The CC form serves as a critical document under the Puducherry Value Added Tax Ordinance, 2007, specifically designed to streamline the audit process for dealers within this jurisdiction. It meticulously requires the examination of balance sheets and accounts including profit and loss statements for a specified financial year, ensuring that the details are in harmony with the books maintained at the dealer's head office and any branches. The form mandates auditors to report any observations, comments, discrepancies, or inconsistencies, ensuring a comprehensive audit is completed. Furthermore, it is tasked with the certification that proper books of accounts have been maintained, adequate audit returns have been submitted, and that the accounts in question accurately reflect the financial status of the dealer as of 31st March of the reported year. It mandates detailed disclosures about the assessee including names, business addresses, Tax Identification Number (TIN), and the type of business entity it operates as. The form also delves into specifics like assessment year, registration details, changes in the business constitution, details of purchase, stock transfer receipts, sales turnover under the Puducherry VAT and CST Act, 1956, alongside detailed input tax credit information, thereby playing a pivotal role in maintaining fiscal transparency and adherence to compliance norms.

| Question | Answer |

|---|---|

| Form Name | Form Cc |

| Form Length | 10 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 30 sec |

| Other names | c c form, form cc puducherry sales tax, cc form pdf, cc forms |

AUDIT REPORT UNDER SECTION 54 OF

THE PUDUCHERRY VALUE ADDED TAX ORDINANCE, 2007

(See rule 52)

I/We ………………………………… ……….. have examined the balance sheet as

at 31st March……………………….and the trading, profit and loss account / income and

expenditure account for the year ended on that date, attached herewith, of the

following dealer.

…………………………………………………………….. (Name of the dealer)

I/We ……………………………………………..certify that the balance sheet and

the trading, profit and loss account / income and expenditure account are in agreement with the books of account maintained at the head office at ……………………and

………………(branches).

(a)I/We ………………………………………….. report the following observations / comments / discrepancies / inconsistencies; (if any):

……………………………………………………………………………………………

(b)Subject to above,-

(A)I/We have obtained all the information and explanations which, to the best of my / our knowledge and belief were necessary for the purposes of the audit.

(B)In my / our opinion, proper books of accounts as required by law have been kept by the dealer, so far as it appears from our examination of those books and proper returns adequate for the purposes of audit have been received from the branches not visited by us. The Branch Auditor’s Report(s) have been forwarded to us and have been appropriately dealt with;

(C)In my / our opinion and to the best of my / our information and according to the explanations given to me / us, the said accounts, read with notes thereon, if any, give true and fair view:-

(i)in the case of the balance sheet, of the state of affairs of the assessee as at 31st March,…………………and

(ii)in the case of the trading, profit and loss account / income and expenditure account of the profit / loss or surplus / deficit of the assessee for the year ended on that date.

1. |

Name of the Assessee |

|

: |

…………………………………… |

|||||||||||

2. |

Address of Principal place of Business |

: |

…………………………………… |

||||||||||||

|

|

|

|

…………………………………… |

|||||||||||

3. |

Address of other place of business |

: |

……………………………………. |

||||||||||||

|

|

|

|

…………………………………….. |

|||||||||||

4. |

TIN |

: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

5. |

Status i.e. Sole Proprietor/ Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Firm / HUF / Company / Society / Trust/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Others (Specify) |

|

: |

…………………………………… |

|||||||||||

6. |

Assessment Year |

|

: |

…………………………………… |

|||||||||||

7.Whether the dealer has paid fee for the

renewal of Registration under rule 8 |

: Yes |

|

No |

|

8. |

Whether the dealer has paid fee for |

|

|

renewal of Fee for travelling salesman |

|

|

and Representative under rule 13(4) |

: Yes |

9.Whether any change in the constitution

of the business of the assessee took |

|

place during the year |

: Yes |

No

No

N.A.

