Filing taxes and understanding the nuances of tax forms can be a daunting process for any corporation, especially for those involved in transportation and transmission. The CT-183 New York State Department of Taxation and Finance Transportation and Transmission Corporation Final Return Franchise Tax Return on Capital Stock represents a critical document for these specialized entities. Designed for the calendar year 1998, it underscores the legislative adherence dictated by Tax Law—Article 9, Section 183. This form not only captures the essence of a corporation’s fiscal responsibility through details such as employer identification number and legal business names but extends to cover intricate financial facets relating to capital stock, business activities, and applicable tax computations. In essence, it serves as a comprehensive ledger for recording allocated issued capital stocks, computing taxes based on dividend rates, and reconciling net worth with total liabilities. Additionally, entities must pay keen attention to the inclusion of schedules relevant to their business operations and potential claims for overpayments. This form, therefore, acts as a cornerstone for corporations to accurately report and remit their franchise taxes, ensuring compliance with New York State’s taxation laws.

| Question | Answer |

|---|---|

| Form Name | Form Ct 183 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | CT-183, 1998, prepayments, New_York |

|

|

|

|

|

|

|

New York State Department of Taxation and Finance |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

Transportation and Transmission Corporation |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

Final Return |

Franchise Tax Return on Capital Stock |

||||||||||||||||

|

|

|

|

|

|

|

|

|

(see procedure in instr.) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Law — Article 9, Section 183 |

|

|

|

For calendar year 1998 |

|||||||||

Employer identification number |

|

|

|

|

|

|

File number |

|

|

|

Check box if |

□ |

For office use only |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

overpayment claimed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal name of corporation |

|

|

|

|

|

|

Trade name / DBA |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

nameMailing addressand |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date received |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Mailing name (if different from legal name) and address |

|

|

|

|

|

|

State or country of incorporation |

|

||||||||||||||||||

|

|

c / o |

|

|

|

|

|

|

|

|

|

|

PLACE LABEL HERE |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Number and street or PO box |

|

|

|

|

|

|

|

|

|

|

|

Date of incorporation |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

Foreign corporations: date began |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

business in NYS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audit use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

If address above is new, |

|

If your name, employer identification number, address, or owner / officer information has changed, |

Business telephone number |

|

|

|||||||||||||||||||||

check box (see |

□ |

|

you must file Form |

( |

|

) |

|

|

|

|||||||||||||||||

instructions) |

|

request one. From areas outside the U.S. and outside Canada, call (518) |

|

|

|

|

||||||||||||||||||||

|

Business activity code number (from federal return; |

● □ NAICS |

Principal business activity |

|

|

|

|

|

|

|||||||||||||||||

|

see instructions) |

|

|

|

|

|

|

|

● □ Other |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Federal return was filed on: □ 1120 □ 1120S |

□ consolidated basis □ other |

|

|

|||||||||||||||||||||||

—Do you do business, employ capital, own or lease property or maintain an office in

|

. . . . . . . . . .the Metropolitan Commuter Transportation District? |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

□ Yes |

□ No |

|||||

|

If you answered Yes, you must file Form |

|

|

|

|

|

|

|

||

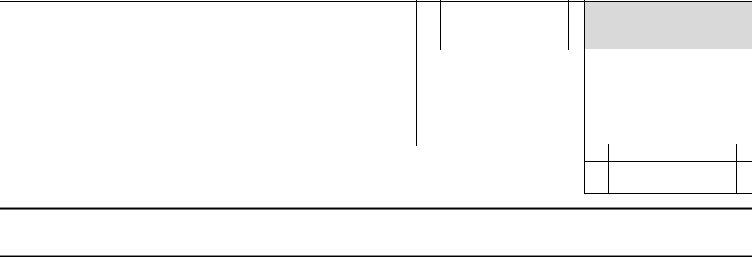

A. Payment — pay amount shown on line 11. Make check payable to: New York State Corporation Tax |

|

|

|

Payment enclosed |

|

|||||

⬅ . . . . . . Attach your payment here. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Tax Computation (see Form |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

1 |

Tax on allocated issued capital stock from line 56 . . . |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

