Quite a few things can be easier than managing documentation through our PDF editor. There is not much you need to do to modify the loss of income form - simply abide by these steps in the next order:

Step 1: Find the button "Get Form Here" and hit it.

Step 2: You're now on the form editing page. You may edit, add information, highlight certain words or phrases, put crosses or checks, and insert images.

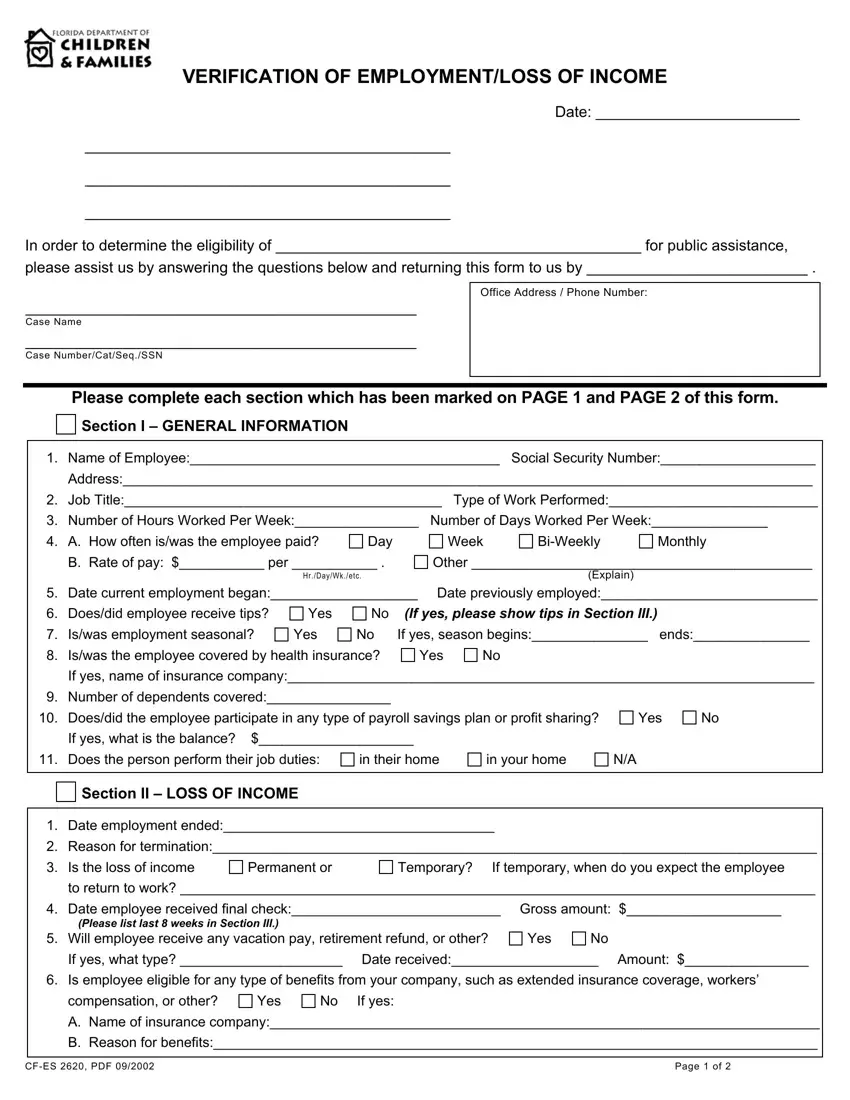

Create the next parts to complete the form:

