franklin county conveyance form can be filled out online without difficulty. Simply use FormsPal PDF editor to complete the job without delay. The tool is continually improved by our staff, getting new awesome functions and becoming even more versatile. This is what you will want to do to get going:

Step 1: Access the PDF form in our editor by clicking on the "Get Form Button" above on this page.

Step 2: Using this state-of-the-art PDF editing tool, you'll be able to accomplish more than simply fill in blank form fields. Edit away and make your forms look professional with customized text incorporated, or modify the file's original input to excellence - all that backed up by the capability to insert your personal pictures and sign the PDF off.

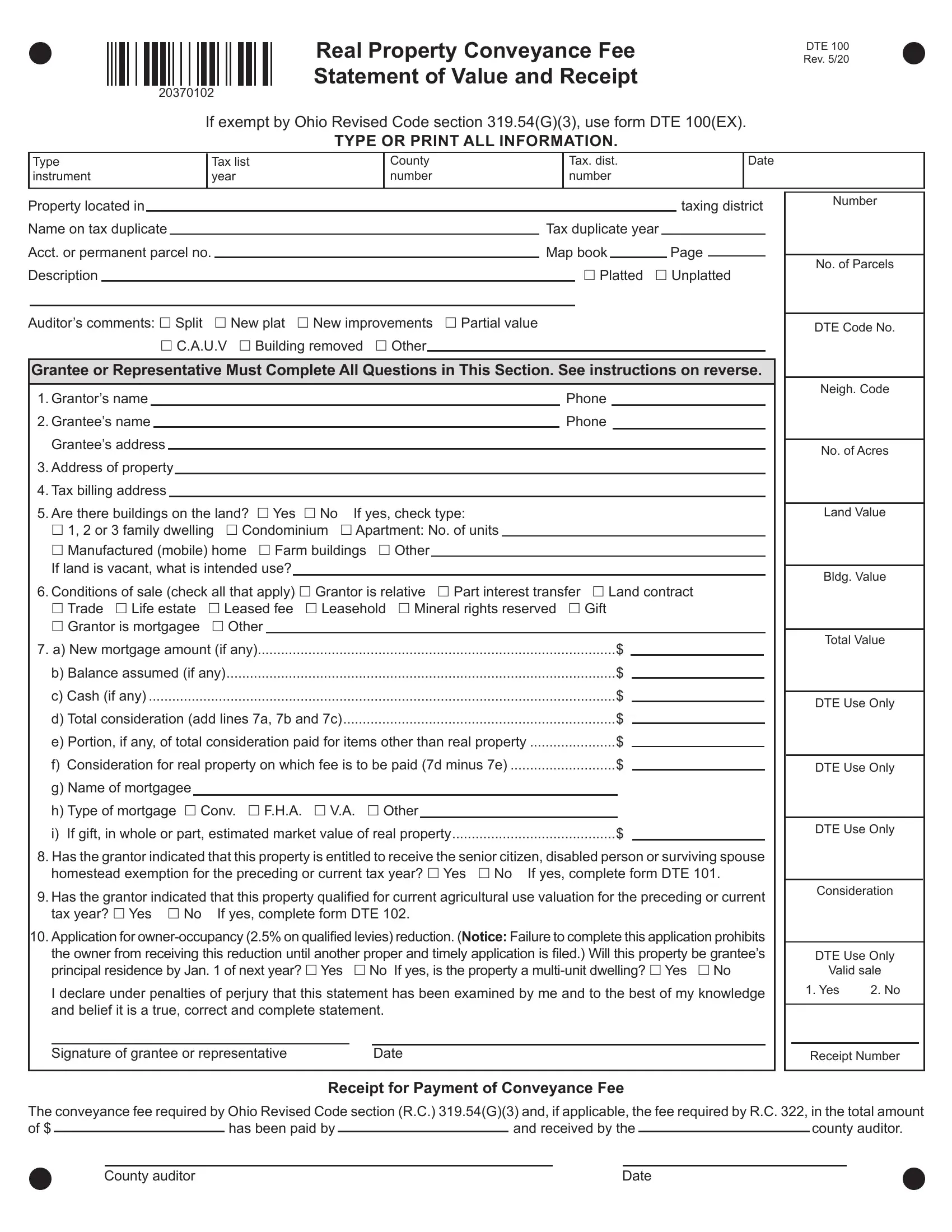

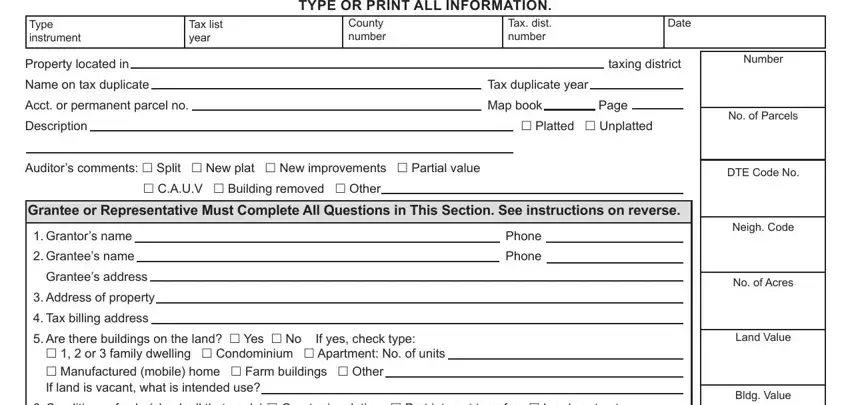

When it comes to blanks of this precise document, this is what you should know:

1. The franklin county conveyance form necessitates particular information to be typed in. Be sure the subsequent fields are filled out:

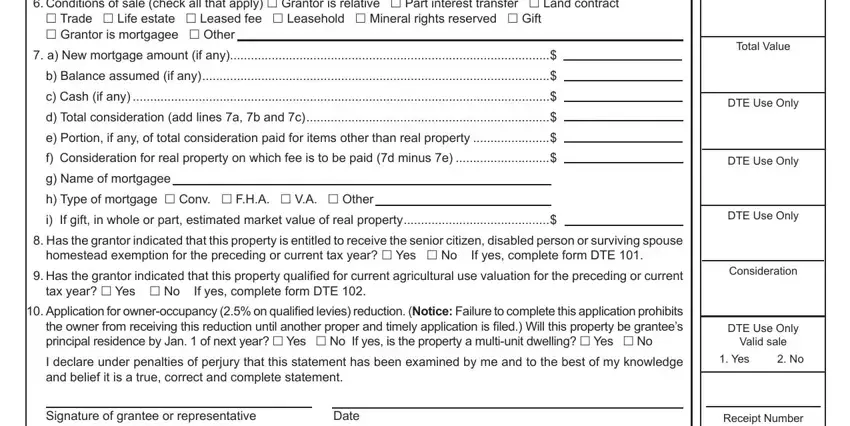

2. Given that the last array of fields is done, you're ready insert the essential particulars in Conditions of sale check all that, Trade Life estate Leased fee, a New mortgage amount if any, b