You can work with Subtractions without difficulty in our PDFinity® editor. In order to make our editor better and easier to work with, we consistently implement new features, taking into account suggestions coming from our users. To get the process started, go through these simple steps:

Step 1: Firstly, open the editor by clicking the "Get Form Button" in the top section of this page.

Step 2: As you access the editor, you will notice the document made ready to be filled in. In addition to filling in various blanks, you may also do various other things with the PDF, specifically adding any text, editing the original text, inserting graphics, placing your signature to the form, and more.

Concentrate while filling in this pdf. Ensure that all necessary areas are filled out correctly.

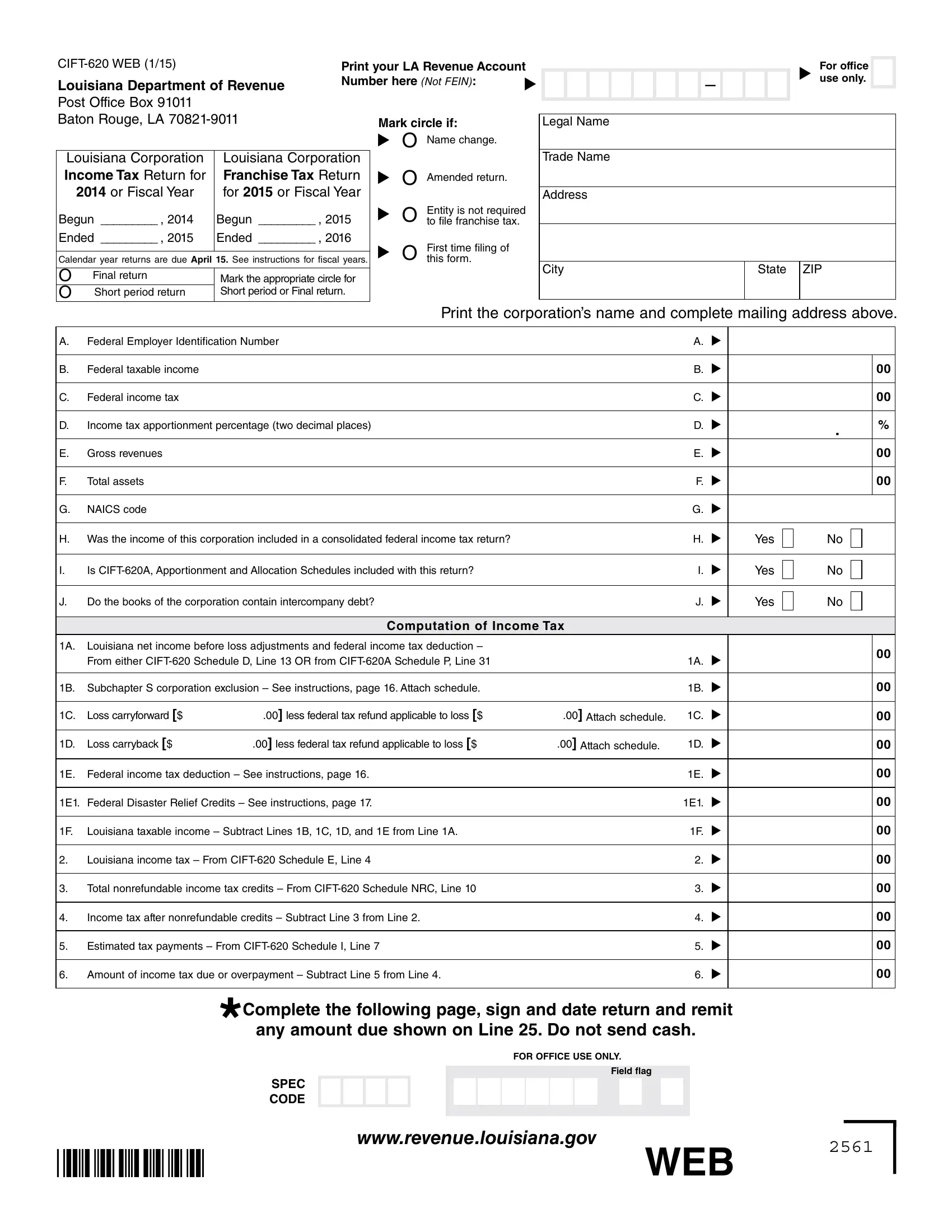

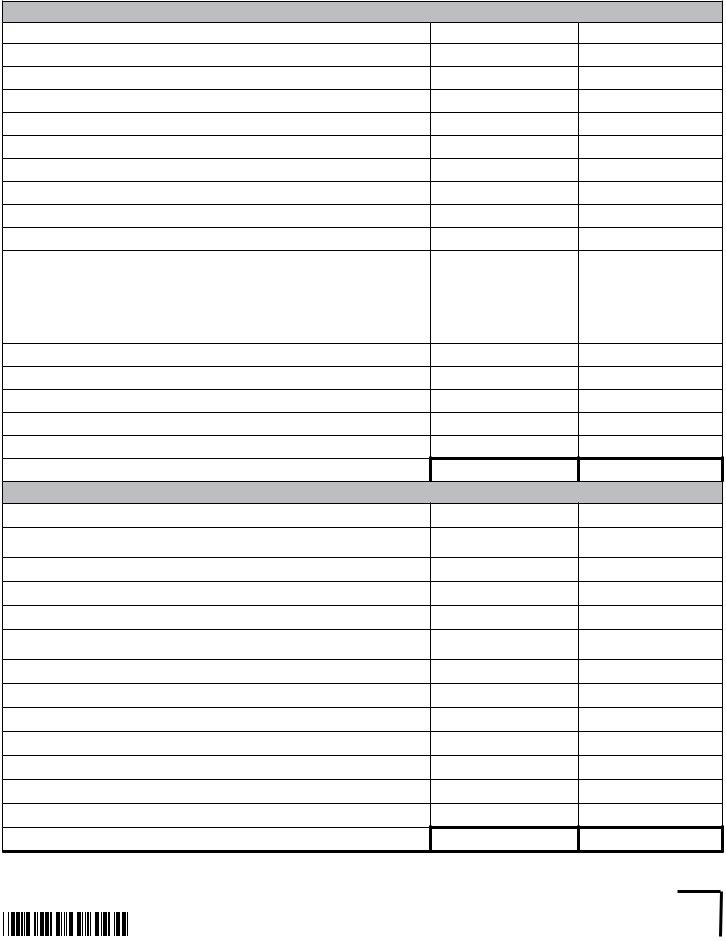

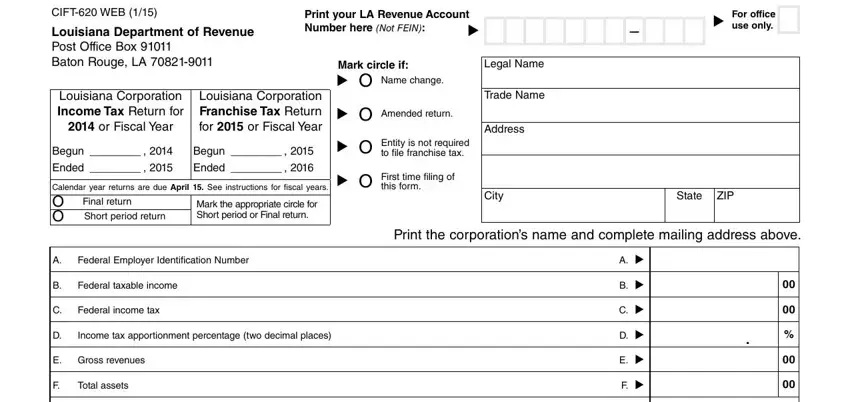

1. First of all, once filling out the Subtractions, start with the form section with the next blank fields:

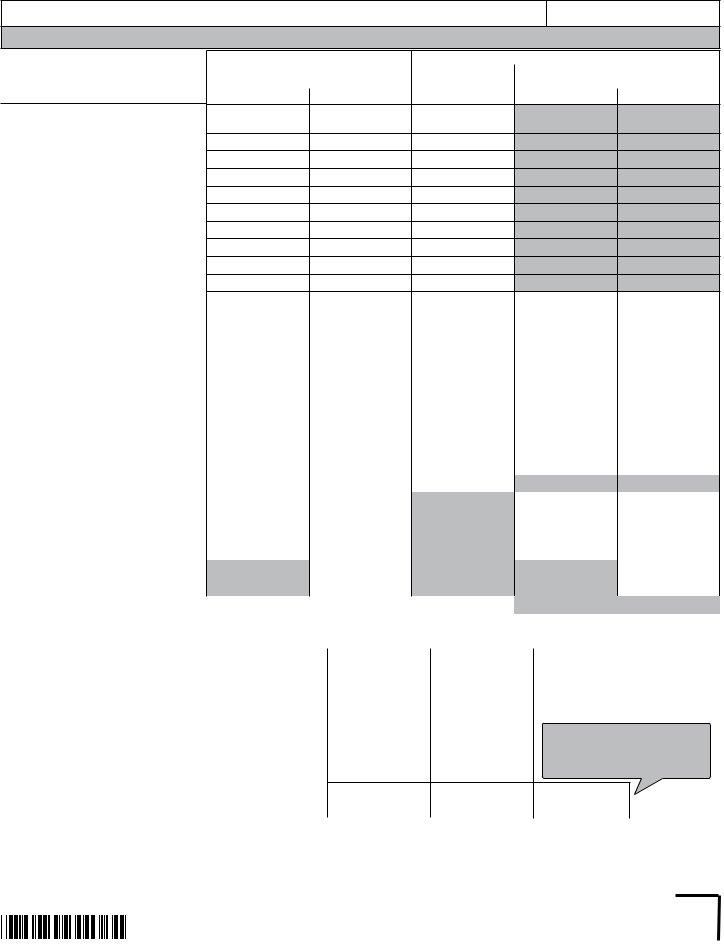

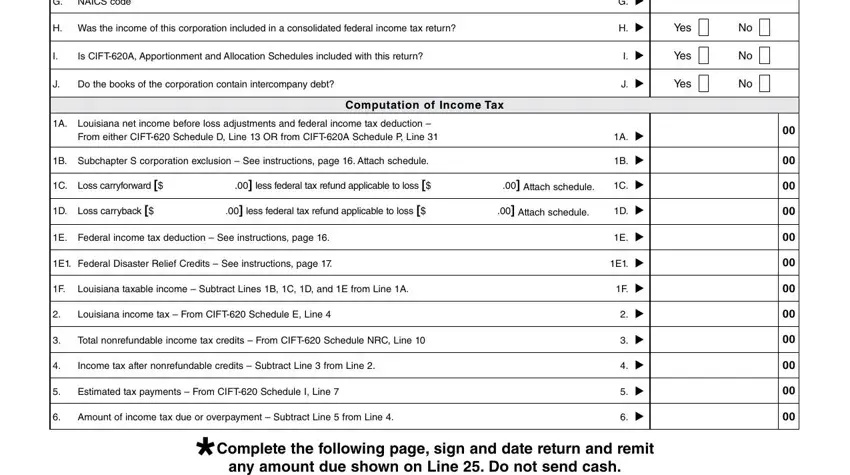

2. Right after this part is filled out, go on to enter the applicable details in these: G NAICS code, H Was the income of this, Is CIFTA Apportionment and, Do the books of the corporation, A Louisiana net income before loss, From either CIFT Schedule D Line, B Subchapter S corporation, Computation of Income Tax, C Loss carryforward less federal, D Loss carryback less federal, E Federal income tax deduction, E Federal Disaster Relief Credits, F Louisiana taxable income, Louisiana income tax From CIFT, and Total nonrefundable income tax.

