Any time you intend to fill out Form Ct 33 M, it's not necessary to download and install any kind of programs - simply make use of our online tool. To make our tool better and easier to work with, we continuously implement new features, bearing in mind suggestions from our users. With just a couple of basic steps, you are able to begin your PDF editing:

Step 1: Press the "Get Form" button in the top area of this webpage to access our editor.

Step 2: This editor grants the capability to customize almost all PDF documents in a range of ways. Improve it with your own text, correct original content, and place in a signature - all when you need it!

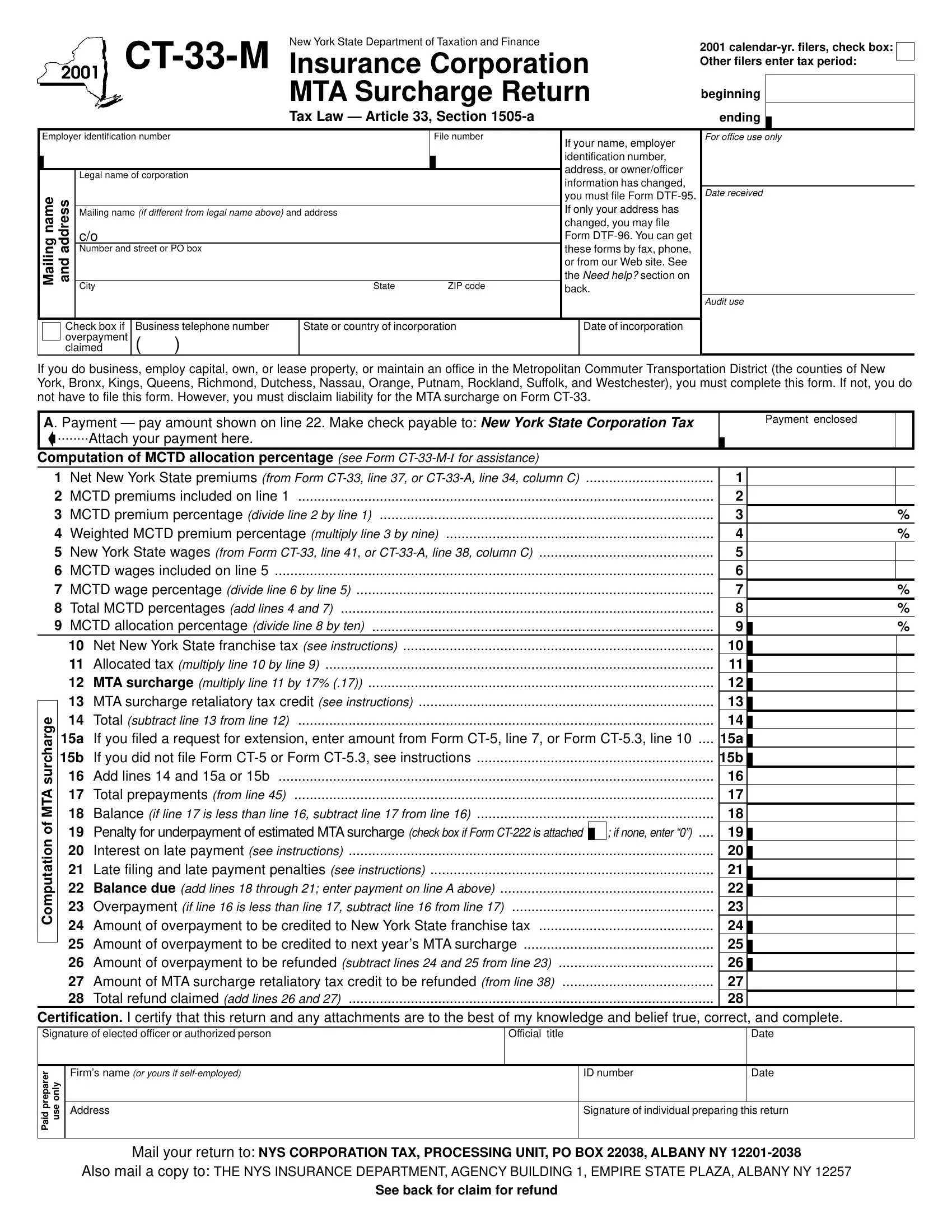

Completing this PDF will require care for details. Make sure that all required blank fields are filled in accurately.

