The Taxpayer filling in procedure is quick. Our editor enables you to use any PDF document.

Step 1: You should press the orange "Get Form Now" button at the top of this webpage.

Step 2: Now, you are on the file editing page. You may add content, edit present data, highlight specific words or phrases, put crosses or checks, add images, sign the document, erase unrequired fields, etc.

The next areas are included in the PDF form you will be creating.

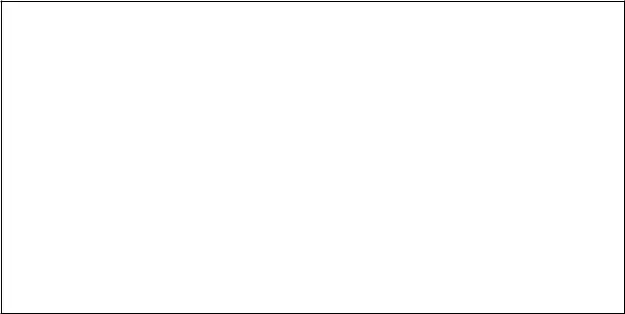

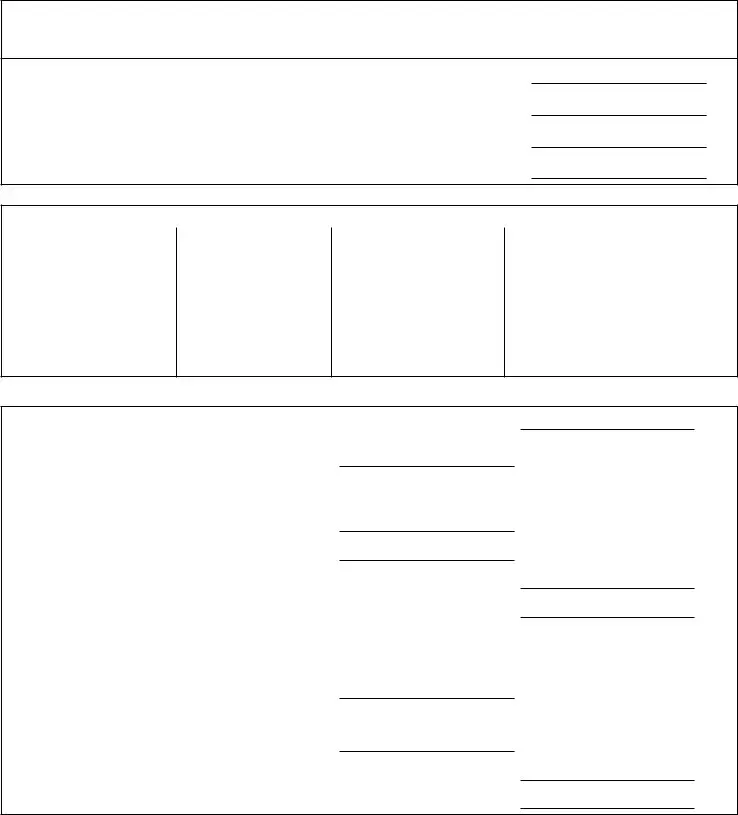

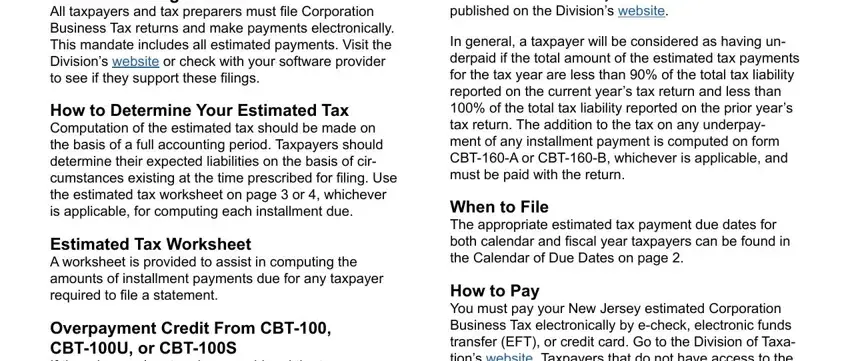

Fill in the How to Pay You must pay your New, If you are not currently enrolled, Overpayment Credit From CBT CBTU, and Calendar Year and Fiscal Year area with all the information required by the application.

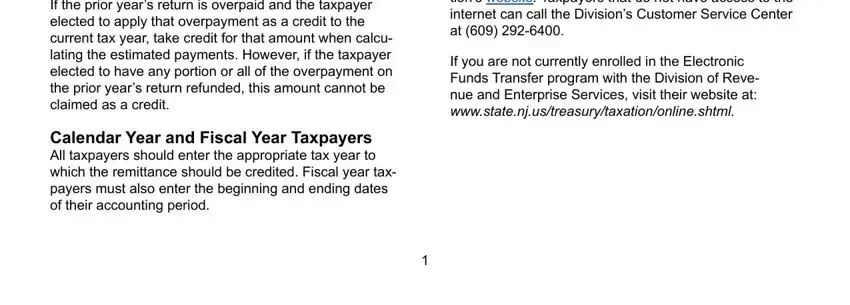

Describe the main details of the Estimated Tax Worksheet for, Total estimated tax for the, Voucher due enter of line, Voucher due enter of line, Voucher due enter of line, Voucher due enter of line, Voucher Number, a Date, b Amount, c Overpayment Credit From Last, d Total Amount Paid and Credited, Record of Estimated Tax Payments, and Total box.

