Using the online tool for PDF editing by FormsPal, it is easy to fill out or change allocation right here. To keep our tool on the leading edge of convenience, we strive to integrate user-oriented features and enhancements regularly. We are at all times looking for feedback - join us in reshaping PDF editing. By taking some simple steps, you'll be able to start your PDF editing:

Step 1: First, access the pdf editor by pressing the "Get Form Button" in the top section of this webpage.

Step 2: Once you open the editor, you will get the form all set to be completed. In addition to filling in different fields, you could also perform various other things with the form, that is adding any textual content, editing the original textual content, adding images, affixing your signature to the form, and a lot more.

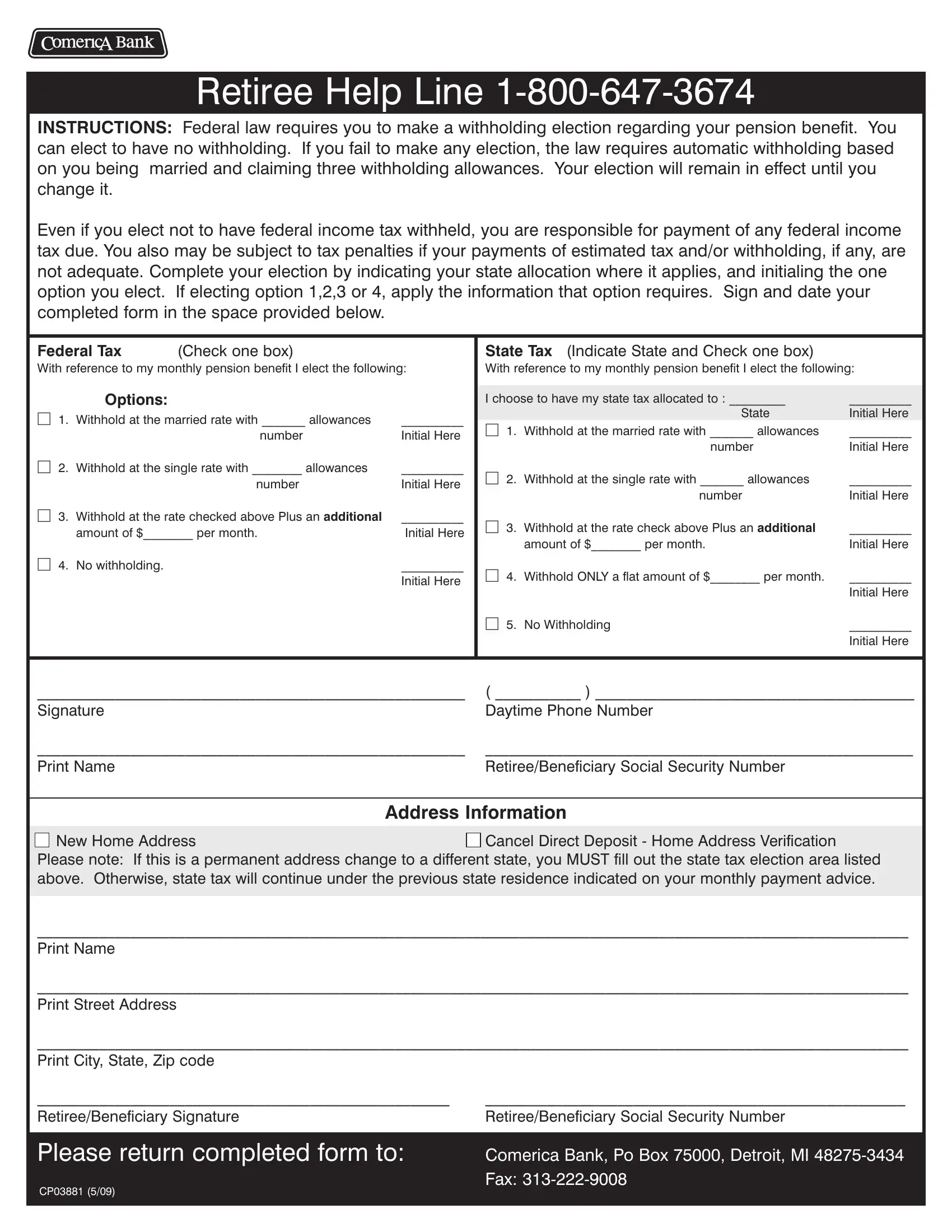

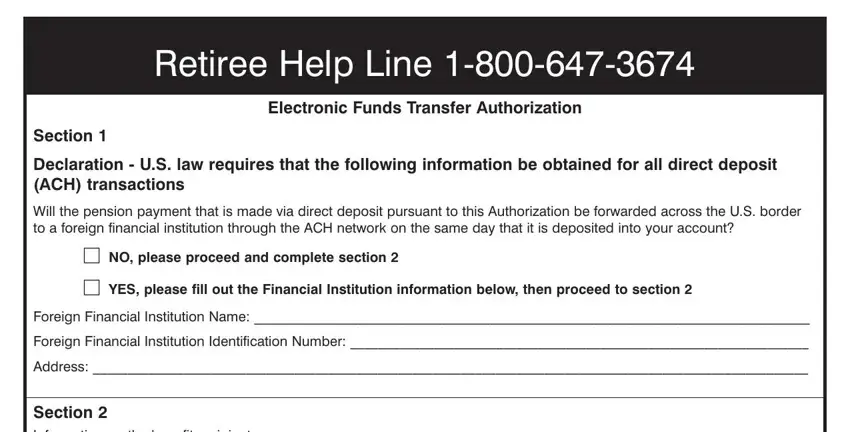

This PDF form will need particular info to be entered, hence make sure you take some time to provide what's required:

1. To start off, once filling out the allocation, start in the section that contains the next fields:

Step 3: After you've reread the details in the file's blank fields, click "Done" to finalize your FormsPal process. Go for a 7-day free trial subscription at FormsPal and gain instant access to allocation - with all changes preserved and accessible inside your FormsPal account. When using FormsPal, you'll be able to fill out documents without the need to worry about information leaks or data entries being distributed. Our protected platform helps to ensure that your private details are stored safe.