

RETURN STATUS

2020

Form |

|

|

Social Security Number

Account ID

Tax Year Ending

No Activity

Amended Return

Final Return

BUSINESS CEASE DATE

Income or |

1. |

Amount of income per Federal Form 1099 (Attach a copy of Form 1099 or |

1. |

$ |

.00 |

|

||||||

(Loss) |

|

|

page 1 of 1040 reflecting other income reported) |

|

|

|

|

|||||

2. |

Gross salaries, wages, tips, etc. reported on Federal Form |

2. |

$ |

.00 |

|

|||||||

|

|

|||||||||||

|

|

|

amount of occupational taxes were not withheld, plus deferred |

|

|

|

|

|||||

|

|

|

compensation from 401 (K)/403 (B)/457 plans (Attach a copy of Form |

|

|

|

|

|||||

|

3. |

Add lines 1 and 2. This is your total income |

|

▶ |

3. |

$ |

.00 |

|

||||

Tax |

|

Do you live in Louisville Metro, Kentucky? |

|

Yes. Complete Section A only |

No. Complete Section B only. |

|||||||

Computation |

|

Section A. Residents of Louisville Metro, Kentucky |

|

|

|

|

|

|

||||

4a. |

Multiply Line 3 by (.0220). This is your Tax Due. |

|

4. |

$ |

.00 |

|

||||||

|

|

|

||||||||||

|

5a. |

Penalty and Interest (see instructions) |

|

|

A |

5. |

$ |

.00 |

|

|||

|

6a. |

Add lines 4 and 5. This is your Amount Due. ▶ |

|

|

6. |

$ |

.00 |

|

||||

|

|

Section B. |

|

|

|

|

||||||

|

|

4b. |

Multiply Line 3 by (.0145). This is your Tax Due. |

|

4. |

$ |

.00 |

|

||||

|

|

5b. |

Penalty and Interest (see instructions) |

|

|

B |

5. |

$ |

.00 |

|

||

|

|

6b. |

Add lines 4 and 5. This is your Amount Due. ▶ |

|

|

6. |

$ |

.00 |

|

|||

Signature |

|

I hereby certify, under penalty of perjury, that the information provided and the attached supporting schedules are true, |

|

|||||||||

|

correct, and complete to the best of my knowledge. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

|

|

Your signature |

|

|

|

|

Date |

|

|

|

|

|

|

|

Print/type your name |

|

|

Your title |

Daytime phone number |

|

|

||||

Preparer |

|

Print/Type preparer’s name |

Preparer’s signature |

|

Date |

PTIN |

|

|

|

|||

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name |

▶ |

|

|

|

|

Firm’s EIN ▶ |

|

|

||

|

|

Firm’s address |

▶ |

|

|

|

|

Phone no. ▶ |

|

|

||

IMPORTANT

ELECTRONIC FILING: Register for electronic filing. It is an easy, secure, and convenient way to file and pay taxes

https://www.metrorevenue.org.

Mail Form

return and payment of taxes due must be received or postmarked by April 15th to avoid penalties and interest.

MAILING ADDRESS: P.O. BOX 35410, LOUISVILLE, KENTUCKY

Telephone: (502)