TEN N ES S EE D EP AR TMEN T OF R EVEN U E

F r a n c h i s e a n d Ex c is e Ta x

Ap p lic a tio n fo r Ex e m p tio n / An n u a l Ex e m p tio n R e n e w a l

FAE 18 3

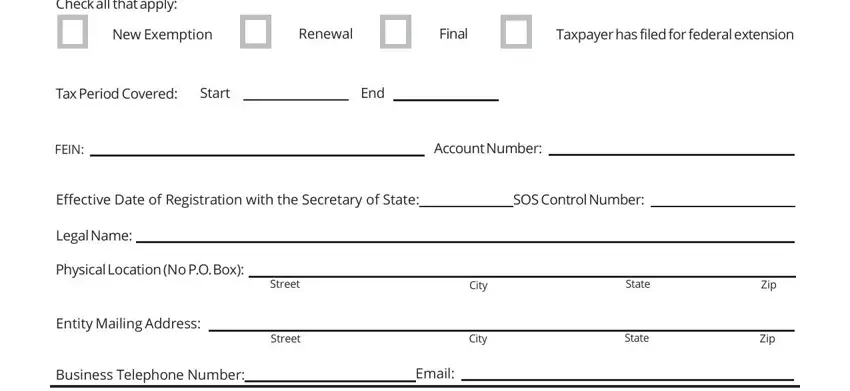

Check all that apply: |

|

|

|

|

New Exemption |

Renewal |

Final |

Taxpayer has filed for federal extension |

Tax Period Covered: |

Start |

|

End |

|

FEIN:AccountNumber:

Effective Date of Registration with the Secretary of State: |

SOS Control Number: |

|

|

|

Legal Name: |

|

|

|

|

|

|

|

|

|

Physical Location (No P.O.Box): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Street |

|

|

City |

State |

Zip |

Entity Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Street |

|

|

City |

State |

Zip |

Business Telephone Number: |

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please check one. All requirements for the selected exemption must be met.

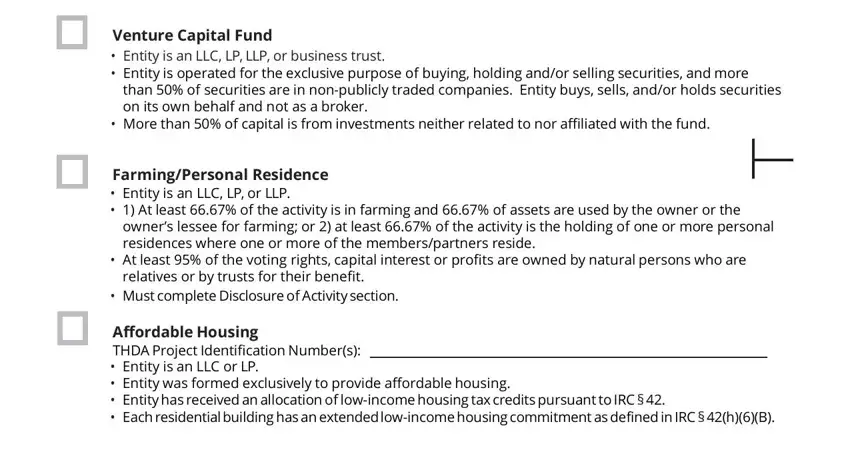

Venture Capital Fund

•Entity is an LLC, LP, LLP, or business trust.

•Entity is operated for the exclusive purpose of buying, holding and/or selling securities, and more than 50% of securities are in non-publicly traded companies. Entity buys, sells, and/or holds securities on its own behalf and not as a broker.

•More than 50% of capital is from investments neither related to nor affiliated with the fund.

Farming/Personal Residence

•Entity is an LLC, LP, or LLP.

•1) At least 66.67% of the activity is in farming and 66.67% of assets are used by the owner or the owner’s lessee for farming; or 2) at least 66.67% of the activity is the holding of one or more personal residences where one or more of the members/partners reside.

•At least 95% of the voting rights, capital interest or profits are owned by natural persons who are relatives or by trusts for their benefit.

•Must complete Disclosure of Activity section.

Affordable Housing

THDA Project Identification Number(s):

•Entity is an LLC or LP.

•Entity was formed exclusively to provide affordable housing.

•Entity has received an allocation of low-income housing tax credits pursuant to IRC § 42.

