Our PDF editor was built with the intention of making it as effortless and intuitive as possible. All of these actions can make filling out the sales dtf 17 easy and quick.

Step 1: The web page has an orange button saying "Get Form Now". Click it.

Step 2: Once you have entered the sales dtf 17 editing page you'll be able to notice the different options you'll be able to conduct relating to your template at the upper menu.

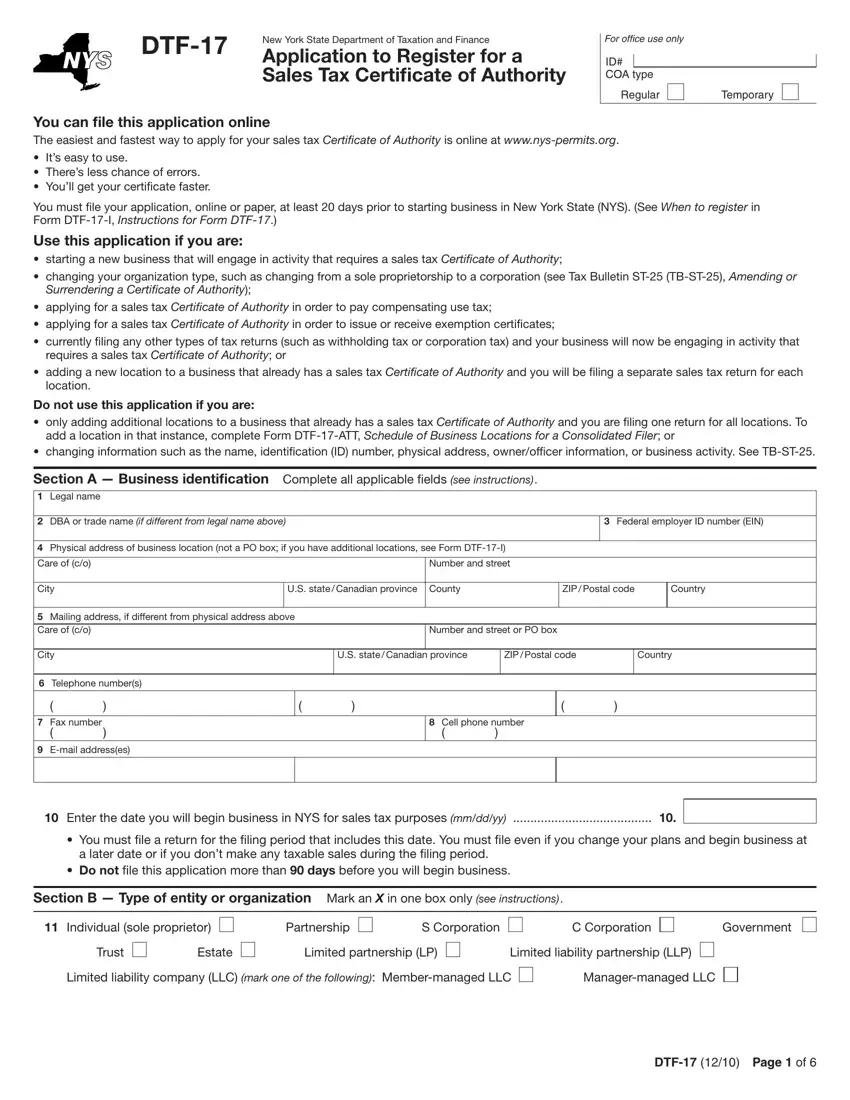

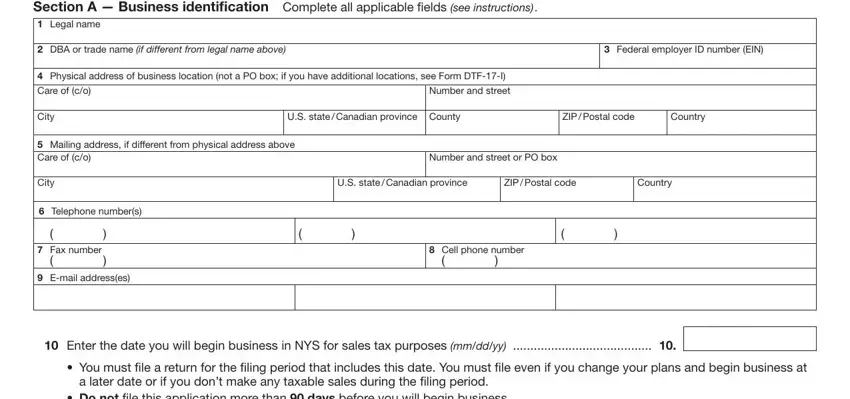

For every single part, create the information requested by the system.

