Navigating the complexities of corporate taxation in New York State can be daunting, particularly when adjustments related to depreciation are involved. This is where the CT-399 Form, officially known as the Depreciation Adjustment Schedule, comes into play. Designed by the Department of Taxation and Finance, this document serves a critical function for corporations operating under Tax Law Articles 9-A and 33. Its primary purpose is to facilitate the computation of New York State depreciation modifications, a crucial step in calculating a corporation's Entire Net Income (ENI). The form is meticulously divided into sections, each addressing different aspects of depreciation. For instance, Section A focuses on ACRS/MACRS property, requiring detailed information about each depreciable asset, including its cost, the date it was placed in service, and both federal and state depreciation figures. Meanwhile, Section B covers property qualified under IRC section 168(k)(2) for federal special depreciation, again necessitating comprehensive details for proper computation. Additionally, for corporations that have disposed of assets, the form provides guidelines on how to adjust for differences between federal and New York State depreciation deductions. This form plays a pivotal role in ensuring corporations accurately adjust their taxable income, reflecting the state-specific taxation rules that apply to depreciation, ultimately playing a vital part in the broader landscape of corporate tax compliance in New York State.

| Question | Answer |

|---|---|

| Form Name | Form Ct 399 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | Fillable Online tax ny CT-399 Staple forms here New York ... |

|

Department of Taxation and Finance |

||

|

Depreciation Adjustment Schedule |

||

|

Tax Law – Articles |

|

|

|

|

|

|

Legal name of corporation |

|

Employer identification number |

|

|

|

|

|

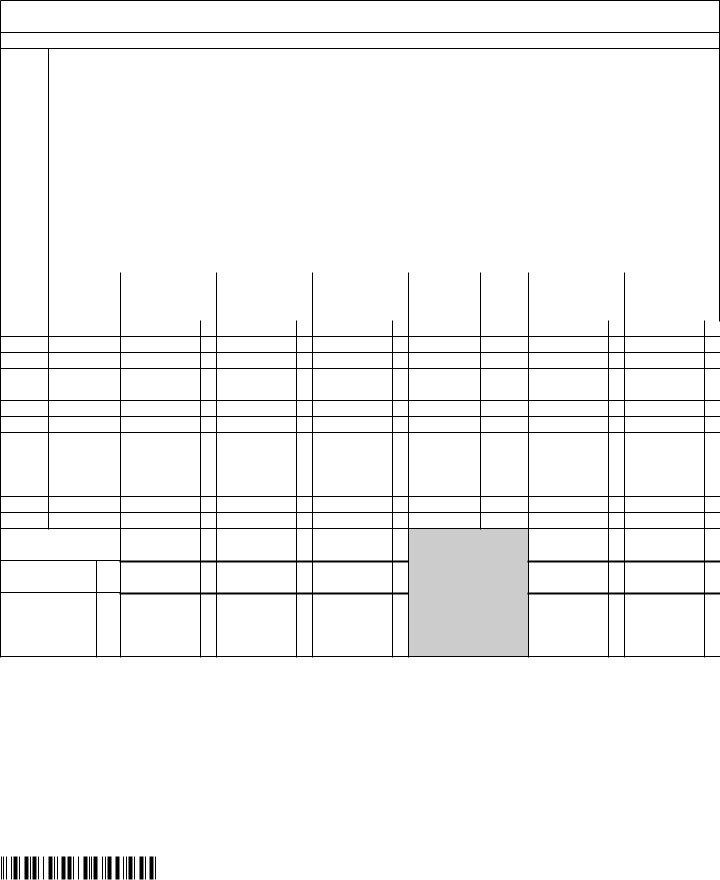

Part 1 – Computation of New York State depreciation modifications when computing entire net income (ENI) List only depreciable property that requires or is entitled to a depreciation modification when computing ENI (see Form

Section A – ACRS/MACRS property (attach separate sheets if necessary, displaying this information formatted as below; see instructions)

A – Description of property (identify each item of property here; for each item of property complete columns B through I on the corresponding lines below)