•Each residential building has an extendedlow-income housing commitment as defined in IRC § 42(h)(6)(B).

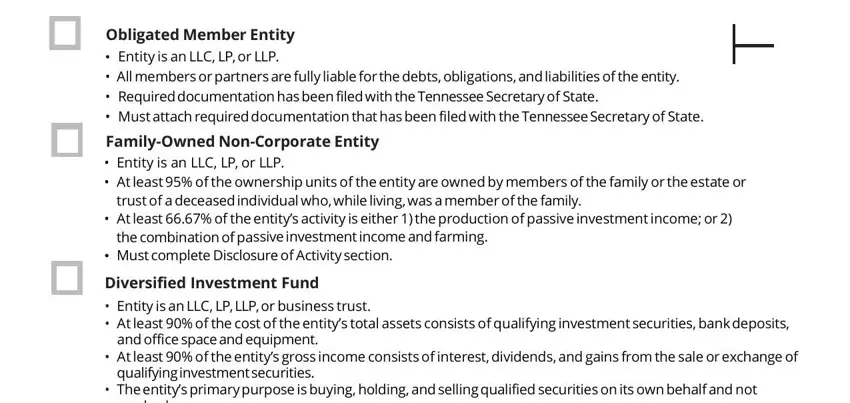

Obligated Member Entity

•Entity is an LLC, LP, or LLP.

•All members or partners are fully liable for the debts, obligations, and liabilities of the entity.

•Required documentation has been filed with the Tennessee Secretary of State.

•Must attach required documentation that has been filed with the Tennessee Secretary of State.

Family-Owned Non-Corporate Entity

•Entity is an LLC, LP, or LLP.

•At least 95% of the ownership units of the entity are owned by members of the family or the estate or trust of a deceased individual who,while living,was a member of the family.

•At least 66.67% of the entity’s activity is either 1) the production of passive investment income; or 2) the combination of passive investment income and farming.

•Must complete Disclosure of Activity section.

Diversified Investment Fund

•Entity is an LLC, LP, LLP,or business trust.

•At least 90% of the cost of the entity’s total assets consists of qualifying investment securities, bank deposits, and office space and equipment.

•At least 90% of the entity’s gross income consists of interest, dividends, and gains from the sale or exchange of qualifyinginvestmentsecurities.

•The entity’s primarypurpose is buying, holding, and selling qualified securities on its own behalf and not as a broker.

•Capital is primarily derived from investments byentities or individuals not affiliated with the fund.

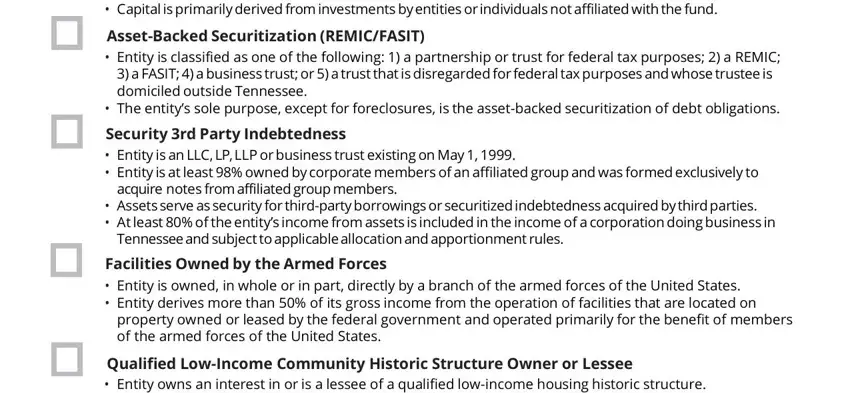

Asset-Backed Securitization (REMIC/FASIT)

•Entity is classified as one of the following: 1) a partnership or trust for federal tax purposes; 2) a REMIC; 3) a FASIT; 4) a business trust; or 5) a trust that is disregarded for federal tax purposes and whose trustee is domiciled outside Tennessee.

•The entity’s sole purpose, except for foreclosures, is the asset-backed securitization of debt obligations.

Security 3rd Party Indebtedness

•Entity is an LLC, LP,LLP or business trust existing on May 1, 1999.

•Entity is at least 98% owned by corporate members of an affiliated group and was formed exclusively to acquire notes from affiliated group members.

