By using the online editor for PDFs by FormsPal, it is easy to complete or modify reapply here. FormsPal is focused on providing you with the absolute best experience with our tool by continuously presenting new capabilities and improvements. With all of these updates, using our editor gets easier than ever! Should you be looking to begin, here is what you will need to do:

Step 1: Press the "Get Form" button at the top of this page to open our tool.

Step 2: Once you start the editor, you'll notice the document ready to be filled in. Other than filling in different blanks, you might also do various other things with the file, specifically adding any text, editing the original text, adding images, putting your signature on the document, and more.

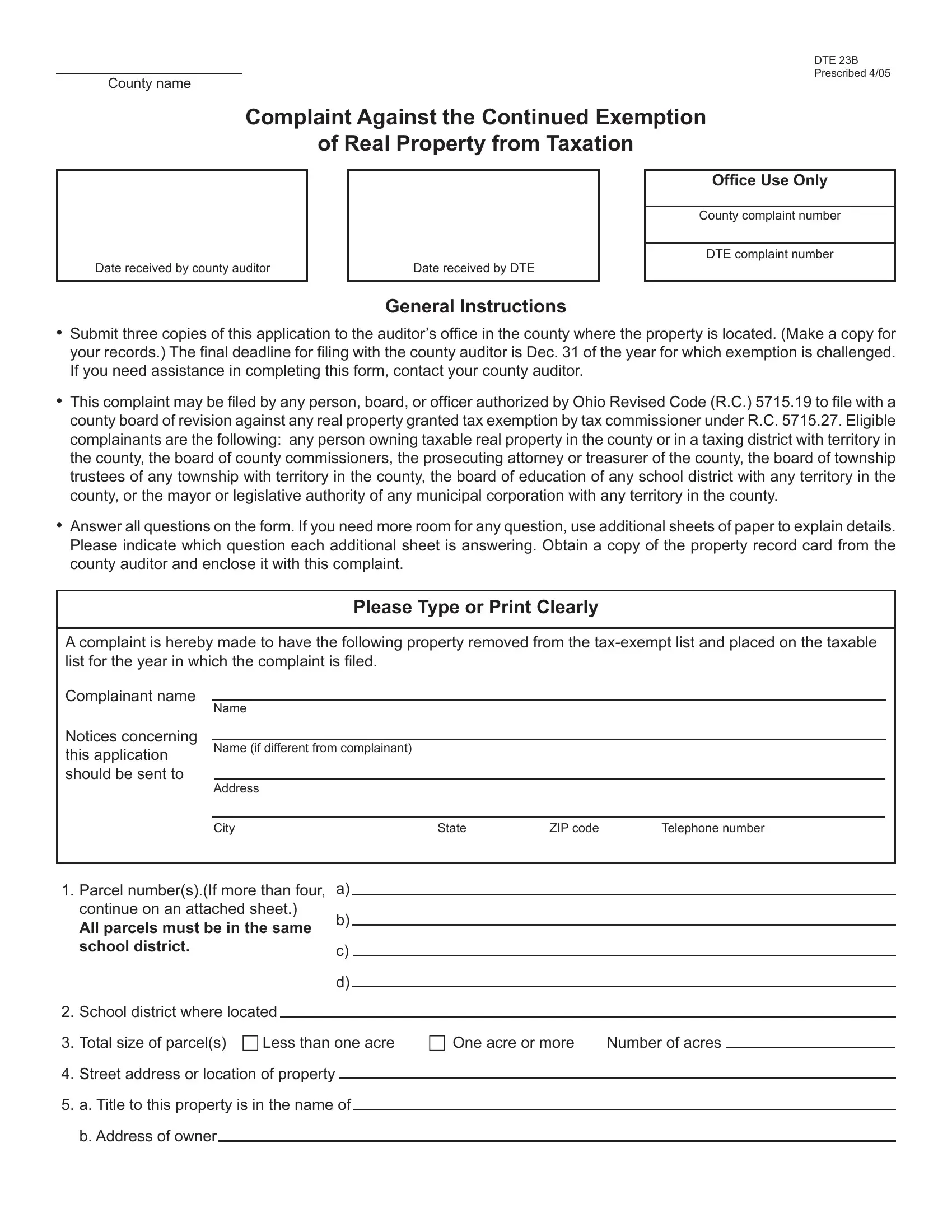

To be able to finalize this form, ensure that you type in the information you need in every single blank field:

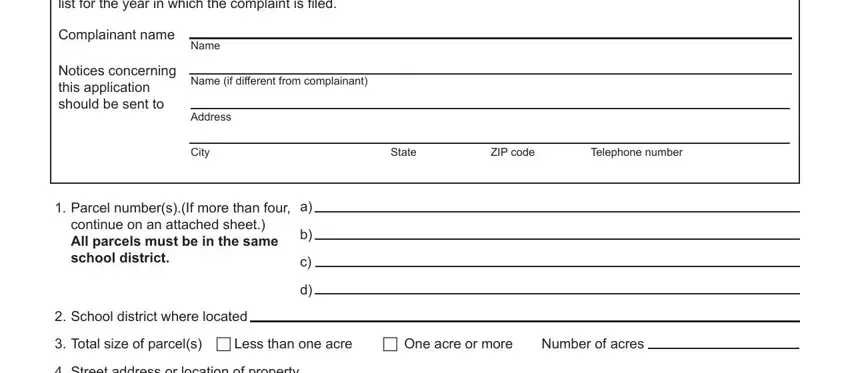

1. It is critical to fill out the reapply accurately, hence be attentive when filling in the sections containing all of these blanks:

2. Once your current task is complete, take the next step – fill out all of these fields - A complaint is hereby made to have, Complainant name, Name, Notices concerning this, Name if different from complainant, Address, City, State, ZIP code, Telephone number, Parcel numbersIf more than four, continue on an attached sheet All, School district where located, Total size of parcels Less than, and Number of acres with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

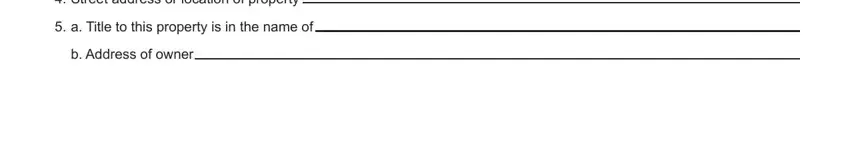

3. In this stage, have a look at Street address or location of, a Title to this property is in, and b Address of owner. All these should be filled in with highest accuracy.

