Understanding the nuances of tax forms is crucial for corporations, especially when dealing with specific requirements related to tax exemptions and international sales. The CT-3-B form, designed by the New York State Department of Taxation and Finance, serves Tax-Exempt Domestic International Sales Corporations (DISC) by providing a structured way to report their information return. This form is a key document for businesses operating under the DISC designation, as it outlines the necessary details regarding the tax period, employer identification number, business and legal names, and pertinent financial data. Beyond basic identification, the form delves into the computation of entire net income, capital, and minimum taxable income, along with detailed schedules that align with federal tax return information. Its layout facilitates the incorporation of information from other related tax forms like the CT-3, CT-3-ATT, and more, ensuring a comprehensive submission for DISCs. Additionally, maintenance fees, interest on late payments, and penalties are addressed within this form, highlighting its role in maintaining tax compliance for corporations engaging in international trade. Emphasizing the connected nature of various tax documents and the specificities required of DISCs, the CT-3-B form stands as a vital tool for navigating the complexities of New York State’s taxation landscape.

| Question | Answer |

|---|---|

| Form Name | Form Ct 3 B |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | ct3b_2007 ct3 form 2016 |

|

|

Staple forms here |

|

|

New York State Department of Taxation and Finance |

|

|||

|

Sales Corporation (DISC) |

|||

|

Information Return |

All filers must enter tax period: |

||

Amended return |

Tax Law – Article |

|

beginning |

ending |

Employer identification number |

File number |

Business telephone number |

For office use only |

|

|

|

( |

) |

|

Legal name of corporation |

|

Trade name/DBA |

|

|

Mailing name (if different from legal name above) |

State or country of incorporation Date received (for Tax Department use only) |

c/o |

|

|

|

|

Number and street or PO box |

|

|

Date of incorporation |

|

|

|

|

|

|

City |

State |

ZIP code |

Foreign corporations: date began |

|

|

|

|

business in NYS |

|

|

|

|

|

|

NAICS business code number (from federal return) |

|

If your name, employer identification number, address, Audit (for Tax Department use only) |

||

|

|

or owner/officer information has changed, you must |

||

|

|

file Form |

||

Principal business activity |

|

you may file Form |

||

|

|

from our Web site, by fax, or by phone. See Need |

||

|

|

help? in the instructions. |

|

|

|

|

|

|

|

Date authorized to do business in New York State (foreign corporations only)

If not authorized to do business in New York State, mark an X in the box: (foreign corporations only)

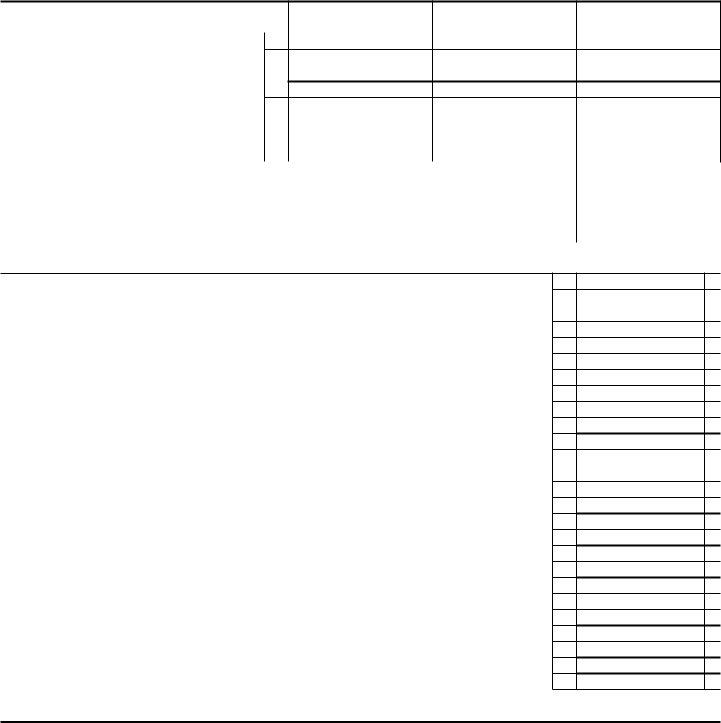

A. Pay amount shown on line E. Make payable to: New York State Corporation Tax |

|

|

|

|

Payment enclosed |

||

Attach your payment here. Detach all check stubs. (See instructions for details.) |