Item |

|

|

|

|

|

|

|

Property |

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

K |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

B |

|

|

C |

D |

E |

F |

G |

H |

I |

|||||

Item |

Date placed |

Cost or |

Accumulated federal |

Federal |

Method of |

Life |

Accumulated |

Allowable |

|||||||

|

in service |

other |

ACRS/MACRS |

ACRS/MACRS |

figuring NYS |

or |

NYS |

NYS |

|||||||

|

basis |

depreciation |

depreciation deduction |

depreciation |

rate |

depreciation |

depreciation |

||||||||

|

|

|

|

(see instructions) |

(see instructions) |

(see instructions) |

(see instructions) |

(see instr.) |

(see instructions) |

(see instructions) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

G |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

J |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

K |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

L |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

P |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Q |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

attached list, if any .... |

|

|

|

|

|

|

|

|

|

|

|

|

|||

1 Totals of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section A |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

482001210094

Page 2 of 3

Section B – Property qualified under IRC section 168(k)(2) for federal special depreciation (attach separate sheets if necessary,

displaying this information formatted as below; see instructions)

A – Description of property (identify each item of property here; for each item of property complete columns B through I on the corresponding lines below)

Item |

|

|

|

|

Property |

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

G |

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

J |

|

|

|

|

|

|

|

|

|

K |

|

|

|

|

|

|

|

|

|

L |

|

|

|

|

|

|

|

|

|

M |

|

|

|

|

|

|

|

|

|

A |

|

B |

C |

D |

E |

F |

G |

H |

I |

Item |

Date placed |

Cost or |

Accumulated |

Federal depreciation Method of figuring |

Life or |

Accumulated NYS |

Allowable NYS |

||

|

in service |

other basis |

federal depreciation |

deduction |

NYS depreciation |

rate |

depreciation |

depreciation |

|

|

(see instructions) |

(see instructions) |

(see instructions) |

(see instructions) |

(see instr.) |

(see instructions) |

|

||

|

|

|

|

|

|

|

|

|

|

A |

- |

- |

|

|

|

|

|

|

|

B- -

C- -

D |

- |

- |

E |

- |

- |

F- -

G- -

H |

- |

- |

I |

- |

- |

J |

- |

- |

K |

- |

- |

L- -

M- -

Amounts from

attached list, if any ....

2Totals of

Section B 2

3Add lines 1 and 2 in columns C, D, E, H, and I

(see instr) ....... 3

If you have not disposed of any ACRS/MACRS property placed in service in tax years beginning before 1994, and you have not disposed of qualified property for which you claimed a federal special depreciation deduction (in a tax year beginning after December 31, 2002, for property placed in service on or after June 1, 2003), enter the total of column E as an addback to federal taxable income (FTI) and the total of column I as a deduction from FTI on the appropriate lines of the applicable form (see line 3

instructions).

If you have disposed of any property listed on this form in a prior year, complete Parts 2 and 3.