•Assets serve as security for third-party borrowings or securitized indebtedness acquired by third parties.

•At least 80% of the entity’s income from assets is included in the income of a corporation doing business in Tennessee and subject to applicable allocation and apportionment rules.

Facilities Owned by the Armed Forces

•Entity is owned, in whole or in part, directly by a branch of the armed forces of the United States.

•Entity derives more than 50% of its gross income from the operation of facilities that are located on property owned or leased by the federal government and operated primarily for the benefit of members of the armed forces of the United States.

Qualified Low-Income Community Historic Structure Owner or Lessee

•Entity owns an interest in or is a lessee of a qualified low-income housing historic structure.

•Entity has no business operations or assets other than its investment or lease in the qualified low-income community historic structure, business operations incidental to such investment or lease, and de minimis other operations and assets.

•Must attach a copy of the approval received under 26 U.S.C. §§ 47 and 45D.

Under penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and belief, it is true, correct, and complete.

Taxpayer's Signature |

|

|

|

|

|

Date |

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Preparer's Signature |

|

Preparer's PTIN |

|

Date |

|

|

|

Telephone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer's Address |

|

|

|

City |

|

|

|

State |

ZIP Code |

Preparer's Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

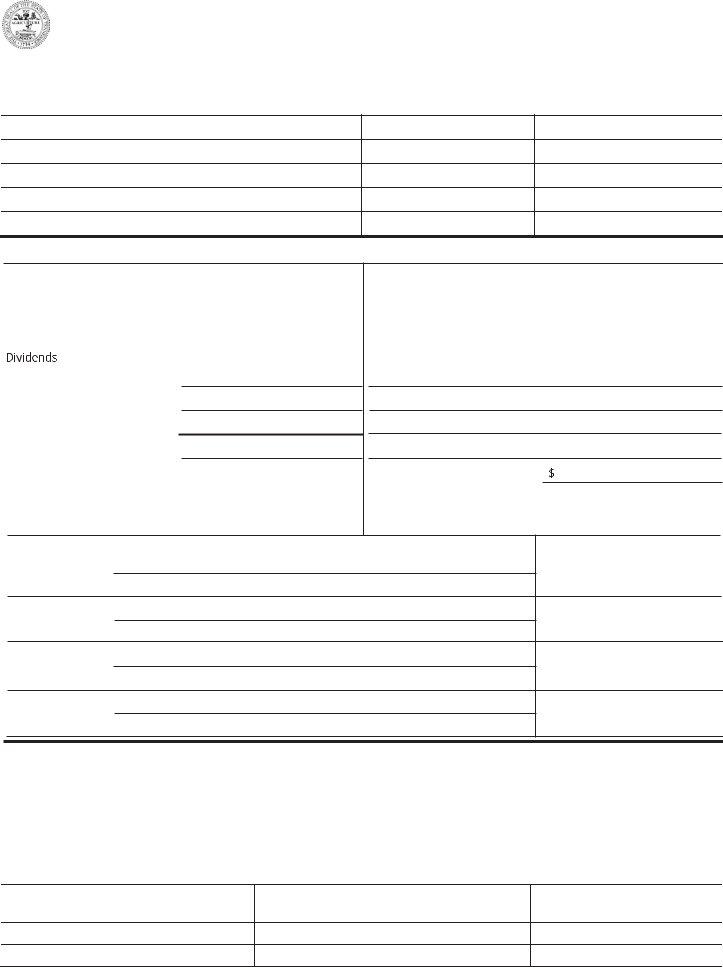

TEN N ES S EE D EP AR TMEN T OF R EVEN U E

F r a n c h i s e a n d Ex c is e Ta x Ex e m p t En tity

D is c lo s u r e o f Ac tivity

Please complete this page if you have indicated that you are applying for or renewing an exemption for a farming/personal residence or a family owned non-corporate entity.

Organizational Structure

(a) Member/Partner Name |

(b) Ownership Percentage (c) Relationship |

1.

2.

3.

4.