|

|

A. |

|

|

||

|

|||||||

B Maintenance fee for an authorized foreign corporation |

|

B. |

|

|

|

||

C Interest on late payment (see instructions) |

|

C. |

|

|

|

||

D Late filing and late payment penalties (see instructions) |

|

D. |

|

|

|

||

E Balance due (add lines B, C, and D and enter here; enter the payment amount on line A above) |

|

E. |

|

|

|

||

Information from Form

Computation of entire net income (ENI)

1 |

............................Federal taxable income (FTI) before net operating loss (NOL) and special deductions |

1. |

|

|

|||

|

Interest on federal, state, municipal, and other obligations not included on line 1 |

|

|

|

|||

2 |

2. |

|

|

||||

3 |

...........Interest paid to a corporate stockholder owning more than 50% of issued and outstanding stock |

3. |

|

|

|||

4a |

Interest deductions directly attributable to subsidiary capital |

|

|

|

4a. |

|

|

4b |

Noninterest deductions directly attributable to subsidiary capital |

|

|

|

4b. |

|

|

5a |

Interest deductions indirectly attributable to subsidiary capital |

|

|

|

5a. |

|

|

5b |

Noninterest deductions indirectly attributable to subsidiary capital |

|

|

|

5b. |

|

|

6 |

.....................................New York State and other state and local taxes deducted on your federal return |

6. |

|

|

|||

7 |

Federal depreciation from Form |

|

|

|

7. |

|

|

8 |

Other additions (attach list) |

|

|

|

8. |

|

|

9 |

Add lines 1 through 8 |

|

|

|

9. |

|

|

10 |

Income from subsidiary capital (from Schedule C, line 26, on page 5) |

10. |

|

|

|

|

|

11 |

Fifty percent of dividends from nonsubsidiary corporations |

11. |

|

|

|

|

|

12 |

Foreign dividends |

12. |

|

|

|

|

|

13 |

New York net operating loss deduction (NOLD) (attach federal and NYS computations) |

13. |

|

|

|

|

|

14 |

Allowable New York depreciation from Form |

14. |

|

|

|

|

|

15 |

Other subtractions (attach list) |

15. |

|

|

|

|

|

16 |

Total subtractions (add lines 10 through 15) |

|

|

|

16. |

|

|

17 |

ENI (subtract line 16 from line 9 above; show loss with a minus |

17. |

|

|

|||

18 |

.....Investment income before allocation (from Schedule B, line 22, on page 5, but not more than line 17 above) |

18. |

|

|

|||

19 |

Business income before allocation (subtract line 18 from line 17) |

|

|

|

19. |

|

|

|

|

|

|

|

|||

Attach a complete copy of your federal return. See instructions.

47401070094

Page 2 of 6

Computation of capital |

A |

B |

C |

Beginning of year |

End of year |

Average value |

|

|

|

|

|

26 Total assets from federal return |

26. |

|

|

27Real property and marketable securities

included on line 26 |

27. |

28 Subtract line 27 from line 26 |

28. |

29Real property and marketable securities at

|

fair market value |

29. |

|

|

|

|

30 |

Adjusted total assets (add lines 28 and 29) |

30. |

|

|

|

|

31 |

Total liabilities |

31. |

|

|

|

|

32 |

......................................................................Total capital (subtract line 31, column C, from line 30, column C) |

32. |

|

|

||

33 |

................................................................................Subsidiary capital (from Schedule C, line 28, on page 5) |

33. |

|

|

||

34 |

.....................................................................Business and investment capital (subtract line 33 from line 32) |

34. |

|

|

||

35 |

...................................................................Investment capital (from Schedule B, line 7, column E on page 4) |

35. |

|

|

||

36 |

Business capital (subtract line 35 from line 34) |

|

36. |

|

|

|

Computation of minimum taxable income (MTI)

42 ENI from page 1, line 17 ...........................................................................................................................

