We've applied the efforts of the best programmers to create the PDF editor you intend to work with. The software will permit you to fill out the C1275-1111 form with no trouble and don’t waste time. Everything you need to undertake is follow the next easy tips.

Step 1: The first task would be to click the orange "Get Form Now" button.

Step 2: Now it's easy to update your C1275-1111. The multifunctional toolbar will allow you to insert, eliminate, change, and highlight content or perhaps undertake similar commands.

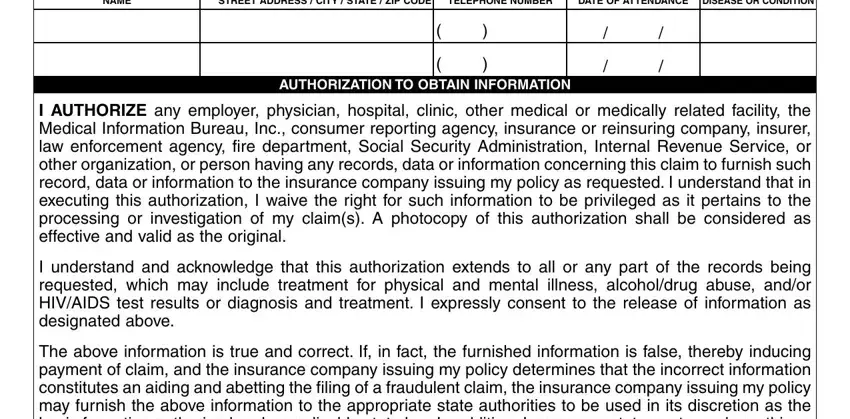

Provide the data requested by the software to prepare the form.

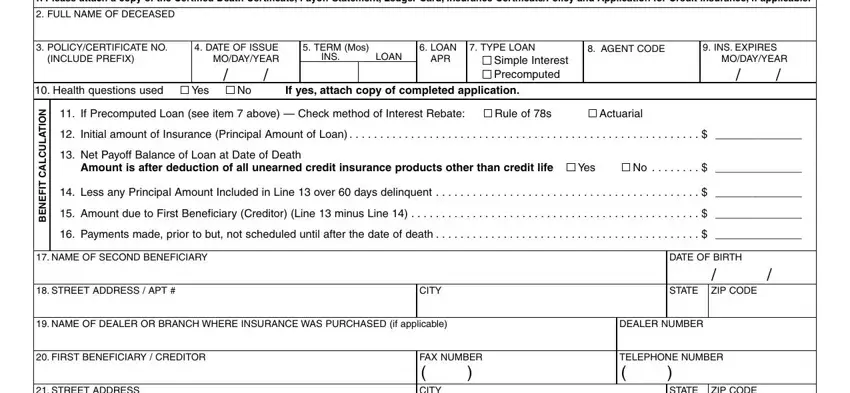

Put the requested details in the C CREDITORS STATEMENT Net, FULL NAME OF DECEASED, POLICYCERTIFICATE NO, INCLUDE PREFIX, DATE OF ISSUE MODAYYEAR, TERM Mos, INS, LOAN, LOAN APR, TYPE LOAN, AGENT CODE, INS EXPIRES, Simple Interest Precomputed, MODAYYEAR, and Health questions used Yes No If field.

