•

!

#$% !&

#$%!!

• %

'

• '

•

%((

" |

)%%$ |

|

% |

|

% |

|

#$%!*!"" |

|

""+ |

|

|

|

(b) |

$ |

|

|

|

|

% |

|

|

|

'+ |

|

|

|

" |

$ |

|

|

|

'+

" $$ $

% %

%

• * $

%$ %% * $%

• ) % , )#!*!

-.

%%%

/0

/12.*3

/

!

#%0 %45!*

,,,6

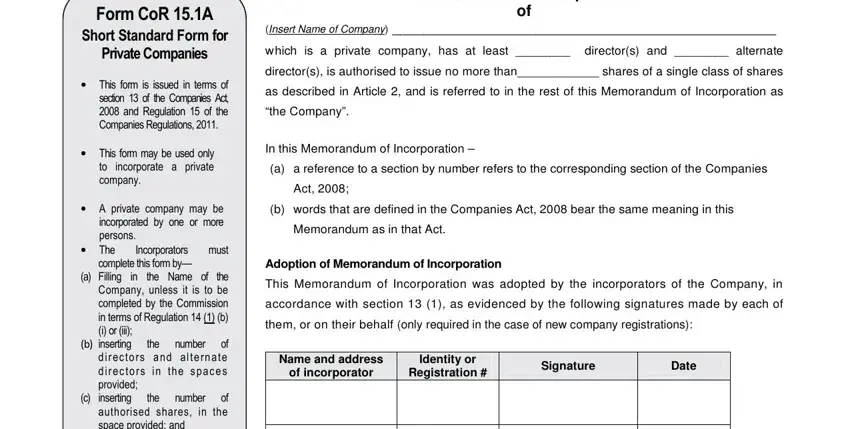

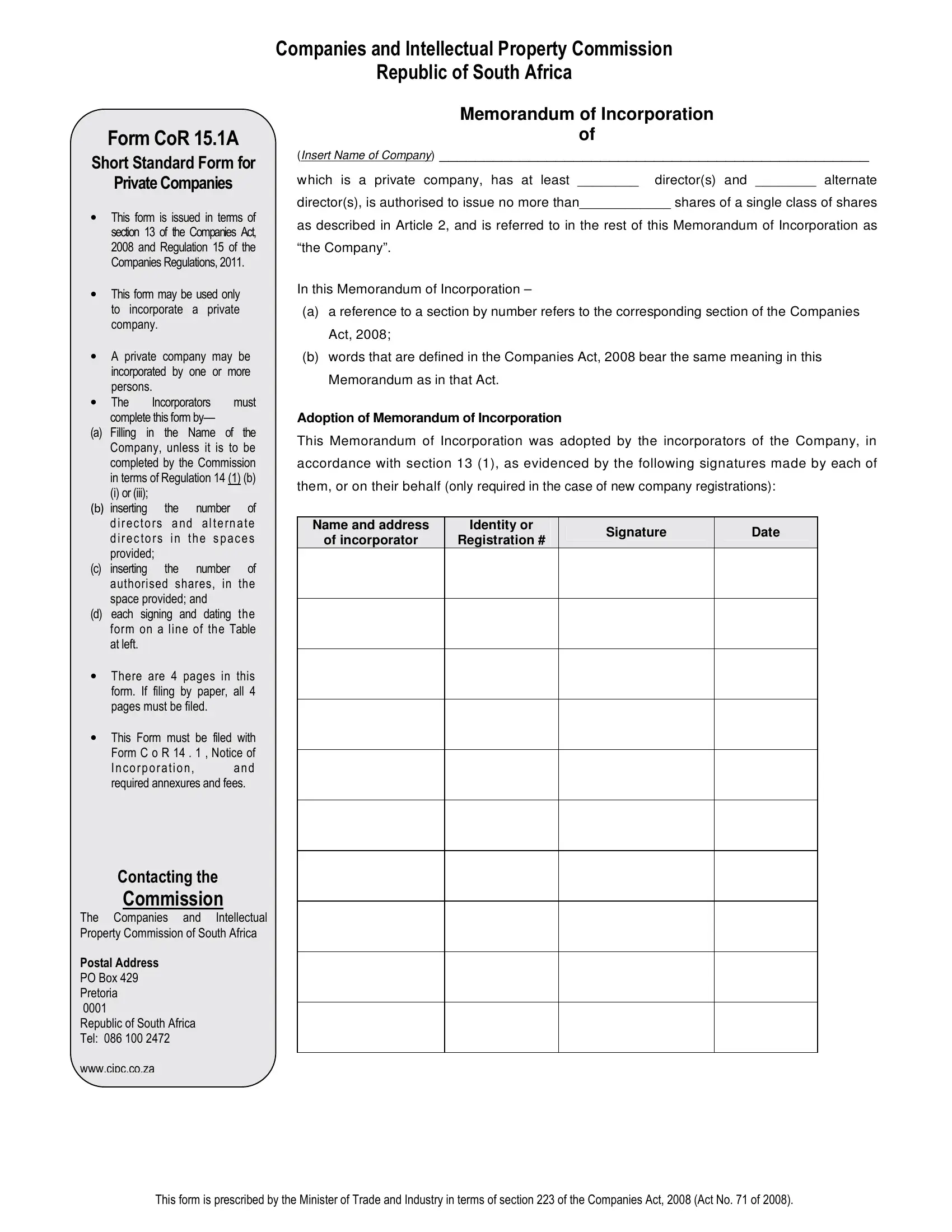

Memorandum of Incorporation

of

(Insert Name of Company) ________________________________________________

which is a private company, has at least ________ director(s) and ________ alternate

director(s), is authorised to issue no more than____________ shares of a single class of shares

as described in Article 2, and is referred to in the rest of this Memorandum of Incorporation as “the Company”.

In this Memorandum of Incorporation –

(a)a reference to a section by number refers to the corresponding section of the Companies Act, 2008;

(b)words that are defined in the Companies Act, 2008 bear the same meaning in this Memorandum as in that Act.

Adoption of Memorandum of Incorporation

This Memorandum of Incorporation was adopted by the incorporators of the Company, in accordance with section 13 (1), as evidenced by the following signatures made by each of them, or on their behalf (only required in the case of new company registrations):

