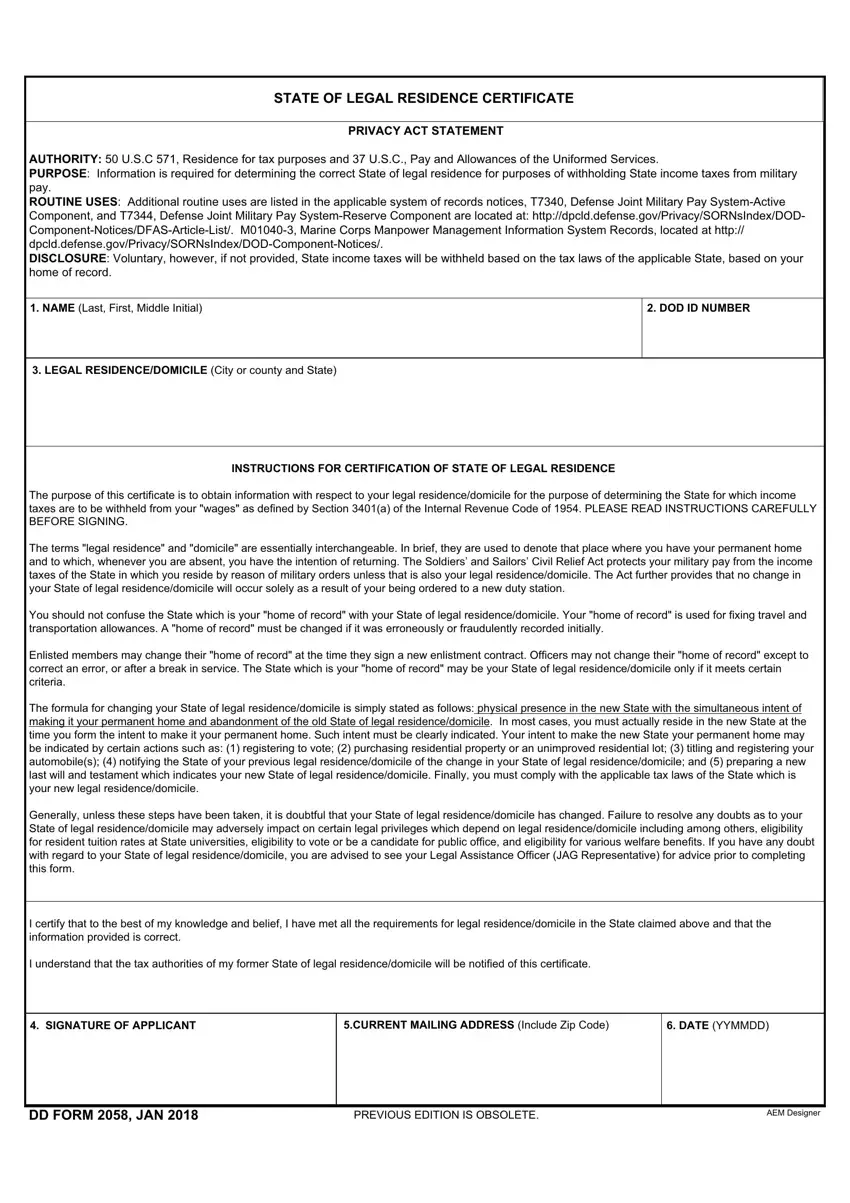

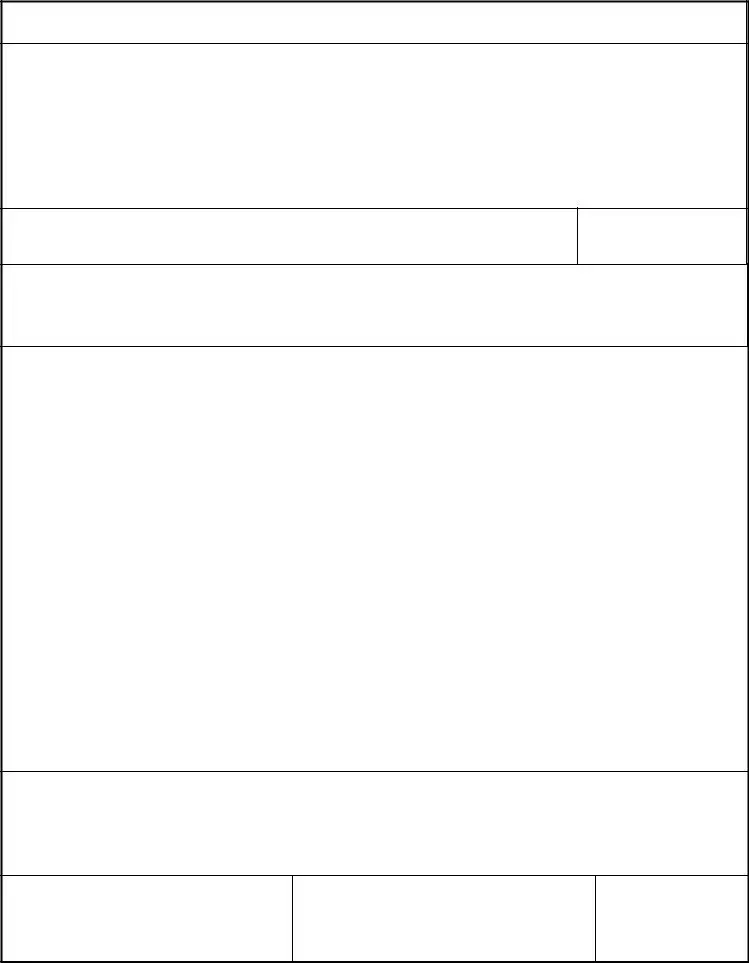

STATE OF LEGAL RESIDENCE CERTIFICATE

PRIVACY ACT STATEMENT

AUTHORITY: 50 U.S.C 571, Residence for tax purposes and 37 U.S.C., Pay and Allowances of the Uniformed Services.

PURPOSE: Information is required for determining the correct State of legal residence for purposes of withholding State income taxes from military pay.

ROUTINE USES: Additional routine uses are listed in the applicable system of records notices, T7340, Defense Joint Military Pay System-Active

