You are able to complete DTF-686-ATT effectively with our online editor for PDFs. Our editor is constantly evolving to provide the best user experience attainable, and that's because of our resolve for constant development and listening closely to customer opinions. If you're looking to get started, this is what it will take:

Step 1: Access the form in our tool by clicking on the "Get Form Button" in the top section of this webpage.

Step 2: The tool offers the opportunity to change your PDF in various ways. Improve it by writing customized text, adjust existing content, and include a signature - all when you need it!

Concentrate while filling out this pdf. Make certain all necessary blanks are done accurately.

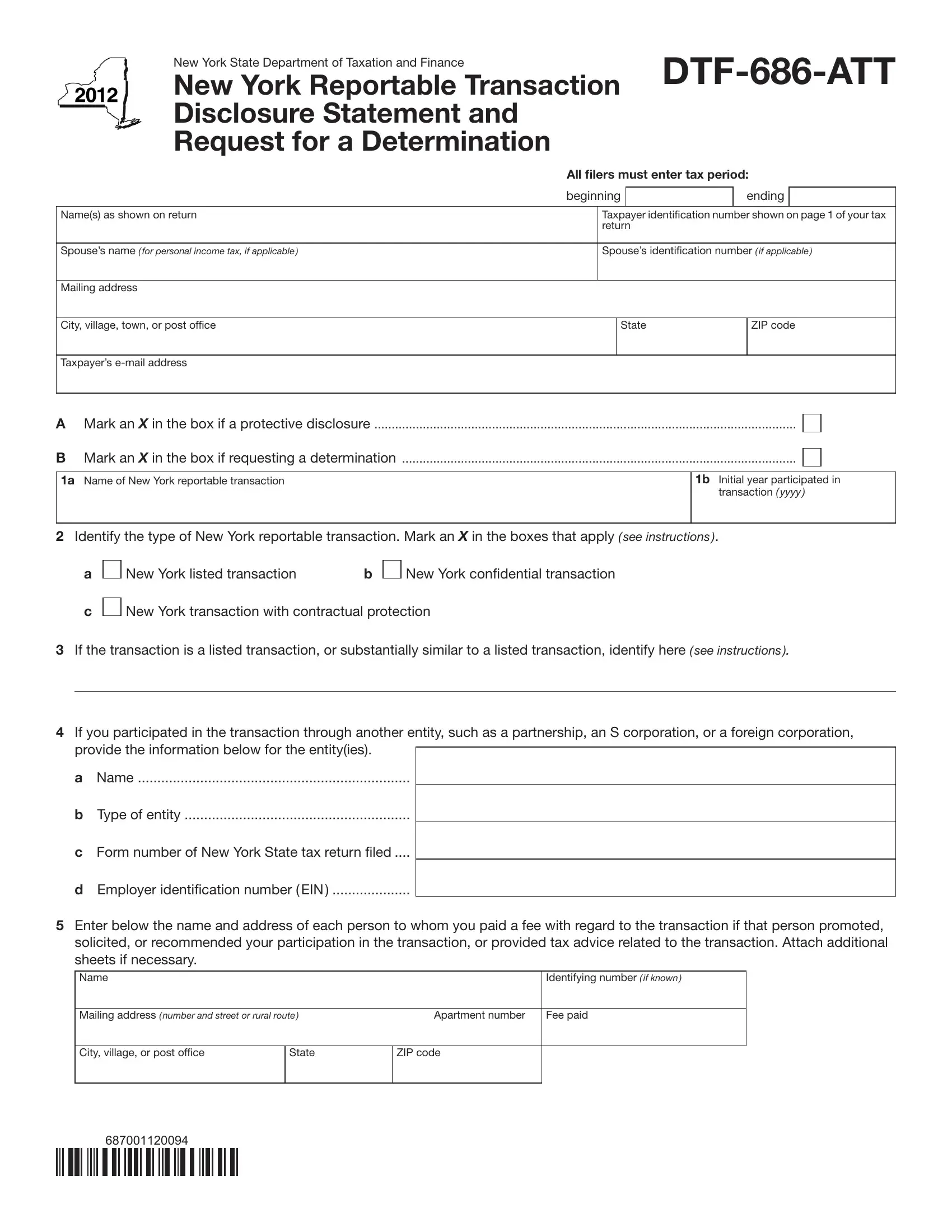

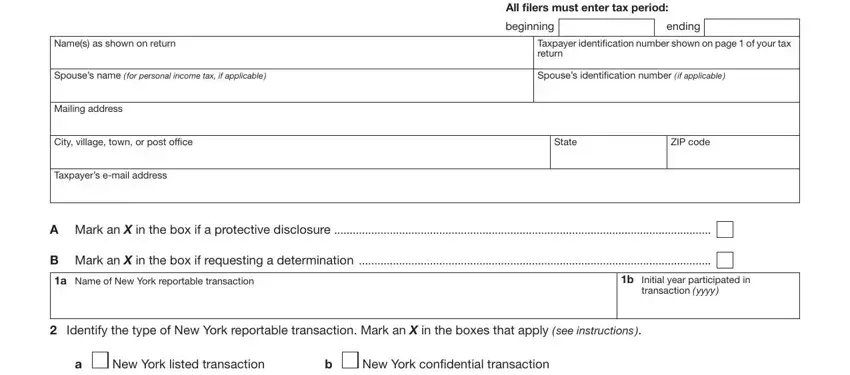

1. It's very important to complete the DTF-686-ATT properly, so be mindful when filling in the segments comprising these blanks:

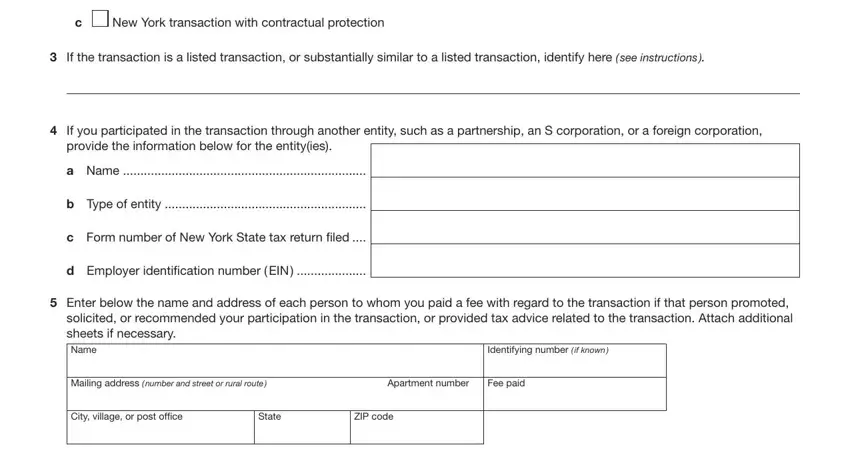

2. Once your current task is complete, take the next step – fill out all of these fields - c New York transaction with, If the transaction is a listed, If you participated in the, a Name, b Type of entity, c Form number of New York State, d Employer identiication number, Enter below the name and address, Identifying number if known, Mailing address number and street, Apartment number, Fee paid, City village or post ofice, State, and ZIP code with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