1. Start filling out the Form Ct 33 M with a group of major blank fields. Consider all the information you need and make certain absolutely nothing is neglected!

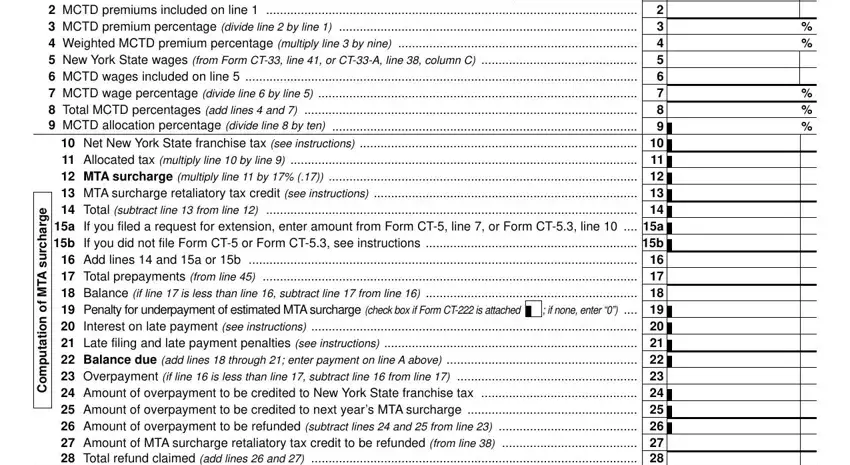

2. Once your current task is complete, take the next step – fill out all of these fields - Net New York State premiums from, Net New York State, e g r a h c r u s A T M, and f o n o i t a t u p m o C with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

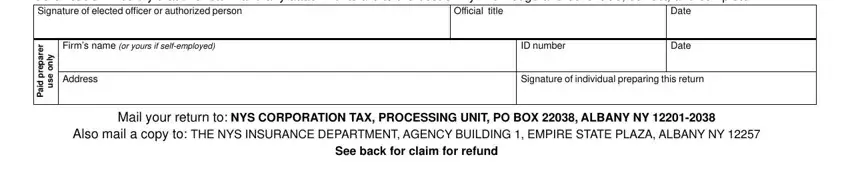

3. Completing Certification I certify that this, Official title, Date, r e r a p e r p d a P, Firms name or yours if selfemployed, ID number, Date, y n o, e s u, Address, Signature of individual preparing, Mail your return to NYS, Also mail a copy to THE NYS, and See back for claim for refund is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Concerning r e r a p e r p d a P and e s u, make certain you don't make any mistakes in this current part. These two are considered the most important ones in the document.