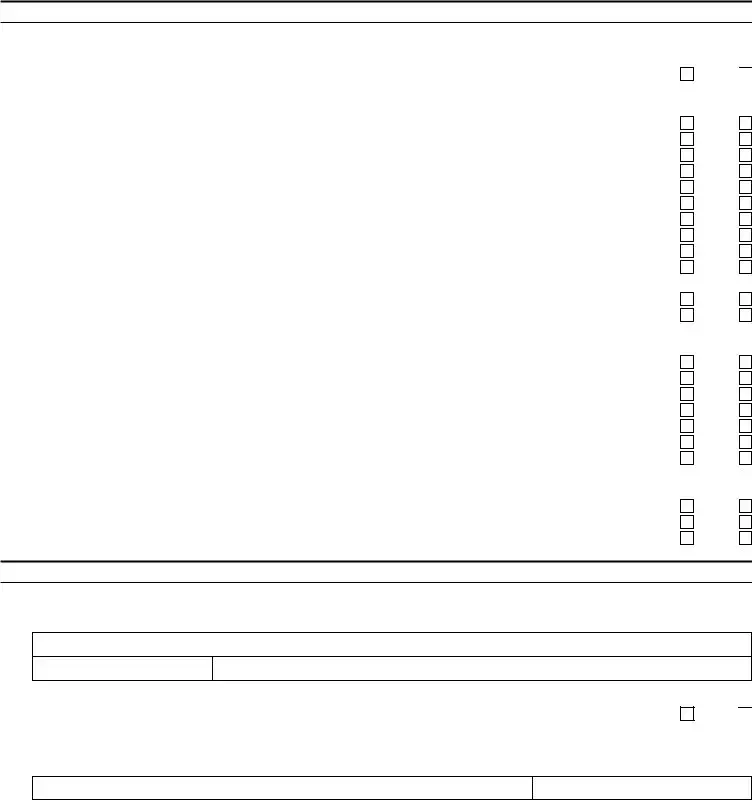

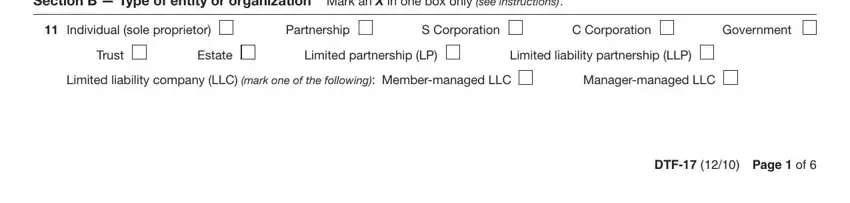

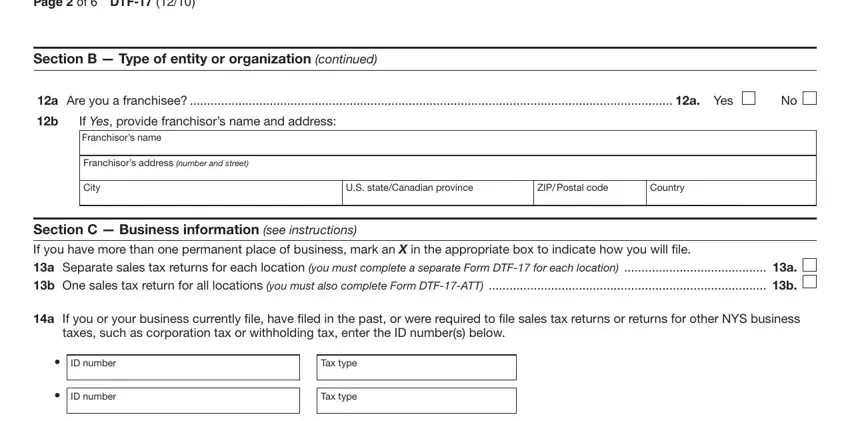

Include the expected information in the Section B Type of entity or, Individual sole proprietor, Partnership, S Corporation, C Corporation, Government, Trust, Estate, Limited partnership LP, Limited liability partnership LLP, Limited liability company LLC mark, Managermanaged LLC, and DTF Page of part.

