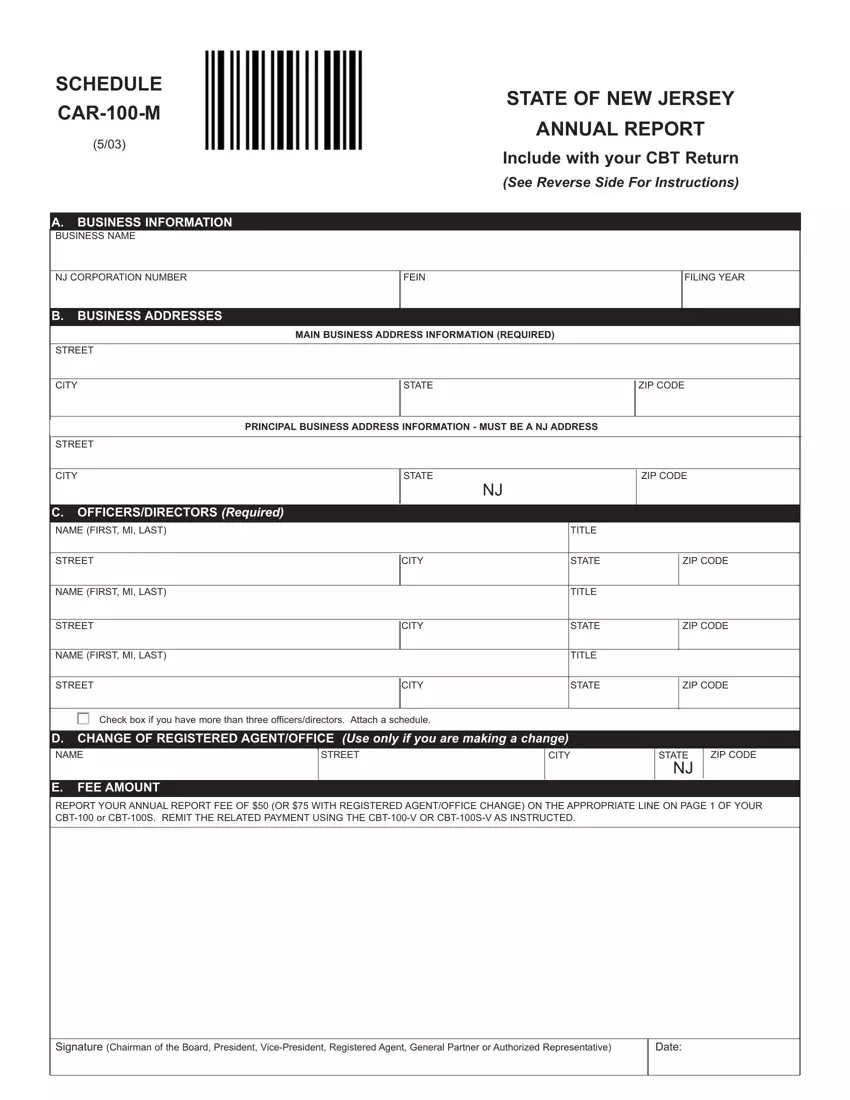

SCHEDULE

STATE OF NEW JERSEY

CAR-100-M

ANNUAL REPORT

(5/03)

Include with your CBT Return

(See Reverse Side For Instructions)

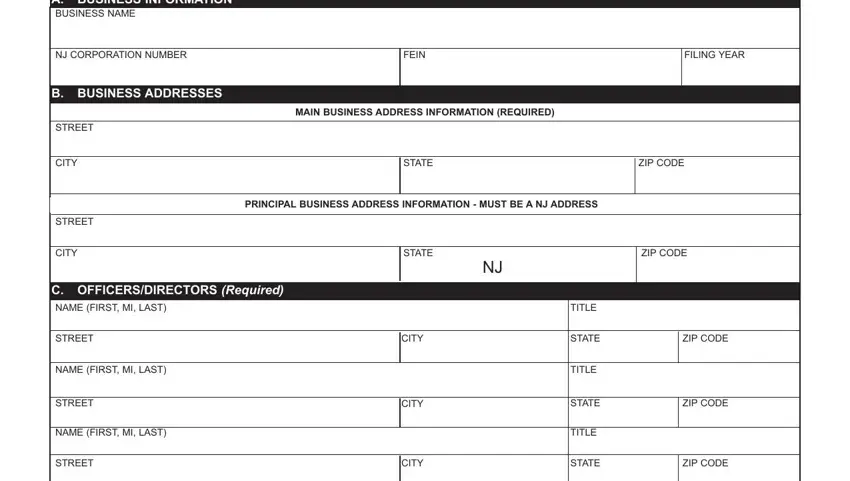

A.BUSINESS INFORMATION

BUSINESS NAME

NJ CORPORATION NUMBER

B.BUSINESS ADDRESSES

MAIN BUSINESS ADDRESS INFORMATION (REQUIRED)

PRINCIPAL BUSINESS ADDRESS INFORMATION - MUST BE A NJ ADDRESS

C.OFFICERS/DIRECTORS (Required)

NAME (FIRST, MI, LAST)

STREET

NAME (FIRST, MI, LAST)

STREET

NAME (FIRST, MI, LAST)