Part I Family-Owned Non-Corporate Entity (“FONCE”)

|

|

|

|

|

|

|

|

(a) Passive Investment Income |

|

(b) Non-Passive Investment Income |

|

|

Source of Income |

Receipts |

Source of Income |

Receipts |

|

|

|

|

Industrial & commercial |

|

|

Royalties |

|

|

real estate rental |

|

|

|

|

|

|

Other (please describe below): |

|

|

|

Annuities

Interest

Gain on sale/exchange of stock

Gain on sale/exchange of securities

Rent from residential property |

|

|

Total non-passive income |

Rent/income from farming |

|

|

Total passive income |

$ |

|

Property address:

Property address:

Property address:

Property address:

Part II Farming Activity

(a) Type of Income |

(b) Assets at Cost/FMV (see instructions) |

|

|

|

|

Farm income |

$ |

Assets used in farming |

$ |

|

|

|

|

Other income |

$ |

Other assets |

$ |

|

|

|

|

Total income |

$ |

Total assets |

$ |

Part III Holding a Personal Residence

(c)Number of Days Residing at Property

I n s tr u c ti o n s : Ap p lic a tio n fo r Ex e m p tio n

Tenn. Code Ann. § 67-4-2008 provides exemption from Tennessee’s franchise and excise taxes under certain situations. The Application for Exemption should be completed by entities requesting exemption under provision of these laws. Please see the descriptions of exempt entities shown below to determine if your entity qualifies for exemption.

Each entity is required to make its initial application for exempt status on this form and must also submit a renewal application annually. This annual application is due each year by the 15th day of the fourth month following the end of the

entity’s fiscal year for which the entity is claiming an exemption. The entity should not submit this renewal before the fiscal year end of the exemption year. The Department will not process any early submitted renewals. Any

entity that fails to timely file an application for exemption or renewal may be charged a $200 penalty.

Please mail completed applications and annual renewals to: Tennessee Department of Revenue, 500 Deaderick Street, Nashville, TN 37242. For questions or assistance with this form, please call (615) 253-0700, Monday through Friday, 8:30 a.m.-4:30 p.m. CST or visit www.tn.gov/revenue for more detailed information.

Entity Descriptions:

Venture Capital Funds [Tenn. Code Ann. § 67-4-2008(a)(5)]: An LLC, LLP, or LP formed and operated exclusively for buying, holding, and/or selling securities, including debt securities, primarily in non-publicly traded companies, on its own behalf and not as a broker. The capital of the fund is primarily (over 50%) derived from investments by entities and/or individuals which are not affiliated with the fund. A “non-publicly traded company” is a business entity that is not a “publicly traded company,” which is defined as (a) a national securities exchange registered under Section 6 of the Securities Exchange Act of 1934 or exempted from registration under such act by 15 U.S.C. Section 78f because of the limited volume of transac- tions; (b) a foreign securities exchange operating under principles analogous to a national securities exchange; (c) a regional or local exchange; (d) an interdealer quotation system that regularly disseminates firm buy or sell quotations by identified brokers or dealers by electronic means or otherwise; or (e) on a secondary market or the substantial equivalent thereof, if taking into account all of the facts and circumstances, the owners are readily able to buy, sell or exchange their ownership interest in a manner that is comparable, economically, to trading on an exchange.

Farming/Personal Residence [Tenn. Code Ann. § 67-4-2008(a)(6)]: An LLC, LP, or LLP where at least 66.67% of the activity of the entity is either farming or holding one or more personal residences, including acreage contiguous to the dwelling, where one or more of the members or partners reside. At least 95% of the entity must be owned either by persons who are relatives of one another or by trusts for their benefit. Natural person shall be considered “rela- tives” by blood or adoption if they are descended from a common ancestor and their relationship with each other is that of a first cousin or closer than that of a first cousin, or if they are spouses of one another.

Affordable Housing [Tenn. Code Ann. § 67-4-2008(a)(8)]: The LLC or LP must have received an allocation of low- income housing tax credits pursuant to Section 42 of the Internal Revenue Code of 1986, as amended (IRC). An “extended low-income housing commitment” as defined in Section 42(h)(6)(B) of the IRC, must be in effect with re- spect to each residential building owned by the entity for the period covered by the return. Attach separate Afford- able Housing Certification Form.

