The CG-1884 form, provided by the Department of Homeland Security U.S. Coast Guard, serves as an essential document for individuals applying for an annuity under various benefit schemes such as the Survivor Benefit Plan (SBP), Reserve Component Survivor Benefit Plan (RCSBP), Retired Serviceman's Family Protection Plan (RSFPP), and for claims concerning the final retired pay due to survivors of a deceased Coast Guard, Public Health Service (PHS), or National Oceanic and Atmospheric Administration (NOAA) member. This comprehensive form seeks to collect all necessary information to verify the eligibility of surviving spouses, dependent children, former spouses, or any natural person with an insurable interest, ensuring they receive the financial support they're entitled to. It covers detailed aspects ranging from the deceased member's information, survivor details, eligible dependents, guardian information, and bank details for direct deposit of the annuity. Moreover, it addresses federal income tax withholding preferences, ultimately culminating in a certification by the applicant confirming the accuracy and truthfulness of the provided information. Importantly, the form also highlights the legal stipulations regarding the provision of false information, potentially leading to severe penalties. The CG-1884 form underscores the U.S. Coast Guard’s commitment to supporting families of service members by providing a structured means for accessing deserved benefits, thus acknowledging the sacrifices made by both the service members and their families.

| Question | Answer |

|---|---|

| Form Name | Form Cg 1884 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | cg_1884 cg 1884 form |

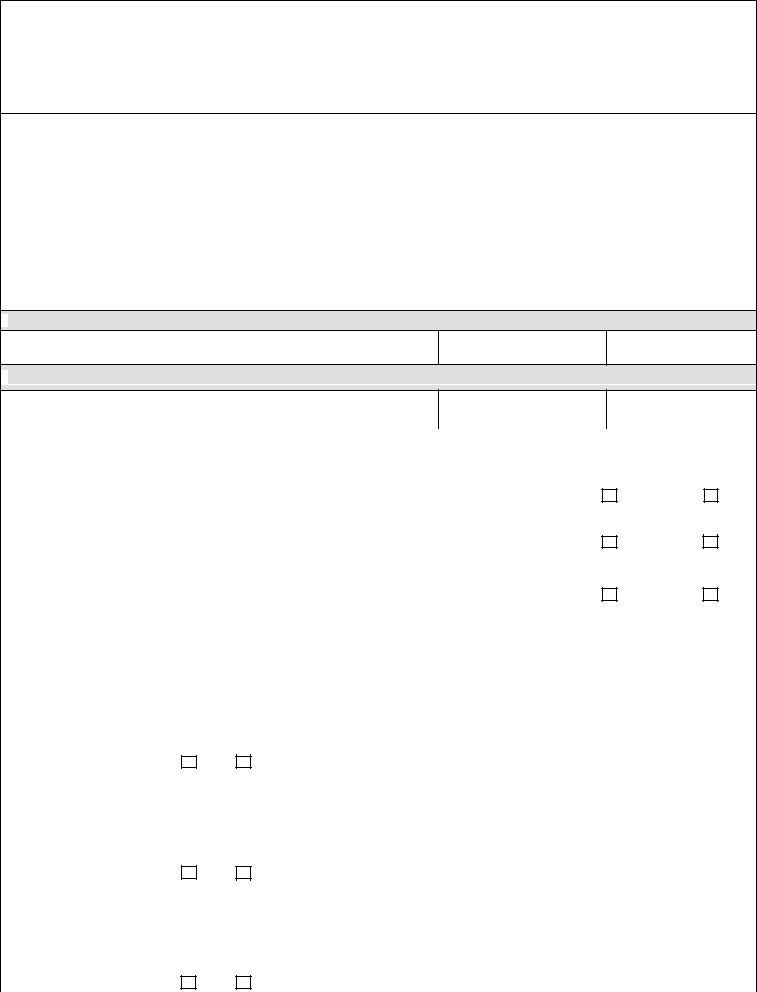

DEPARTMENT OF HOMELAND SECURITY

U.S. Coast Guard

APPLICATION FOR ANNUITY UNDER THE SURVIVOR BENEFIT PLAN (SBP),

RESERVE COMPONENT SURVIVOR BENEFIT PLAN (RCSBP),

RETIRED SERVICEMANᄊV FAMILY PROTECTION PLAN (RSFPP) and/or

FINAL RETIRED PAY DUE

PRIVACY ACT STATEMENT

Dq|#ᄈfroohfwlrq#ri#lqirupdwlrqᄡ#dv#ghilqhg#lq#wkh#Sdshuzrun#Uhgxfwlrq#Dfw#ri#4<<8#+frglilhg#dw#77#X1V1F1#6834#hw#vht,#rq#wklv#form has not been approved by the Director of the Office of Management and Budget (OMB) and does not display a valid control number assigned by the Director. Therefore, no person shall be subject to any penalty for failing to comply with any such collection of information.