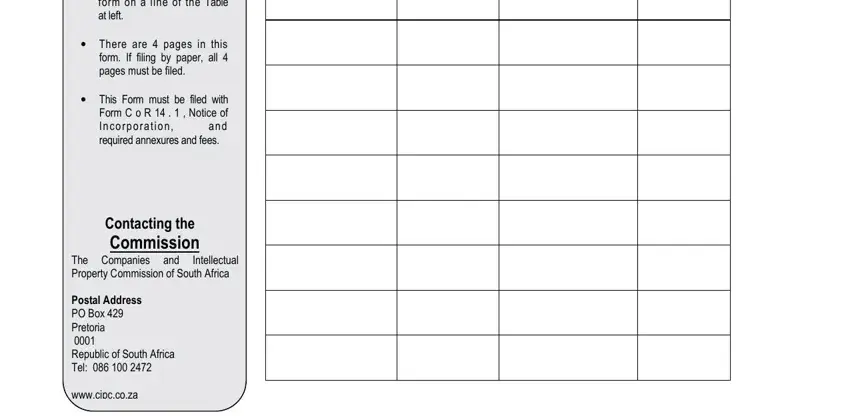

|

Name and address |

|

|

Identity or |

|

|

Signature |

|

|

Date |

|

|

of incorporator |

|

|

Registration # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article 1 - Incorporation and Nature of the Company

1.1Incorporation

(1)The Company is incorporated as a private company, as defined in the Companies Act, 2008.

(2)The Company is incorporated in accordance with, and governed by-

(a)the provisions of the Companies Act, 2008, without any limitation, extension, variation or substitution; and

(b)the provisions of this Memorandum of Incorporation.

1.2Powers of the Company

(1)The Company is not subject to any provision contemplated in section 15 (2)(b) or (c).

(2)The purposes and powers of the Company are not subject to any restriction, limitation or qualification, as

contemplated in section 19 (1)(b)(ii).

1.3Memorandum of Incorporation and Company rules

(1)This Memorandum of Incorporation of the Company may be altered or amended only in the manner set out in section 16, 17 or 152 (6) (b).

(2)The authority of the Company’s Board of Directors to make rules for the Company, as contemplated in section 15 (3) to (5), is not limited or restricted in any manner by this Memorandum of Incorporation.