482002210094

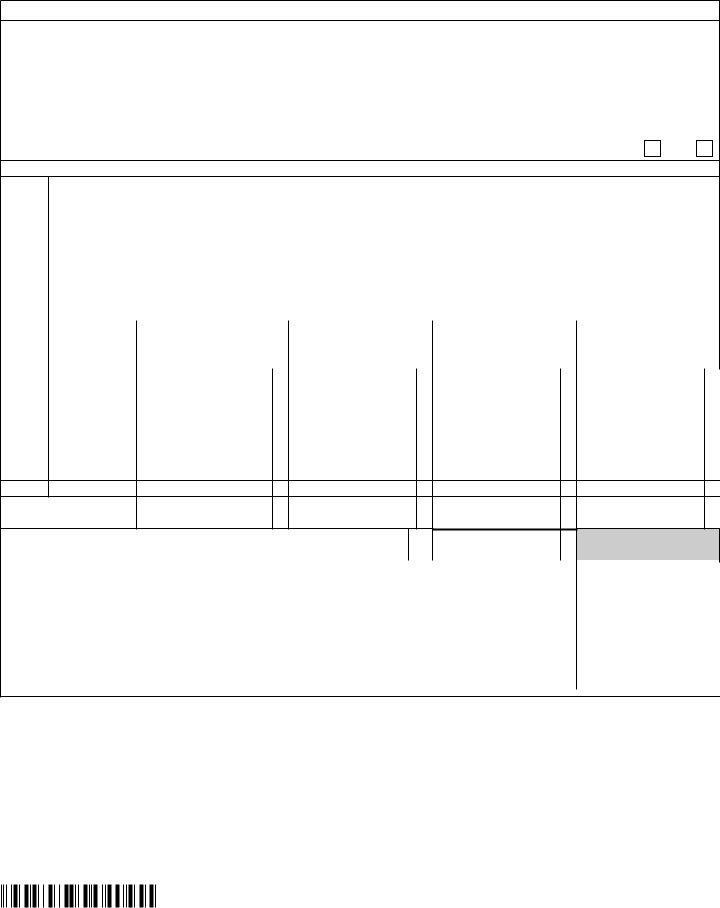

Part 2 – Disposition adjustments (attach separate sheets if necessary, displaying this information formatted as below; see instructions)

•For each item of property listed below, determine the difference between the total federal depreciation deduction, including a federal special depreciation deduction allowed under IRC section 168(k) for qualified property under IRC section 168(k)(2), and the total New York State depreciation used in the computation of federal and New York State taxable income in prior and current years.

•If the federal depreciation deduction is larger than the New York State depreciation deduction, subtract column D from column C and enter the result in column E.

•If the New York State depreciation deduction is larger than the federal depreciation deduction, subtract column C from column D and enter the result in column F.

Disposition of property for certain tax credits – In this tax period, did you dispose of property for which the |

Yes |

No |

investment tax credit was previously claimed? (mark an X in one box; see instructions) |

A – Description of property (identify each item of property here; for each item of property complete columns B through F on the corresponding lines below)

Item |

|

|

|

Property |

|

|

A |

|

|

|

|

|

|

B |

|

|

|

|

|

|

C |

|

|

|

|

|

|

D |

|

|

|

|

|

|

E |

|

|

|

|

|

|

F |

|

|

|

|

|

|

G |

|

|

|

|

|

|

H |

|

|

|

|

|

|

A |

B |

|

C |

D |

E |

F |

Item |

Date placed |

Total federal depreciation |

Total New York State |

Adjustment (if C is larger |

Adjustment (if D is larger |

|

|

in service |

deduction taken |

depreciation taken |

than D, column C - column D; |

than C, column D - column C; |

|

|

(see instructions) |

(see instructions) |

see instructions) |

see instructions) |

||

|

|

|

|

|

|

|

A |

- |

- |

|

|

|

|

B |

- |

- |

|

|

|

|

C |

- |

- |

|

|

|

|

D |

- |

- |

|

|

|

|

E |

- |

- |

|

|

|

|

F |

- |

- |

|

|

|

|

G |

- |

- |

|

|

|

|

H- -

Amounts from attached list, if any........

4 Total excess federal depreciation deductions over New York State

|

depreciation deductions (add column E amounts) |

4 |

|

|

|

|

|

5 |

Total excess New York State depreciation deductions over federal depreciation deductions (add column F amounts) |

5 |

|

|

|||

Part 3 – Summary of adjustments to ENI |

|

A |

|

|

B |

||

|

Federal |

|

|

New York State |

|||

6 |

Enter amount from line 3, column E |

6 |

|

|

|

|

|

7 |

Enter amount from line 3, column I |

7 |

|

|

|

|

|

8 |

Enter amount from line 4 |

8 |

|

|

|

|

|

9 |

Enter amount from line 5 |

9 |

|

|

|

|

|

10 |

..................................................Add amounts in column A and column B |

10 |

|

|

|

|

|

If you file Form: |

Enter the amount from line 10, column A, on Form: |

Enter the amount from line 10, column B, on Form: |

482003210094