This PDF editor allows you to prepare forms. You don't need to undertake much to modify 1040 es form forms. Merely keep to these actions.

Step 1: Choose the button "Get Form Here".

Step 2: Right now, you can start editing the 2020 ct tax. Our multifunctional toolbar is readily available - insert, remove, adjust, highlight, and perform many other commands with the text in the form.

For every single area, add the information asked by the application.

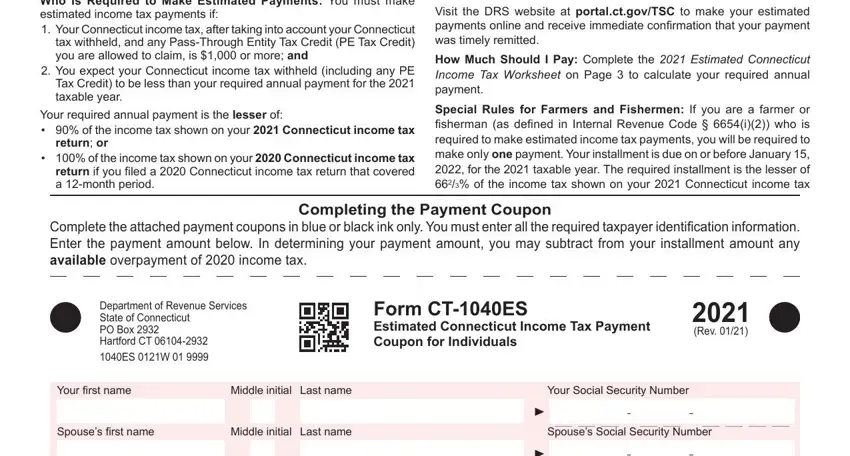

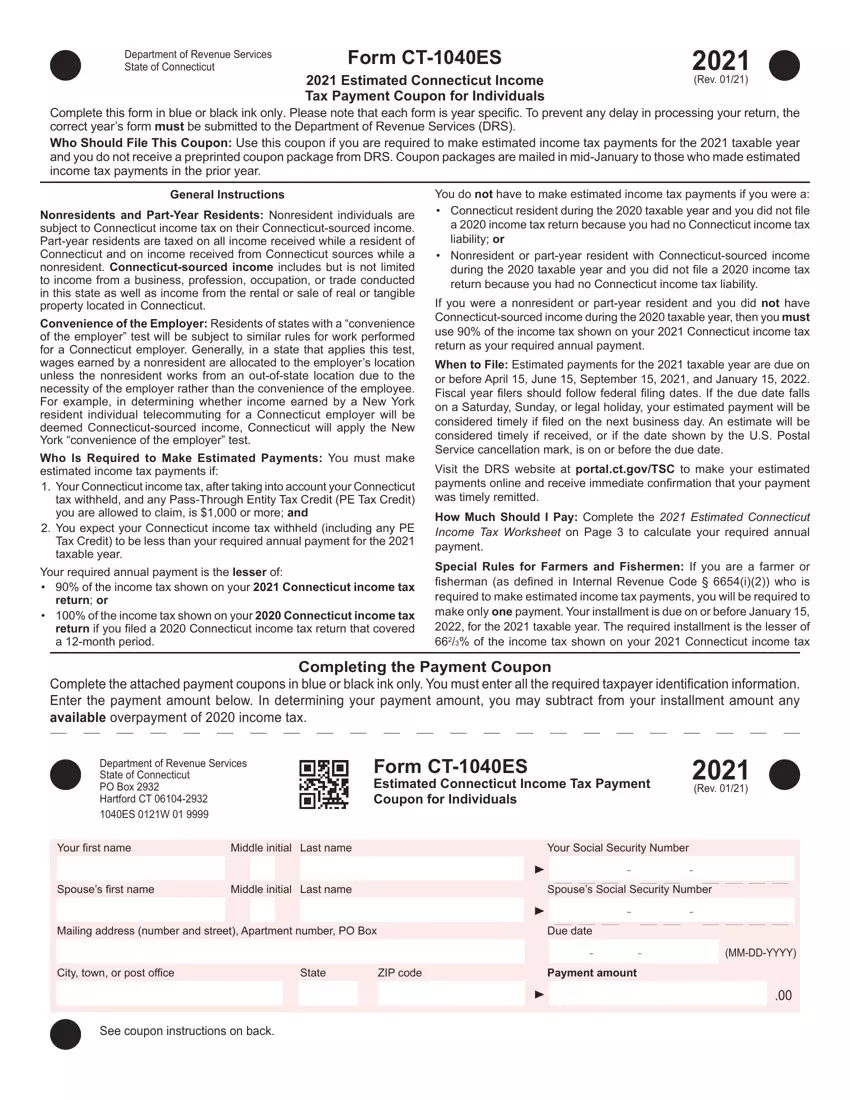

Type in the necessary information in the space Mailing address number and street, City town or post office, State, ZIP code, See coupon instructions on back, Due date, Payment amount, and MMDDYYYY.

