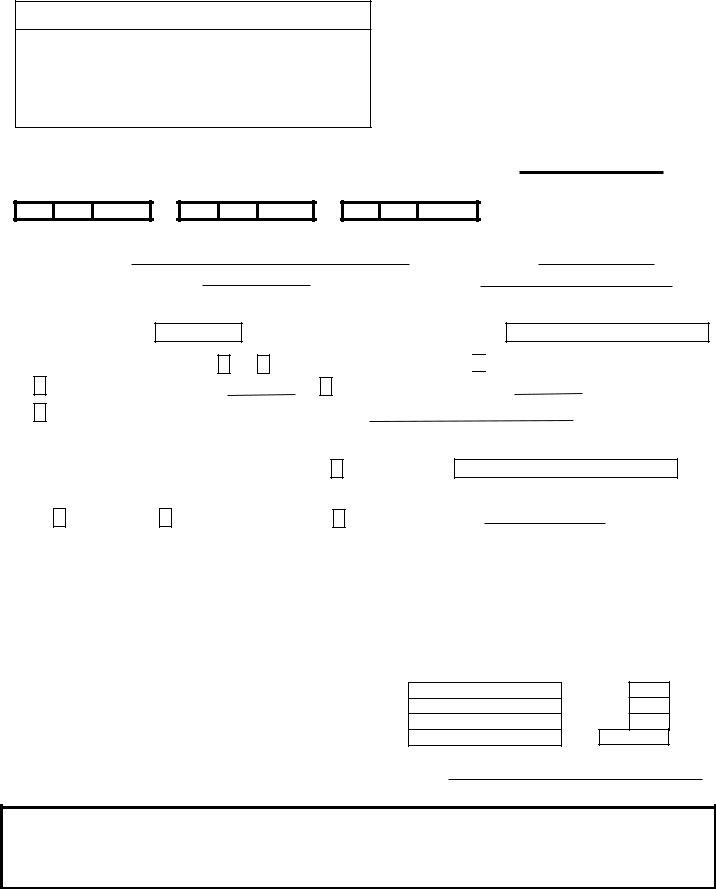

The 2020 CIT-1 New Mexico form, a fundamental document for corporations operating within the state, encapsulates the requisites for filing Corporate Income and Franchise Tax Returns. This comprehensive form demands thorough details beginning with basic corporation information, such as name, address, and tax identification numbers, moving on to specific fiscal data including the fiscal year start and end dates, and any extended due dates. It intricately mandates details about the corporation’s incorporation, business commencement in New Mexico, and the appointment of a registered agent within the state, ensuring that corporations are well accounted for and registered according to New Mexico state laws. Furthermore, the form delves into the financial aspects, requiring information on the corporation's method of accounting, the nature of its final return, whether due to dissolution, merger, or reorganization, and any changes in federal income tax liabilities that have yet to be reported to New Mexico's Taxation and Revenue Department. The form also addresses the specifics of unitary group returns and mandates information on accounting adjustments, allocated and apportioned income, highlighting its intricate role in facilitating corporate tax compliance within the state. As such, the 2020 CIT-1 form stands as an essential bridge between corporate entities and tax obligations, underscoring the importance of accurate and comprehensive tax reporting.

| Question | Answer |

|---|---|

| Form Name | Form Cit 1 New Mexico |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | Form Cit-1 - New Mexico Corporate Income And Franchise Tax ... |

2020

NEW MEXICO CORPORATE INCOME AND FRANCHISE TAX RETURN

Corporation name

1a

Mailing address (number and street name)

2a |

|

|

|

|

|

City |

|

State |

Postal/ZIP code |

3a |

|

|

|

|

|

|

|

|

|

|

If foreign address, enter country |

Foreign province and/or state |

||

3b |

|

|

|

|

|

|

|

|

|

|

FEIN (Required) |

New Mexico Business ID # |

||

5a |

|

5b |

|

|

*206080200*

4a |

|

Original Return |

FOR DEPARTMENT USE ONLY |

4b |

|

|

|

4c |

|

|

|

4d |

|

|

|

|

|

6d

Contact phone number

Fiscal (or |

Extended Due Date |

6a

6b

6c

COMPLETE THE FOLLOWING: |

|

|

|

|

|

|

A. |

State of incorporation |

|

A1. Date of incorporation |

|

|

|

B. |

Date business began in New Mexico |

B1. State of commercial domicile |

|

|

|

|

C. |

Name and address of registered agent in New Mexico |

|

|

|

|

|

|

|

name |

address |

city |

state |

ZIP code |

D.NAICS Code (Required)

