Making use of the online tool for PDF editing by FormsPal, you can complete or edit nebraska form 33 right here and now. Our editor is continually developing to present the very best user experience possible, and that's due to our resolve for continual improvement and listening closely to customer comments. This is what you'll need to do to get started:

Step 1: Just hit the "Get Form Button" in the top section of this page to launch our pdf form editor. There you'll find everything that is necessary to fill out your file.

Step 2: The editor provides the capability to work with your PDF in various ways. Improve it by writing customized text, adjust what's originally in the PDF, and put in a signature - all close at hand!

Filling out this form will require attention to detail. Make sure all required fields are filled out properly.

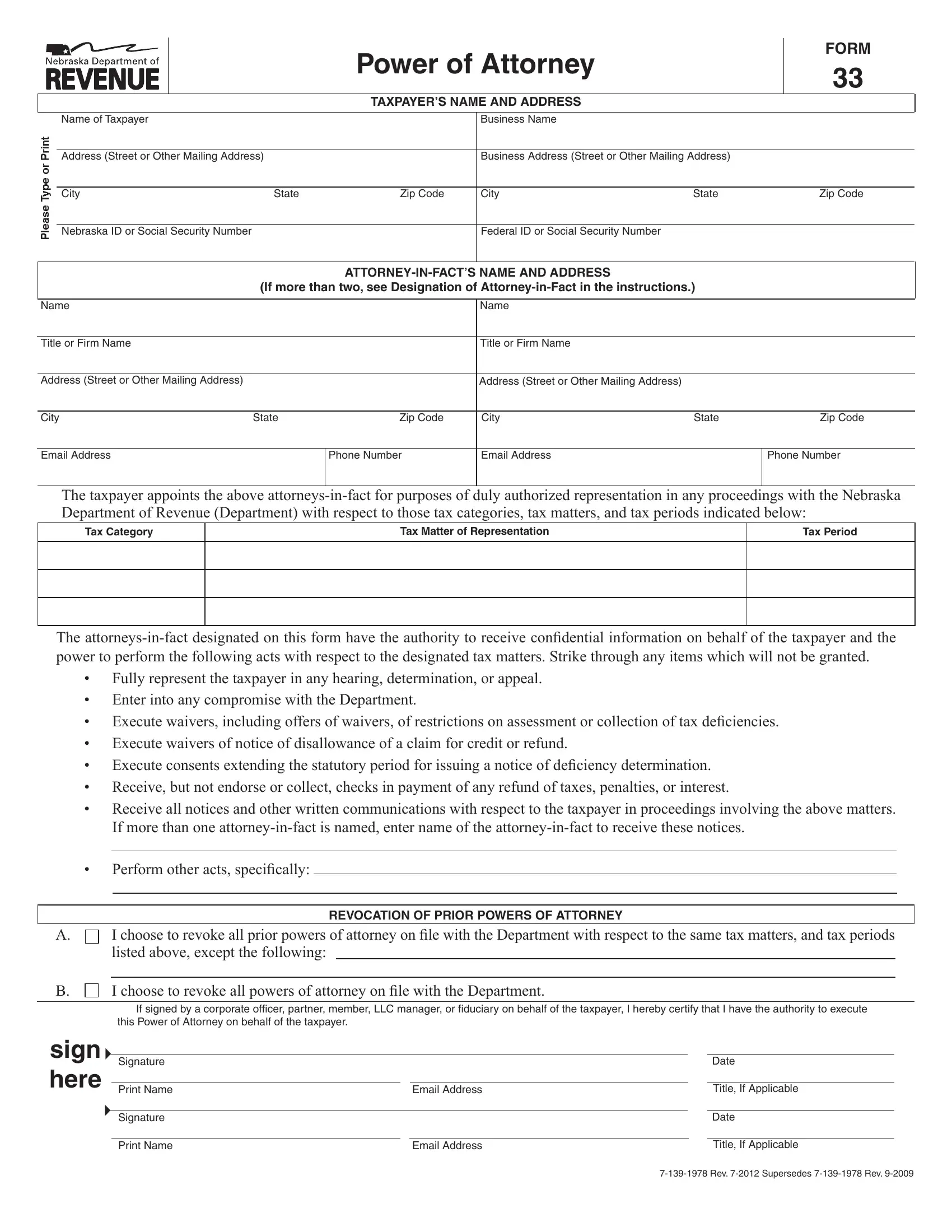

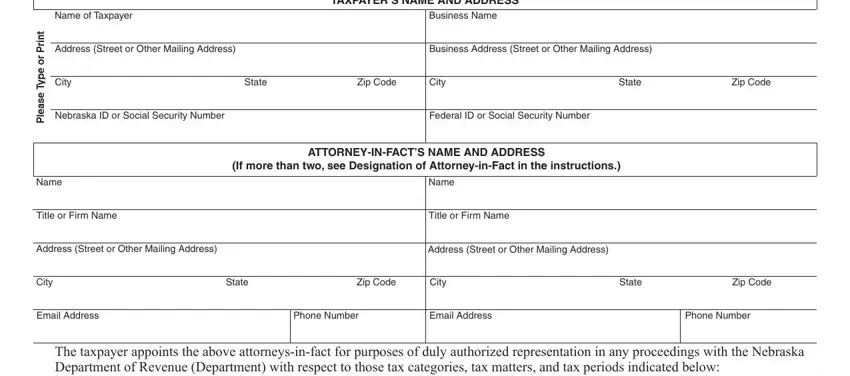

1. Before anything else, while filling out the nebraska form 33, start with the section that has the following fields:

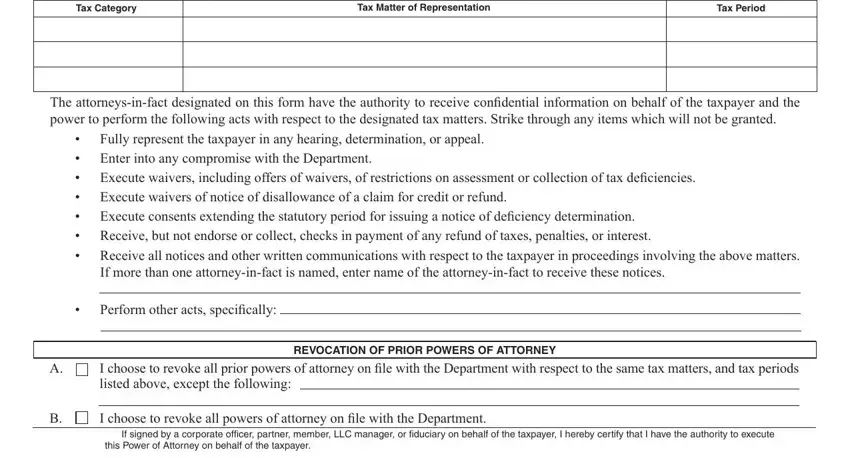

2. The subsequent step would be to fill out these particular fields: Tax Category, Tax Matter of Representation, Tax Period, Fully represent the taxpayer in, The attorneysinfact designated on, Enter into any compromise with, If more than one attorneyinfact is, Perform other acts speciically, I choose to revoke all prior, REVOCATION OF PRIOR POWERS OF, I choose to revoke all powers of, If signed by a corporate officer, and this Power of Attorney on behalf.

