Through the online PDF tool by FormsPal, you'll be able to complete or change check cashing anti money independent printable right here and now. We are devoted to giving you the perfect experience with our editor by regularly introducing new functions and improvements. With all of these updates, working with our tool becomes better than ever! To get the ball rolling, go through these simple steps:

Step 1: Access the PDF in our editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: With this state-of-the-art PDF file editor, it is possible to accomplish more than merely complete blanks. Express yourself and make your docs look sublime with customized text added, or fine-tune the original input to excellence - all that comes along with an ability to add almost any photos and sign the PDF off.

This document requires specific details to be typed in, hence you should definitely take whatever time to enter what's expected:

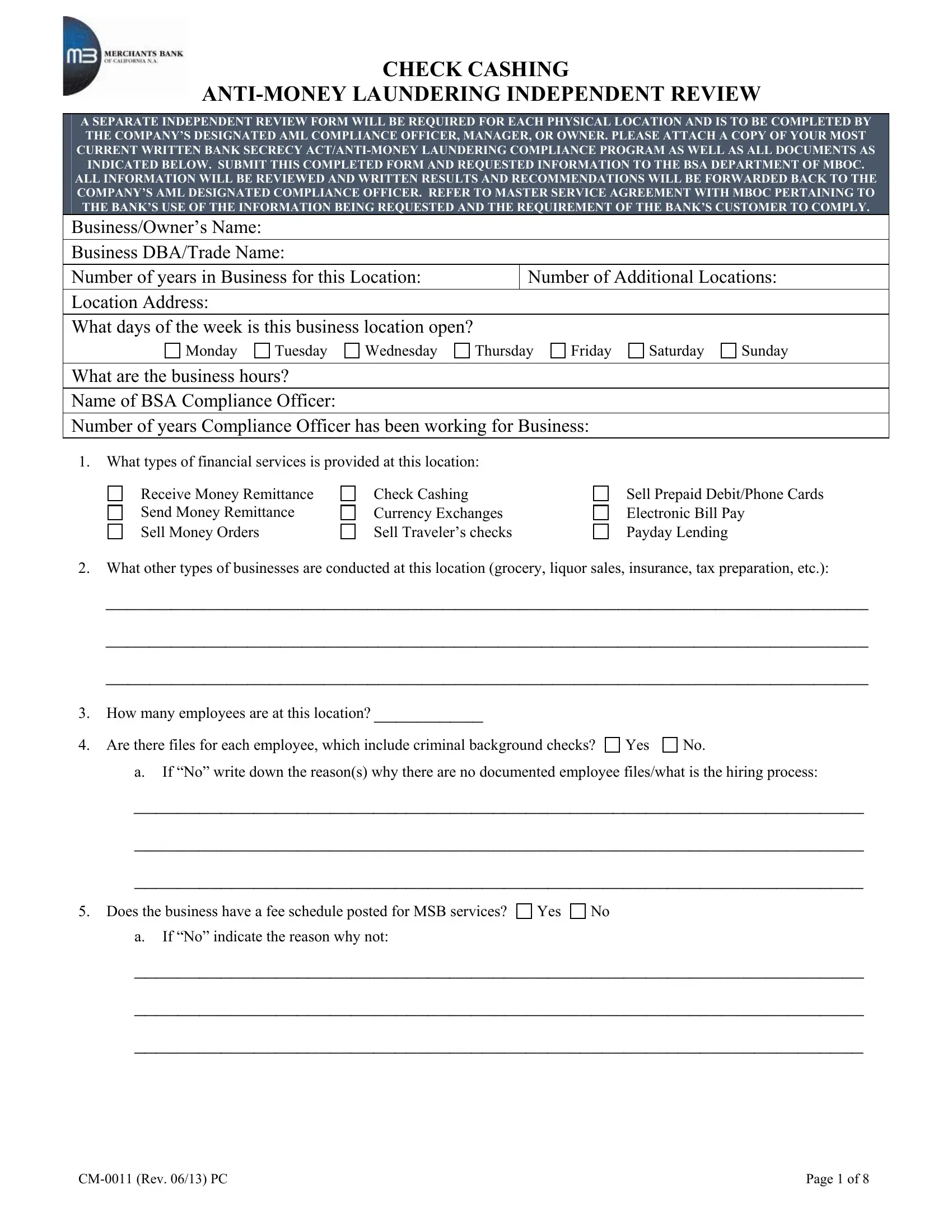

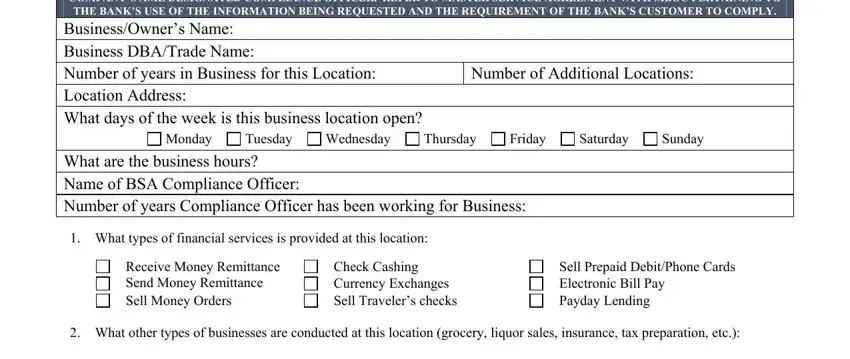

1. Firstly, while filling in the check cashing anti money independent printable, begin with the page that has the next blank fields:

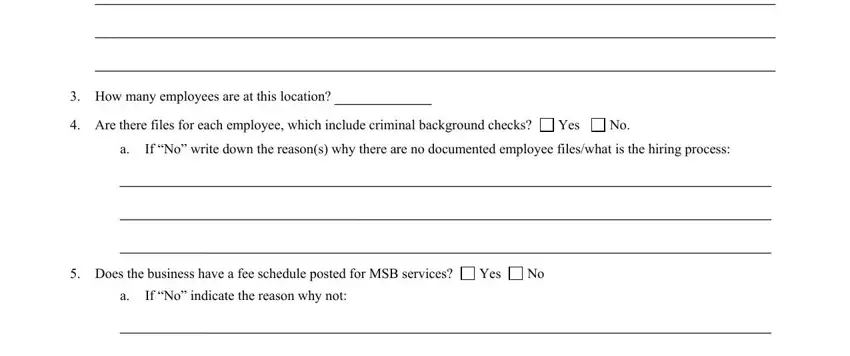

2. Immediately after the last array of blank fields is completed, proceed to type in the applicable details in all these: How many employees are at this, Are there files for each employee, Yes, If No write down the reasons why, Does the business have a fee, Yes, and If No indicate the reason why not.

3. This next part is normally straightforward - complete all the empty fields in CM Rev PC, and Page of to complete this segment.

As for Page of and CM Rev PC, make sure that you double-check them in this current part. These two are definitely the key fields in the form.