Authority: Collection of this information is authorized by: 10 U.S.C. Chapters 73 and 165; DOD Financial Management Regulation, Volume 7B, Chapters 30, 37, 49, and 54; and E.O. 9397.

Purpose: The Coast Guard Pay & Personnel Center will use this information to verify eligibility of a surviving spouse, dependent child, former spouse, or natural person with an insurable interest for an annuity under the Survivor Benefit Plan (SBP) and/or Retired Servicemans Family Protection Plan (RSFPP). The information will also be used to verify eligibility for final retired pay arrears due a deceased Coast Guard, PHS, or NOAA member.

Routine Uses: The information will be used by the Coast Guard Pay & Personnel Center to establish a survivor annuity account. The information may be shared with the Internal Revenue Service for tax purposes, and with the Department of Veterans Affairs in conjunction with administration of DVA compensation.

Disclosure: Disclosure of this information (including your SSN) is voluntary; however, failure to furnish the requested information will delay payment of annuities and final pay arrears.

PART ᄆ INFORMATION ABOUT THE DECEASED MEMBER

1.Name (Last, First, Middle Initial)

2. Employee ID Number

3. Date of Death

PART B ᄆ SURVIVING SPOUSE/FORMER SPOUSE, INSURABLE INTEREST INFORMATION

4.Name (Last, First, Middle Initial)

5. Social Security Number

6. Date of Birth

|

7. Area Code and Telephone Number |

8. Correspondence Mailing Address (including zip/postal code) |

|

9. What is your country of citizenship? |

|||||||

|

|

|

|

|

|

|

|

|

|

||

|

10. Were you legally married to the deceased at the time of death? |

|

|

|

Yes |

No |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

10a. |

If yes, provide, Place of Marriage: |

|

|

|

|

10b. Date of Marriage: |

|

|||

|

|

|

|

|

|

|

|

|

|||

|

11. If former spouse, have you remarried? (If yes, provide place and date of remarriage) |

|

|

|

Yes |

No |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

11a. |

Place of Remarriage: |

|

|

|

|

|

11b. Date of Remarriage: |

|

||

|

|

|

|

|

|

|

|

|

|||

|

12. Are you receiving a survivor annuity on behalf of any other deceased military member? |

|

|

|

Yes |

No |

|||||

|

(If yes, provide deceased member's name, social security number, branch of service and monthly amount below) |

