Navigating tax responsibilities can often seem daunting for businesses, especially when specific permits or forms are at play, such as the DR-700030 form, vital for companies dealing with communications services in Florida. This form, formally titled "Application for Self-Accrual Authority / Direct Pay Permit" within the realm of communications services tax as per the Florida Administrative Code and effective from January 2016, serves a crucial purpose. It is designed for businesses that either partake in interstate communication services or find themselves in a position where the taxable status of their communications services can only be determined upon usage. The intent behind this application is to qualify businesses for a direct pay permit, enabling them to self-accrue and remit taxes directly to the Florida Department of Revenue, thereby bypassing the need to pay taxes through their communications service providers. This streamlined process not only allows for potentially significant tax savings—especially for businesses that meet the state and local communications service tax payment thresholds—but also introduces a direct line of accountability and interaction with the tax authorities. By meticulously completing this application, including business information and affirming eligibility based on the outlined tax statutes, businesses can step into a more autonomous role in managing their tax obligations, all while ensuring compliance with Florida's tax laws.

| Question | Answer |

|---|---|

| Form Name | Form Dr 700030 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | accrual, CityState, myflorida, DR-1 |

|

|

|

|

Application for |

|

|

R. 01/16 |

|

|

Communications Services Tax |

TC |

|

|

Rule |

|

|

|

|

|

|

|

|

Florida Administrative Code |

MAIL TO: |

Effective 01/16 |

|

ACCOUNT MANAGEMENT |

|

|

FLORIDA DEPARTMENT OF REVENUE |

THIS AREA FOR DOR USE ONLY |

|

PO BOX 6480 |

PERMIT NO.________________________________ |

|

TALLAHASSEE FL |

||

EFF DATE___________________________________ |

||

|

||

|

EXP DATE___________________________________ |

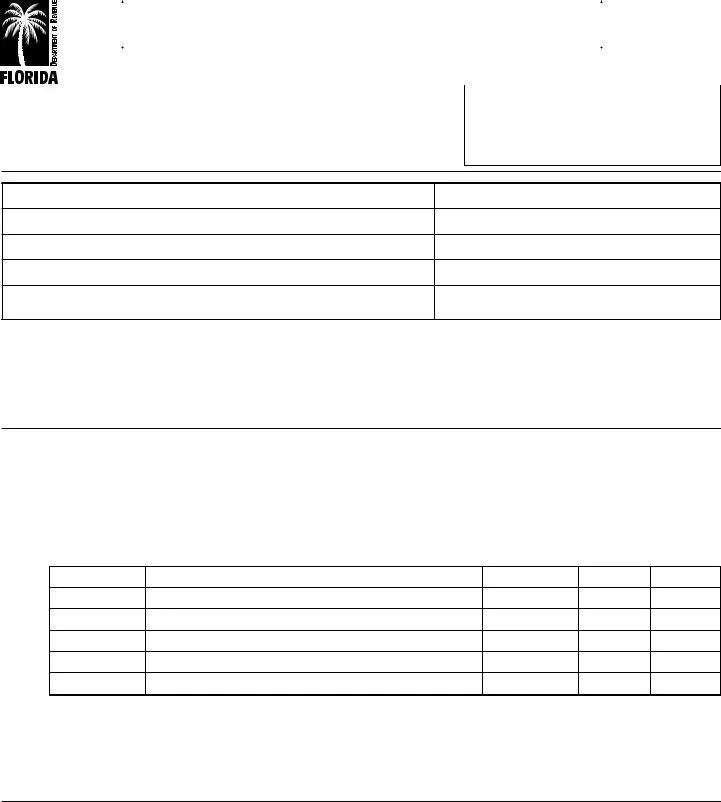

PART 1 - BUSINESS INFORMATION

Business name |

Communications services tax certificate/business partner number * |

Street address |

Federal Employer Identification Number (FEIN) |

City/State/ZIP |

Telephone number (include area code) |

Name of contact person |

Contact person's telephone number (include area code) |

Contact person's mailing address (if different than above) |

City/State/ZIP |

*A communications services tax certificate/business partner number is required for processing this request. If you have not registered for this tax and do not have a certificate/business partner number, you must complete and submit the Application to Collect and/or Report Tax in Florida (Form