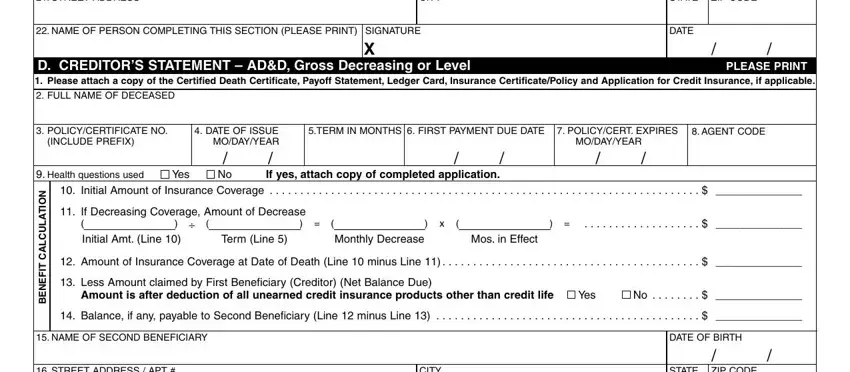

The program will request information to quickly submit the section STREET ADDRESS, NAME OF PERSON COMPLETING THIS, FAX NUMBER CITY, SIGNATURE X, STATE ZIP CODE, DATE, D CREDITORS STATEMENT ADD Gross, PLEASE PRINT, FULL NAME OF DECEASED, POLICYCERTIFICATE NO, INCLUDE PREFIX, Health questions used, DATE OF ISSUE MODAYYEAR, Yes No If yes attach copy of, and MODAYYEAR.

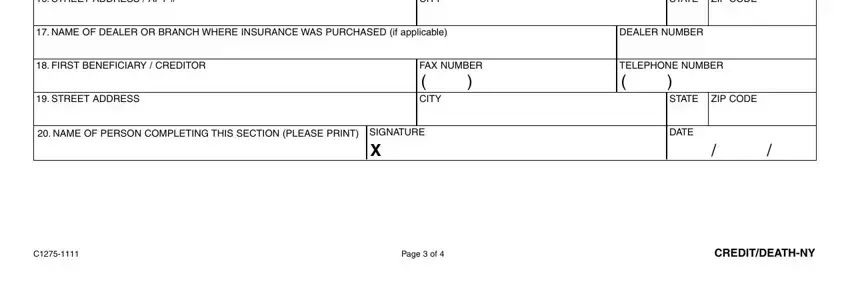

Describe the rights and obligations of the parties inside the field STREET ADDRESS APT, CITY, STATE ZIP CODE, NAME OF DEALER OR BRANCH WHERE, DEALER NUMBER, FIRST BENEFICIARY CREDITOR, STREET ADDRESS, NAME OF PERSON COMPLETING THIS, FAX NUMBER CITY, SIGNATURE X, TELEPHONE NUMBER, STATE ZIP CODE, DATE, Page of, and CREDITDEATHNY.

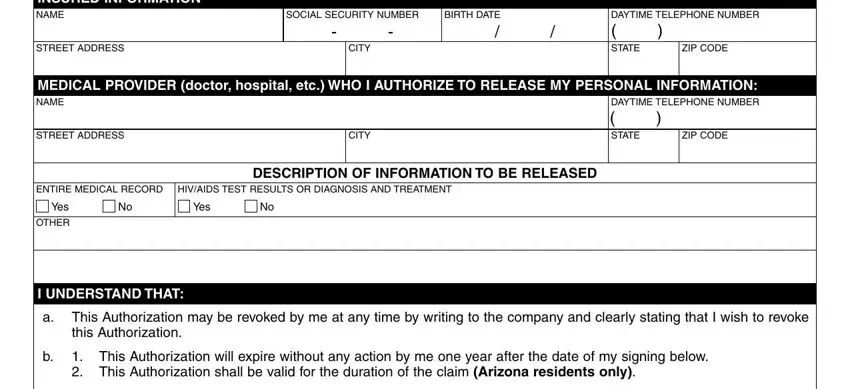

Look at the sections INSURED INFORMATION NAME, STREET ADDRESS, SOCIAL SECURITY NUMBER, BIRTH DATE, CITY, DAYTIME TELEPHONE NUMBER STATE, ZIP CODE, MEDICAL PROVIDER doctor hospital, STREET ADDRESS, ZIP CODE, CITY, ENTIRE MEDICAL RECORD, HIVAIDS TEST RESULTS OR DIAGNOSIS, DESCRIPTION OF INFORMATION TO BE, and Yes No and then complete them.

Step 3: Press the Done button to save the document. Now it is at your disposal for transfer to your gadget.

Step 4: To protect yourself from any hassles down the road, try to prepare as much as two or three copies of the file.