Should you would like to fill out form montana attaching, you don't have to download any sort of applications - simply make use of our online PDF editor. We are aimed at providing you the absolute best experience with our editor by constantly adding new features and improvements. Our tool is now even more user-friendly with the newest updates! Now, working with PDF files is simpler and faster than ever before. Should you be looking to get started, here's what it will require:

Step 1: First of all, access the editor by pressing the "Get Form Button" in the top section of this page.

Step 2: Using this state-of-the-art PDF file editor, it is possible to do more than simply fill out blanks. Edit away and make your documents appear faultless with custom textual content added, or optimize the original content to excellence - all backed up by an ability to incorporate your own images and sign it off.

This PDF form will require specific info to be entered, thus be sure to take whatever time to provide what's expected:

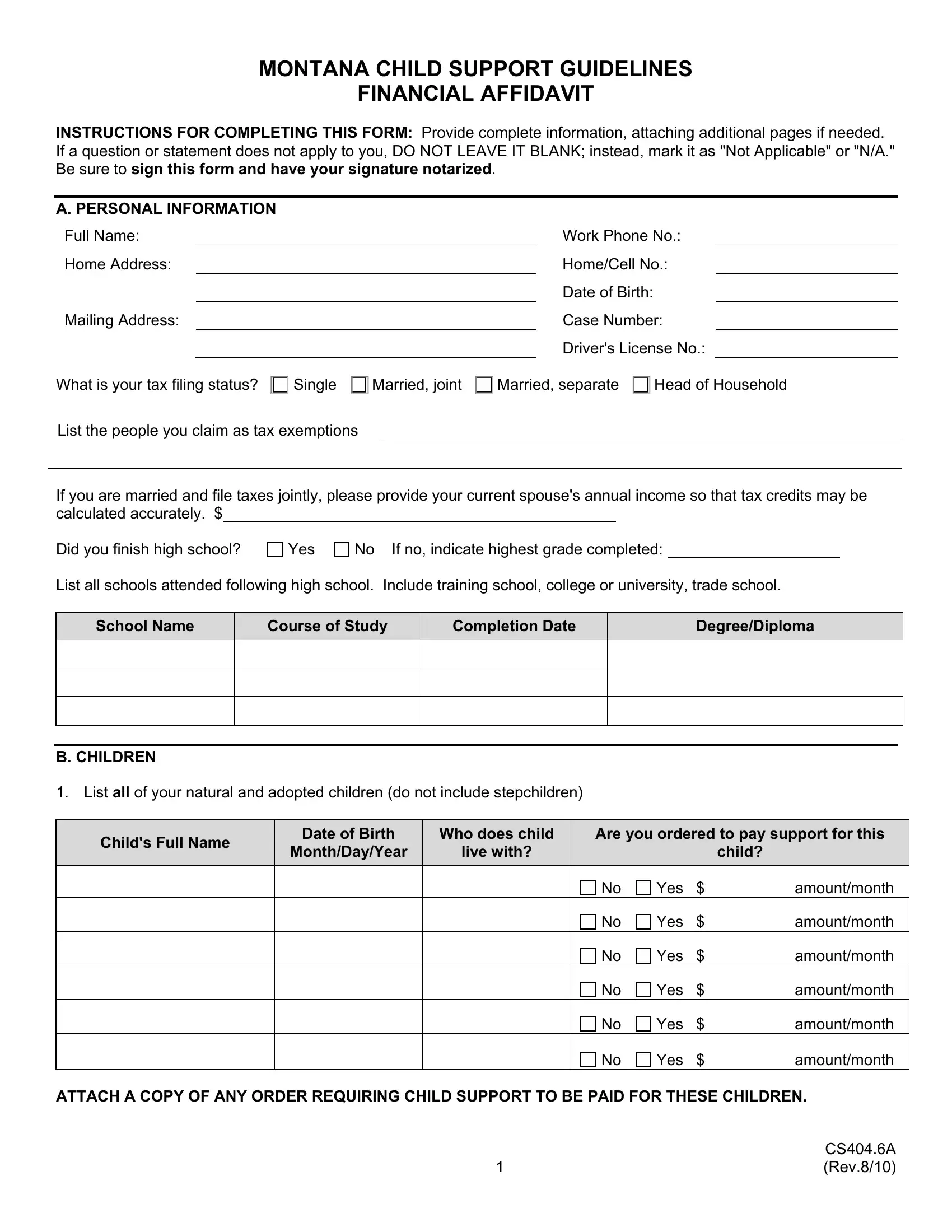

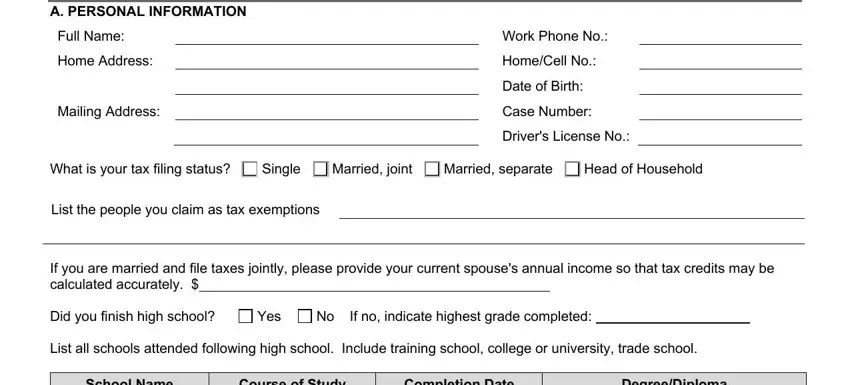

1. Begin completing the form montana attaching with a group of major blanks. Note all of the information you need and be sure there's nothing overlooked!

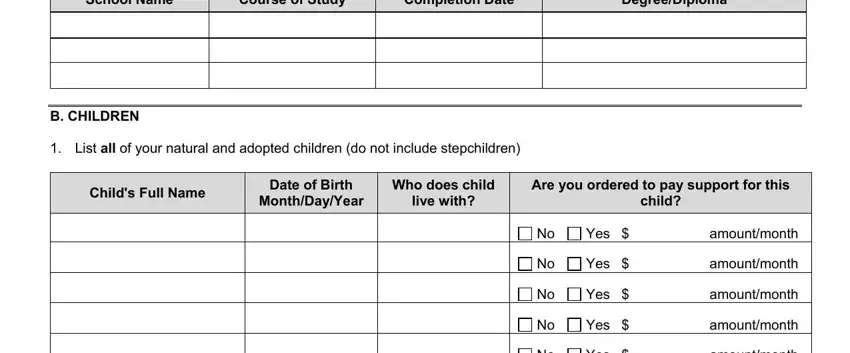

2. The third part is to submit the next few blank fields: School Name, Course of Study, Completion Date, DegreeDiploma, B CHILDREN List all of your, Childs Full Name, Date of Birth, Who does child, MonthDayYear, live with, Are you ordered to pay support for, child, Yes, Yes, and Yes.

Always be very attentive while filling out child and Who does child, because this is the section in which most users make errors.

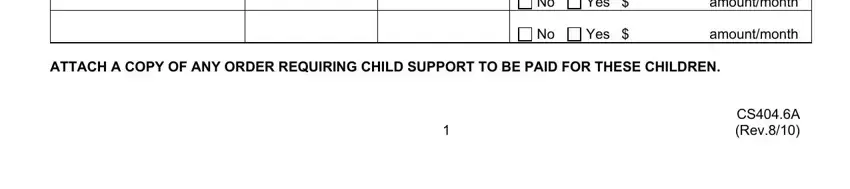

3. Completing Yes, amountmonth, Yes, amountmonth, ATTACH A COPY OF ANY ORDER, and CSA Rev is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

