It is possible to work with colorado affidavit exemption instantly with our online PDF editor. Our expert team is always endeavoring to develop the editor and make it much better for people with its handy features. Benefit from the latest modern prospects, and find a trove of unique experiences! Here is what you would want to do to get started:

Step 1: Click the orange "Get Form" button above. It is going to open up our pdf editor so that you could start filling in your form.

Step 2: Using this advanced PDF tool, you can actually do more than merely complete forms. Edit away and make your docs appear sublime with custom text added, or modify the original input to excellence - all comes with the capability to insert stunning pictures and sign the PDF off.

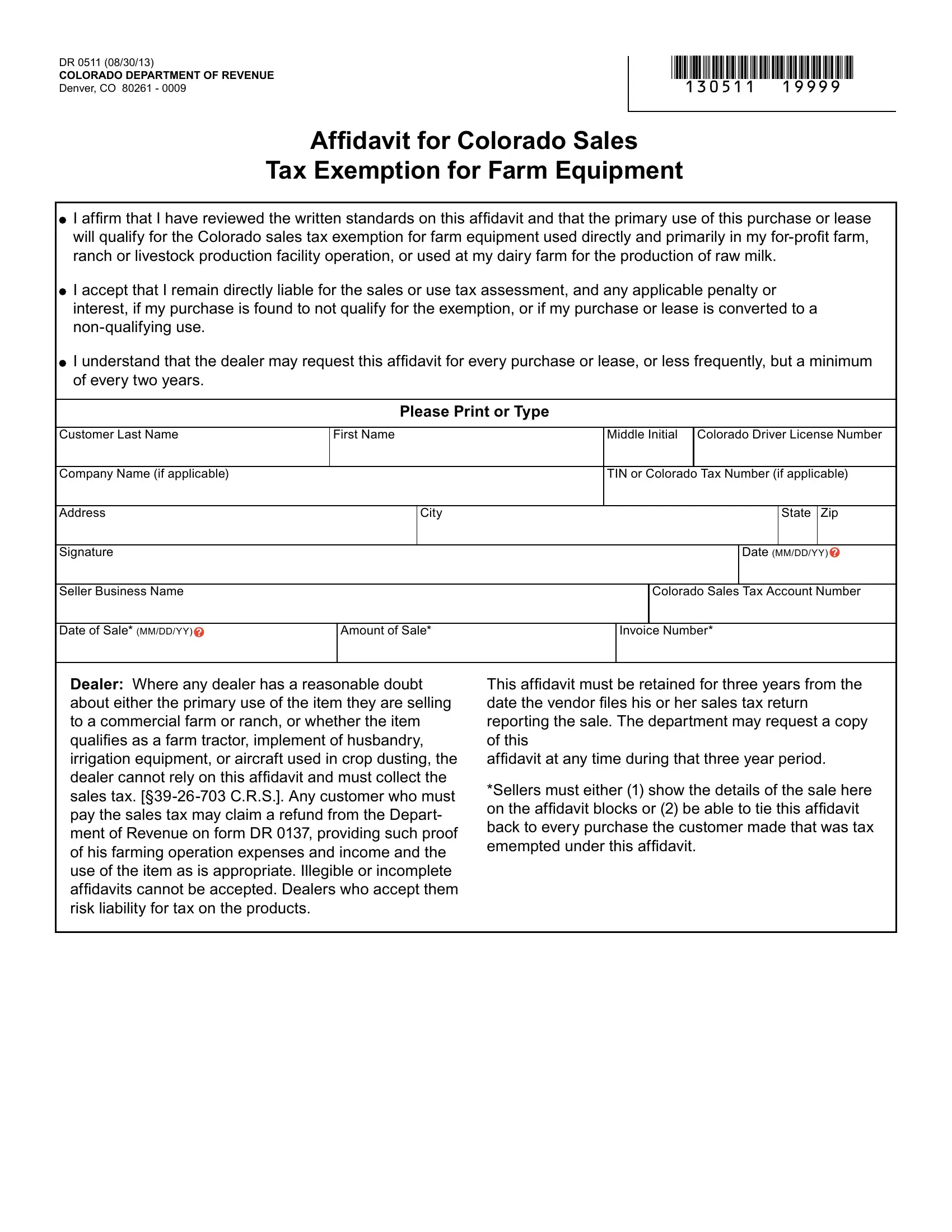

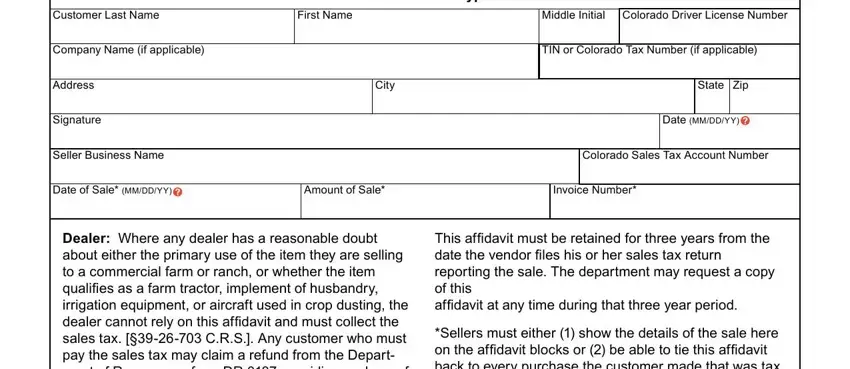

This PDF form requires specific information to be entered, hence be sure you take some time to fill in precisely what is required:

1. Before anything else, while filling out the colorado affidavit exemption, begin with the section that contains the subsequent fields:

Step 3: Prior to finishing this form, double-check that all blanks have been filled in the correct way. When you’re satisfied with it, click on “Done." Join us now and immediately access colorado affidavit exemption, set for downloading. Each and every edit made is handily saved , helping you to edit the file later anytime. FormsPal offers secure form editing with no personal data recording or sharing. Be assured that your data is in good hands here!