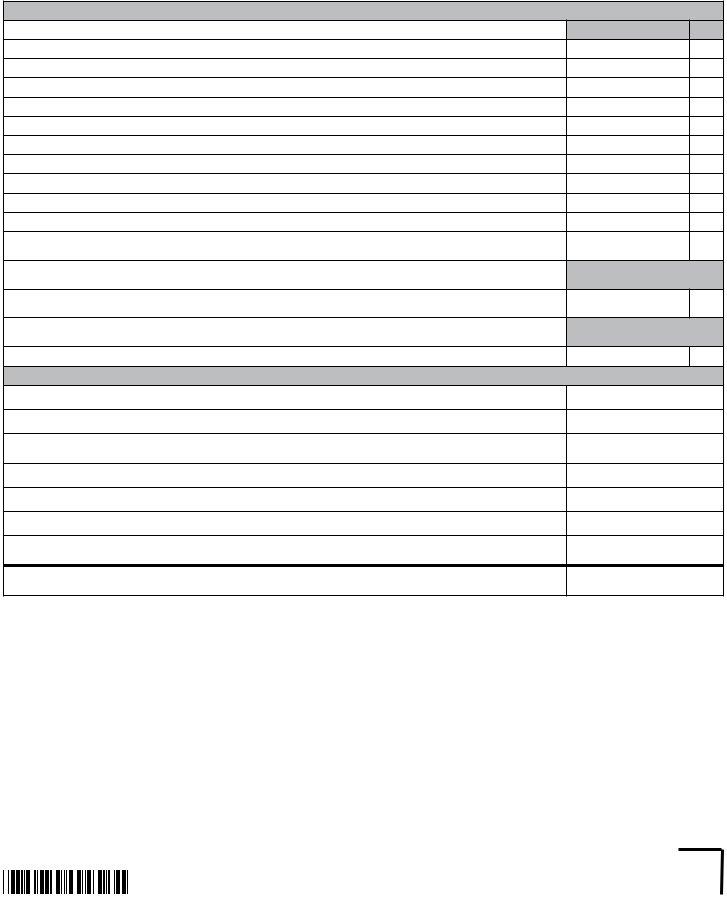

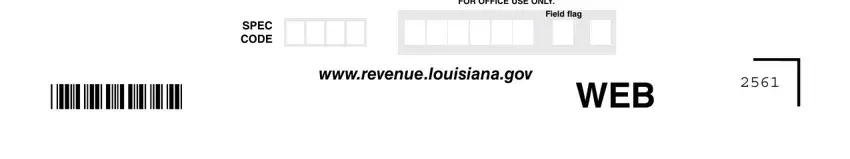

3. Completing Complete the following page sign, FOR OFFICE USE ONLY, SPEC CODE, Field lag, wwwrevenuelouisianagov, and WEB is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

It's easy to get it wrong when filling out your wwwrevenuelouisianagov, so make sure you look again prior to deciding to send it in.