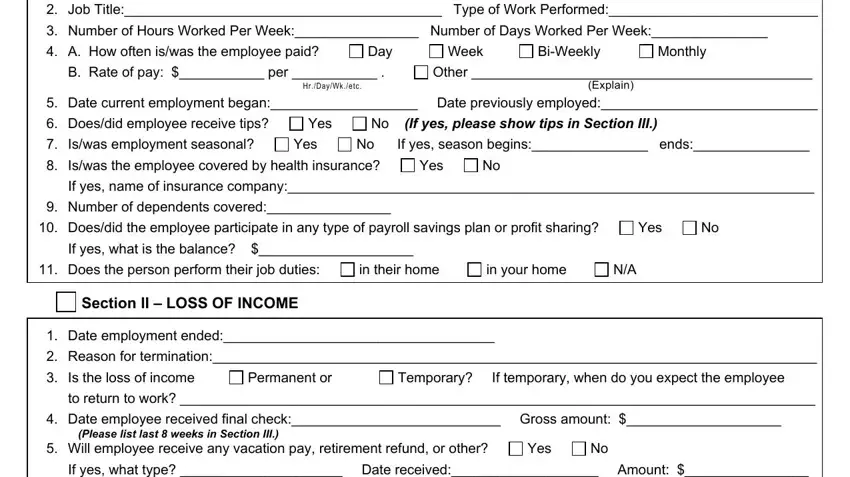

Make sure you fill in the Name of Employee Social Security, BiWeekly, Monthly, Week, Day, B Rate of pay per, Other, HrDayWketc, Explain, Date current employment began, No If yes season begins ends, No If yes please show tips in, Yes, Yes, and Number of dependents covered box with the necessary information.

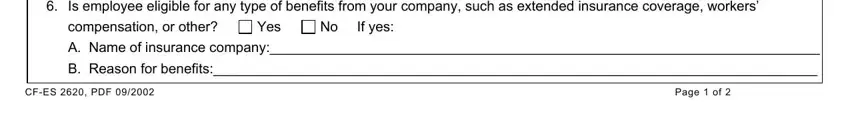

The system will request you to give certain relevant information to automatically fill out the part If yes what type Date received, No If yes, Yes, CFES PDF, and Page of.

