ACCESS FLORIDA APPLICATION

Before You Begin

Before You Begin

You are ready to start your application. Here is some important information when applying and what to expect.

Applying for Benefits

You may apply for help by giving us just your name, address, and signing your application. We encourage you to answer as many questions as you can, and sign your application today. This will allow us to help you more quickly. If you need help in completing this application or need interpreter services, there may be Community Partners in your area who can help. Visit our website at www.myflorida.com/accessflorida or contact our Customer Call Center at 1-866-762-2237 for more information. You may apply faster online at www.myflorida.com/accessflorida.

Processing Your Application

Processing begins with the date we receive your signed application. It may take 7 to 30 days to process your food assistance application. Expedited households may get food assistance benefits within seven days. Your answers on the application will decide if your household meets expedited food assistance criteria. Expedited households must have: 1. Monthly gross income less than $150 and liquid assets less than $150; 2. Monthly gross income plus liquid assets less than the household rent or mortgage plus utility costs; or, 3. Be a destitute migrant or seasonal farmworker with liquid assets less than $100. Applications for Medical Assistance and Temporary Cash Assistance may take 30 to 45 days, and Medical Assistance applications may take longer if we need to determine if someone is disabled. You may check the status of your application by visiting the ACCESS Florida website at http://www.myflorida.com/accessflorida and click on the "My ACCESS Account" link.

An Application for Assistance may be submitted to any Department of Children and Families Economic Self-Sufficiency Services office in the State of Florida by you, or by someone acting for you, in person, by mail, by facsimile (FAX), or electronically through the internet. Applications received during normal business hours are considered received the same day. When an application is received after normal business hours, it will be considered received on the first business day following its receipt. Food assistance benefits start from the date of application if the applicant meets all eligibility requirements, completes the interview, and provides all necessary eligibility information by the 30th day after the date of application. The household has the right to file an application form on the same day it contacts DCF, in an office, by phone, fax, in person, or electronically. Applicants do not have to complete the interview prior to filing the application. Receiving food assistance does not affect other program time limits. For an individual applying for food assistance and SSI at the same time, the filing date is the date of release from the institution or the actual date of receipt if filed after release. The collection of information on the application, including the SSN of each household member, is authorized under the Food and Nutrition Act of 2008 as amended, 7 U.S.C. 2011-2036. The information will be used to determine whether your household is eligible, or continues to be eligible to participate in food assistance. We will verify this information through computer matching programs. This information will also be used to monitor compliance with program regulations and for program management. The household cannot be denied food assistance benefits solely because of the denial of other program benefits.

Head of Household

The household may select an adult parent of children (of any age) living in the household, or an adult who has parental control over children (under 18 years of age) living in the household, as the head of household provided all adult household members agree to the selection. Households may select the head of household at application, at each review, or when there is a change in household composition. If all adult household members do not agree to the selection, or decline to select an adult parent as the head of household, the state agency may designate the head of household or permit the household to make another selection. If the household does not consist of adult parents and children or adults who have parental control of children living in the household, the state agency shall designate the head of household or permit the household to do so.

Social Security Number

We may treat household members who are ineligible, or who are not applying for benefits, as non-applicants. Non-applicants, or persons applying only for Emergency Medical Assistance for Aliens, Refugee Cash Assistance, or Refugee Medical Assistance, do NOT need to give a Social Security Number (SSN). If you were not eligible for an SSN because of your immigration status, you may be eligible for a non-work SSN. If you need an SSN, we can help you apply for one. Non-applicants do NOT need to give proof of immigration status. Noncitizens who are applying for benefits will have their immigration status verified with the U.S. Citizenship and Immigration Services (USCIS). We will not tell USCIS about the immigration status of those living in your household who are not applying for benefits.

Important Information for Immigrants

Applying for or receiving Food Assistance (SNAP) benefits or Medical Assistance will not affect you or your family members' immigration status or ability to get permanent resident status (green card). Receiving Temporary Cash Assistance or long term institutional care, such as nursing home benefits might create problems with getting that status, especially if the benefits are your family's only income.

CF-ES 2337, Aug 2016 [65A-1.205, F.A.C.]

Public Assistance Fraud / Notice of Penalties

If you are found guilty (by a state or federal court, or an administrative disqualification hearing, or sign a hearing waiver) of intentionally making a false or misleading statement, concealing or withholding facts in order to receive or in an attempt to receive food assistance or Temporary Cash Assistance (TCA) or committing any act that violates the Food and Nutrition Act of 2008, food assistance regulations, or any state statute for purposes of using, presenting, transferring, acquiring, receiving, or possessing food assistance benefits, you will be disqualified. You will be ineligible for food assistance or TCA for 12 months for the first violation, 24 months for the second violation, and permanently for the third violation. If you are convicted of trafficking food assistance benefits of $500 or more, you will be disqualified permanently. Trafficking of food assistance includes:

1.Buying, selling, stealing, or exchanging benefits for cash;

2.Exchanging firearms, ammunition, explosives, or illegal drugs for benefits;

3.Buying sodas, water, or other items in a container to get the cash deposit;

4.Buying an item with food assistance and then purposely selling the item for cash; and

5.Trading cash for items paid for with food assistance benefits.