E.Is this a return for a unitary group? Yes

No

D1. Principal business activity in New Mexico

E1. If yes, which type of unitary group? worldwide combined group

consolidated group. Year of election

Member of a unitary group, filing separately. Name of parent entity

NOTE: A unitary group has certain filing requirements. See page 9 of the instructions for definition.

F. Indicate method of accounting: |

|

Cash |

|

Accrual |

|

|

|

|

|

G.If this is the corporation's final return, was the corporation:

Other (specify) F1.

Dissolved

Merged or reorganized

Withdrawn |

G1. Date |

H.Has this corporation's federal income tax liability changed for any year due to an IRS audit or the filing of an amended federal return that has not

been reported to New Mexico? Yes |

|

No |

|

If yes, submit an amended New Mexico Corporate Income and Franchise Tax Return, |

|

|

|

|

|

and a copy of the amended federal return or Revenue Agent's Report (RAR), if applicable, to the New Mexico Taxation and Revenue Department.

I. If this a return for a filing group, complete the following information for each corporation in the filing group.

The total of column 3 must equal

|

|

|

Column 3 |

Column 1 |

|

Column 2 |

Amount of quarterly, tentative, or other |

Corporation name |

|

FEIN |

payments to apply to this return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Column 4 $50 if corporation

pays franchise tax

Totals

J.If other than a corporation, enter your legal entity type (for example, LLC or partnership):

Refund Express!!

RE1 1. Routing number:

RE2 2. Account number:

Have your refund directly deposited. See instructions and fill in 1, 2, 3, and 4.

|

RE3 3. Type: Checking |

|

Savings |

|

|

|

|

Enter X. |

|

Enter X. |

|

|

|

|

|

||

|

|

|

|

|

|

4.REQUIRED: WILL THIS REFUND GO TO OR THROUGH AN ACCOUNT LOCATED OUTSIDE THE UNITED STATES? If yes, you may not use this refund delivery option. See instructions.

RE4 YES |

|

|

|

You must answer |

|

NO |

|

this question. |

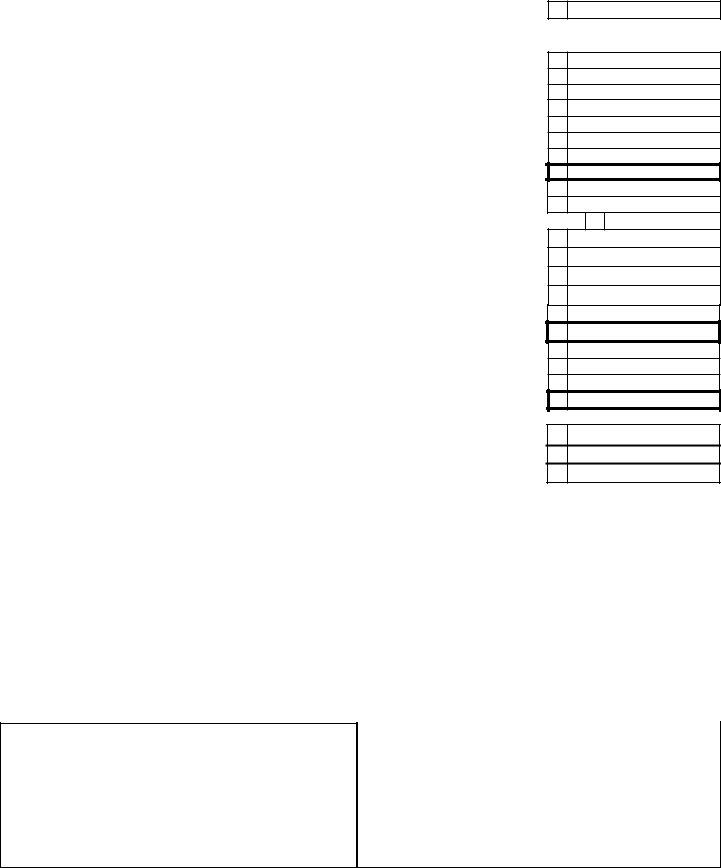

2020 |

*206090200* |

||||

NEW MEXICO CORPORATE INCOME AND FRANCHISE TAX RETURN |

|||||

|

|

||||

|

FEIN |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Federal form 1120, line 28, taxable income before NOL and special deductions.............................................

