licensees can be completed in no time. Just use FormsPal PDF tool to get the job done fast. Our editor is constantly evolving to provide the very best user experience possible, and that is due to our commitment to continuous enhancement and listening closely to feedback from customers. To get the process started, go through these simple steps:

Step 1: Access the PDF in our tool by clicking the "Get Form Button" above on this page.

Step 2: As soon as you open the online editor, you will get the form ready to be filled out. Other than filling out different fields, you may as well do many other things with the PDF, that is putting on any textual content, modifying the original textual content, adding graphics, affixing your signature to the PDF, and much more.

Filling out this form demands thoroughness. Make certain every blank field is filled out accurately.

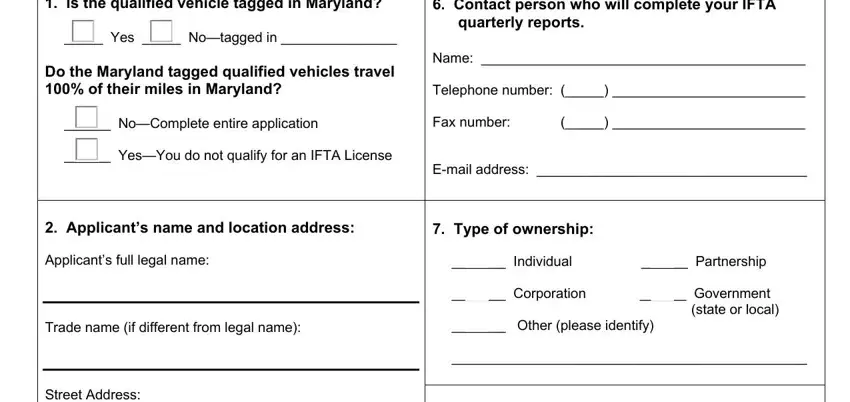

1. It's essential to complete the licensees correctly, hence pay close attention while filling in the areas comprising all of these fields:

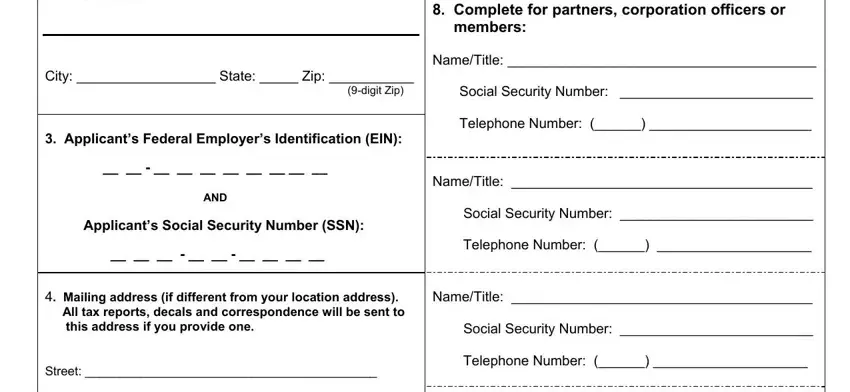

2. Once your current task is complete, take the next step – fill out all of these fields - Applicants name and location, Mailing address if different from, Type of ownership Individual, NameTitle Social Security Number, and NameTitle Social Security Number with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

In terms of Applicants name and location and Mailing address if different from, ensure you don't make any mistakes in this section. Both these are the most important fields in this form.

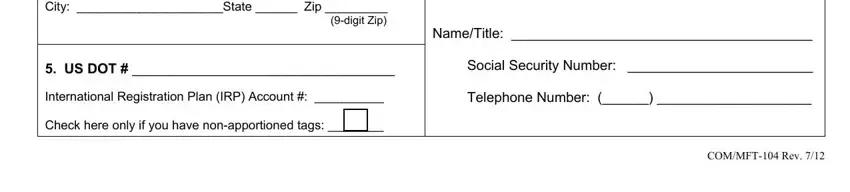

3. Completing Mailing address if different from, NameTitle Social Security Number, and COMMFT Rev is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

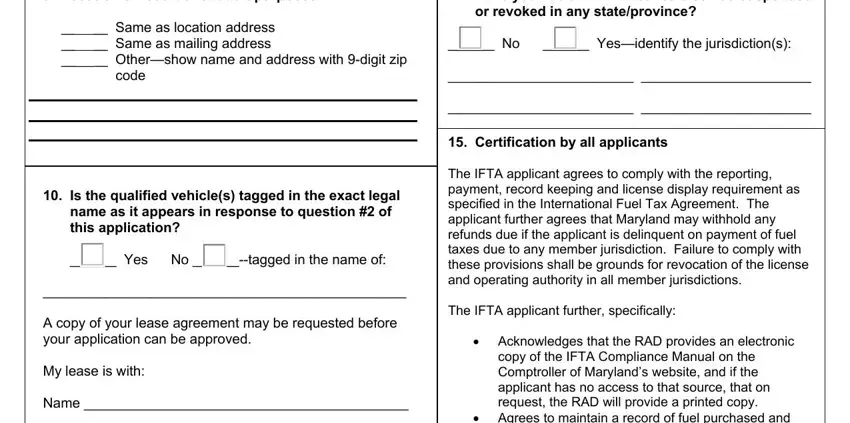

4. This next section requires some additional information. Ensure you complete all the necessary fields - Location of records for audit, Is the qualified vehicles tagged, Have you had an IFTA License that, Certification by all applicants, Acknowledges that the RAD, copy of the IFTA Compliance Manual, and Agrees to maintain a record of - to proceed further in your process!

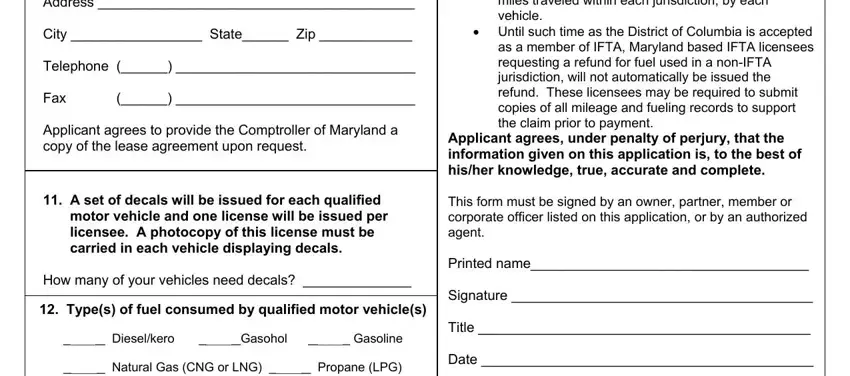

5. Last of all, this final section is what you'll want to complete before submitting the document. The fields under consideration include the next: Is the qualified vehicles tagged, A set of decals will be issued, Types of fuel consumed by, miles traveled within each, Until such time as the District, and Applicant agrees under penalty of.

Step 3: Soon after looking through the fields you have filled in, press "Done" and you're done and dusted! Download the licensees once you register online for a free trial. Quickly use the pdf in your personal cabinet, together with any modifications and changes all saved! FormsPal is devoted to the privacy of all our users; we always make sure that all personal data coming through our system remains secure.