late fee review can be filled out online effortlessly. Just try FormsPal PDF tool to complete the job in a timely fashion. To have our tool on the leading edge of practicality, we strive to put into practice user-oriented features and enhancements on a regular basis. We're routinely pleased to get feedback - assist us with revolutionizing PDF editing. By taking a few easy steps, you can begin your PDF editing:

Step 1: Hit the orange "Get Form" button above. It is going to open up our pdf editor so that you can start filling out your form.

Step 2: This editor allows you to customize nearly all PDF forms in a variety of ways. Transform it with your own text, correct what's already in the PDF, and add a signature - all within a couple of mouse clicks!

It really is simple to finish the document using out detailed tutorial! This is what you must do:

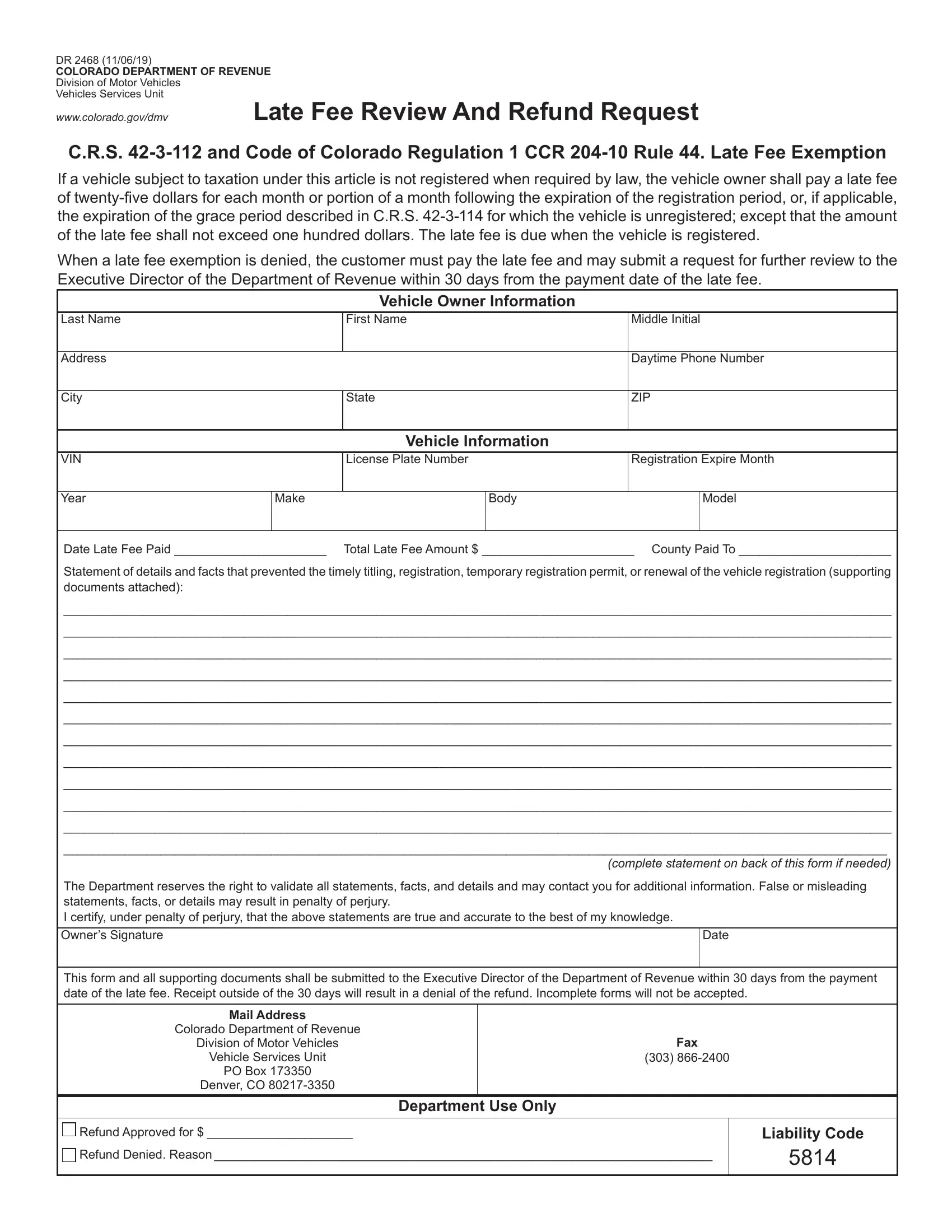

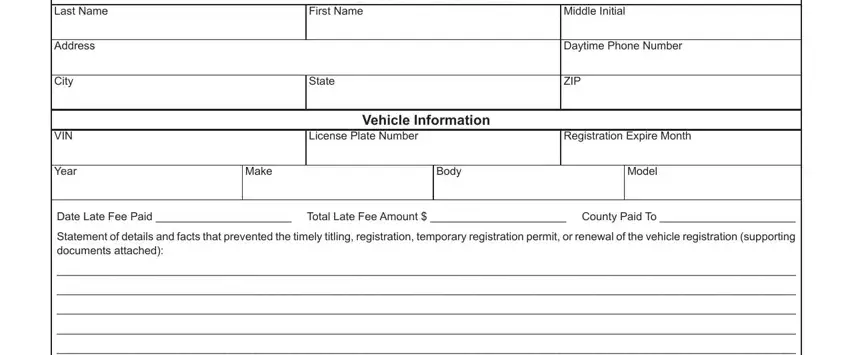

1. While filling out the late fee review, be certain to complete all of the necessary blank fields within the associated area. It will help facilitate the work, which allows your details to be handled efficiently and correctly.