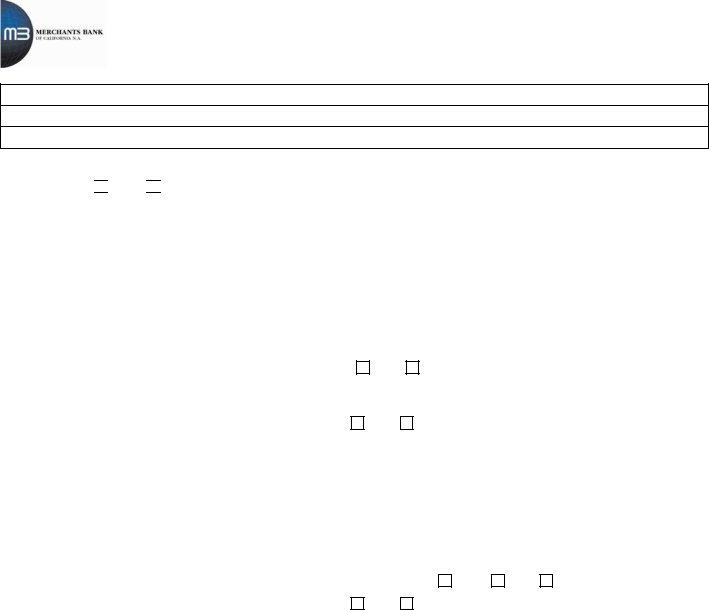

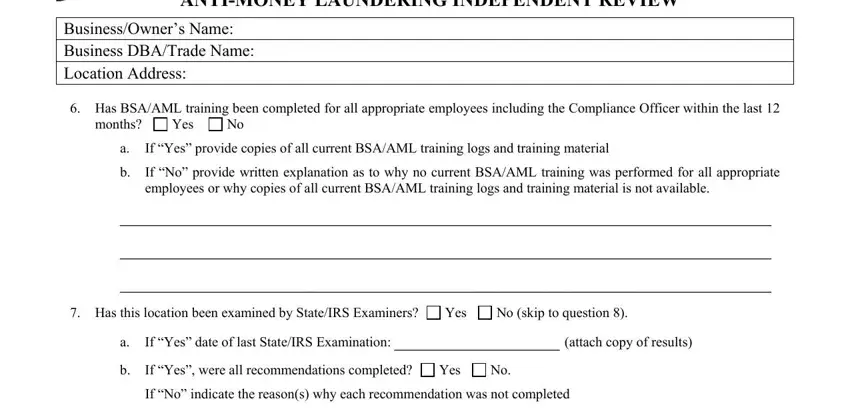

4. Filling in ANTIMONEY LAUNDERING INDEPENDENT, BusinessOwners Name Business, Has BSAAML training been, months, Yes, If Yes provide copies of all, If No provide written explanation, Has this location been examined, Yes, No skip to question, If Yes date of last StateIRS, If Yes were all recommendations, Yes, and If No indicate the reasons why is essential in this next step - ensure that you take the time and take a close look at each and every blank!

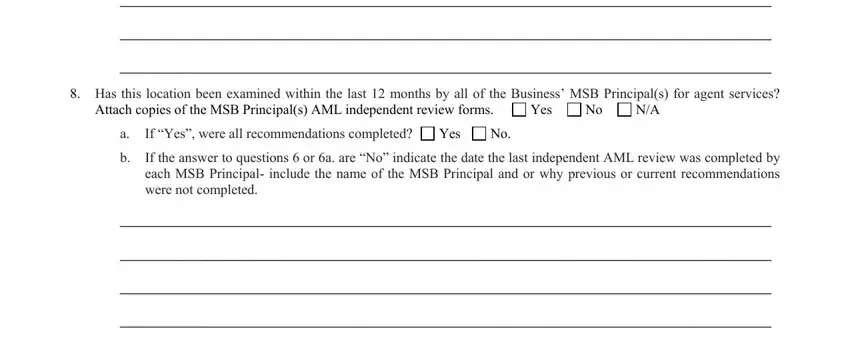

5. Since you reach the final sections of the form, you will find a couple more requirements that need to be satisfied. Mainly, Has this location been examined, Attach copies of the MSB, Yes, If Yes were all recommendations, Yes, and If the answer to questions or a should all be filled out.

Step 3: Immediately after taking another look at your fields you've filled out, hit "Done" and you're all set! After registering afree trial account here, you will be able to download check cashing anti money independent printable or send it via email at once. The PDF document will also be easily accessible in your personal account menu with your each edit. FormsPal is devoted to the privacy of our users; we always make sure that all personal data used in our system is kept confidential.