Component, and T7344, Defense Joint Military Pay System-Reserve Component are located at: http://dpcld.defense.gov/Privacy/SORNsIndex/DOD- Component-Notices/DFAS-Article-List/. M01040-3, Marine Corps Manpower Management Information System Records, located at http:// dpcld.defense.gov/Privacy/SORNsIndex/DOD-Component-Notices/.

DISCLOSURE: Voluntary, however, if not provided, State income taxes will be withheld based on the tax laws of the applicable State, based on your home of record.

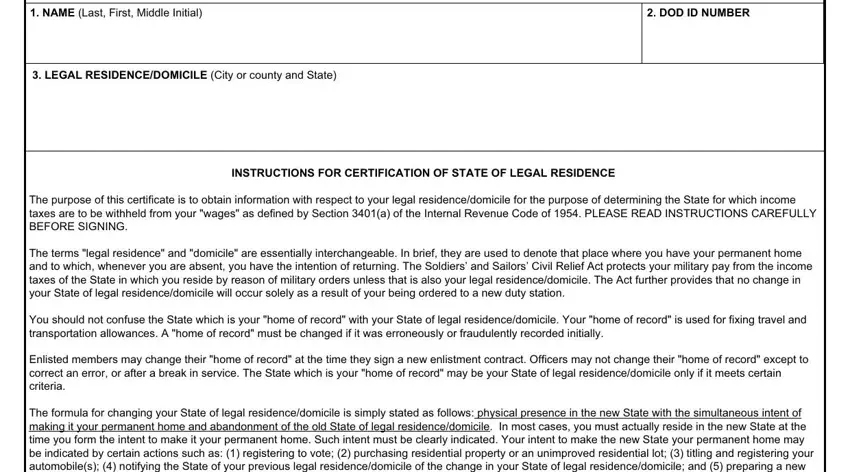

1.NAME (Last, First, Middle Initial)

