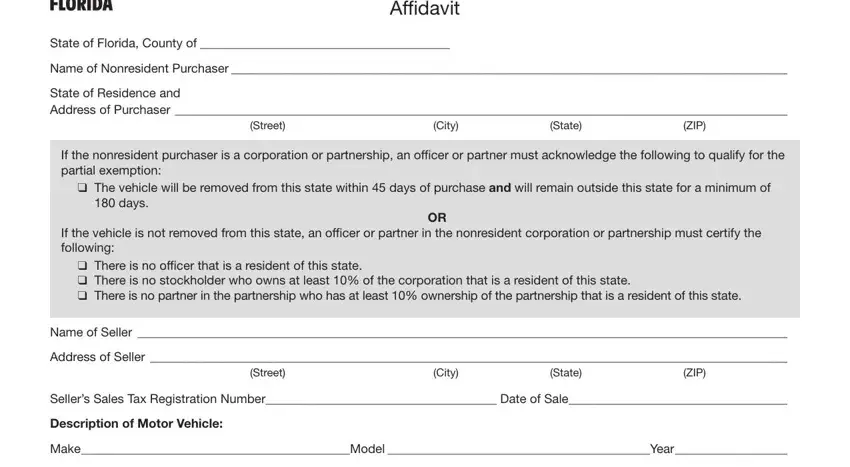

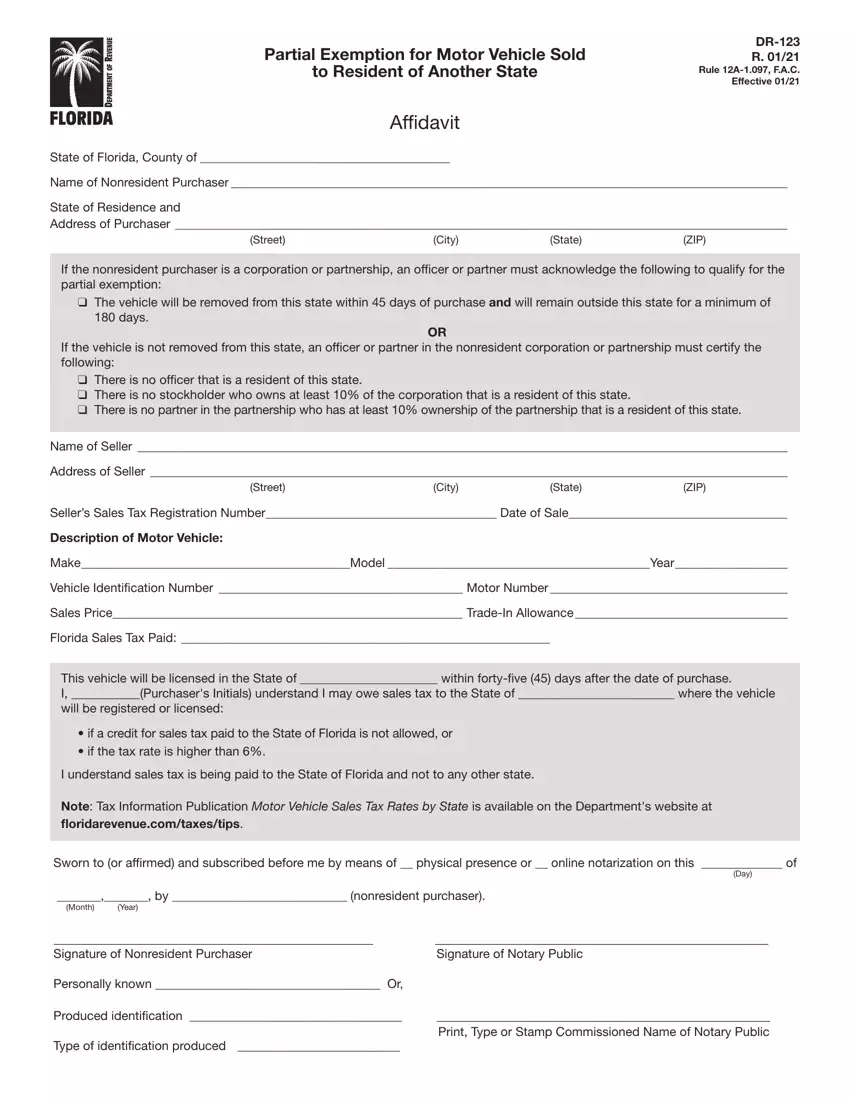

State of Florida, County of ________________________________________

Name of Nonresident Purchaser _________________________________________________________________________________________