Adjustments

43Depreciation of tangible property placed in service after 1986 .................................................................

44Amortization of mining exploration and development costs paid or incurred after 1986 ...........................

45Amortization of circulation expenditures paid or incurred after 1986 (personal holding companies only) .......

46Basis adjustments in determining gain or loss from sale or exchange of property ...................................

47

48Installment sales of certain property .........................................................................................................

49Merchant marine capital construction funds..............................................................................................

50Passive activity loss (closely held and personal service corporations only) .......................................................

51Add lines 42 through 50 ............................................................................................................................

Tax preference items

52Depletion ...................................................................................................................................................

53Appreciated property charitable deduction................................................................................................

54Intangible drilling costs ..............................................................................................................................

55Add lines 51 through 54 ............................................................................................................................

56New York NOLD from page 1, line 13 ........................................................................................................

57Add lines 55 and 56...................................................................................................................................

58Alternative net operating loss deduction (ANOLD)....................................................................................

59MTI (subtract line 58 from line 57) ..................................................................................................................

60Investment income before apportioned NOLD (add page 1, line 18 and page 5, line 21) ................................

61Investment income not included in ENI but included in MTI ......................................................................

62Investment income before apportioned ANOLD (add lines 60 and 61) ........................................................

63Apportioned New York ANOLD .................................................................................................................

64Alternative investment income before allocation (subtract line 63 from line 62) .............................................

65Alternative business income before allocation (subtract line 64 from line 59) ................................................

42.

43.

44.

45.

46.

47.

48.

49.

50.

51.

52.

53.

54.

55.

56.

57.

58.

59.

60.

61.

62.

63.

64.

65.

(continued)

47402070094

|

|

|

|

|

||

|

|

|

|

|

|

|

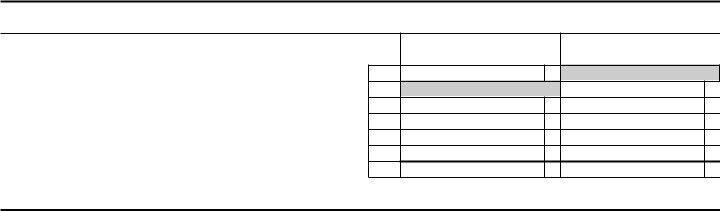

Schedule A, Part 3 — Computation of business allocation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

B |

||

Receipts in the regular course of business from: |

|

New York State |

Everywhere |

|||

129 |

Sales of tangible personal property allocated to New York State .... |

129. |

|

|

|

|

130 |

All sales of tangible personal property |

130. |

|

|

|

|

131 |

Services performed |

131. |

|

|

|

|

132 |

Rentals of property |

132. |

|

|

|

|

133 |

Royalties |

133. |

|

|

|

|

134 |

Other business receipts |

134. |

|

|

|

|

135 |

Total (add lines 129 through 134) |

135. |

|

|

|

|

Schedule A, Part 4 — Computation of alternative business allocation for MTI base

Receipts in the regular course of business from:

149Sales of tangible personal property allocated to New York State

150All sales of tangible personal property ............................................

151Services performed .........................................................................

152Rentals of property ..........................................................................

153Royalties..........................................................................................

154Other business receipts...................................................................

155Total (add lines 149 through 154) .............................................................

A |

B |

New York State |

Everywhere |

149.

150.

151.

152.

153.

154.

155.

(continued)

47403070094

Page 4 of 6

Schedule B, Part 1 — Computation of investment capital and investment allocation percentage

Attach separate sheets if necessary, displaying this information formatted as below.