1a. Captive REIT deductions |

1a |

|

|

1b. Exempt entity deductions |

1b |

|

|

1

2.Interest income from municipal bonds, excluding New Mexico bonds .............................................................

3.Other additions to the base income of a unitary group (see

4.Subtotal of base income after additions. Add lines 1, 1a, 1b, 2 and 3.................................................................

5.Federal special deductions (from federal Form 1120, line 29b). Enter only a positive number........................

6.Interest from U.S. government obligations or

7.Certain foreign dividends, Subpart F income, and GILTI (from

8.Other subtractions to the base income of a unitary group (see

9.New Mexico net income or loss. Subtract lines 5, 6, 7, and 8 from 4...............................................................

10.Net allocated income or loss (from

11.Total apportionable income or loss. Subtract line 10 from line 9 ......................................................................

12.New Mexico apportionment percentage (from

13.Income or loss apportioned to New Mexico. Line 11 multiplied by the percentage on line 12.........................

14.Net New Mexico allocated income or loss (from

15.New Mexico apportioned net income or loss. Add lines 13 and 14.....................................................................

16.Net operating loss deduction, not in excess of 80% of line 15. Attach form

17.New Mexico taxable income. Subtract line 16 from 15 .....................................................................................

18.New Mexico Income tax. Tax on amount on line 17 (see tax table on page 13 of

19. Total tax credits applied against the income tax liability on line 18 (from

20.Net income tax. Subtract line 19 from line 18. Amount cannot be negative.......................................................

21.Franchise tax ($50 per corporation) ..................................................................................................................

22.Total income and franchise tax. Add lines 20 and 21....................................................................................

23.Amended Returns Only. Enter amount of all 2020 refunds received and overpayments applied to 2021. Also see instructions for line 25.........................................................................................................................

24.Subtotal. Add lines 22 and 23............................................................................................................................

25. Total Payments: |

|

Quarterly |

|

Extension |

|

......................................Applied from prior year |

2

3

4

5

6

7

8

9

10

11

12_ _ _ . _ _ _ _ %

13

14

15

16

17

18

19

20

21

22

23

24

25

Mark this box if you want to use method 4 to calculate penalty and interest on underpayment of |

|

|

25a |

|

|

estimated tax. See instructions, attach |

|

|

|

|

|

|

|

26. |

........New Mexico income tax withheld from oil and gas proceeds. Attach Forms |

26 |

|

||

27. |

........New Mexico income tax withheld from a |

27 |

|

||

28. |

Total payments and tax withheld. Add lines 25 through 27 |

28 |

|

||

29. |

Tax due. If line 24 is greater than line 28, subtract line 28 from line 24 |

29 |

|

||

30. |

Penalty. See |

30 |

|

||

|

|

||||

31 |

|

||||

31. |

Interest. See |

|

|||

32 |

|

||||

32. |

Total amount due. Mail your check separately with |

|

|

||

..................................... |

|

|

|||

|

33 |

|

|||

33. |

Overpayment. If line 28 is greater than line 24, enter the difference |

|

|||

33a |

|

||||

|

33a. Amount of overpayment to apply to 2021 liability (not more than line 33) |

|

|

||

|

|

|

|||

|

|

33b |

|

||

|

33b. Amount of overpayment to refund. Subtract line 33a from line 33 |

REFUND |

|

||

|

|

|

|||

34. Total portion of tax credits to refund |

|

|

|

||

|

(from |

34 |

|

||

35. |

Total refund of overpaid tax and refundable credit due to you. Add lines 33b and 34 |