STREET

|

|

TITLE |

|

|

|

|

|

|

|

CITY |

STATE |

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

TITLE |

|

|

|

|

|

ZIP CODE |

|

|

|

|

CITY |

|

STATE |

|

|

|

|

|

|

|

|

TITLE |

|

|

CITY |

STATE |

|

ZIP CODE |

|

|

|

|

|

|

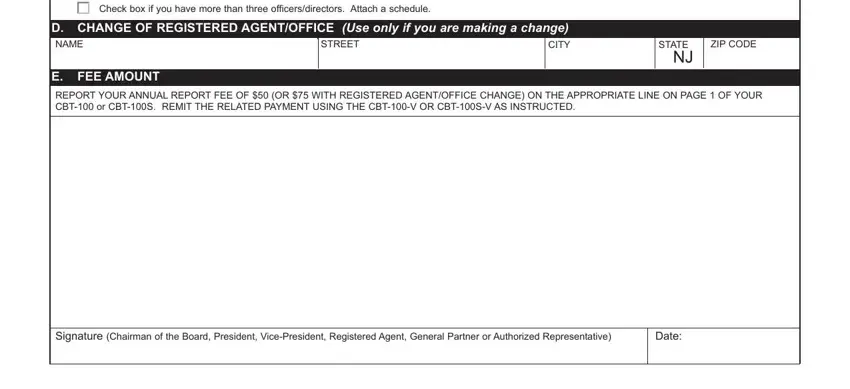

̊ Check box if you have more than three officers/directors. Attach a schedule.

D.CHANGE OF REGISTERED AGENT/OFFICE (Use only if you are making a change)

E.FEE AMOUNT

REPORT YOUR ANNUAL REPORT FEE OF $50 (OR $75 WITH REGISTERED AGENT/OFFICE CHANGE) ON THE APPROPRIATE LINE ON PAGE 1 OF YOUR CBT-100 or CBT-100S. REMIT THE RELATED PAYMENT USING THE CBT-100-V OR CBT-100S-V AS INSTRUCTED.

Signature (Chairman of the Board, President, Vice-President, Registered Agent, General Partner or Authorized Representative)

5/03

Instructions for Completing Annual Report (CAR-100-M)

Please read the following instructions and notices carefully before filling out your report.

A.Business Information and Fees Due

Business Name: This is the business name as shown on the State's Corporate Database.

NJ Corporation Number: This is the ten-digit ID number assigned by the State at the time the business was incorporated or reg- istered by the State's Commercial Recording Unit.

Federal Tax ID: This is the Federal Employer ID Number assigned by the Federal Government and entered on the State's tax registration system. If the number is incorrect, please contact the Client Registration Bureau at 609-292-1730 and request that the number be updated.

Filing Year: Indicates the calendar year for which you are filing the report. The filing year must be the same as the tax year print- ed on the CBT-100 or CBT-100S tax return.

Fees: The annual report filing fee is $50 for all filers. If you file a change of registered agent and/or office (Block D), you must pay an additional $25. Please insure that you remit the appropriate filing fees as part of your CBT payment and record the amount on the appropriate line of your CBT return. Do not remit fee with CAR-100-M. Your account will be credited for the filing fee with your CBT payment.

B.Business Addresses

Main Business Address (Required): Provide a complete, new address . A New Jersey address is not required here.

Principal Business Address (Optional): Provide a complete, new address. This address is reported if you maintain a business office in New Jersey other than the Main Business Address. A New Jersey address is required here.

C.Officers/Directors

List the names (First, MI, Last), titles and addresses for all officers, directors, trustees, members/managers or general partners, as applicable. You may use either home or office addresses.

D.Registered Agent/Office

Provide information only if you are changing your registered agent and/or office address. If you are making a change, enter the new agent name and/or address. If you are not making a change, leave these fields blank. If you are entering a new agent and/or office, remember that a registered agent may be an individual or a corporation duly registered and in good standing with the State of New Jersey. The registered office must be a New Jersey street address. A post office box may only be used if the street address is listed and both are in the same zip code. Any submission in this block requires the payment of the $25 agent change fee. See instruction A above.

E.Fee Amount

Report the correct amount as instructed on the appropriate line, page 1 of your CBT-100 or CBT-100S and remit the related pay- ment using the CBT-100-V or the CBT-100S-V as instructed. Do not attach payment to the Schedule CAR-100-M. If you are fil- ing a short period return (for six months or less), you need not remit the fee.

Signature

Have the appropriate party sign and date the annual report.

Important Notices:

1.Corporations, Limited Liability Companies, Limited Partnerships and Limited Liability Partnerships must submit a completed Annual Report. Failure to comply with this requirement for two consecutive years may result in the revocation of your business privilege in this State. Submission of a current year annual report does not guarantee that your account is up to date. See num- ber 2 below for instructions on how to verify your current business status and related information on file with the State.

2.To complete your annual report accurately, you may need to verify certain information about your business status, prior compli- ance with annual reporting and/or information currently on file with the State of New Jersey. To verify your business status (that is, whether you are active, revoked, etc.), the last date that you submitted an annual report, and/or business and registered agent address information currently on file, order a business status report from the Division of Revenue. Status reports are available online at www.accessnet.state.nj.us, or via the Commercial Recording Service Line at 609-292-9292 (Option 4, Status Report Service). Status reports are provided for a fee, payable by credit card or depository account. You may also verify your business name and business ID online, free of charge at the previously cited web address.

3.If you wish to dissolve, cancel or withdraw your business, you must file the proper forms. The annual report form cannot be used to deactivate a business. Likewise, if your business is inactive, revoked or voided, you must file the proper forms to reinstate or reestablish your good standing with the State. The annual report form cannot be used to reinstate a business. Call the Commercial Recording Service Line at 609-292-9292 (Option 2, Forms Line) to request the appropriate forms.