Balance assumed if any c Cash, Total Value, DTE Use Only, DTE Use Only, DTE Use Only, Has the grantor indicated that, homestead exemption for the, Has the grantor indicated that, Consideration, tax year Yes No If yes complete, Application for owneroccupancy, and I declare under penalties of so that you can move forward further.

Regarding DTE Use Only and a New mortgage amount if any, be sure you do everything right here. The two of these could be the most significant ones in the document.

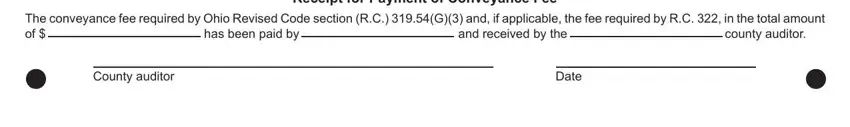

3. This third segment is usually quite straightforward, Receipt for Payment of Conveyance, The conveyance fee required by, and received by the, has been paid by, county auditor, County auditor, and Date - all of these blanks is required to be completed here.

Step 3: Confirm that the information is accurate and just click "Done" to complete the project. Sign up with us right now and easily get access to franklin county conveyance form, ready for downloading. All changes you make are kept , letting you modify the form at a later time as needed. When you work with FormsPal, you're able to complete documents without worrying about personal data incidents or records getting distributed. Our secure system helps to ensure that your private data is stored safe.