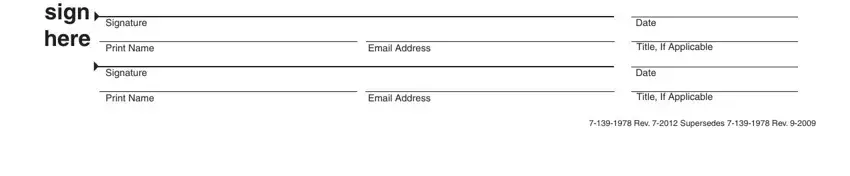

3. Throughout this stage, have a look at sign here, Signature, Print Name, Signature, Print Name, Email Address, Email Address, Date, Title If Applicable, Date, Title If Applicable, and Rev Supersedes Rev. All these must be taken care of with highest accuracy.

Be very careful when filling out Signature and Signature, since this is the section where most people make some mistakes.

4. This next section requires some additional information. Ensure you complete all the necessary fields - TAXPAYERS NAME AND ADDRESS If the, and not wish to authorize the named - to proceed further in your process!

Step 3: When you have reread the information in the file's blanks, click on "Done" to complete your form. Create a 7-day free trial account at FormsPal and obtain instant access to nebraska form 33 - which you'll be able to then make use of as you want in your FormsPal cabinet. When you use FormsPal, you'll be able to fill out documents without having to get worried about database breaches or data entries getting distributed. Our secure system helps to ensure that your private details are maintained safe.