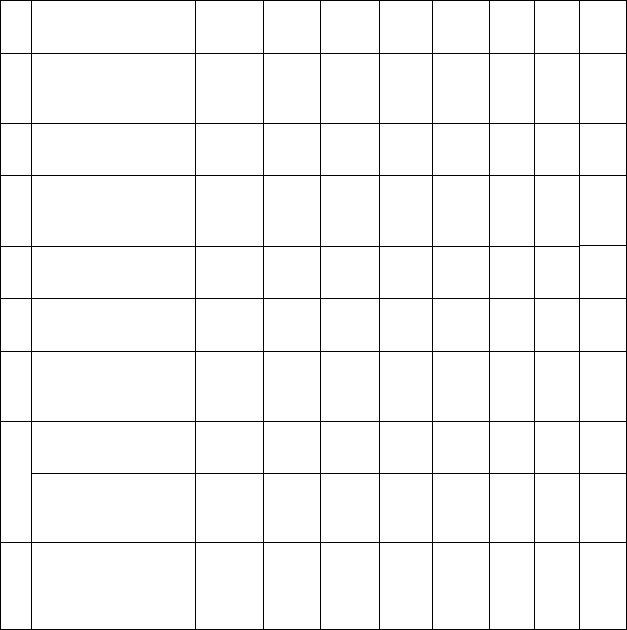

10.Specify purchase / stock transfer receipts details (Furnish

Sl. |

Category |

|

Turnover |

Tax |

No. |

|

Rs. |

Rs. |

|

|

|

|||

1. |

Exempted goods |

|

|

|

|

|

|

|

|

2. |

Goods taxable @ 1% |

|

|

|

|

|

|

|

|

3. |

Goods taxable @ 4% |

|

|

|

|

|

|

|

|

4. |

Goods taxable @ 12.5% |

|

|

|

|

|

|

|

|

5. |

Special rate Goods |

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

|

|

|

|

8. |

Import |

|

|

|

|

|

|

|

|

9. |

Others (Bought Note etc.,) |

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

11.Specify the sales turnover details under Puducherry Value Added Tax Ordinance, 2007: (Furnish

Sl. |

Category |

Turnover |

Tax |

|

No. |

Rs. |

Rs. |

||

|

1.Exempted goods

2.Goods subject to tax at the rate of 1% at sale point

3.Goods subject to tax at the rate of 1% on the last purchase

4.Goods subject to tax at the rate of 4% at sale point

5.Goods subject to tax at the rate of 4% at the first purchase point

6.Goods subject to tax at the rate of 4% at the last purchase point

7.Goods subject to tax at the rate of 12.5% at sale point

8.Goods subject to tax at the rate of 12.5% at the last purchase

9.Goods subject to tax at the rate of 20% at the first point of sale

10.Goods subject to tax at the rate of 35% at the first point of sale

11.Others (specify)

Total

12.Specify the sales turnover details under the CST Act, 1956 (Furnish commodity- wise

Sl. |

Category |

Turnover |

Tax |

|

No. |

Rs. |

Rs. |

||

|

||||

1. |

Interstate sales under section 8(1) |

|

|

|

|

|

|

|

|

2. |

Interstate sales under section 8(2) (a) |

|

|

|

|

|

|

|

|

3. |

Interstate sales under section 8(2) (b) |

|

|

|

|

|

|

|

|

4. |

Interstate sales under section 8(2) (c) |

|

|

|

|

|

|

|

|

5. |

Interstate sales under section 8(5) |

|

|

|

|

[Specify the notification] |

|

|

|

6. |

Sales under section 8(6) |

|

|

|

|

|

|

|

|

7. |

Exports under section 5(1) |

|

|

|

|

|

|

|

|

8. |

Imports under section 5(2) |

|

|

|

|

|

|

|

|

9. |

Penultimate exports under section 5(3) |

|

|

|

|

|

|

|

|

10. |

Stock transfer under section |

|

|

|

|

|

|

|

|

11. |

Transit sale under section 6(2) |

|

|

|

|

|

|

|

|

12. |

Others (Specify) |

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

13.I. Details of Input Tax Credit :- (Details in

Sl. |

|

|

|

|

|

Purchase/ |

ITC under the Puducherry Value Added Tax |

|||||

|

|

|

|

|

Sale value |

|

|

Ordinance,2007 |

|

|||

No. |

Details of Credit |

|

|

|

||||||||

excluding |

1% |

4% |

|

12.5% |

Others |

Total |

||||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

VAT |

|

(Specify) |

||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Rs. |

Rs. |

|

Rs. |

Rs. |

Rs. |

1 |

Opening Balance* |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||

|

Credit |

entitled |

on |

|

|

|

|

|

|

|

||

|

capital |

goods |

as |

|

|

|

|

|

|

|

||

2 |

provided |

u/r |

17(4) |

|

|

|

|

|

|

|

||

subject |

to |

17(14)(iv) |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

and 17(19)(iv) |

read |

|

|

|

|

|

|

|

|||

|

with sec.16 (2). |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

Credit |

entitled |

on |

|

|

|

|

|

|

|

||

3 |

purchase |

of |

taxable |

|

|

|

|

|

|

|

||

goods |

subject |

to |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

section 16(2) |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

Purchase Turnover |

|

|

|

|

|

|

|

||||

4 |

u/r.14(3) |

excluding |

|

|

|

|

|

|

|

|||

|

sugarcane |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

5 |

Output Tax |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Others |

|

|

|

|

|

|

- |

|

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

7 |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8Zero rated sale u/s 21 of PVAT

9Sale of exempted goods u/r 17(14)(i) and (iii)

10Local sale [u/s 4(2) of the CST Act, 1956]

11Sale of goods at concessional rate u/r 17(3) (v)(b)

12Others

13ITC Reversal

14Total of col.