|

|||||||||

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

Name of Deceased Member |

|

|

|

12b. Social Security Number |

12c. Branch of Service |

|

12d. Amount |

||

|

|

|

|

|

|

||||||

|

|

|

|

|

|||||||

|

PART C ᄆ ELIGIBLE CHILDREN OF THE DECEASED UNDER THE AGE OF 23 OR INCAPABLE OF |

|

|||||||||

|

|

|

|

|

|

|

|

||||

|

13a. |

Name |

|

|

|

13f. Name, Address, Relationship and Telephone Number of Custodian |

|

||||

|

|

|

|

|

|

|

|

|

|

||

|

13b. |

Social Security Number |

13c. Date of Birth |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

13d. |

Marital Status |

13e. |

Relationship |

|

|

|

Telephone |

|

||

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

14a. |

Name |

|

|

|

14f. Name, Address, Relationship and Telephone Number of Custodian |

|

||||

|

|

|

|

|

|

|

|

|

|

||

|

14b. |

Social Security Number |

14c. Date of Birth |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

14d. |

Marital Status |

14e. |

Relationship |

|

|

|

Telephone |

|

||

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

15a. |

Name |

|

|

|

15f. Name, Address, Relationship and Telephone Number of Custodian |

|

||||

|

|

|

|

|

|

|

|

|

|

||

|

15b. |

Social Security Number |

15c. Date of Birth |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

15d. |

Marital Status |

15e. |

Relationship |

|

|

|

Telephone |

|

||

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Page 1 of 2 |

|||

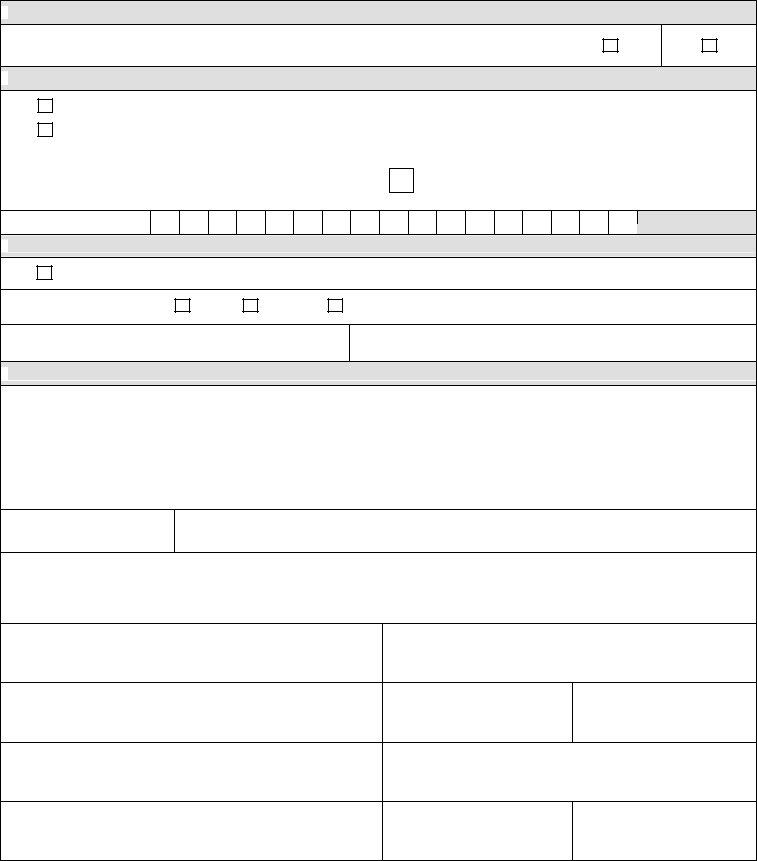

PART D ᄆ#GUARDIAN INFORMATION

16. Has a guardian been appointed by a court for any of the named survivors in Part B or C? |

Yes |

|

If yes, provide a copy of the court order. |

||

|

||

|

|

No

PART E ᄆ#DIRECT DEPOSIT INFORMATION

17a.

17b.

Continue direct deposit to the same account used for member's retired pay. (Continue to Part F)

Direct deposit account shown below. (Complete blocks 18 through 19b or attach a blank voided check)

18. |

Type of Account: |

|

Checking |

|

|

|

Savings |

|||||

19a. |

Routing Transit Number: |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Digit

19b. Account Number

PART F ᄆ#FEDERAL INCOME TAX WITHHOLDING INFORMATION

20.

I do not want any federal tax withheld from my annuity. (Continue to Part G)

21. Marital Status (check one):

Single,

Married or

Married but withhold at higher single rate

22. Total No. of Exemptions Claimed: ______________

23. Additional Withholding (optional): $ ______________________________

PART G ᄆ#AFFIDAVIT AND SIGNATURE

24.I certify that all statements on this claim are true to the best of my knowledge, information, and belief. I certify that no evidence to the settlement of this claim has been suppressed or withheld. I understand that any false statement on this claim, or any misrepresentation relative thereto, is a violation of the law punishable by a fine of not more than $10,000 or imprisonment of not more than 10 years or both (32 Stat. 197; 18 U.S.C. 10).

I understand under the law, I cannot receive both a CG, PHS, or NOAA Annuity and Dependency & Indemnity Compensation (DIC) in full amounts from the same retiree. I am only entitled to the amount of the CG, PHS, or NOAA annuity that exceeds the DIC spouse payment. If any overpayments of CG, PHS, or NOAA benefits occur, I authorize the Department of Veteran Affairs to repay the Coast Guard, PHS, or NOAA the Amount of the overpayment from the DIC payments to which I may become entitled.

24a. Date

24b. Signature of Applicant

WITNESSES REQUIRED ONLY IF SIGNATURE OF APPLICANT IS MADE E\#ᄈ[ᄡ#PDUN#DERYH1#

Dq#dqqxlwdqw#zkrvh#dssolfdwlrq#lv#vljqhg#zlwk#dq#ᄈ[ᄡ#pxvw#eh#zlwqhvvhg#+e|#wzr#glvlqwhuhvwhg#shuvrqv,#ru#qrwdul}hg#ru#frxqwhusigned by the person holding power of attorney. A copy of the power of attorney and explanation why the annuitant required assistance must also be submitted

25.(PRINT) Witness Name (Last, First, MI)

25a. Witness Signature

25b. Witness Address (Street, City, State and Zip Code)

25c. Witness Telephone Number

25d. Date

26.(PRINT) Witness Name (Last, First, MI)

26a. Witness Signature

26b. Witness Address (Street, City, State and Zip Code)

26c. Witness Telephone Number

26d. Date

Page 2 of 2 |