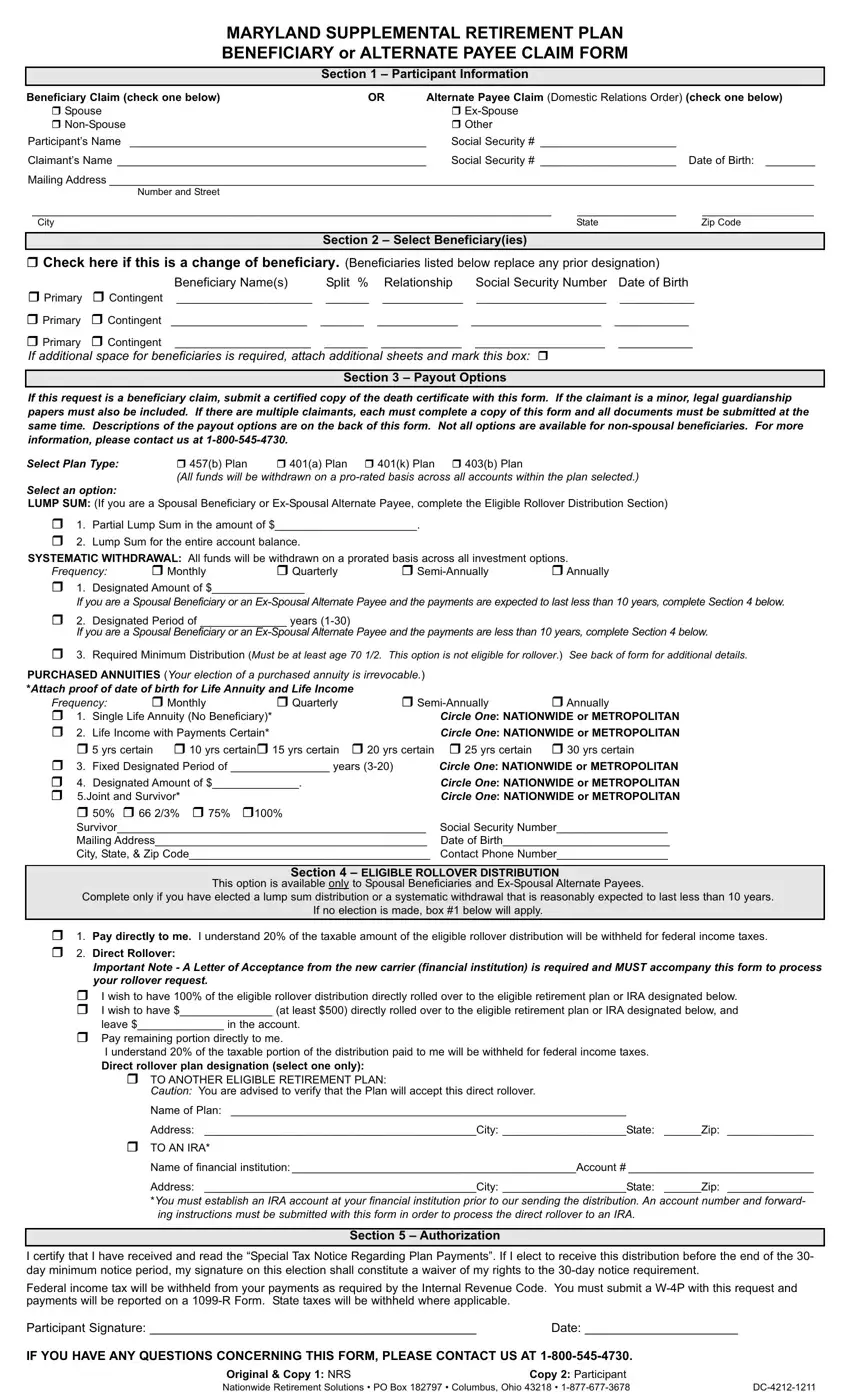

PAYOUT OPTION DESCRIPTIONS

PARTIAL LUMP SUM PAYMENT: This option provides for a single payment in the amount requested (minimum of $25.00) from the value of your account.

LUMP SUM PAYMENT: This option provides for the payment of the full value of your account in a single payment.

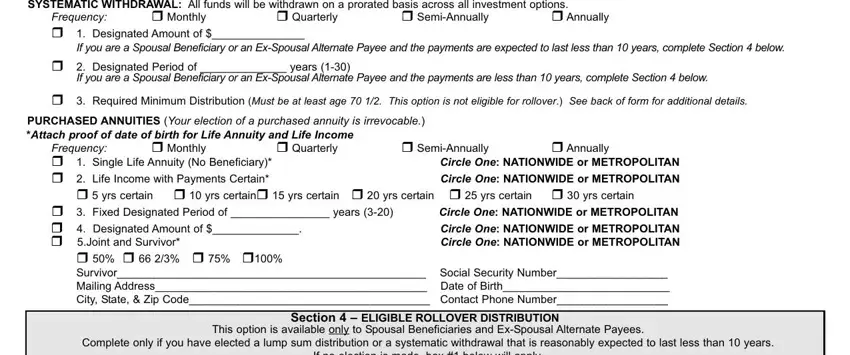

SYSTEMATIC WITHDRAWAL OPTIONS: Your account is maintained on the Administrator’s Accumulation System and continues to earn either recurrent interest in the fixed return or fund investment performance if in the variable return option, throughout the payout period. You will continue to receive quarterly statements. In the event of your death prior to the exhaustion of your account, upon the claim, the beneficiary will receive payments until the account is exhausted or a lump sum payment of the remaining account balance. All funds are withdrawn on a prorated basis.