Obligated Member [Tenn. Code Ann. § 67-4-2008(a)(9)]: In order to qualify as an exempt obligated member entity, the appropriate documentation required for each of the entity’s members, partners or owners to waive their limited liability protection shall be filed with the Tennessee Secretary of State on or before the first day of the first otherwise taxable year for which the entity wishes to claim exemption. This does not relieve the obligated member entity from filing an initial Application for Exemption with the Department of Revenue by the 15th day of the fourth month following the end of the entity’s fiscal year for which the person claims the exemption or from submitting a renewal application annually by the date on which a return would otherwise be due were it not for the exemption. To the extent that any obligated member, or any owner of an obligated member, provides limited liability protection, the obligated member entity shall owe the taxes otherwise imposed by the franchise and excise statutes on the portion of income and equity attributable to such obligated member. Ownership includes any form of ownership, whether in whole, in part, direct or indirect. Also, estates, trusts that are not taxpayers, nonprofit entities, or other entities exempt under this section, shall not be deemed to provide limited liability protection. Documentation filed with the Tennessee Secretary of State’s office must also be filed with the Department of Revenue when this form is submitted.

REMIC or FASIT [Tenn. Code Ann. § 67-4-2008(a)(10)]: An entity: (a) which is classified as a partnership or trust in accordance with the federal regulations and rulings promulgated under 26 U.S.C. Section 7701, or has elected to be treated as a real estate mortgage investment conduit (REMIC) under 26 U.S.C. Section 860D, or as a financial asset securitization investment trust (FASIT) under 26 U.S.C. Section 860L, or a business trust, as defined in Section 48-101-202(a), when the commercial domicile of the trustee is not in Tennessee; and (b) the sole purpose of which, except for foreclosures and dispositions of the assets of foreclosures, is the asset-backed securitization of debt obligations, such as first or second mortgages, includ- ing home equity loans, trade receivables, whether an open account or evidenced by a note or installment or conditional sales contract, obligations substituted for trade receivables, credit card receivables, personal property leases treated as debt for purposes of the IRC, automobile loans or similar debt obligations. “Trade receivables” are defined as obligations arising from the sale of inventory in the ordinary course of business.

Family-Owned Non-Corporate Entity [Tenn. Code Ann. § 67-4-2008(a)(11)]: Any family-owned non-corporate entity where substantially all the activity of the entity is either (a) the production of passive investment income, or (b) the combination of the production of passive investment income and farming. “Family-owned” means that at least 95% of the ownership units of the entity are owned by members of the family, which means, with respect to an individual, only an ancestor of such individual; the spouse or former spouse of such individual; a lineal descendent of such individual, of such individual’s spouse or former spouse, or of a parent of such individual; the spouse or former spouse of any lineal descendent; or the estate or trust of a deceased individual who, while living, qualified as a lineal descendent. A legally adopted child of an individual shall be treated as the child of such individual by blood. “Passive investment income” means gross receipts derived from royalties, rent from residential real estate, dividends, interest, annuities, and any gains from sales or ex- changes of stock or securities. Entities with no income may qualify for this exemption if all other requirements are met.

Third Party Indebtedness [Tenn. Code Ann. § 67-4-2008(a)(7)]: This exemption is effective for periods beginning on or after May 1, 1999. The entity must be at least 98% owned by corporate members of an affiliated group and be formed and operated for the exclusive purpose of acquiring notes from members of such affiliated group, accounts receivable, install- ment sale contracts, and similar evidence of indebtedness obtained in the ordinary course of business by one or more members of such affiliated group. The entity’s assets must directly or indirectly serve as security for third party borrowings or securitized indebtedness acquired by third parties. At least 80% of the income therefrom must be included in the income of a corporation doing business in Tennessee, and such income must be subject to the applicable franchise and excise tax allocation and apportionment rules.

Diversified Investment Fund [Tenn. Code Ann. § 67-4-2008(a)(12)]: An entity that is formed and operated for the purpose of buying, holding, or selling qualified investment securities on its own behalf. The capital of the fund must be primarily derived from investments by entities or individuals that are not affiliated with the fund. At least 90% of the fund’s income must consist of interest, dividends, and gains from the sale or exchange of such investment securities.

Facilities Owned by the Armed Forces [Tenn. Code Ann. § 67-4-2008(a)(16): Any entity owned directly, in whole or in part, by a branch of the United States Armed Forces. The entity must derive more than 50% of its gross income from the operation of facilities that are located on property owned or leased by the federal government and operated primarily for the benefit of members of the United States Armed Forces.