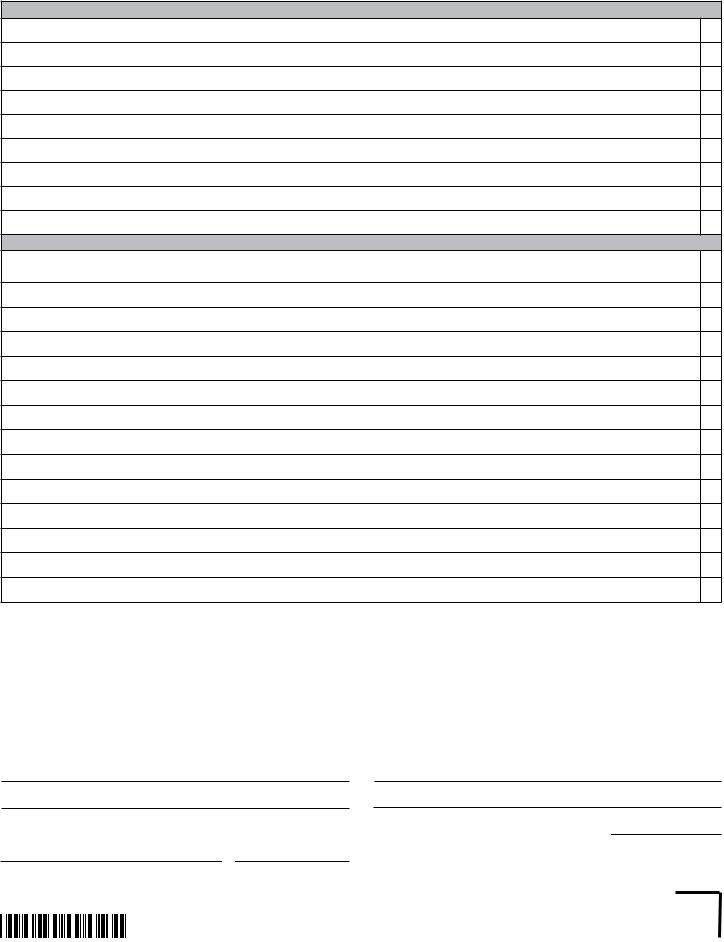

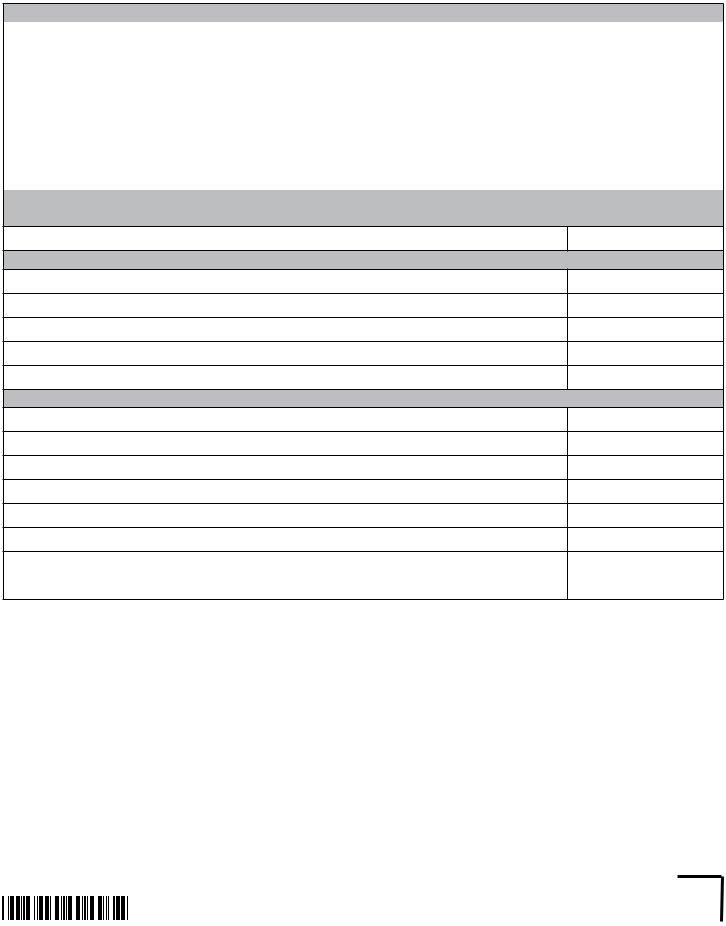

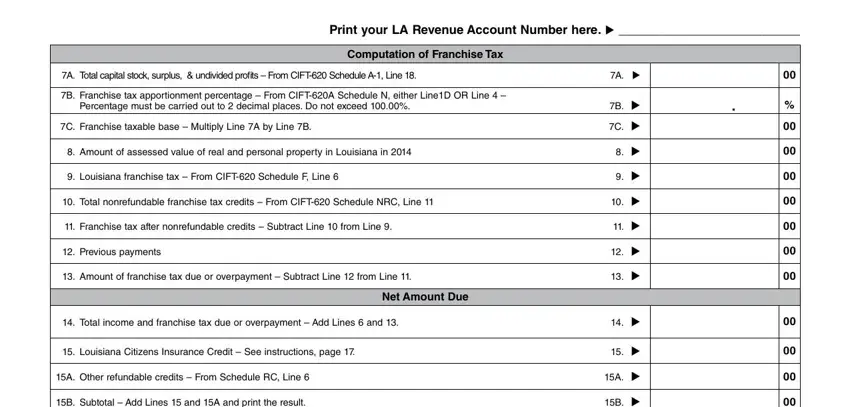

4. This fourth section comes next with the following form blanks to focus on: Print your LA Revenue Account, A Total capital stock surplus, B Franchise tax apportionment, Percentage must be carried out to, Computation of Franchise Tax, C Franchise taxable base Multiply, Amount of assessed value of real, Louisiana franchise tax From, Total nonrefundable franchise tax, Franchise tax after nonrefundable, Previous payments, Amount of franchise tax due or, Net Amount Due, Total income and franchise tax, and Louisiana Citizens Insurance.