(3)The Board must publish any rules made in terms of section 15 (3) to (5) by delivering a copy of those rules to each shareholder by ordinary mail.

(4)The Company must publish a notice of any alteration of the Memorandum of Incorporation or the Rules, made in terms of section 17 (1), by delivering a copy of the notice to each shareholder by ordinary mail.

1.4Optional provisions of Companies Act, 2008 do not apply

(1)The Company does not elect, in terms of section 34 (2), to comply voluntarily with the provisions of Chapter 3 of the Companies Act, 2008.

(2)The Company does not elect, in terms of section 118 (1)(c)(ii), to submit voluntarily to the provisions of Parts B and C of Chapter 5 of the Companies Act, 2008, and to the Takeover Regulations provided for in that Act.

Article 2 - Securities of the Company

2.1Securities

(1)The Company is authorised to issue no more than the number of shares of a single class of shares with no nominal or par value as shown on the cover sheet, and each such issued share entitles the holder to––

(a)vote on any matter to be decided by a vote of shareholders of the company;

(b)participate in any distribution of profit to the shareholders; and

(c)participate in the distribution of the residual value of the company upon its dissolution.

(2)The Company must not make an offer to the public of any of its securities and an issued share must not be transferred to any person other than––

(a)the company, or a related person;

(b)a shareholder of the company, or a person related to a shareholder of the company;

(c)a personal representative of the shareholder or the shareholder's estate;

(d)a beneficiary of the shareholder's estate; or

(e)another person approved by the company before the transfer is effected.

(3)The pre-emptive right of the Company’s shareholders to be offered and to subscribe for additional shares, as set

(a)out in section 39, is not limited, negated or restricted in any manner contemplated in section 39 (3), or subject to any conditions contemplated in that section.

(4)This Memorandum of Incorporation does not limit or restrict the authority of the Company’s Board of Directors to ––

(a)authorise the company to issue secured or unsecured debt instruments, as set out in section 43 (2); or

(b)grant special privileges associated with any debt instruments to be issued by the Company, as set out in section 43 (3);

(c)authorise the Company to provide financial assistance to any person in relation to the subscription of any option or securities of the Company or a related or inter-related company, as set out in section 44;

(d)approve the issuing of any authorised shares of the Company as capitalisation shares, as set out in section 47 (1); or

(e)resolve to permit shareholders to elect to receive a cash payment in lieu of a capitalisation share, as set out in section 47 (1).

2.2Registration of beneficial interests

The authority of the Company’s Board of Directors to allow the Company’s issued securities to be held by and registered in the name of one person for the beneficial interest of another person, as set out in section 56 (1), is not limited or restricted by this Memorandum of Incorporation.

Article 3 –Shareholders and Meetings

3.1Shareholders’ right to information

Every person who has a beneficial interest in any of the Company’s securities has the rights to access information set out in section 26 (1).

3.2Shareholders’ authority to act

(1)If, at any time, there is only one shareholder of the company, the authority of that shareholder to act without notice or compliance with any other internal formalities, as set out in Section 57 (2), is not limited or restricted by this Memorandum of Incorporation.

(2)If, at anytime, every shareholder of the Company is also a director of the Company, as contemplated in section 57 (4), the authority of the shareholders to act without notice or compliance with any other internal formalities, as set out in that section is not limited or restricted by this Memorandum of Incorporation.

3.3Shareholder representation by proxies

(1)This Memorandum of Incorporation does not limit, restrict or vary the right of a shareholder of the Company––

(a)to appoint 2 or more persons concurrently as proxies, as set out in section 58 (3)(a); or

(b)to delegate the proxy’s powers to another person, as set out in section 58 (3)(b).

(2)The requirement that a shareholder must deliver to the Company a copy of the instrument appointing a proxy before that proxy may exercise the shareholder’s rights at a shareholders meeting, as set out in section 58 (3)(c) is not varied by this Memorandum of Incorporation.

(3)The authority of a shareholder’s proxy to decide without direction from the shareholder whether to exercise, or abstain from exercising, any voting right of the shareholder, as set out in section 58 (7) is not limited or restricted by this Memorandum of Incorporation.