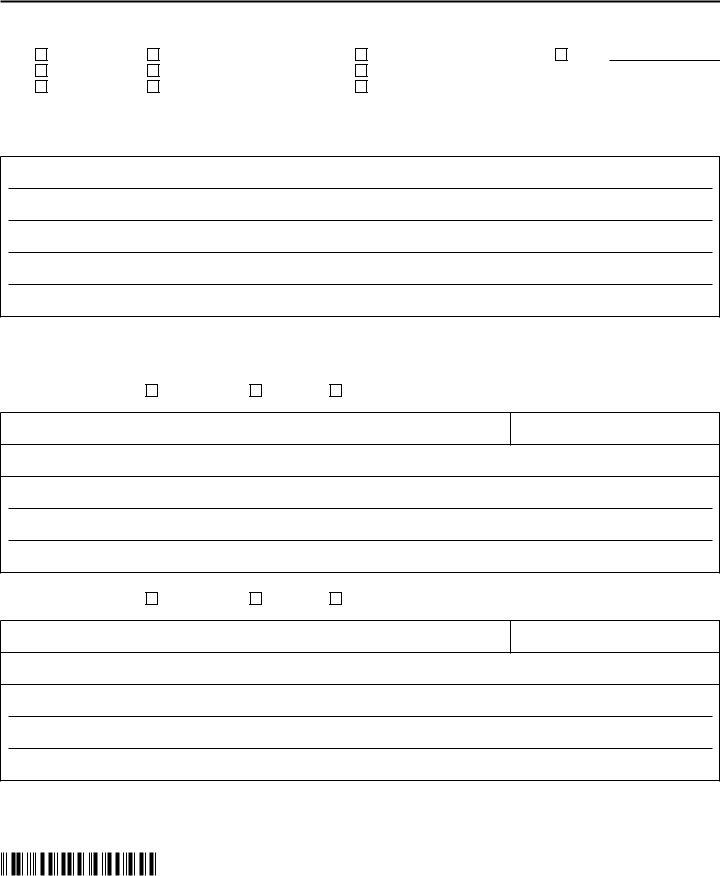

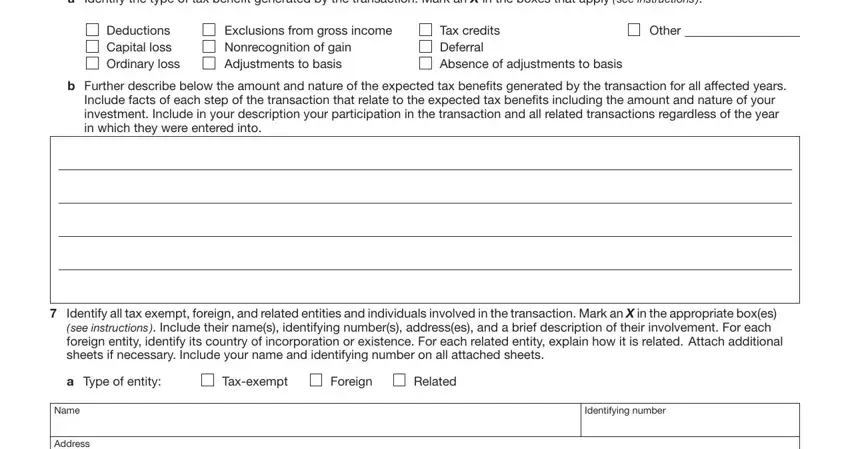

3. In this step, check out a Identify the type of tax beneit, Deductions Capital loss Ordinary, Exclusions from gross income, Tax credits Deferral Absence of, Other, b Further describe below the, Include facts of each step of the, Identify all tax exempt foreign, a Type of entity, Taxexempt, Foreign, Related, Identifying number, Name, and Address. All of these will have to be taken care of with highest precision.

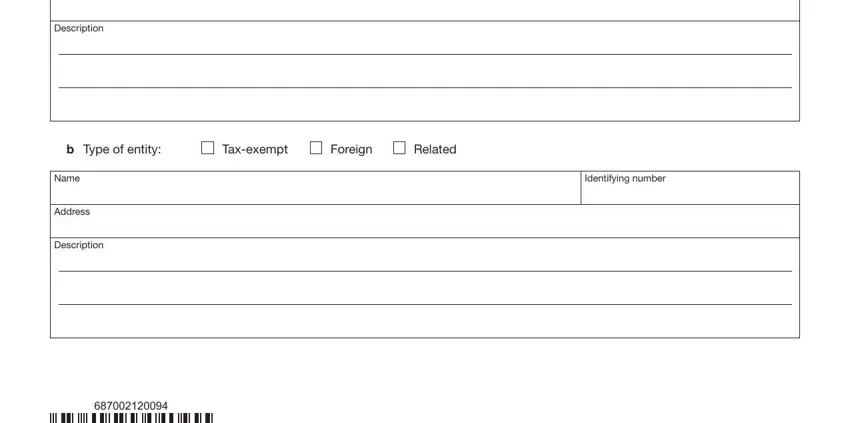

4. The following paragraph requires your information in the subsequent areas: Identifying number, Address, Description, b Type of entity, Taxexempt, Foreign, Related, Name, Address, and Description. Make sure you fill out all required information to move onward.

It's simple to get it wrong when filling in the Address, and so make sure that you take a second look prior to when you finalize the form.

Step 3: Proofread what you've entered into the blank fields and then click the "Done" button. After setting up afree trial account at FormsPal, you'll be able to download DTF-686-ATT or email it without delay. The PDF document will also be accessible through your personal account with your every single modification. We don't sell or share the details you provide while dealing with documents at our site.