..................................... |

35 |

|

|

|

|

|

|

|

|

Taxpayer's Signature |

|

|

Paid Preparer's Use Only |

|

||||

I declare that I have examined this return, including accompanying schedules and statements, |

|

|

|

|

|

|||

and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of |

|

|

|

|

|

|||

preparer (other than taxpayer or an employee of the taxpayer) is based on all information of |

|

|

|

|

|

|||

which preparer has any knowledge. |

|

|

Signature of preparer if |

other than employee of the taxpayer |

Date |

|||

|

|

|

|

|

P1 FEIN |

_ |

|

|

Signature of officer |

Date |

|

|

|||||

|

|

|

|

|

||||

|

|

|

|

|

P2 Preparer's PTIN |

_____________________ |

|

|

|

|

|

|

|

P3 Preparer's phone number ____________________________ |

|||

|

Title |

Contact phone number |

||||||

Taxpayer's email address |

|

|

|

|

|

|

|

|

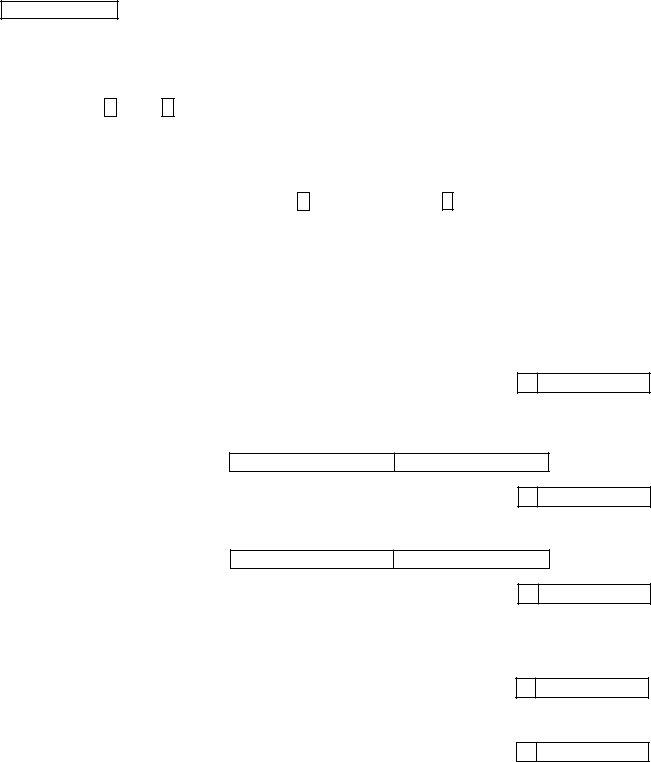

2020

NEW MEXICO APPORTIONED INCOME FOR |

*206280200* |

MULTISTATE CORPORATIONS (attach to |

|

|

FEIN

Taxpayers with income from inside and outside New Mexico must complete this schedule.

The Department cannot accept computerized schedules instead of this form. You must complete column 1, Total Everywhere, and all other applicable line items for the Department to process the return. Round all dollar amounts.

A. Have you changed your reporting of any class or type of allocated or apportioned income from the way it was reported in

a prior taxable year?

Yes

No

B. This entity submitted written notification of its election to use one of the special methods of apportionment of business

income for tax year ending _______________. The effective date of the election is |

______________. See instructions. |

Month/Day/Year |

Month/Day/Year |

C. Mark the box indicating the special method elected.

Manufacturers

Headquarters Operation

PROPERTY FACTOR

Average annual value of inventory |

1a |

Average annual value of real property |

1b |

Average annual value of personal property |

1c |

Rented property. Multiply annual rental value by 8 |

1d |

Total property |

1e |

Column 1 |

Column 2 |

Percent |

Total Everywhere |

Inside New Mexico |

Inside New Mexico |

|

|

Calculate each |

|

|

|

|

|

percentage to four |

|

|

|

|

|

decimal places; for |

|

|

|

|

|

example, 22.5431%. |

|

|

|

1. Property factor. Divide Total property column 2 by column 1 and then multiply by 100...............................................