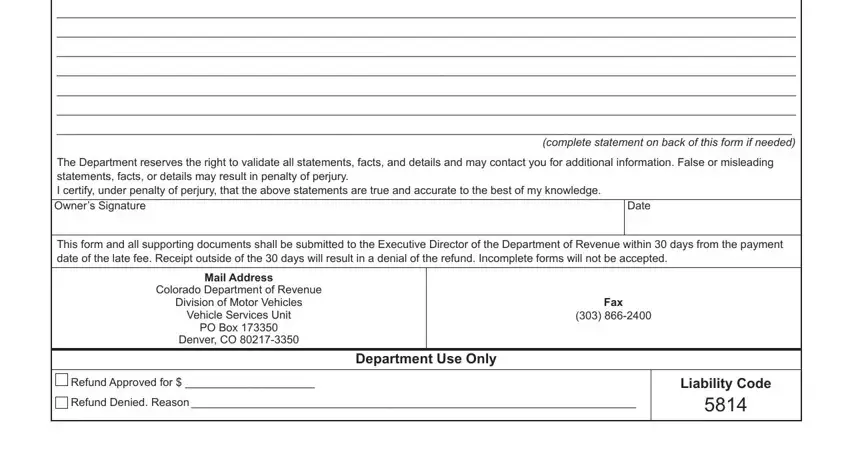

2. Right after this part is filled out, go on to type in the applicable information in these - Date Late Fee Paid Total Late Fee, The Department reserves the right, Date, This form and all supporting, Mail Address, Colorado Department of Revenue, Division of Motor Vehicles, Vehicle Services Unit, PO Box, Denver CO, Fax, Refund Approved for Refund, Liability Code, and Department Use Only.

It is easy to make an error when filling in your Fax, so make sure you take a second look prior to when you finalize the form.

Step 3: Go through the information you have typed into the blank fields and then click on the "Done" button. Find the late fee review when you subscribe to a free trial. Easily view the pdf file within your FormsPal cabinet, together with any modifications and changes being automatically saved! FormsPal provides secure document editing without personal information record-keeping or distributing. Feel comfortable knowing that your details are safe here!