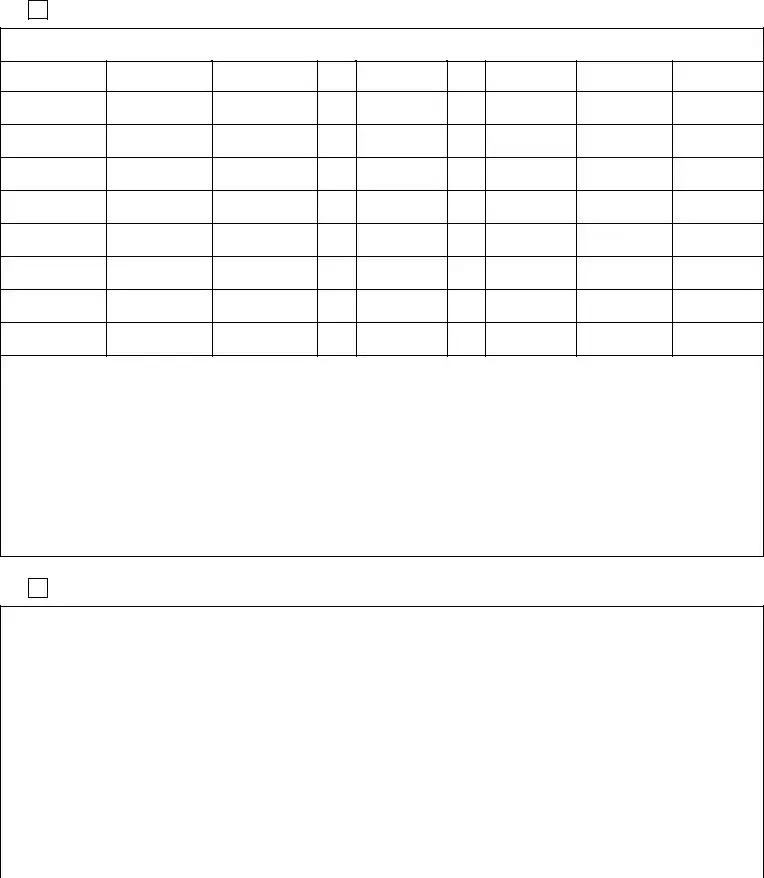

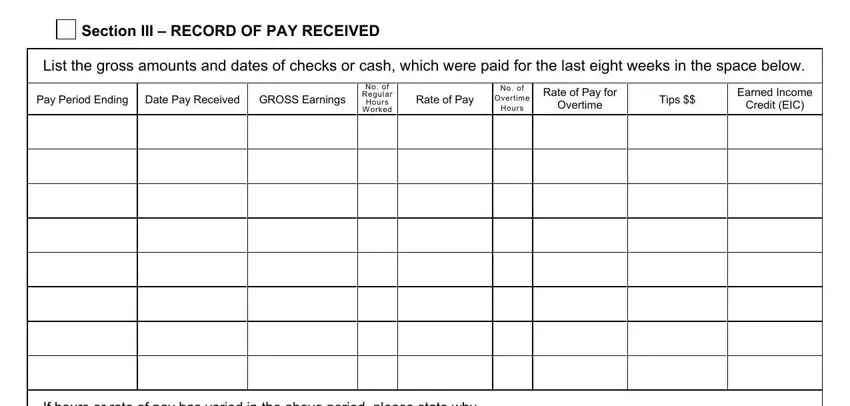

The Section III RECORD OF PAY RECEIVED, List the gross amounts and dates, Pay Period Ending, Date Pay Received, GROSS Earnings, No of Regular Hours W orked, Rate of Pay, No of Overtime Hours, Rate of Pay for Overtime, Tips, Earned Income Credit EIC, and If hours or rate of pay has varied area is the place where all parties can insert their rights and obligations.

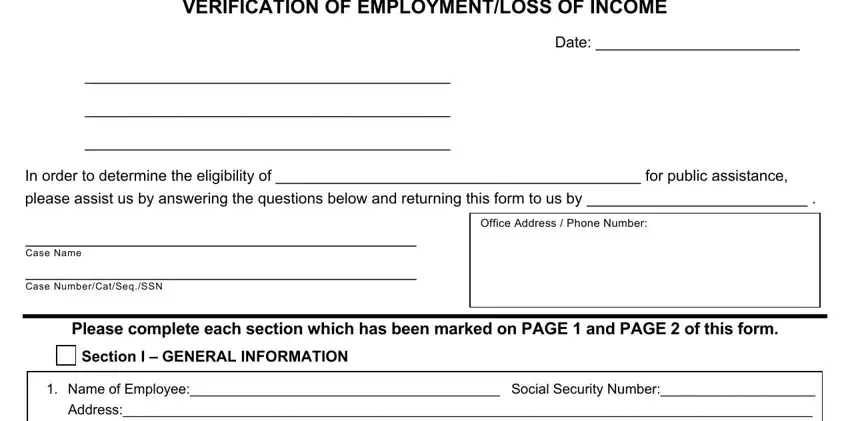

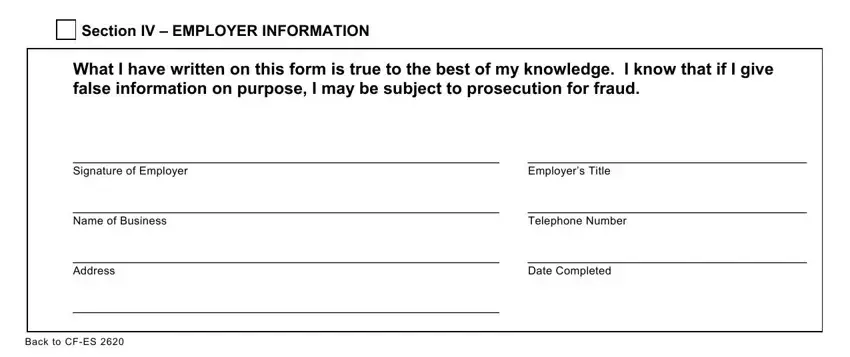

End by taking a look at the following areas and filling them in as needed: Section IV EMPLOYER INFORMATION, What I have written on this form, Signature of Employer, Employers Title, Name of Business, Telephone Number, Address, Date Completed, and Back to CFES.

Step 3: Press "Done". Now you can upload the PDF document.

Step 4: Be sure to remain away from future misunderstandings by getting a minimum of a pair of copies of your file.