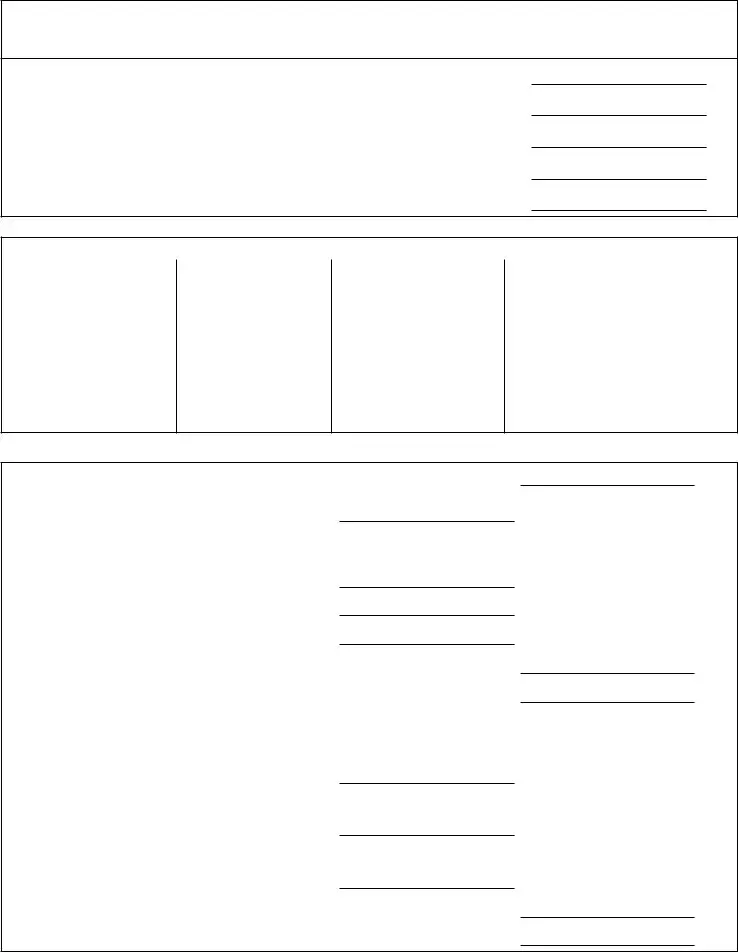

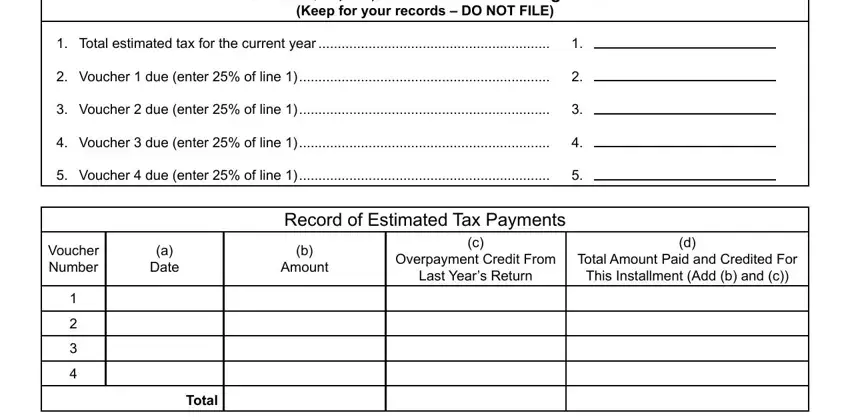

Take the time to record the rights and obligations of the parties in the Amended Computation Use if your, Enter the amended estimated tax, Less a Amount of overpayment, b Previous estimated tax payments, made this year, From Voucher, From Voucher, From Voucher, c Total lines a and b, Unpaid balance subtract line c, Unpaid balance to be paid as, a On Voucher if unused of, amended estimated tax line less, b On Voucher if unused of, and amended estimated tax line less part.

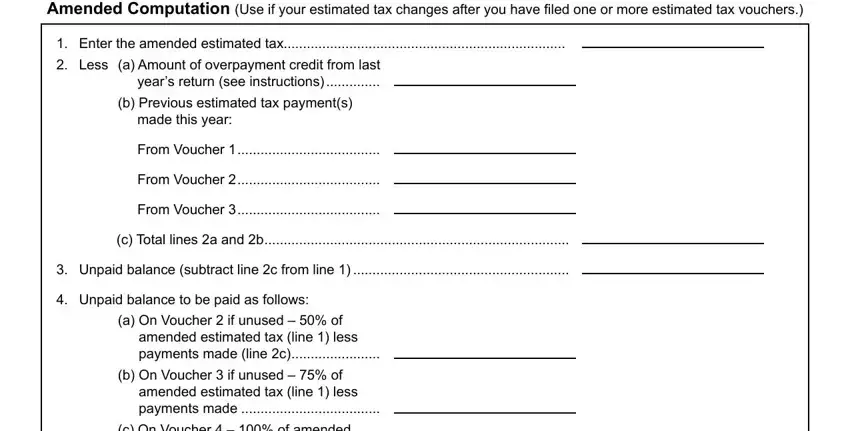

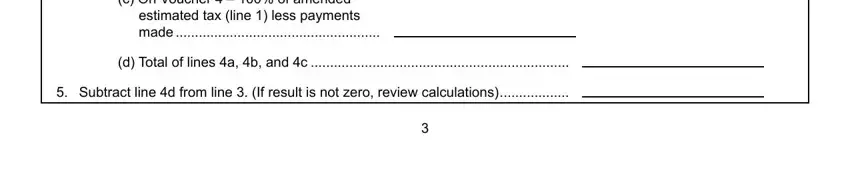

Finish by reviewing the next fields and preparing them accordingly: c On Voucher of amended, estimated tax line less payments, d Total of lines a b and c, and Subtract line d from line If.

Step 3: Select "Done". Now you can upload your PDF form.

Step 4: To prevent potential forthcoming difficulties, take the time to possess a minimum of two or more duplicates of every single document.