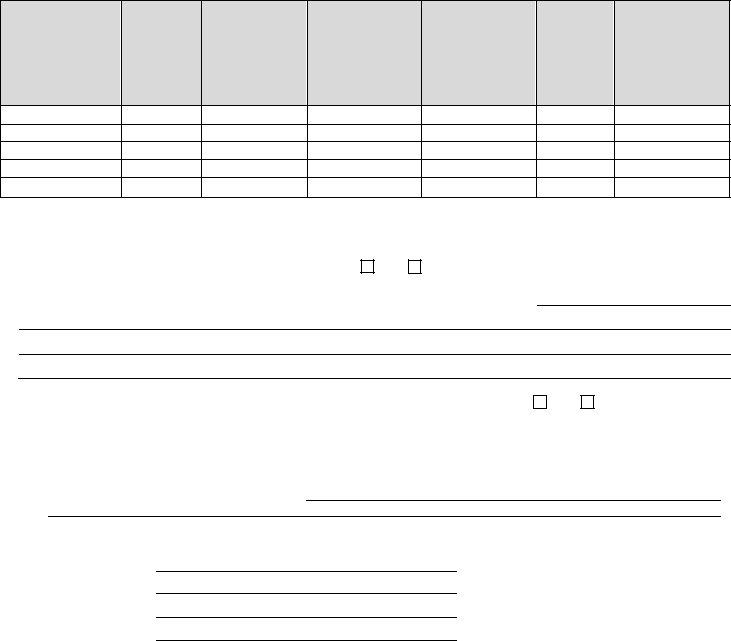

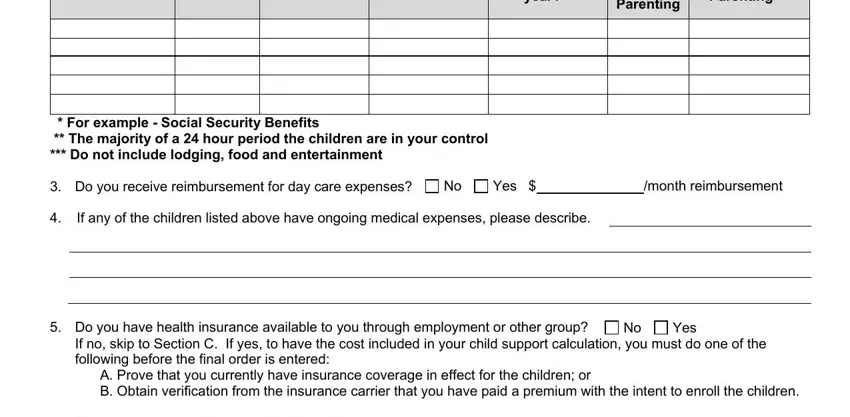

4. Your next section requires your attention in the following parts: year, Distance Parenting, Parenting, For example Social Security, month reimbursement, Yes, If any of the children listed, Do you have health insurance, If no skip to Section C If yes to, Yes, A Prove that you currently have, and Name everyone who is covered by. It is important to give all required info to move forward.

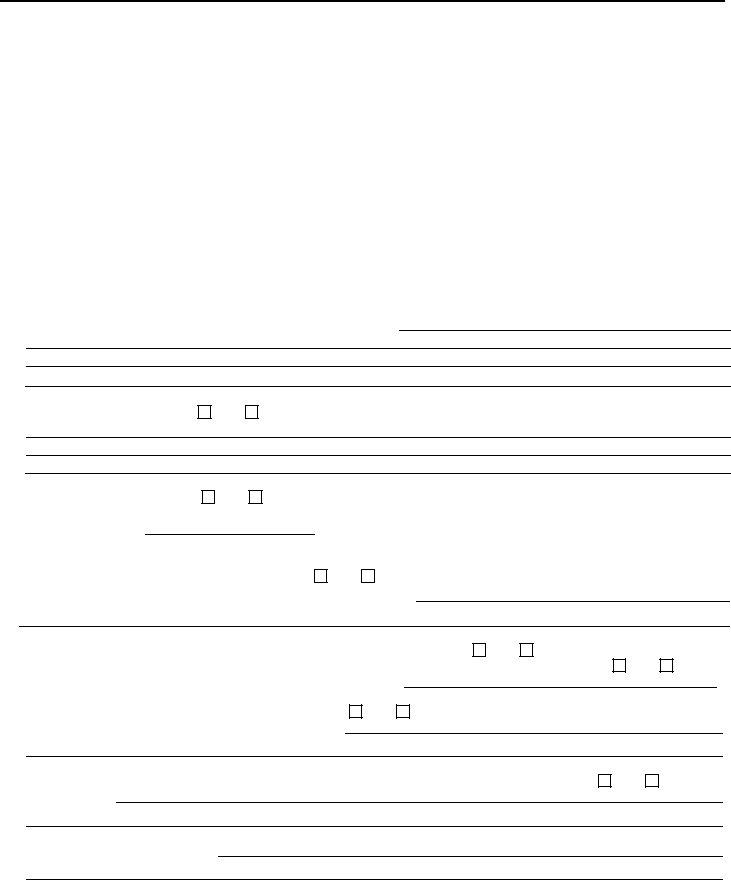

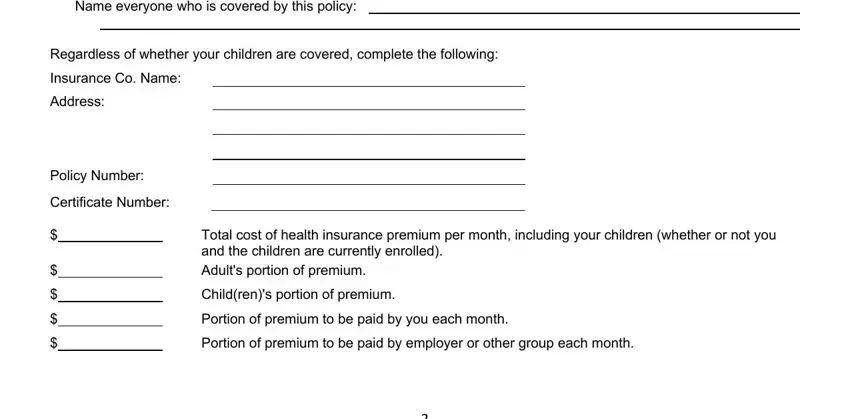

5. This form needs to be finished with this part. Here you can find a detailed listing of blanks that have to be completed with correct details in order for your form usage to be accomplished: Name everyone who is covered by, Regardless of whether your, Insurance Co Name, Address, Policy Number, Certificate Number, Total cost of health insurance, Childrens portion of premium, Portion of premium to be paid by, and Portion of premium to be paid by.

Step 3: Before submitting the form, make sure that blank fields are filled out the right way. When you’re satisfied with it, click “Done." Create a 7-day free trial plan at FormsPal and acquire immediate access to form montana attaching - download or modify inside your personal account. FormsPal is focused on the personal privacy of all our users; we make sure all personal information used in our tool is confidential.