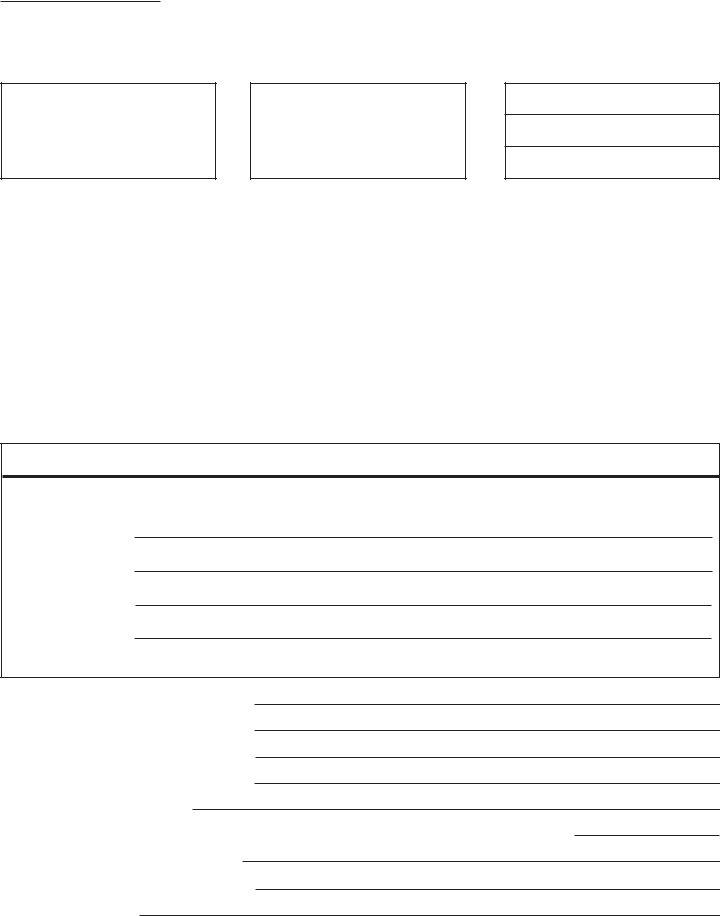

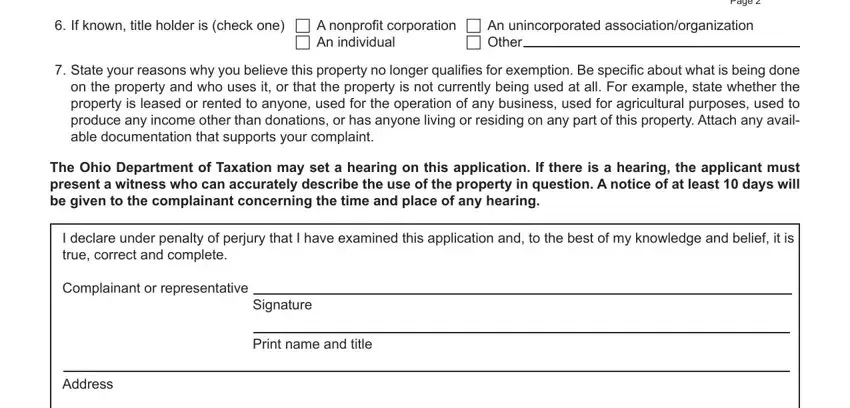

4. To go ahead, the following step will require typing in a few form blanks. Examples include DTE B Prescribed Page, If known title holder is check, An individual, Other, State your reasons why you believe, The Ohio Department of Taxation, I declare under penalty of perjury, Complainant or representative, Signature, Print name and title, Address, and City, which you'll find vital to continuing with this particular document.

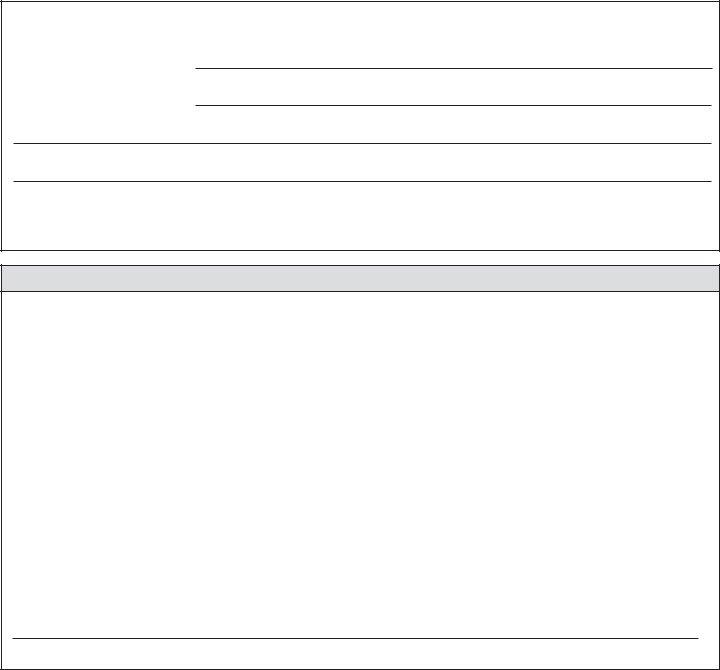

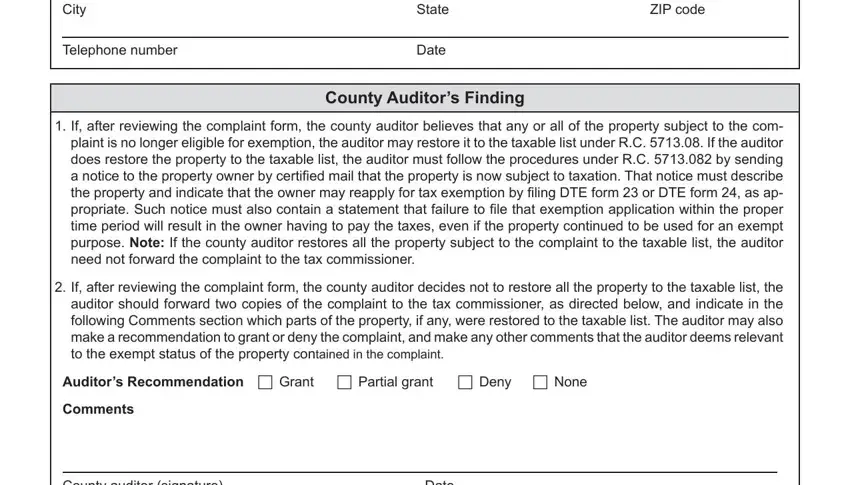

5. The document has to be wrapped up with this particular part. Here you can see a detailed set of form fields that need to be filled out with appropriate information to allow your document submission to be faultless: City, Telephone number, State, Date, ZIP code, County Auditors Finding, If after reviewing the complaint, If after reviewing the complaint, Auditors Recommendation Grant, Comments, County auditor signature, and Date.

It's simple to make errors when completing the If after reviewing the complaint, consequently be sure to go through it again before you send it in.

Step 3: As soon as you have reread the details in the fields, click "Done" to finalize your form. Try a free trial plan at FormsPal and obtain instant access to reapply - with all transformations preserved and accessible from your personal account page. At FormsPal.com, we do everything we can to ensure that your information is maintained private.