Section 1 — Corporate and governmental debt instruments

Description of investment (identify each debt instrument and its date of maturity here; for each debt instrument complete columns C through G on the corresponding lines below)

Item |

|

A — Debt instrument |

|

|

B — Maturity date |

A |

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

C |

D |

E |

F |

G |

Item |

Average value |

Liabilities directly or |

Net average value |

Issuer’s |

Value allocated to |

|

|

indirectly attributable to |

(column C – column D) |

allocation |

New York State |

|

|

investment capital |

|

% |

(column E × column F) |

|

|

|

|

|

|

A

B

Amounts from attached list

1.

Totals of Section 1

Section 2 — Corporate stock, stock rights, stock warrants, and stock options

Description of investment (identify each investment and enter number of shares here; for each investment complete columns C through G on the corresponding lines below)

Item |

|

|

A — Investment |

|

|

|

B — Number of shares |

|||

A |

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

E |

F |

G |

||||

Item |

Average value |

Liabilities directly or |

|

Net average value |

Issuer’s |

Value allocated to |

||||

|

|

|

indirectly attributable to |

|

(column C – column D) |

allocation |

New York State |

|||

|

|

|

investment capital |

|

|

|

% |

(column E × column F) |

||

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

Amounts from attached list

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Totals of Section 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Totals of Section 1 (from line 1) |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Totals (add lines 2 and 3 in columns C, D, E, and G) |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Investment allocation percentage without the addition of cash (divide line 4, column G, by line 4, column E) |

5. |

% |

||||||||||||

6. |

Cash (optional) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment capital (add lines 4 and 6 in columns C, D, and E). Enter column E total on page 2, line 35 of this form. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47404070094

Name

Employer identification number (EIN)

Schedule B, Part 2 — Computation of investment income before allocation

8 |

Interest income from investment capital in Part 1, Section 1 |

|

|

|

8. |

|

|

9 |

Interest income from bank accounts |

|

|

|

9. |

|

|

10 |

All other interest income from investment capital |

|

|

|

10. |

|

|

11 |

Dividend income from investment capital |

|

|

|

11. |

|

|

12 |

Net capital gain or loss from investment capital |

|

|

|

12. |

|

|

13 |

....................................Investment income other than interest, dividends, capital gains, or capital losses |

13. |

|

|

|||

14 |

Total investment income (add lines 8 through 13) |

|

|

|

14. |

|

|

|

|

|

|

|

|||

15 |

Interest deductions directly attributable to investment capital |

15. |

|

|

|

|

|

16 |

Noninterest deductions directly attributable to investment capital |

16. |

|

|

|

|

|

17 |

Interest deductions indirectly attributable to investment capital |

17. |

|

|

|

|

|

18 |

Noninterest deductions indirectly attributable to investment capital.. |

18. |

|

|

|

|

|

19 |

Total deductions (add lines 15 through 18) |

|

|

|

19. |

|

|

20 |

Balance (subtract line 19 from line 14) |

|

|

|

20. |

|

|

21 |

Apportioned New York NOLD |

|

|

|

21. |

|

|

22 |

..............Investment income before allocation (subtract line 21 from line 20; enter here and on page 1, line 18) |

22. |

|

|

|||

|

|

|

|

|

|

|

|

Schedule C, Part 1 — Income attributable to subsidiary capital

23Interest from subsidiary capital (attach list) .................................................................................................

24Dividends from subsidiary capital (attach list) .............................................................................................

25Capital gains from subsidiary capital (attach list) ........................................................................................

26Total (add lines 23 through 25; enter here and on page 1, line 10) ......................................................................

23.

24.

25.

26.

Schedule C, Part 2 — Computation and allocation of subsidiary capital base

Include all corporations (except a DISC) in which you own more than 50% of the voting stock. Attach separate sheets if necessary, displaying this information formatted as below.