DESIGNATED AMOUNT: This option provides for payments of the designated amount (minimum of $25.00) until your account is exhausted. The final payment will be the balance of your account. Please indicate the amount to be paid, your beneficiaries, their rela- tionships to you, their Social Security numbers, and their birth dates.

Exchanges are permitted, subject to annual exchange limitations.

For example:

Participant dies prior to the exhaustion of the account.

––Upon their claim, the beneficiary receives payments until the account is exhausted or a lump sum payment of the remaining account balance.

DESIGNATED PERIOD: This option allows you to choose the number of years you will receive payments. Your payment may fluctuate if some or all of your money is invested in Mutual Fund Options. Please indicate the amount to be paid, your beneficiaries, their relationships to you, their Social Security numbers, and their birth dates.

Exchanges are permitted, subject to annual exchange limitations.

For example:

Participant dies prior to the exhaustion of the account.

––Upon their claim, the beneficiary receives payments until the account is exhausted or a lump sum payment of the remaining account balance.

REQUIRED MINIMUM DISTRIBUTION: A minimum distribution of your account is required to begin when you attain age 70 1/2. This payment option will only pay the minimum that is required to be paid to you each year. The amount that is required to be distributed will be calculated for each distribution year in accordance with regulations under Section 401(a)(9) of the Internal Revenue Code. The Required Minimum Distribution (RMD) will usually be different for each year because of the changes in your account balance and the change in your life expectan- cy. This payment option is not available unless you have attained age 70 1/2 and your account cannot be rolled over to another

eligible retirement plan or IRA. Please indicate the amount to be paid, your beneficiaries, their relationships to you, their Social Security numbers, and their birth dates

For example:

Participant dies prior to the exhaustion of the account.

–– Beneficiary receives payments until the account is exhausted or a lump sum payment of the remaining account balance.

PURCHASED ANNUITY OPTIONS: Your account is removed from the Administrator’s Accumulation System and your account balance is used to purchase an annuity contract that you select. Purchase rates are subject to change monthly. However, once you have purchased an annuity, the benefit amount will remain the same for the life of the annuity. You will receive an annuity certificate stating the terms of the con- tract. You will no longer receive quarterly statements.

SINGLE LIFE ANNUITY: This option provides equal payments over your lifetime. At the participant’s death, payments will stop. There is no named beneficiary. Attach proof of date of birth.

For example:

Annuitant dies after two payments are made - no death benefit payable.

LIFE INCOME WITH PAYMENTS CERTAIN: This option provides payments for your lifetime. If you die before the selected number of guaranteed payments has been made, payments will continue to your named beneficiary until the total number of guaranteed payments (5, 10, 15, 20, 25, or 30 years) has been made to you and your beneficiary. If you die after the guaranteed number of payments has been made, no death benefit is payable. Please select a guaranteed period and indicate your beneficiaries, their relationships to you, their Social Security numbers and their birth date and attach proof of your date of birth.

For example:

20 Years Certain – Annuitant dies in the 5th year.

–– Beneficiary receives 15 years of monthly payments or an adjusted lump sum payment.

JOINT & SURVIVOR: This option provides payments for you and your survivor for your lifetimes. Upon your death, payments will contin- ue to survivor, if he or she is living. No other beneficiaries are permitted under this option. Payments to the survivor may be a percentage (50%, 66 2/3%, 75% 100%) of the original amount. Please name your survivor, the survivor’s relationship to you, the survivor’s Social Security number, and the survivor’s birth date.

For example:

Annuitant dies and survivor is still living.

––Survivor receives the monthly benefit for as long as they live at 50%, 66 2/3%, 75%, or 100% of the original amount. Annuitant dies and survivor is also deceased.

––No death benefit, once the annuitant and the survivor are deceased the annuity is over.

FIXED DESIGNATED PERIOD: This option provides for payments for the number of years chosen. You may select any whole number of years between 3 and 20, inclusive. If you should die before the end of the period, payments will continue to the beneficiary. Please indi- cate the number of years to be paid, your beneficiaries, their relationships to you, their Social Security numbers, and their birth dates.

For example:

Annuitant dies prior to the end of the designated number of years.

–– Beneficiary receives payments to the end of the designated period or an adjusted lump sum payment.

DESIGNATED AMOUNT: This option provides for payments of a specified dollar amount. The length of the payout is determined by the account value and a set purchase rate. If you should die before the annuity is exhausted, your beneficiary could either continue the pay- out or receive the remaining lump sum.

For example:

Annuitant dies before all annuity payments are received.

–– Beneficiary receives payments to end of annuity amount or adjusted lump sum.