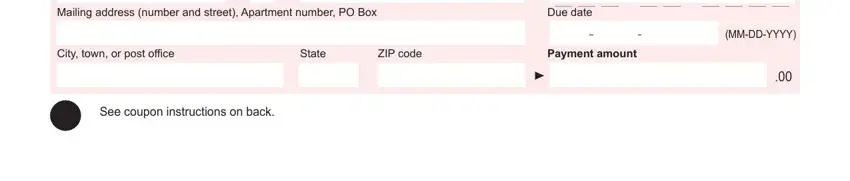

It is necessary to record some details inside the field Federal adjusted gross income you, from federal Form ES Estimated, Estimated Connecticut Income Tax, Allowable Connecticut, Connecticut adjusted gross income, Nonresidents and partyear, Connecticut income tax Complete, Apportionment factor Connecticut, see Page, Multiply Line by Line, Credit for income taxes paid to, Subtract Line from Line, Estimated Connecticut alternative, Add Line and Line, and Estimated allowable credits from.

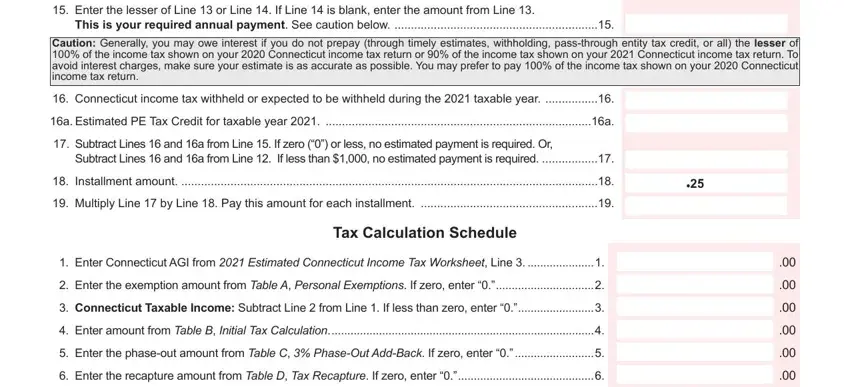

You will need to identify the rights and obligations of every party in part Enter the lesser of Line or Line, This is your required annual, Caution Generally you may owe, Connecticut income tax withheld, a Estimated PE Tax Credit for, Subtract Lines and a from Line, Subtract Lines and a from Line, Installment amount, Multiply Line by Line Pay this, Tax Calculation Schedule, Enter Connecticut AGI from, Enter the exemption amount from, Connecticut Taxable Income, Enter amount from Table B Initial, and Enter the phaseout amount from.

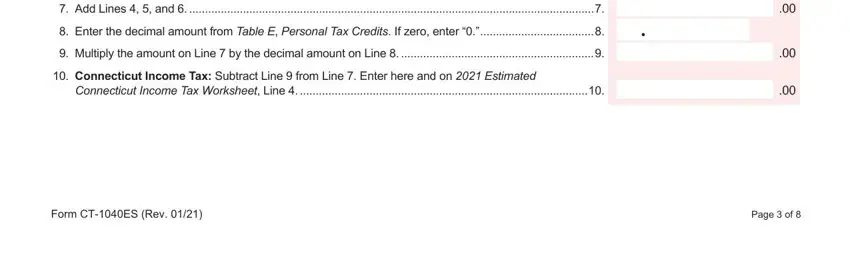

Finish by reviewing the following areas and filling them in as required: Add Lines and, Enter the decimal amount from, Multiply the amount on Line by, Connecticut Income Tax Subtract, Connecticut Income Tax Worksheet, Form CTES Rev, and Page of.

Step 3: Once you hit the Done button, your finished file can be easily transferred to any kind of your devices or to email provided by you.

Step 4: Prepare a duplicate of every single file. It could save you some time and allow you to prevent issues as time goes on. Also, the information you have is not shared or analyzed by us.

.00

.00