3. LEGAL RESIDENCE/DOMICILE (City or county and State)

INSTRUCTIONS FOR CERTIFICATION OF STATE OF LEGAL RESIDENCE

The purpose of this certificate is to obtain information with respect to your legal residence/domicile for the purpose of determining the State for which income taxes are to be withheld from your "wages" as defined by Section 3401(a) of the Internal Revenue Code of 1954. PLEASE READ INSTRUCTIONS CAREFULLY BEFORE SIGNING.

The terms "legal residence" and "domicile" are essentially interchangeable. In brief, they are used to denote that place where you have your permanent home and to which, whenever you are absent, you have the intention of returning. The Soldiers’ and Sailors’ Civil Relief Act protects your military pay from the income taxes of the State in which you reside by reason of military orders unless that is also your legal residence/domicile. The Act further provides that no change in your State of legal residence/domicile will occur solely as a result of your being ordered to a new duty station.

You should not confuse the State which is your "home of record" with your State of legal residence/domicile. Your "home of record" is used for fixing travel and transportation allowances. A "home of record" must be changed if it was erroneously or fraudulently recorded initially.

Enlisted members may change their "home of record" at the time they sign a new enlistment contract. Officers may not change their "home of record" except to correct an error, or after a break in service. The State which is your "home of record" may be your State of legal residence/domicile only if it meets certain criteria.

The formula for changing your State of legal residence/domicile is simply stated as follows: physical presence in the new State with the simultaneous intent of making it your permanent home and abandonment of the old State of legal residence/domicile. In most cases, you must actually reside in the new State at the time you form the intent to make it your permanent home. Such intent must be clearly indicated. Your intent to make the new State your permanent home may be indicated by certain actions such as: (1) registering to vote; (2) purchasing residential property or an unimproved residential lot; (3) titling and registering your automobile(s); (4) notifying the State of your previous legal residence/domicile of the change in your State of legal residence/domicile; and (5) preparing a new last will and testament which indicates your new State of legal residence/domicile. Finally, you must comply with the applicable tax laws of the State which is your new legal residence/domicile.

Generally, unless these steps have been taken, it is doubtful that your State of legal residence/domicile has changed. Failure to resolve any doubts as to your State of legal residence/domicile may adversely impact on certain legal privileges which depend on legal residence/domicile including among others, eligibility for resident tuition rates at State universities, eligibility to vote or be a candidate for public office, and eligibility for various welfare benefits. If you have any doubt with regard to your State of legal residence/domicile, you are advised to see your Legal Assistance Officer (JAG Representative) for advice prior to completing this form.

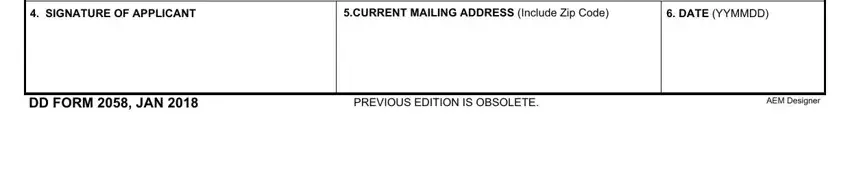

I certify that to the best of my knowledge and belief, I have met all the requirements for legal residence/domicile in the State claimed above and that the information provided is correct.

I understand that the tax authorities of my former State of legal residence/domicile will be notified of this certificate.

4. SIGNATURE OF APPLICANT

5.CURRENT MAILING ADDRESS (Include Zip Code)

DD FORM 2058, JAN 2018 |

PREVIOUS EDITION IS OBSOLETE. |

AEM Designer |