If you are convicted of these acts, depending on the severity, you may be fined up to $250,000, imprisoned for up to 20 years, or both. You may also be subject to prosecution under other applicable Federal and State Laws. You may be barred from receiving food assistance for an additional 18 months if court ordered. If you are convicted by a state or federal court of making a fraudulent statement with respect to identity or residency in order to receive food assistance or TCA in more than one state at the same time, you will be ineligible to participate in the Food Assistance Program or TCA for a period of 10 years.

If you are fleeing to avoid prosecution, custody, or confinement, after conviction for a crime or an attempt to commit a crime, which is a felony, or are in violation of probation or parole imposed under a federal or state law, you are ineligible for food assistance and Temporary Cash Assistance. This information may be disclosed to other federal and state agencies for official examination, and to law enforcement officials for the purpose of apprehending persons fleeing to avoid the law.

If you are found guilty of a drug-trafficking felony after 8/22/96, or convicted by a federal, state, or local court of trading firearms, ammunition, or explosives for food assistance benefits, you are ineligible for food assistance. If you are convicted of using or receiving food assistance benefits in a transaction involving the sale of a controlled substance, you will be ineligible 24 months for the first violation and permanently for the second violation. Households must not use food assistance benefits to purchase nonfood items, pay on credit accounts, pay for food purchased on a credit account, use or possess the Electronic Benefits Transfer (EBT) cards of others, allow unauthorized use of the household’s EBT card by non-household members, sell or trade EBT cards, or use someone else’s EBT card. If a food assistance claim arises against your household, the information on this application, including all SSNs, may be referred to Federal and State agencies, as well as private claims collection agencies, for claims collection action.

Income and Eligibility Verification System (IEVS)

We will request information through computer matches in IEVS and may verify the information if we find differences based on the answers you gave on your application. We may use the information found in IEVS to affect your eligibility and level of benefits.

Reporting Requirements

For all programs, households are encouraged to report any change in the household living and/or mailing address. For programs except Food Assistance (SNAP), households must report changes in who lives in the household, employment, and income. Food Assistance (SNAP) households must report when the total monthly household gross income exceeds 130% of the federal poverty level for the household size and when the work hours of able-bodied adults fall below 20 hours per week when averaged monthly, by the 10th of the month after the month of the change. Households receiving Medicaid or Temporary Cash Assistance must report changes within 10 days.

Requesting a Fair Hearing

You have the right to ask for a hearing before a state hearings officer. You can bring with you or be represented at the hearing by a lawyer, relative, friend, or anyone you choose. If you want a hearing, you must ask for the hearing by writing, calling the Customer Call Center, or coming into the office within 90 days from the mailing date of your notice of case action. If you ask for a hearing by the end of the last day of the month prior to the effective date of the adverse action, your benefits may continue at the prior level until the hearing decision. You will be responsible to repay any benefits continued if the hearing decision is not in your favor. If you need information about how to receive free legal advice, you can call the Customer Call Center toll free at 1-866-762-2237 for a listing of free legal agencies in your area.

Medical Assistance Applications

Use this application to see what coverage choices you qualify for such as free or low-cost insurance from Medicaid or the Children’s Health Insurance Program (CHIP), affordable private health insurance plans that offer comprehensive coverage to help you stay well, and a new tax credit that can immediately help pay your premiums for health coverage. To complete your application, you may need social security numbers, document numbers for legal immigrants, employer and income information for everyone in your family, policy numbers for current health insurance, and job-related health insurance information. Please send copies not originals.

What Happens Next

Submit your signed application at any Department of Children and Families Economic Self-Sufficiency Services office or mail your application to ACCESS Central Mail Center, P.O. Box 1770, Ocala, FL 34478-1770. You may fax your application to a Customer Service Center in your area. Find a local fax number at http://www.myflfamilies.com/service-programs/access-florida-food-medical-assistance-cash/locate-service-center-your-area.

CF-ES 2337, Aug 2016 [65A-1.205, F.A.C.]