State of Residence and

Address of Purchaser __________________________________________________________________________________________________

(Street) |

(City) |

(State) |

(ZIP) |

If the nonresident purchaser is a corporation or partnership, an officer or partner |

must acknowledge the following to qualify for the |

partial exemption: |

|

|

|

qThe vehicle will be removed from this state within 45 days of purchase and will remain outside this state for a minimum of 180 days.

OR

If the vehicle is not removed from this state, an officer or partner in the nonresident corporation or partnership must certify the following:

qThere is no officer that is a resident of this state.

qThere is no stockholder who owns at least 10% of the corporation that is a resident of this state.

qThere is no partner in the partnership who has at least 10% ownership of the partnership that is a resident of this state.

Name of Seller ________________________________________________________________________________________________________

Address of Seller ______________________________________________________________________________________________________

(Street)(City)(State)(ZIP)

Seller’s Sales Tax Registration Number_____________________________________ Date of Sale___________________________________

Description of Motor Vehicle:

Make___________________________________________Model __________________________________________Year__________________

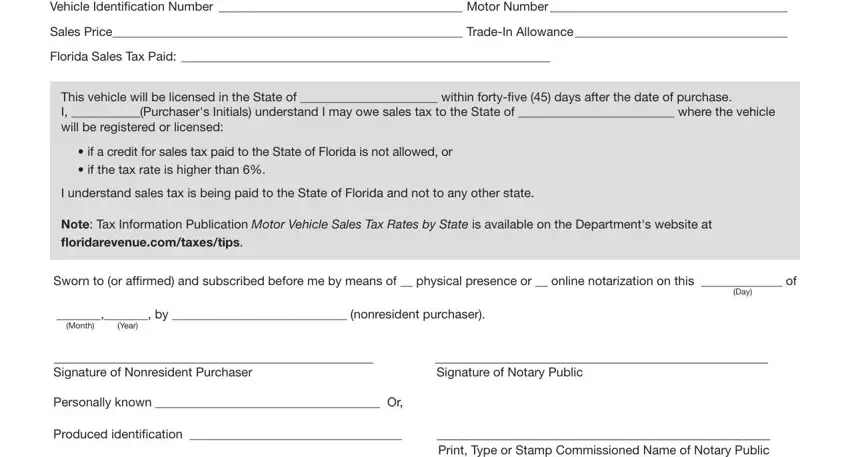

Vehicle Identification Number _______________________________________ Motor Number ______________________________________

Sales Price________________________________________________________ Trade-In Allowance __________________________________

Florida Sales Tax Paid: ___________________________________________________________

This vehicle will be licensed in the State of ______________________ within forty-five (45) days after the date of purchase.

I, ___________(Purchaser's Initials) understand I may owe sales tax to the State of _________________________ where the vehicle

will be registered or licensed:

•if a credit for sales tax paid to the State of Florida is not allowed, or

•if the tax rate is higher than 6%.

I understand sales tax is being paid to the State of Florida and not to any other state.

Note: Tax Information Publication Motor Vehicle Sales Tax Rates by State is available on the Department's website at

floridarevenue.com/taxes/tips .

Sworn to (or affirmed) and subscribed before me by means of __ physical presence or __ online notarization on this _____________ of

(Day)

_______,_______, by ____________________________ (nonresident purchaser).

(Month) (Year)

______________________________________________ |

________________________________________________ |

Signature of Nonresident Purchaser |

Signature of Notary Public |

Personally known ____________________________________ Or, |

|

Produced identification __________________________________ |

________________________________________________ |

|

Print, Type or Stamp Commissioned Name of Notary Public |

Type of identification produced __________________________ |

|