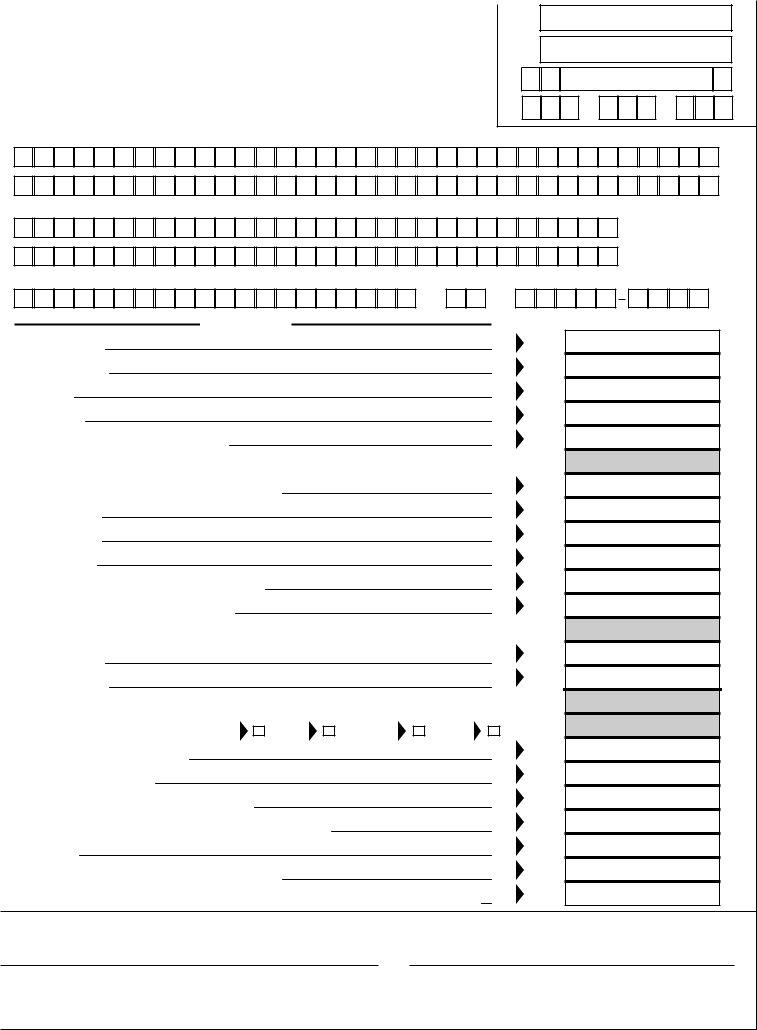

Navigating the complexities of municipal tax obligations requires a clear understanding of specific forms and mandates, particularly for entities operating within Detroit. The D-U1 form, a crucial document for managing utility users' taxes, is a cornerstone for businesses to comply accurately with the City of Detroit's tax requirements. On a monthly basis, this form captures essential data including the beginning and ending dates, the Federal Employer Identification Number, the taxpayer's name and address, alongside detailed information on the taxes billed and self-assessed taxes across utilities such as electricity, telephone, gas, and others. Furthermore, it allows for deductions including collection fees, write-offs, refusals, and refunds, thereby accurately portraying the net tax due. Importantly, the form stipulates the need for detailed documentation of various lines, including transported gas transactions and other adjustments that might impact the tax calculation. Businesses are mandated to remit the form and payment by the last day of the month following the month reported, ensuring timely compliance. Beyond monthly filings, an annual return compounds the compliance landscape, highlighting the procedural and substantive nuances that businesses must navigate to maintain good standing with the municipal tax authority. Moreover, the underpinning declaration under penalty of perjury underscores the seriousness and legal implications tied to the form's accurate and complete submission. All told, the D-U1 form epitomizes the intricate interplay between businesses and municipal tax regulations, serving as a vital tool for both accountability and operational transparency.

| Question | Answer |

|---|---|

| Form Name | Form D U1 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | MichCon, D-U1, CCF, MCF |

|

CITY OF DETROIT |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

UTILITY USERS TAX |

|||||||||||||||

|

|

|

|

|

|

Month Beginning |

|

|

|

|

|

|

|

Ending |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

M M D D |

|

M M D D Y Y Y Y |

||||||||||||

|

Federal Employer Identification Number |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

$

STAMP DLN HERE

STAMP DATE HERE

, ,.