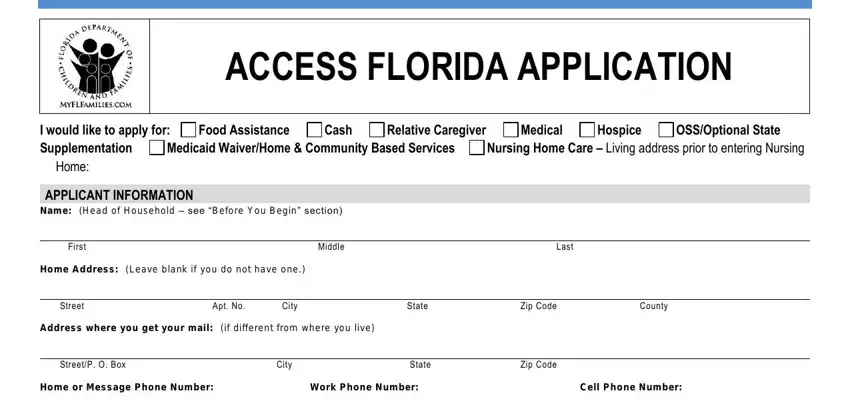

ACCESS FLORIDA APPLICATION

I would like to apply for: |

Food Assistance |

Cash |

Relative Caregiver |

|

Medical |

Hospice |

OSS/Optional State |

Supplementation |

Medicaid Waiver/Home & Community Based Services |

Nursing Home Care – Living address prior to entering Nursing |

Home: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPLICANT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

Name: (Head of Household – see “Before You Begin” section) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

Middle |

|

|

|

Last |

|

|

|

|

Home Address: (Leave blank if you do not have one.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street |

|

Apt. No. |

City |

|

State |

|

Zip Code |

County |

|

|

|

Address where you get your mail: (if different from where you live) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street/P. O. Box |

|

|

City |

|

State |

|

Zip Code |

|

|

|

|

Home or Message Phone Number: |

|

Work Phone Number: |

|

|

|

Cell Phone Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

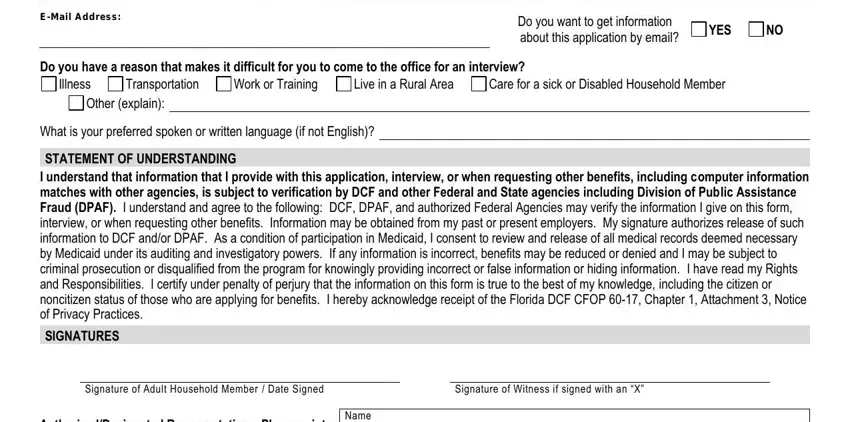

E-Mail Address: |

|

|

|

|

|

|

Do you want to get information |

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

about this application by email? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you have a reason that makes it difficult for you to come to the office for an interview?

|

|

|

|

|

|

Illness |

Transportation |

Work or Training |

Live in a Rural Area |

Care for a sick or Disabled Household Member |

Other (explain): |

|

|

|

|

What is your preferred spoken or written language (if not English)?

STATEMENT OF UNDERSTANDING

I understand that information that I provide with this application, interview, or when requesting other benefits, including computer information matches with other agencies, is subject to verification by DCF and other Federal and State agencies including Division of Public Assistance Fraud (DPAF). I understand and agree to the following: DCF, DPAF, and authorized Federal Agencies may verify the information I give on this form, interview, or when requesting other benefits. Information may be obtained from my past or present employers. My signature authorizes release of such information to DCF and/or DPAF. As a condition of participation in Medicaid, I consent to review and release of all medical records deemed necessary by Medicaid under its auditing and investigatory powers. If any information is incorrect, benefits may be reduced or denied and I may be subject to criminal prosecution or disqualified from the program for knowingly providing incorrect or false information or hiding information. I have read my Rights and Responsibilities. I certify under penalty of perjury that the information on this form is true to the best of my knowledge, including the citizen or noncitizen status of those who are applying for benefits. I hereby acknowledge receipt of the Florida DCF CFOP 60-17, Chapter 1, Attachment 3, Notice of Privacy Practices.

SIGNATURES

|

Signature of Adult Household Member / Date Signed |

|

|

Signature of Witness if signed with an “X” |

|

|

|

|

|

|

Authorized/Designated Representative – Please print |

Name |

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

Phone Number |

|

|

|

|

|

|

|

|

Signature of Authorized/Designated Representative

Community Access Site Participant Name/Phone Number:

CF-ES 2337, Aug 2016 [65A-1.205, F.A.C.] |

* Indicates information optional for the Food Assistance Program |

Page 1 |

EXPEDITED FOOD ASSISTANCE: Eligible households may receive benefits within 7 days.