A — Description of subsidiary capital (list the name of each corporation and the EIN here; for each corporation, complete columns B through G |

|||||||||

on the corresponding lines below) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Item |

|

|

Name |

|

|

|

|

EIN |

|

A |

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

A |

B |

C |

D |

E |

F |

G |

|||

Item |

% of voting |

Average |

Liabilities directly or indirectly |

Net average |

Issuer’s |

Value allocated |

|||

|

stock |

value |

attributable to |

value |

allocation |

to New York State |

|||

|

owned |

|

subsidiary capital |

(column C – column D) |

% |

|

(column E x column F) |

||

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

Amounts from |

|

|

|

|

|

|

|

|

|

attached list |

|

|

|

|

|

|

|

|

|

27Totals (add amounts in columns C

and D) ... |

27. |

|

|

|

|

|

|

28 |

Total net average value of subsidiary capital |

|

|

|

|

|

(add amounts in column E; enter here and on page 2, line 33) |

28. |

|

|

|

29 |

...................................................................Subsidiary capital base before deduction (add column G amounts) |

29. |

|||

30Value of subsidiary capital included in column G of subsidiaries taxable under Tax Law Article 32;

Article 33; or Article 9, section 186 |

30. |

31 Subsidiary capital base (subtract line 30 from line 29) |

31. |

47405070094

Page 6 of 6

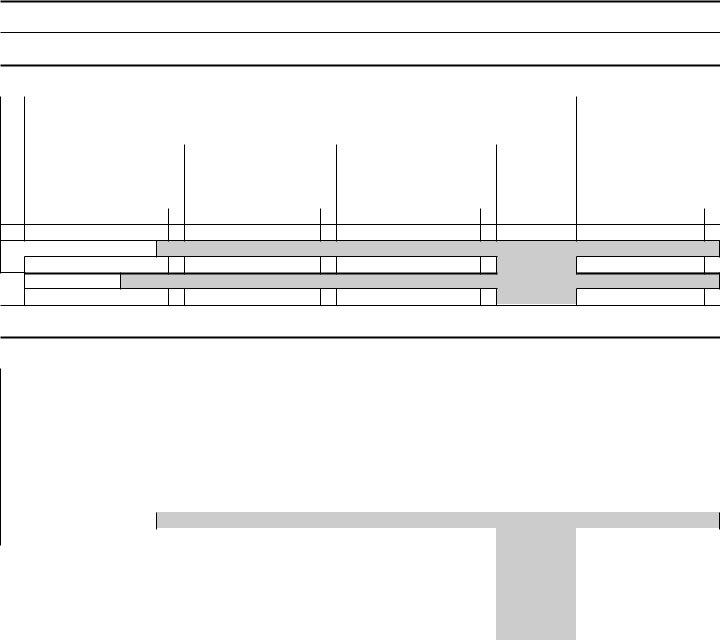

Schedule E — Computation of adjusted minimum tax

1 |

ENI from page 1, line 17 |

1. |

|

|

2 |

Depletion from page 2, line 52 |

2. |

|

|

3 |

Total (add lines 1 and 2) |

|

|

|

|

|

|

||

4 |

Investment income before allocation from page 1, line 18 |

|

|

|

5 |

Modified business income before allocation (subtract line 4 from line 3) |

|

|

|

3.

4.

5.

Location of corporation’s books and records

If more than 50% of the stock of this corporation is owned by another corporation, enter the name and EIN of the parent corporation:

Parent corporation’s name

EIN

Corporations organized outside New York State complete the following for capital stock issued and outstanding:

Number of par shares

Value

$

Number of

Value

$

Third – |

Do you want to allow another person to discuss this return with the Tax Dept? (see instructions) |

Yes |

|

|

(complete the following) No |

|

|

||||

|

|

|

|

||||||||

party |

|

|

|

|

|

|

|

|

|

|

|

designee |

Designee’s name |

Designee’s phone number |

|

Personal identification |

|

|

|

||||

|

( |

) |

|

number (PIN) |

|

|

|

|

|||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Certification. I certify that this return and any attachments are to the best of my knowledge and belief true, correct, and complete.

Signature of authorized person |

|

|

|

Official title |

|

Date |

||

|

|

|

|

|

|

|

|

|

Paid preparer |

|

Signature of individual preparing this return |

|

Firm’s name (or yours if |

|

|

||

use only |

Address |

City |

State |

ZIP code |

ID number |

Date |

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See instructions for where to file.

47406070094