1 |

● |

|

|

|

2 |

Tax based on dividend rate, from line 75 or line 78, whichever applies |

. . . . . . . . . . . . . . . . . . . . . . . |

|

2 |

● |

|

|

|||

3 |

Minimum tax |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

3 |

|

|

75 |

00 |

4 |

Tax (amount from line 1, 2 or 3, whichever is largest) |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

4 |

● |

|

|

|

5 |

Tax credits: Check forms filed and attach forms● |

|

5 |

|

|

|

|

|||

|

|

|

|

|

||||||

6 |

Total tax after credits (subtract line 5 from line 4) |

|

|

|

|

6 |

|

|

|

|

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|||

7 |

Total prepayments (from line 82) |

|

|

|

|

7 |

|

|

|

|

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|||

8 |

. . . . . . . . . .Balance (if line 7 is less than line 6, subtract line 7 from line 6) |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

8 |

|

|

|

|

|

9 |

Interest on late payment (see instructions) |

|

|

|

|

9 |

|

|

|

|

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|||

10 |

Late filing and late payment penalties(see instructions) |

|

|

|

|

10 |

|

|

|

|

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|||

11 |

Balance due (add lines 8, 9, and 10; enter payment on line A above) |

|

|

|

11 |

|

|

|

|

|

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

||||

12 |

Overpayment (if line 6 is less than line 7, subtract line 6 from line 7) |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

12 |

|

|

|

|

|

13 |

Amount of overpayment to be credited to the next period |

|

|

|

13 |

|

|

|

|

|

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

||||

14 |

Balance of overpayment (subtract line 13 from line 12) |

|

|

|

|

14 |

|

|

|

|

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|||

15 |

Amount of overpayment to be credited to Form |

|

|

|

15 |

|

|

|

|

|

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

||||

16 |

.Amount of overpayment to be refunded (subtract line 15 from line 14) |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

16 |

|

|

|

|

|

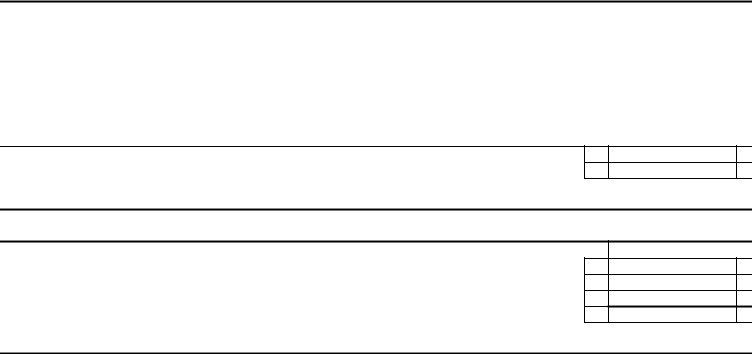

Certification. I certify that this return and any attachments are to the best of my knowledge and belief true, correct, and complete.

Signature of elected officer or authorized person |

Official title |

Date |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PaidPreparer |

|

Firm’s name (or yours if |

|

ID number |

Date |

||||||||

UseOnly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

Signature of individual preparing this return |

|||||||||||

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

It may also be necessary for you to file Form

Mail your return on or before March 15, 1999 to: NYS CORPORATION TAX, PROCESSING UNIT, PO BOX 22038, ALBANY NY

Page 2

Schedule A — Allocation Percentage/Issuer’s Allocation Percentage

(if no allocation is claimed, enter 100% on line 24 or 26; see instructions)

|

|

Average Value for the Year 1998 |

||

|

|

|

|

|

Part I — Allocation for General Transportation and Transmission Corporations |

A |

B |

||

New York |

Everywhere |

|||

|

|

|||

|

|

|

|

|

17 Accounts receivable |

17 |

|

|

|

18Shares of stock of other companies owned (attach list showing corporate

|

name, shares held and actual value) |

18 |

|

|

|

|

19 |

Bonds, loans and other securities, other than U.S. obligations |

19 |

|

|

|

|

20 |

Leaseholds |

20 |

|

|

|

|

21 |

Real estate owned |

21 |

|

|

|

|

22 |

All other assets (except cash and investments in U.S. obligations) |

22 |

|

|

|

|

23 |

Total (add lines 17 through 22) |

23 |

● |

|

● |

|

24 |

Allocation percentage (divide line 23, column A by column B) |

24 |

|

|

% |

|

|

|

|

||||

|

|

|

|

|

|

|

Part II — Allocation Percentage/Issuer’s Allocation Percentage for Corporations |

