Navigating the complexities of tax compliance requires a thorough understanding of the applicable forms and their requirements. One such form, the Form CT-11 Non-Stamper Cigarette Excise Return, serves a critical function for individuals and entities dealing with cigarette purchases in Massachusetts that lack the state's excise tax stamp. Designed for transactions occurring before July 1, 2008, this form mandates submission by the 20th day of the month following each calendar quarter's end. It encapsulates various facets of the reporting process, from the identification of non-Massachusetts stamped cigarette purchases to the computation of excise based on the number of cartons acquired. Additionally, it allows for a credit against the Massachusetts cigarette excise for any taxes paid to other jurisdictions, albeit capped or determined by specific conditions. Failure to file this return timely or correctly can lead to penalties and interest, underscoring the importance of accurate completion and submission. The form, which also emphasizes the consequences of willful tax evasion, serves as a conduit for maintaining tax compliance while acknowledging transactions that may not initially include Massachusetts’ excise stamp. It exemplifies the state's efforts to ensure fair tax collection and compliance, even in scenarios where purchases originate outside traditional retail channels.

| Question | Answer |

|---|---|

| Form Name | Form Ct 11 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | mass form ct 3t, massachusetts form ct 3t, ma formct 3t, mass ct 3t form |

Form

(for transactions occurring before July 1, 2008)

Rev. 7/08

Massachusetts

Department of

Revenue

Thisreturnisdueonorbeforethe20thdayofthemonthfollowingthecloseofeachcalendarquarter.Forthequarterending

Name |

Social Security number |

|

|

|

|

Address |

|

|

|

|

|

City/Town |

State |

Zip |

|

|

|

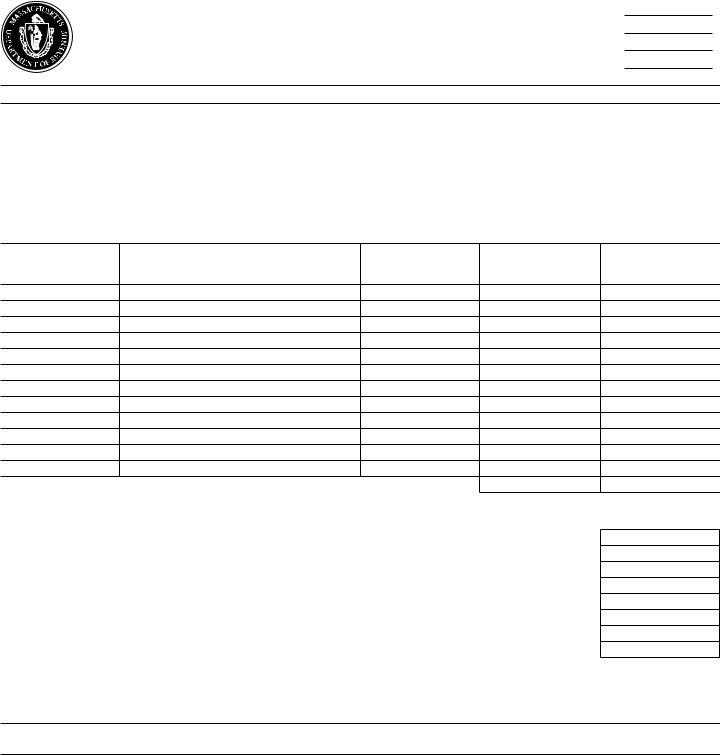

Date of

purchase

Name of seller, city and state

Brand name

a. Number of

cartons purchased

b. Cigarette excise paid to another jurisdiction (if any; see instructions)

1 Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Cigarette Excise

2 Total cartons purchased from line 1, column a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 3 Massachusetts cigarette excise rate ($15.10 per carton) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4 Massachusetts cigarette excise. Multiply line 2 by line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 5 Credit for cigarette excise paid to another state. Enter the amount from line 1, col. b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 6 Net Massachusetts cigarette excise due. Subtract line 5 from line 4. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 7 Penalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 8 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 9 Total amount due. Add lines 6 through 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

15.10

Declaration

I declare under the penalties of perjury that this return has been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

Signature |

Date |

Return and payment are due on or before the 20th day of the month following the close of the calendar quarter. Mail to: Massachusetts Department of

Revenue, PO Box 7004, Boston, MA02204. Make check or money order payable to: Commonwealth of Massachusetts.

Form

General Information

Form

Note: Form

This return with payment is due on or before the 20th day of the month following the close of any calendar quarter that you purchased or took possession of cigarettes without a Massachusetts stamp. For the calendar quarter of January through March this return is due on or before April 20. For the calendar quarter of April through June this return is due on or before July 20. For the calendar quarter of July through September this return is due on or before October 20. For the calendar quarter of October through December this return is due on or before January 20 of the following year.

Cigarette Excise Paid to Another Jurisdiction

Generally, anyone who pays cigarette excise to another state or ter- ritory of the United States on cigarettes subject to the Massachusetts cigarette excise is entitled to a credit against the Massachusetts cig-

arette excise. The amount of this credit is limited to the cigarette ex- cise paid to another jurisdiction, or $15.10 per carton, whichever is less. If you do not know if the cigarettes you purchased bore the stamp of a jurisdiction other than Massachusetts, or if you need to know the excise rate in another jurisdiction, you should contact your cigarette vendor.

Penalties and Interest

Penalties are imposed for late filing of a return and late payment on a return. The late filing penalty is calculated at a rate of 1% of the tax due per month, up to a maximum of 25%. The late payment penalty is calculated at a rate of 1⁄2% of the tax due per month, up to a maximum of 25%. Interest is charged on underpayments and late payments of tax. Willful evasion of taxes is a felony punishable by a fine of up to $100,000, or imprisonment of up to five years or both. Anyone who signs a return or statement under the penalties of perjury that he/she does not believe to true and correct as to every material matter is guilty of a felony, punishable by a fine of up to $100,000, or imprisonment of up to three years or both.

If you have any questions about this form or the Massachusetts cig- arette excise, contact the Massachusetts Department of Revenue’s Cigarette Excise Unit at (617)

Sign and date this form. Make checks payable to: Commonwealth of

Massachusetts. Mail to: Massachusetts Department of Revenue, PO Box 7004, Boston, MA 02204.

printed on recycled paper