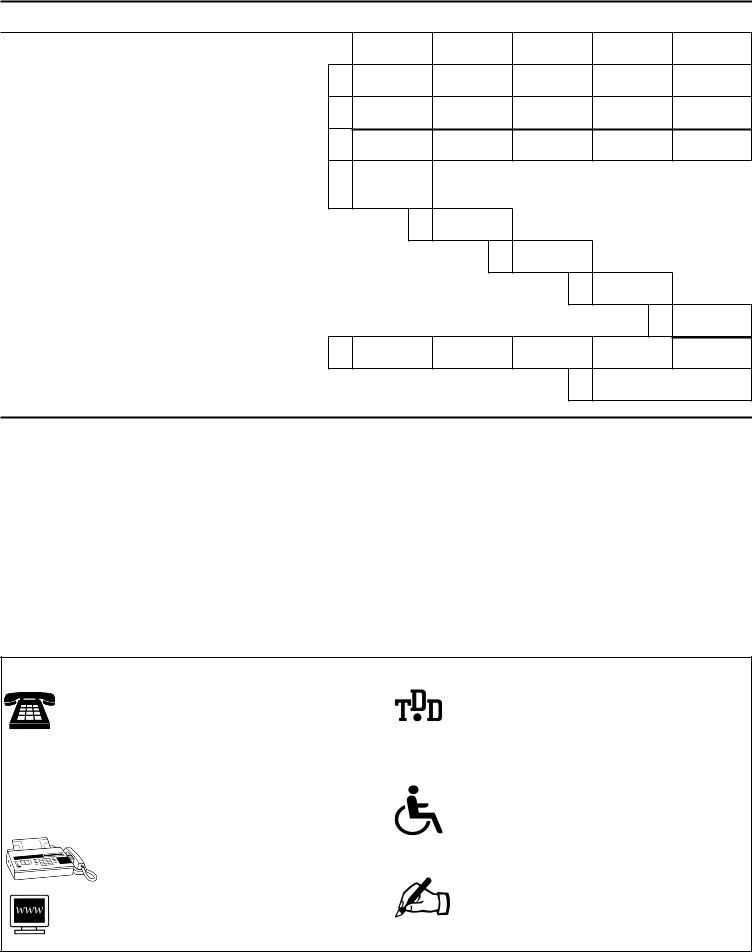

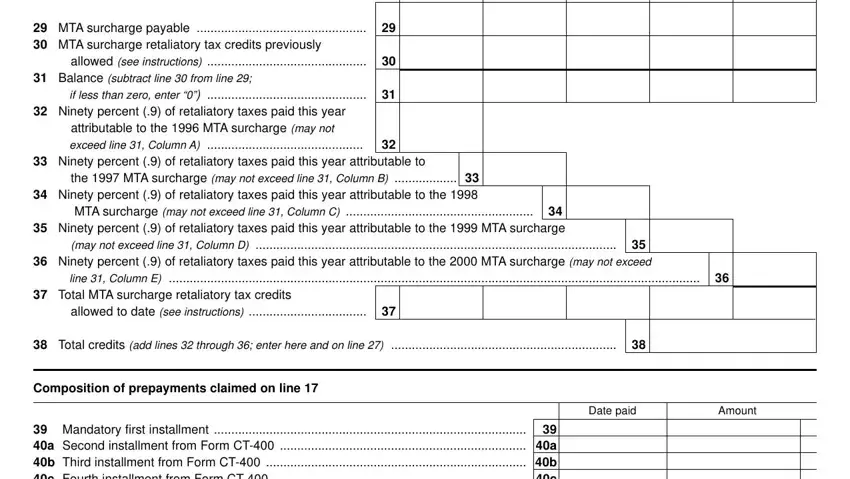

4. The following paragraph requires your details in the subsequent parts: MTA surcharge payable MTA, allowed see instructions, Balance subtract line from line, if less than zero enter, Ninety percent of retaliatory, attributable to the MTA surcharge, Ninety percent of retaliatory, the MTA surcharge may not exceed, MTA surcharge may not exceed line, Ninety percent of retaliatory, may not exceed line Column D, Ninety percent of retaliatory, line Column E, Total MTA surcharge retaliatory, and allowed to date see instructions. Make sure you give all required info to go onward.

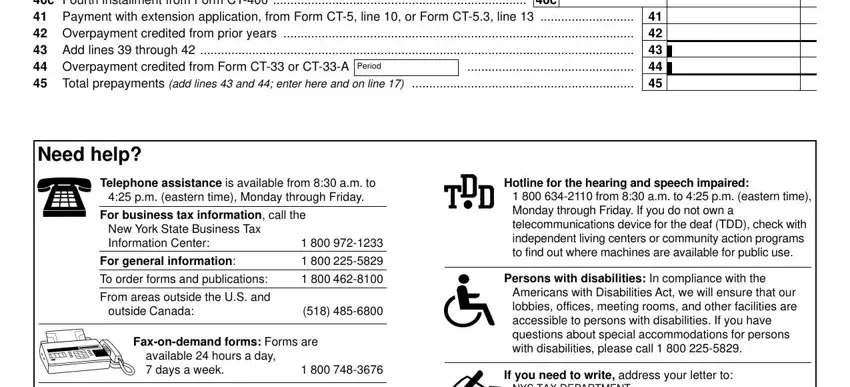

5. To finish your form, the last area has a number of extra fields. Entering Mandatory first installment a, Period, Need help, Telephone assistance is available, pm eastern time Monday through, For business tax information call, New York State Business Tax, For general information, To order forms and publications, From areas outside the US and, outside Canada, Faxondemand forms Forms are, available hours a day days a week, Hotline for the hearing and speech, and from am to pm eastern time should conclude everything and you will be done in a flash!

Step 3: Prior to finishing your form, you should make sure that all blank fields have been filled out properly. The moment you believe it's all fine, click “Done." Grab your Form Ct 33 M when you sign up at FormsPal for a 7-day free trial. Immediately get access to the form inside your personal cabinet, along with any modifications and changes being conveniently preserved! With FormsPal, you can easily fill out documents without being concerned about personal data breaches or data entries being distributed. Our protected system makes sure that your personal details are stored safely.