Is your household’s gross income less than $150? |

YES |

NO |

Do you pay to heat or cool your home? |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

Are your total liquid assets (such as |

|

|

|

What is the monthly amount of your rent or mortgage? $ |

|

cash, bank accounts, etc) less than $100? |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

Is your household’s monthly gross income plus your total liquid assets less |

Has all of your household’s income recently stopped? |

YES |

NO |

than your monthly rent or mortgage plus utilities? |

YES |

NO |

If yes, WHEN? |

|

|

|

|

|

|

|

|

|

Check the bills you pay: |

Electricity |

Gas |

Water |

Is anyone in your household a migrant or seasonal farmworker? |

|

Sewage |

Phone |

|

|

|

YES |

NO If yes, WHO? |

|

|

|

|

|

|

|

|

|

|

|

|

|

HOUSEHOLD INFORMATION: If you need extra space in the following sections, please use extra pages. Please provide as much information as you can to help us determine your eligibility quickly.

In Sections A and B, list yourself and all people living in your home even if you are not applying for them. If you are not applying for a member, you do not have to give their SSN or citizenship status. Include your spouse, your children under 21 who live with you, anyone you include on your tax return, even if they do not live with you, and anyone else under 21 who you take care of and lives with you. If living in a nursing home or other institutional arrangement, list only self, spouse and dependents.

ETHNICITY (Voluntary/Optional Information): A = Hispanic or Latino or, |

B = Not Hispanic or Latino |

|

|

|

|

RACE (Voluntary/Optional Information): You may choose one or more numbers: 1 – American Indian or Alaskan Native; |

2 – Asian or Pacific |

Islander; 3 – Black or African American, Not of Hispanic Origin; |

4 – White, Not of Hispanic Origin; 5 – Southeast Asian; 6 – Other; |

or, |

7 – Unknown. This will not affect eligibility or the level of benefits. The reason we ask for this information is to assure program benefits are |

distributed without regard to race, color, or national origin. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION A – List All Adults Living At Your Address |

|

|

|

|

|

|

|

|

|

|

|

|

Adult’s Legal Name |

Want to |

|

Social Security |

Date and |

|

U.S. |

Ethnicity |

Race |

Marital |

Attends School/ |

Buys and |

|

Number (see |

|

# Hours / Week/ |

Sex |

|

Place |

|

|

(see |

Eats Food |

First, Middle, Last |

Apply? |

|

instructions |

of Birth* |

|

Citizen |

above) |

(see above) |

Status |

Last Grade |

with You |

|

|

|

|

above) |

|

|

|

|

Completed* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

1 |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

# hours per |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

F |

|

|

|

|

No |

|

|

A |

3 |

|

Yes |

|

|

|

|

|

|

|

|

|

week: |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

No |

M |

|

|

|

|

|

|

|

B |

|

* Last Grade |

No |

Relation- |

|

|

|

|

|

USCIS # |

|

|

5 |

|

ship to |

SELF |

|

|

|

|

|

|

|

|

|

|

6 |

|

Completed: |

|

you |

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

1 |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

# hours per |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

F |

|

|

|

|

No |

|

|

A |

3 |

|

Yes |

|

|

|

|

|

|

|

|

|

week: |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

No |

M |

|

|

|

|

|

|

|

B |

|

* Last Grade |

No |

Relation- |

|

|

|

|

|

USCIS # |

|

|

5 |

|

ship to |

|

|

|

|

|

|

|

|

|

|

|

6 |

|

Completed: |

|

you |

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

1 |

|

Yes |

N |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

# hours per |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

F |

|

|

|

|

No |

|

|

A |

3 |

|

Yes |

|

|

|

|

|

|

|

|

|

week: |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

No |

M |

|

|

|

|

|

|

|

B |

|

* Last Grade |

No |

Relation- |

|

|

|

|

|

USCIS # |

|

|

5 |

|

ship to |

|

|

|

|

|

|

|

|

|

|

|

6 |

|

Completed: |

|

you |

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

1 |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

# hours per |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

F |

|

|

|

|

No |

|

|

A |

3 |

|

Yes |

|

|

|

|

|

|

|

|

|

week: |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

No |

M |

|

|

|

|

|

|

|

B |

|

* Last Grade |

No |

Relation- |

|

|

|

|

|

USCIS # |

|

|

5 |

|

ship to |

|

|

|

|

|

|

|

|

|

|

|

6 |

|

Completed: |

|

you |

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CF-ES 2337, Aug 2016 [65A-1.205, F.A.C.] |

* Indicates information optional for the Food Assistance Program |

Page 2 |

Before You Begin

Before You Begin