Any time you would like to fill out Vendor, there's no need to install any sort of programs - just give a try to our online PDF editor. We are aimed at providing you the perfect experience with our tool by regularly presenting new features and improvements. Our tool is now even more intuitive thanks to the latest updates! Now, working with documents is simpler and faster than ever. To get started on your journey, consider these basic steps:

Step 1: Firstly, open the editor by pressing the "Get Form Button" at the top of this page.

Step 2: With our handy PDF editor, you could accomplish more than just fill in blank form fields. Try all the features and make your docs seem sublime with customized textual content added in, or adjust the file's original input to perfection - all that comes along with the capability to add any pictures and sign the document off.

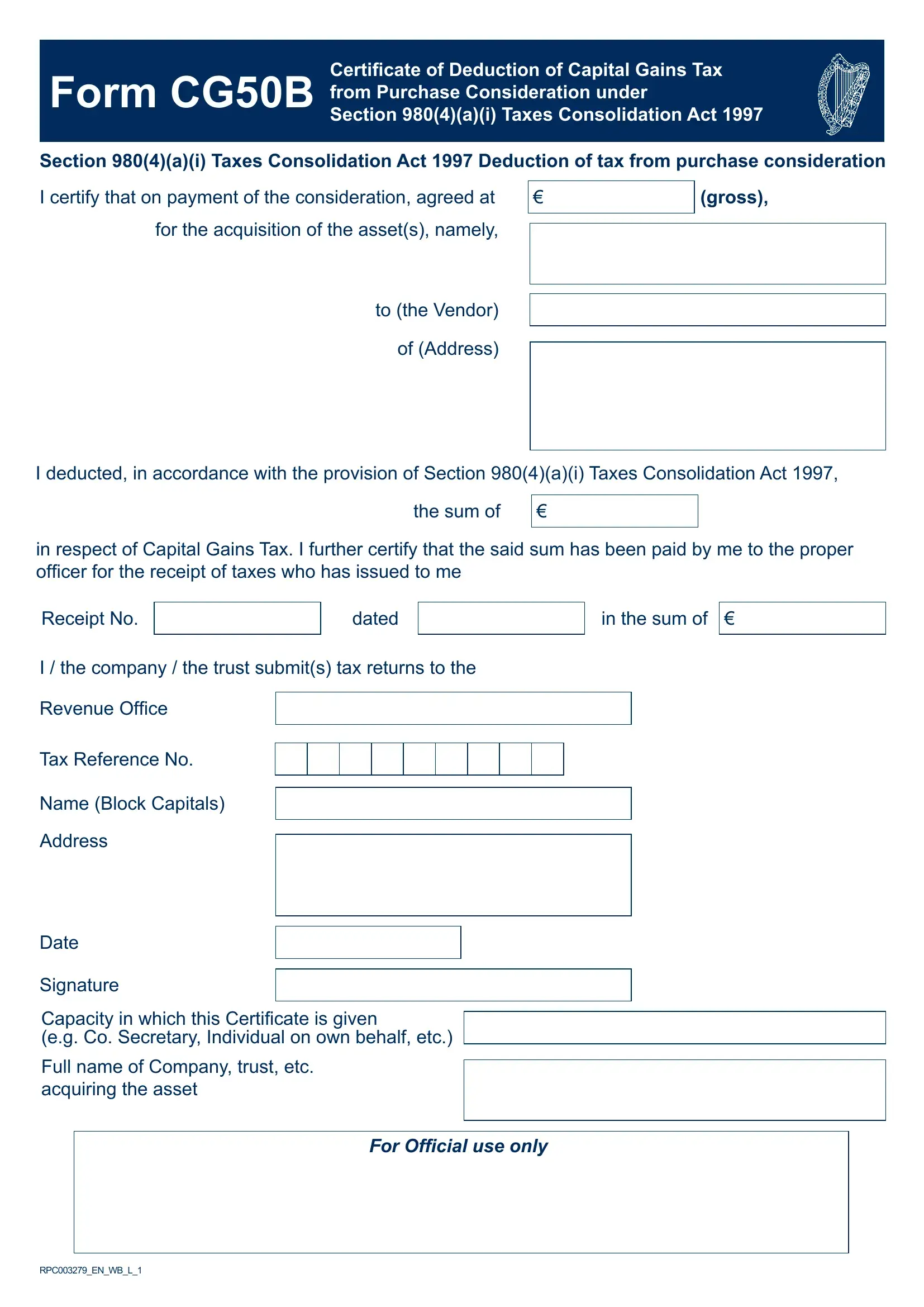

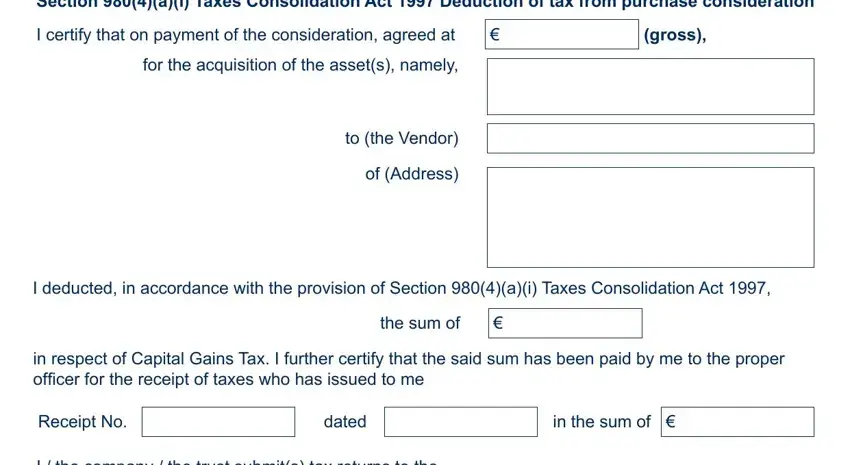

This PDF requires particular info to be typed in, hence you must take whatever time to type in exactly what is asked:

1. For starters, while filling in the Vendor, start with the area containing next blanks:

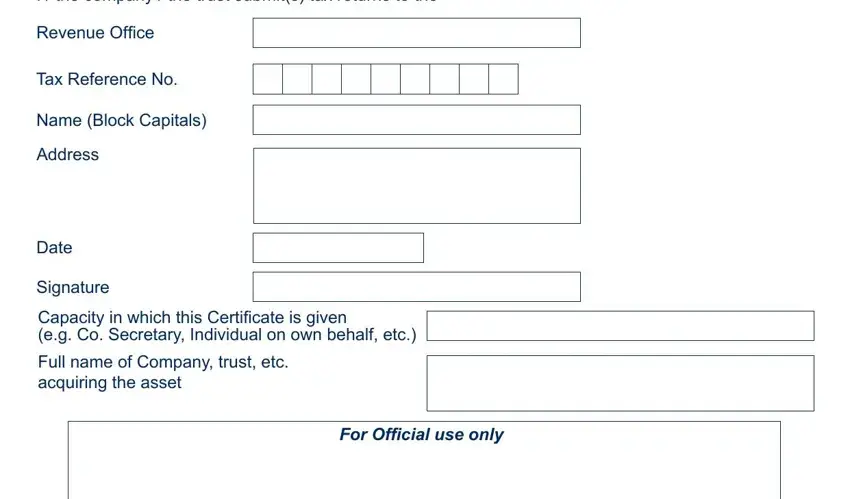

2. Now that this array of fields is complete, it is time to add the required details in I the company the trust submits, Revenue Ofice, Tax Reference No, Name Block Capitals, Address, Date, Signature Capacity in which this, Full name of Company trust etc, and For Oficial use only in order to go to the next part.

Concerning I the company the trust submits and Revenue Ofice, be certain that you double-check them in this section. These two could be the key fields in this page.

Step 3: Before addressing the next step, double-check that blanks were filled in right. As soon as you determine that it is fine, click on “Done." Join FormsPal now and easily gain access to Vendor, prepared for download. Each edit you make is handily kept , making it possible to modify the form later on when necessary. FormsPal is focused on the personal privacy of our users; we ensure that all information put into our tool remains secure.