Office Use Only

Address

City or TownStateZip Code

Tax Billed

1. |

Electricity |

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

||

2. |

Telephone |

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

||

3. |

Gas |

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

||

4. |

Other |

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

||

5. |

Tax Billed (add lines 1 through 4) |

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

||

Deductions from Tax Billed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Collection Fee (multiply line 5 x .01 (1.0%)) |

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|||

7. |

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

||

8. |

Refusals |

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

||

9. |

Refunds |

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

||

10. |

Total Deductions (add lines 6 through 9) |

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|||

11. |

Total Tax Billed (line 5 less line 10) |

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Self Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Electricity |

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

||

13. |

Telephone |

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

||

Transported Gas |

|

|

|

|

|

|

|

|

14. |

Unit of Measure (Check one) |

CCF |

MCF |

MMBTU |

DKTH |

|||

15. |

Volume of Gas Purchased |

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

||

16. |

Gas Purchase Rate |

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

||

17. |

Cost of Gas (multiply line 15 x line 16) |

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|||

18. |

Transported Gas Tax — multiply line 17 x .05 (5.0%) |

|

|

|

18 |

|||

|

|

|

|

|||||

19. |

Other |

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

||

20. |

Total Self Tax (add lines 12, 13, 18 and 19) |

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|||

21.Total Tax Due (add lines 11 and 20) (make check payable to: Treasurer, City of Detroit |

|

|

21 |

|||||

|

|

|

||||||

Under penalty of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct and complete.

Signature |

Date |

Title |

Telephone Number |

Fax Number |

MAILING INSTRUCTIONS: Due Date: This return is due the last day of the month following the month of the return.

Returns With Payments: Income Tax Division 46501, P.O. Box 67000, Detroit, MI

DOCID 200 1997

INSTRUCTIONS FOR FORM

DETROIT UTILITY USERS TAX

MONTHLY RETURN

FILING — A return must be filed for each month of the calendar year. Tax amounts billed or self tax amounts for any given month must be remitted on or before the last day of the following month. If no tax was billed, or no self tax is due, you must nevertheless file a return with the nota- tion “NONE” on line 5 or line 20. In addition, the filing of an annual return is required on Form

TAX BILLED (Lines

DEDUCTIONS (Lines

Collection Fee — A collection fee of 1% of the tax billed utility users (Line 5) is deduct- ed from total tax.

Refusal to Pay — If a “User” refuses to pay the tax billed, a deduction may be made for such amounts. However, a listing showing user’s name, address and amount billed must be submitted with your return to support your deduction.

Refunds — If tax previously billed and remitted to Detroit is refunded at a later date, the tax refunded may be deducted from your current remittance.

TOTAL TAX BILLED — Report Tax Billed, line 5, less the sum of your deductions for collec- tion fee,

SELF TAX (Lines

Transported Gas — Lines

OTHER (Line 19) — All other adjustments to the tax due, may be reported on Line 19; howev- er, an explanation and schedules to support your adjustment must be submitted with your return. TOTAL TAX DUE (Line 21) — Total Tax Due is the sum of Total Tax Billed and Total Self Tax, lines 11 and 20.

PAY THIS AMOUNT (Line 21) — Make your remittance payable to “Treasurer, City of

Detroit” and mail to: Income Tax Division 46501, P.O. Box 67000, Detroit, MI

Information concerning Forms