PAYROLL FACTOR

1

_ _ _ . _ _ _ _%

Wages, salaries, commissions, and other compensation |

2a |

|

of employees related to apportionable income |

|

|

|

|

|

2. Payroll factor. Divide column 2 by column 1 and then multiply by 100 |

+ |

|

SALES FACTOR

2

_ _ _ . _ _ _ _%

gross receipts |

3a |

3. Sales factor. Divide column 2 by column 1 and then multiply by 100 |

+ |

3

_ _ _ . _ _ _ _%

4. |

Sum of factor percentages. Add lines 1, 2, and 3 |

+ |

||

|

4a. Count of factors. Enter the total count of all factors used |

|

|

|

|

4a |

|

|

|

|

NEW MEXICO PERCENTAGE. Divide line 4 by the count of factors used to calculate line 4a |

|

|

|

5. |

||||

4_ _ _ . _ _ _ _%

5_ _ _ . _ _ _ _%

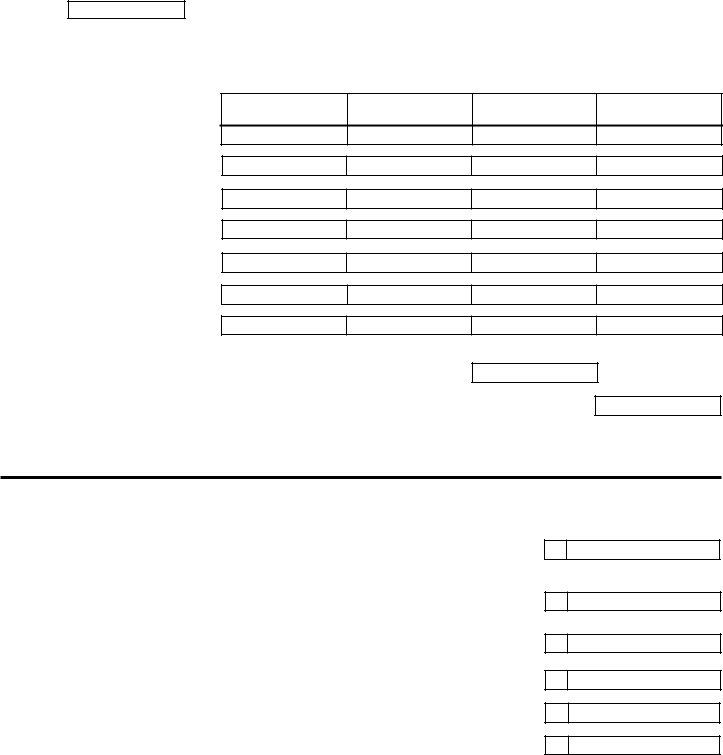

FEIN |

*206380200* |

2020

NEW MEXICO ALLOCATION OF

SCHEDULE OF INCOME NOT DERIVED FROM THE CORPORATION'S TRADE OR BUSINESS The Department cannot accept computerized schedules instead of this form. Round all dollar amounts.

1. |

1 |

|

2. |

2 |

|

3. |

3 |

|

4. |

4 |

|

5. |

Profit or loss on sale or exchange of |

|

|

5 |

|

6. |

6 |

|

7. Other |

7 |

|

|

(Attach schedule) |

|

Column 1

Gross Amount

Column 2

Related Expenses

Column 3

Column 1 less Column 2

Column 4

Allocation to New Mexico

8. |

Net allocated income. |

|

|

Enter here and on |

8 |

9. |

Net New Mexico allocated income. |

|

|

Enter here and on |

9 |

2020

CERTAIN FOREIGN DIVIDENDS, SUBPART F, AND GILTI

1.Certain dividends from foreign corporations (from federal form 1120, Schedule C, Line 14)..............................

2.Subpart F inclusions derived from hybrid dividends of tiered corporations (from federal form 1120, Schedule C,

Line 16b)..............................................................................................................................................................

3.Other inclusions from CFCs under subpart F (from federal form 1120, Schedule C, Line 16c)...........................

4.Global Intangible Low Taxed Income (GILTI) net of the deduction provided under IRC Sec. 250 (federal form 1120, Schedule C, Line 17, net of line 22)............................................................................................................

5.Foreign dividend

6.Total. Add lines 1 through 5. Also enter on line 7,

1

2

3

4

5

6