Qualified Low-Income Community Structure Owner or Lessee [Tenn. Code Ann. § 67-4-2008(a)(17): The entity must own an interest in or be the lessee of a qualified low-income community historic structure. The entity must have no business operations or assets other than its investment or lease in the qualified low-income community historic structure, business operations and assets incidental to such investment or lease, and de minimis other operations and assets. Attach a copy of the approval received under 26 U.S.C.§§ 47 and 45D.

In s t r u c ti o n s : D is c lo s u re o f Ac ti vi ty

If the entity does not meet the exemption requirements in any given year, it is taxable on all activities for that year. A completed franchise and excise tax return (FAE170) must be filed electronically with payment of any taxes due by the 15th day of the fourth month following the close of the taxable year.

Definitions:

Family Member – To determine who is considered a family member of a family-owned non-corporate entity (FONCE), identify one person (either an owner or non-owner, living or deceased) to whom the owners are potentially related. With respect to that person, the following are considered members of the family:

1.Ancestor (mother, grandfather, great grandmother, etc.)

2.Spouse or former spouse

3.Lineal descendent of individual, individual’s spouse or former spouse or individual’s parent (brother, daugh- ter, grandson, niece, step-daughter, step-grandson, etc.)

4.Spouse or former spouse of #3 above

5.The estate or trust (testamentary) of a deceased individual who, while living, was one of the above

Relative – To determine who is considered a relative for the farming/personal residence exemption, natural persons shall be considered relatives, if, by blood or adoption, they are descended from a common ancestor and their rela- tionship with each other is that of a first cousin or closer than that of a first cousin, or if they are spouses of one another.

Farming – The growing of crops, nursery products, timber or fibers, such as cotton, for human or animal use or consumption; the keeping of horses, cattle, sheep, goats, chickens or other animals for human or animal use or consumption; the keeping of animals that produce products, such as milk, eggs, wool or hides for human or animal use or consumption; or the leasing of the land to be used for farming.

Filing Requirement:

The following entities must complete the Disclosure of Activity section:

1.FONCEs qualifying for exemption. Complete the Organizational Structure section and Part I.

2.LLCs,LPs, and LLPs qualifying for the farming activity exemption. Complete the Organizational Structure section and Part II.

3.LLCs,LPs, and LLPs qualifying for the holding a personal residence exemption. Complete the Organizational Structure section and Part III.

Organizational Structure:

(a)Provide the full names of all members or partners.

(b)Enter each member’s or partner’s percentage interest in the entity. The total must equal 100%.

(c)Identify the relationship of each partner (e.g., spouse, daughter, etc.). See definition of family member and relative above.

Part I - Family-Owned Non-Corporate Entity:

Passive Investment Income:

(a)Enter the gross amount received from each source. However, enter the net gain for capital gains on the sale of stock or securities. For a capital loss on the sale of stock or securities, enter $0.

Non-Passive Income:

(b)List the source and gross amount of non-passive income received during the reporting period.

Note: In order for an entity to qualify for the FONCE exemption: 1) at least 95% of its ownership must be held by members/partners who are family members; and 2) at least 66.67% of its income must be from passive investments and/or farming. If the entity has no income for the year, it meets the passive investment income test.

Part II - Farming Activity:

(a)Enter the amount of gross receipts earned by the entity from farming activities and all other activities. Farm income includes gross receipts derived from the property, including capital gains from the sale of land and other assets.

(b)Enter the original cost of assets owned by the entity. In the event an asset’s original cost cannot be determined, or there is no original cost to the entity, the property should be reported at its fair market value at the time of acquisition by the entity.

Note: In order for an entity to qualify for the Farming Activity exemption: 1) at least 66.67% of its income must be from farming; 2) at least 66.67% of its assets must be used in farming; and 3) at least 95% of the voting rights, capital interest or profits must be owned by family members as defined above.

Part III - Holding a Personal Residence:

(a)Enter the complete address of the property.

(b)If the property listed is residential property, enter the name of the person(s) residing at the property.

(c)Enter the length of time during the year that the person occupied the dwelling.

Note: In order for an entity to qualify for the Holding a Personal Residence exemption: 1) at least 66.67% of its activity must consist of holding one or more personal residences where one or more of the members/partners reside, 2) at least 95% of the voting rights, capital interest or profits must be owned by family members as defined above.