|

A |

|

B |

||

|

Operating Vessels Not Exclusively Engaged in Foreign Commerce |

|

|

New York |

|

|

|

(see instructions) |

|

|

Territorial Waters |

|

Everywhere |

25 |

Aggregate number of working days |

25 |

|

|

|

|

26 |

Allocation percentage (divide line 25, column A by column B) |

26 |

|

|

% |

|

|

|

|

||||

Schedule B — Assets and Liabilities |

|

|

|

|

As of 12/31/98 |

||

|

|

|

|

|

|

|

|

27 |

Total assets |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . |

27 |

● |

|

28 |

Total liabilities |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . |

28 |

● |

|

29 |

Net worth (subtract line 28 from line 27; enter here and on line 53) |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . |

29 |

● |

|

30 |

Capital stock — preferred stock |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . |

30 |

|

|

31 |

Capital stock — common stock |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . |

31 |

|

|

32 |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . |

32 |

|

|

|

33 |

Retained earnings (appropriated or unappropriated) |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . |

33 |

|

|

34 |

Add lines 28, 30, 31, 32, and 33 |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . |

34 |

|

|

35 |

Cost of treasury stock |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . |

35 |

|

|

36 |

Total liabilities and capital (subtract line 35 from line 34) |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . |

36 |

● |

|

|

|

|

|

|

|

|

|

Schedule C — Reconciliation of Retained Earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

Balance beginning of year |

37 |

|

|

|

|

|

38 |

Net income (attach profit and loss statement) |

38 |

|

|

|

|

|

39 |

Other additions (explain) |

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

39 |

|

|

|

|

|

40 |

Total (add lines 37, 38, and 39) |

|

|

40 |

|

|

|

41 |

Dividends |

41 |

● |

|

|

|

|

42 |

Other deductions (explain) |

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

42 |

|

|

|

|

|

43 |

Total dividends and other deductions (add lines 41 and 42) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

43 |

|

|

||

44 |

Balance at end of year (subtract line 43 from line 40) |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . |

44 |

|

|

45Did this corporation purchase any of its capital stock during the year?

●

Yes ●

No

If Yes, attach a separate sheet showing number and kinds of shares, consideration received for the issuances of the shares and purchase price of each share.

|

|

|

|

|

|

|

|

|

|

|||||

Schedule D — Computation of Tax Based on the Net Value of Issued Capital Stock |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

B |

C |

D |

|

E |

F |

G |

|

||||||

|

Number of |

|

|

|

|

Selling Price During Year |

Average |

|

|

|

||||

Class of |

Shares as of |

Par |

Amount Paid in |

|

|

|

|

Selling |

Net Value |

|||||

Stock |

12/31/98 |

Value |

on Each Share |

High |

|

Low |

Price |

(column B x column F) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No par value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

46 Total |

|

|

|

|

|

|

|

|

|

Total net value |

● |

|

|

|

47Multiply issued shares of stock on line 46, column B, by the net value per share

|

of stock outstanding at the end of the year, but not less than $5.00 per share . . |

47 |

● |

|

|

|||||

48 |

Taxable base (multiply line 47 by |

|

%, from line 24 or 26) |

48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

49 |

Tax (multiply line 48 |

by .0015 (11⁄2 mills)) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

49 |

● |

|

|

50 |

Net value of issued capital stock (from line 46, column G) |

50 |

● |

|

|

|

|

|||

51 |

Taxable base (multiply line 50 by |

|

%, from line 24 or 26) |

51 |

|

|

|

|

|

|

52 |

Tax (multiply line 51 |

by .0015 (11⁄2 mills)) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

52 |

● |

|

||

53 |

Net worth |

53 |

● |

|

|

|

|

|||

54 |

Taxable base (multiply line 53 by |

|

%, from line 24 or 26) |

54 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

55 |

Tax (multiply line 54 |

by .0015 (11⁄2 mills)) |

55 |

● |

||||||

56Tax on allocated issued capital stock (amount from line 49, 52, or 55, whichever is largest; enter here

and on line 1) |

56 |

Schedule E — Computation of Tax if Dividend Rate is 6% or More on Some or All Classes of Capital Stock. All corporations except those operating vessels in foreign commerce complete Parts I and II. Corporations operating vessels in foreign commerce complete Parts III and IV.