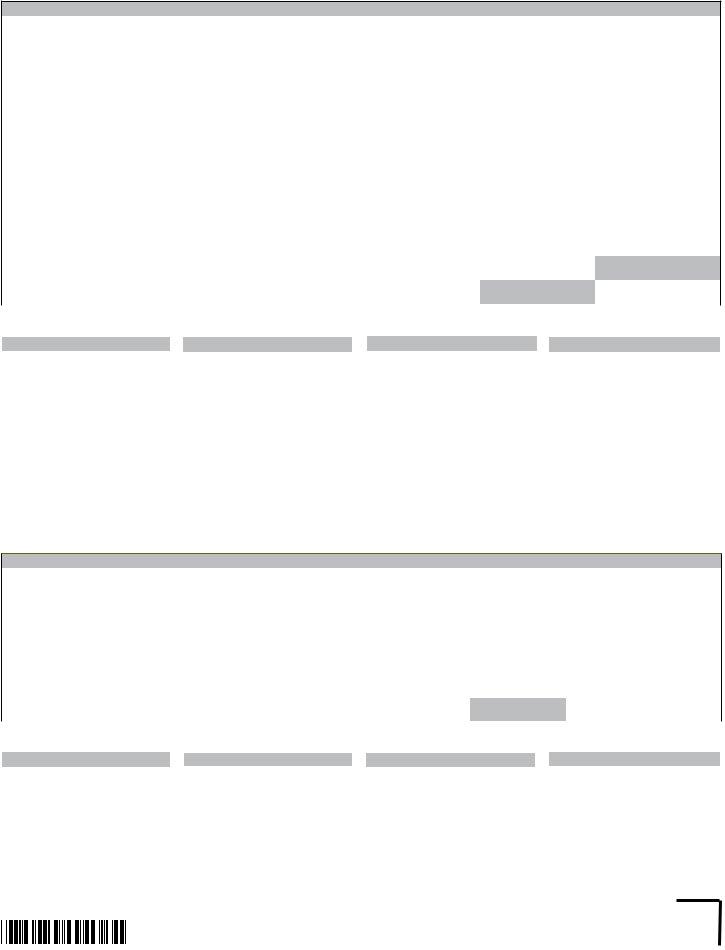

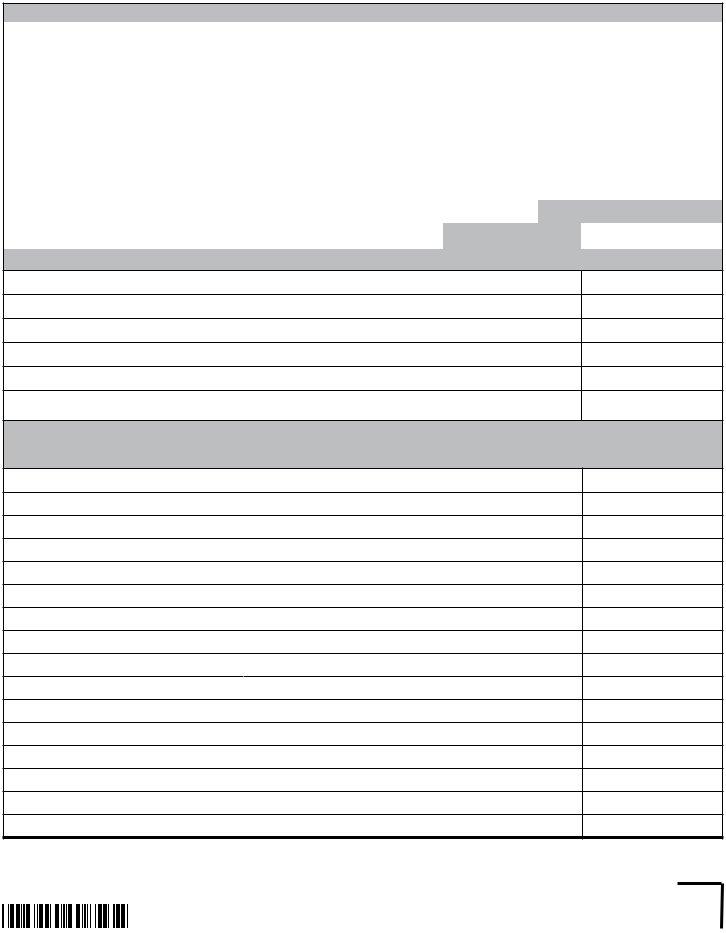

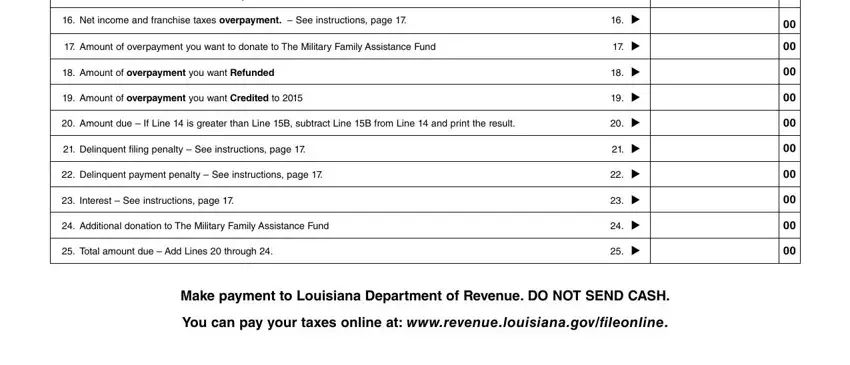

5. To finish your document, this last subsection features several additional blanks. Filling in B Subtotal Add Lines and A and, Net income and franchise taxes, Amount of overpayment you want to, Amount of overpayment you want, Amount of overpayment you want, Amount due If Line is greater, Delinquent iling penalty See, Delinquent payment penalty See, Interest See instructions page, Additional donation to The, Total amount due Add Lines, B u, Make payment to Louisiana, and You can pay your taxes online at is going to conclude everything and you're going to be done in a tick!

Step 3: Soon after double-checking your entries, hit "Done" and you are good to go! Sign up with us now and immediately access Subtractions, prepared for downloading. All adjustments you make are preserved , so that you can change the pdf later if needed. With FormsPal, you can easily complete documents without having to be concerned about information breaches or records being distributed. Our protected platform makes sure that your private data is kept safely.