PART 2 - DIRECT PAY PERMIT CATEGORY FOR WHICH YOU ARE APPLYING (CHECK ONLY ONE):

qUse of interstate communications services [sections 202.12(3) and 202.19(8), Florida Statutes]. The majority of the communications services used by this business are for communications that originate outside of Florida and terminate within the state. This business has paid, or will pay, an amount in excess of (check only one):

q $100,000 for the Florida communications services tax only (s. 202.12, F.S.).

q $100,000 for the Florida communications services tax statewide and $25,000 for the local communications services tax per service address (s. 202.19, F.S.). List each service address that qualifies for the partial exemption below. Attach additional sheets if necessary.

Complete street address |

City |

State |

ZIP |

Location 1

Location 2

Location 3

Location 4

Location 5

qTax due upon determination of use [s. 202.27(6)(b), F.S.]. The taxable status of sales of communications services will only be known upon use; the purchaser will pay the amount of tax, to be determined upon use, due on all of its purchases made in connection with the direct pay permit issued.

PART 3 - APPLICANT AFFIRMATION AND DECLARATION

I HEREBY ATTEST THAT: I am authorized to sign on behalf of the entity described above; that this entity has circumstances that qualify it for the communications services tax direct pay permit, as indicated; and furthermore that if granted, the communications services tax direct pay permit will only be used in the manner authorized pursuant to the appropriate sections of Chapter 202, F.S. Under penalties of perjury, I declare that I have read the information on this application and that the facts stated in it are true [ss. 92.525(2) and 837.06, Florida Statutes].

____________________________________________________ |

_____________________________________________________ |

Signature |

Title |

____________________________________________________ |

_____________________________________________________ |

Print name |

Date |

Information and Instructions for Completing Application

for

Communications Services Tax

R.01/16 Page 2

Sections 202.12 and 202.19, Florida Statutes, provide that

Purposes and Use of Permits

1.Direct Pay Permit for Interstate Communications Services [ss. 202.12(3) and 202.19(8), F.S.]

Who qualifies? Purchasers of communications services where the majority of the communications services used by the entity are for communications that originate outside of Florida and terminate within the state. Qualified businesses will receive a Communications Services Tax Direct Pay Permit (Form

What can the direct pay permit be used for? This direct pay permit allows the purchaser a partial exemption either from the state communications services tax only, or from both the state and the local communications services taxes on interstate communications services. The amount of state communications services tax to be paid shall

not exceed $100,000. The amount of the local communications services tax to be paid shall not exceed $25,000 per service address. Note: Entities qualifying for this permit category will be required to report and remit the tax to the Department electronically.

2.Direct Pay Permit for Tax Due Upon Determination of Use [s. 202.27(6)(b), F.S.]

Who qualifies? Purchasers of communications services where the taxable status of sales of communications services will only be known upon use. Qualified businesses will receive a Communications Services Tax Direct Pay Permit (Form

What can the direct pay permit be used for? The permit allows purchasers of communications services to accrue and remit taxes upon determination of the use of the services, rather than paying tax at the time of the purchase.

Instructions for Completing the Application

üReview the purposes stated above and identify the category under which your business qualifies.

üNote the specific uses of the direct pay permit, if granted.

üComplete Parts 1 and 2.

üRead and sign Part 3.

Note: Incomplete or unsigned applications will be returned, thus delaying the issuance of the direct pay permit.

Mail or deliver your completed application to:

Account Management

Florida Department of Revenue

PO Box 6480

Tallahassee FL

Information and forms are available on our Internet site at

floridarevenue.com

For general information about communications services tax or assistance with this application, call Taxpayer Services at