Part I — Tax Rate Computation Based on Dividends Paid During the Year

|

A |

B |

|

C |

D |

|

E |

||

|

|

Value of |

|

|

|

|

Tax Rate Computation - If column D is 6% or more, |

||

|

Class |

Stock on Which |

|

|

|

Dividend |

multiply each percent, including fractions of a percent, |

||

|

of |

Dividends |

|

Dividends |

Rate |

in column D by .000375 (3/8 of a mill). Do not convert |

|||

|

Stock |

Were Paid |

|

Paid |

C 4 B |

the percentage amount in column D to a decimal. |

|||

57 |

Common |

|

|

|

|

% |

Enter tax rate here |

|

and on line 63 |

|

|

|

|

|

|

|

|

|

|

58 |

Preferred |

|

|

|

|

% |

Enter tax rate here |

|

and on line 66 |

|

|

|

|

|

|

|

|

|

|

59 |

No par value |

|

|

|

|

% |

Enter tax rate here |

|

and on line 69 |

|

|

|

|

|

|

|

|

|

|

60 |

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part II — Tax Computation (see instructions)

61 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Par value common stock (line 57, column B) |

61 |

|

|

|

|

|

||||

62 |

Taxable base (multiply line 61 by |

|

%, from line 24) |

62 |

|

|

|

|

|

||

63 |

Tax (multiply line 62 by |

|

tax rate, from line 57, column E) |

|

|

|

63 |

● |

|

||

64 |

Par value preferred stock (line 58, column B) |

64 |

|

|

|

|

|

||||

65 |

Taxable base (multiply line 64 by |

|

%, from line 24) |

65 |

|

|

|

|

|

||

66 |

Tax (multiply line 65 by |

|

tax rate, from line 58, column E) |

|

|

|

66 |

● |

|

||

67 |

Amount paid in on no par value stocks (line 59, column B) |

67 |

|

|

|

|

|

||||

68 |

Taxable base (multiply line 67 by |

|

%, from line 24) |

68 |

|

|

|

|

|

||

69 |

Tax (multiply line 68 by |

|

. . . . . . . . . . . . . .tax rate, from line 59, column E) |

|

|

|

69 |

● |

|

||

70 |

Total value of stockholder’s equity |

70 |

|

|

|

|

|

||||

71 |

Capital subject to tax on dividends (add lines 61, 64, and 67) |

71 |

|

|

|

|

|

||||

72 |

. . . . . . . . . . . . . . . . .Capital not previously taxed (subtract line 71 from line 70) |

72 |

|

|

|

|

|

||||

73 |

Taxable base (multiply line 72 by |

|

%, from line 24) |

73 |

|

|

|

|

|

||

74 |

|

1 2 |

|

|

|

|

|

74 |

● |

|

|

Tax (multiply line 73 by .0015 (1 ⁄ mills)) . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . |

|

|

|

||||

75 |

. .Tax on allocated issued capital stock using dividend rates (add lines 63, 66, 69, and 74; enter here and on line 2) |

75 |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Page 4

Part III — Tax Rate Computation Based on Dividends Paid During the Year

A |

B |

C |

|

|

D |

|||

|

|

|

|

|

|

Tax Rate Computation - If column C is 6% or |

||

Dividends Paid |

Dividend Rate |

|

more, multiply the percent in column C |

|||||

|

|

|

|

B 4 A |

|

by .000375 (3⁄8 of a mill) |

||

76 ● |

|

|

|

|

% |

Enter tax rate here |

|

and on line 78 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part IV — Tax Computation

77 |

Taxable base (multiply line 76, column A by |

|

%, from line 26) |

||

78 |

Tax (multiply line 77 by |

|

the tax rate, from line 76, column D; enter here and on line 2) |

||

77●

78

Schedule F — Composition of Prepayments on Line 7

79 Payments with extension Form

80 Credit from prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

81 Credit from Form

82 Add lines 79, 80, and 81; enter here and on line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section 183 amount

79

80

81

82