(10 to 13)

Net VAT payable if column 14 exceeds column 7

15ITC carried forward if column 7 exceeds column 14

16Special Rate Tax due (if any) including tax due on purchase of sugarcane

* - For the year

14. |

Whether the dealer has paid the |

|

|

VAT / Sales Tax due on due date, |

|

|

if not paid, whether the dealer has |

|

|

paid applicable penalty for the delayed |

|

|

payment u/s. 37(4) |

: Yes |

15.Whether the dealer has deducted / paid

TDS u/r 30 |

: Yes |

16.Whether any tax / penalty / fees which have

not reported on account of any dispute |

|

under PVAT Ordinance, 2007 / CST Act, |

|

1956. |

: Yes |

17.Whether the dealer is regular in depositing

with appropriate authorities in the U.T. of |

|

|

Puducherry undisputed statutory dues |

, |

|

income tax, VAT / sales tax , wealth tax, |

|

|

custom duty, excise duty, cess and other |

|

|

material statutory dues applicable to it. |

: |

Yes |

18. Whether according to the information and |

|

|

explanations given, any undisputed |

|

|

amounts payable in respect of income tax, |

|

|

wealth tax, sales tax / VAT in other States, |

|

|

customs duty, excise duty and cess were in |

|

|

arrears, as at ……… for a period of more |

|

|

than six months from the date they became |

|

|

payable. |

: |

Yes |

19.Whether according to the information and

|

explanation given, are there any |

|

|

|

|

dues of Sales Tax / VAT in other States, |

|

|

|

|

income tax, customs duty, wealth tax, excise |

|

|

|

|

duty and cess which have not been deposited |

|

|

|

|

on account of any dispute. |

: |

Yes |

|

20. |

Whether the dealer is having any arrear of tax |

: |

Yes |

|

|

PVAT / CST |

|

|

|

21. |

(a) In the case of a trading concern, give |

|

|

|

|

|

quantitative details of principal items of |

|

|

|

|

goods traded: |

|

|

|

(i) |

Opening Stock; |

|

|

|

(ii) |

Purchases during the year; |

|

|

|

(iii) |

Sales during the year; |

|

|

|

(iv) |

Closing stock; |

|

|

|

(v) |

Shortage / excess, if any. |

|

|

No

No

No

N.A

No

No

No

No

22.In the case of a manufacturing concern, give quantitative details of the principal items of raw materials, finished products and

A. Raw materials:

(i)opening stock;

(ii)purchases during the year;

(iii)consumption during the year;

(iv)sales during the year;

(v)closing stock;

(vi)* |

yield of finished products; |

(vii)* |

percentage of yield; |

(viii)*shortage / excess, if any, B. Finished products /

(i)opening stock;

(ii)purchases during the year;

(iii)quantity manufactured during the year;

(iv)sales during the year;

(v)closing stock;

(vi)*shortage / excess, if any

*- Information may be given to the extent available.

23.Accounting ratios with calculations as follows:-

(a)Gross Profit/Turnover;

(b)Net profit / Turnover;

(c)

(d)Material consumed / finished goods produced

24.Whether all the purchases/ sales are supported by bills, invoice etc.,

if not, give details. |

: |

Yes |

25.Whether the Auditor has come across any

payment of penalty or fine for violation |

|

|

of any law for the time being in force |

: |

Yes |

26.Whether the Auditor has come across any violation of the Puducherry VAT Ordinance, 2007 / CST Act, 1956 or

Rules made thereunder during the |

|

course of audit. |

Yes |

No

No

No

27.Whether the auditor has come across

any excess collection |

: |

Yes |

No

The statement of particulars furnished above, in my / our opinion and to the best

of my / our information and according to explanations given to me / us, are true and

correct.

|

|

|

|

|

|

……………… |

|

||

|

|

|

|

|

|

Signature |

|

|

|

Place…………………. |

|

|

|

Name: |

|

|

|

||

|

|

|

|

|

|

CA./ICWA Membership No: |

|||

Date………………….. |

|

|

|

Address: |

|

|

|

||

|

|

|

|

|

|

|

|||

Details of purchases / receipts during the year …………………. (Relates to local |

|

||||||||

purchase of taxable goods) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Sl. |

Name of the |

Seller’s |

Commodity |

|

Purchase |

Rate of |

|

VAT |

|

No. |

seller |

TIN |

Invoice |

Invoice |

|

/ Receipt |

tax |

|

Paid |

|

|

|

No. |

Date |

|

value |

|

|

(Rs.) |

|

|

|

|

|

|

(Rs.) |

|

|

|

(1) |

(2) |

(3) |

(4) |

(5) |

|

(6) |

(7) |

|

(8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE.- Alternatively, the above

ACTION POINTS

1.This Form must be filled up and signed by the designated person.

2.Judicial pronouncements may be relied upon in the matter of inclusion or exclusion of any items in the particulars to be furnished under any of the clause.

3.In case there is a conflict of judicial opinion on any particular issue, the view which has been followed may be referred to while giving the particulars under any specified clause.

4.General accounting principles / guidelines issued by the Institute of Chartered Accountants / Cost Accountants should be followed.

5.Relevant changes in law relating to items to be reported on.

6.