3.4Record date for exercise of shareholder rights

If, at any time, the Company’s Board of Directors fails to determine a record date, as contemplated in section 59, the record date for the relevant matter is as determined in accordance with section 59 (3).

3.5Shareholders meetings

(1)The Company is not required to hold any shareholders meetings other than those specifically required by the Companies Act, 2008.

(2)The right of shareholders to requisition a meeting, as set out in section 61 (3), may be exercised by the holders of at least 10% of the voting rights entitled to be exercised in relation to the matter to be considered at the meeting.

(3)The authority of the Company’s Board of Directors to determine the location of any shareholders meeting, and the authority of the Company to hold any such meeting in the Republic or in any foreign country, as set out in section 61

(9) is not limited or restricted by this Memorandum of Incorporation

(4)The minimum number of days for the Company to deliver a notice of a shareholders meeting to the shareholders, is

as provided for in section 62 (1).

(5)The authority of the Company to conduct a meeting entirely by electronic communication, or to provide for participation in a meeting by electronic communication, as set out in section 63 is not limited or restricted by this Memorandum of Incorporation.

(6)The quorum requirement for a shareholders meeting to begin, or for a matter to be considered is as set out in section 64 (1) without variation.

(7)The time periods allowed in section 64 (4) and (5) apply to the Company without variation.

(8)The authority of a meeting to continue to consider a matter, as set out in section 64 (9) is not limited or restricted by this Memorandum of Incorporation.

(9)The maximum period allowable for an adjournment of a shareholders meeting is as set out in section 64 (13), without variation.

3.6Shareholders resolutions

(1)For an ordinary resolution to be adopted at a shareholders meeting, it must be supported by the holders of more than 50% of the voting rights exercised on the resolution, as provided in section 65 (7).

(2)For a special resolution to be adopted at a shareholders meeting, it must be supported by the holders of at least 75% of the voting rights exercised on the resolution, as provided in section 65 (9).

(3)A special resolution adopted at a shareholders meeting is not required for a matter to be determined by the Company, except those matters set out in section 65 (11), or elsewhere in the Act.

Article 4 - Directors [and Officers]

4.1Composition of the Board of Directors

(1)The Board of Directors of the Company comprises at least the number of directors, and alternate directors shown on the cover sheet, each of whom is to be elected by the holders of the company’s securities as contemplated in section 68.

(2)The manner of electing directors of the Company is as set out in section 68 (2), and each elected director of the Company serves for an indefinite term, as contemplated in section 68 (1).

4.2Authority of the Board of Directors

(1)The authority of the Company’s Board of Directors to manage and direct the business and affairs of the Company, as set out in section 66 (1) is not limited or restricted by this Memorandum of Incorporation.

(2)If, at anytime, the Company has only one director, as contemplated in section 57 (3), the authority of that director to act without notice or compliance with any other internal formalities, as set out in that section is not limited or restricted by this Memorandum of Incorporation.

(3)The Company’s Board of Directors must not register the transfer of any shares unless the conditions for the transfer contemplated in article 2.1 (2) have been met.

4.3Directors’ Meetings

(1)The right of the Company’s directors to requisition a meeting of the Board, as set out in section 73 (1), may be exercised by at least 25% of the directors, if the board has 12 or more members, or by 2 (two) directors, in any other case.

(2)This memorandum of incorporation does not limit or restrict the authority of the Company’s Board of Directors to––

(a)conduct a meeting entirely by electronic communication, or to provide for participation in a meeting by electronic communication, as set out in section 73 (3); or

(b)determine the manner and form of providing notice of its meetings, as set out in section 73 (4); or

(c)proceed with a meeting despite a failure or defect in giving notice of the meeting, as set out in section 73 (5), or

(d)consider a matter other than at a meeting, as set out in section 74.

4.4 Directors compensation and financial assistance

This Memorandum of Incorporation does not limit the authority of the Company to -

(a)pay remuneration to the Company’s directors, in accordance with a special resolution approved by the Company’s shareholders within the previous two years, as set out in section 66 (9) and (10);

(b)advance expenses to a director, or indemnify a director, in respect of the defense of legal proceedings, as set out in section 78 (4),

(c)indemnify a director in respect of liability, as set out in section 78 (5); or

(d)purchase insurance to protect the Company, or a director, as set out in section 78 (7).