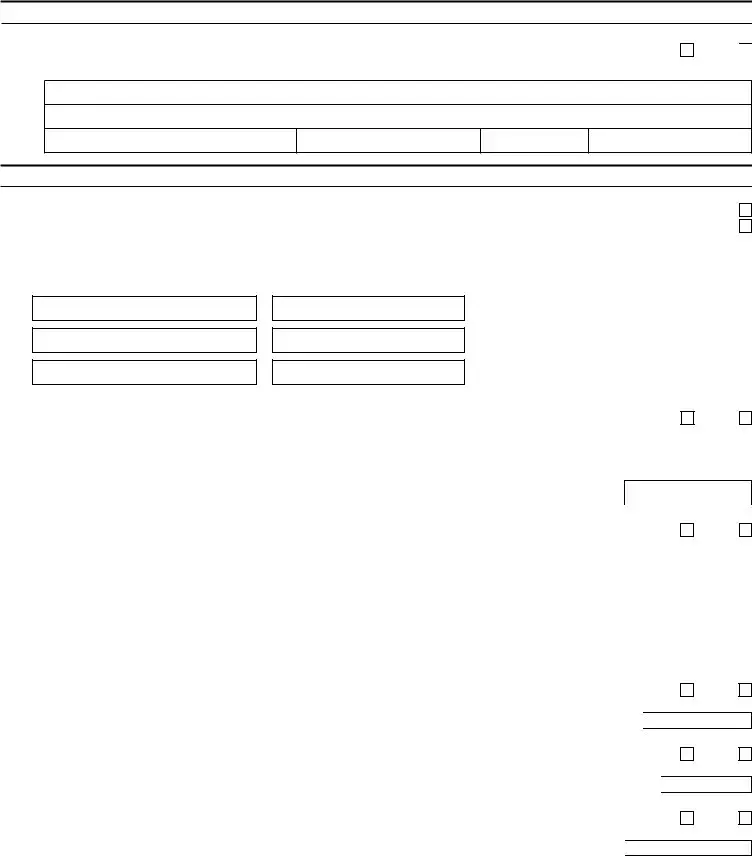

Write the valuable particulars when you are on the Page of DTF, Section B Type of entity or, a Are you a franchisee a Yes, If Yes provide franchisors name, Franchisors address number and, City, US stateCanadian province, ZIP Postal code, Country, Section C Business information, a If you or your business, taxes such as corporation tax or, ID number, ID number, and Tax type box.

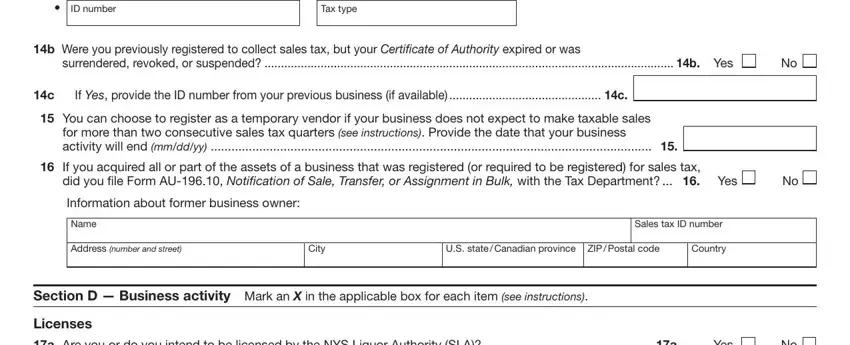

The ID number, Tax type, b Were you previously registered, surrendered revoked or suspended, If Yes provide the ID number from, You can choose to register as a, If you acquired all or part of, did you ile Form AU Notification of, Information about former business, Name, Sales tax ID number, Address number and street, City, US state Canadian province ZIP, and Country box is the place to add the rights and obligations of all sides.

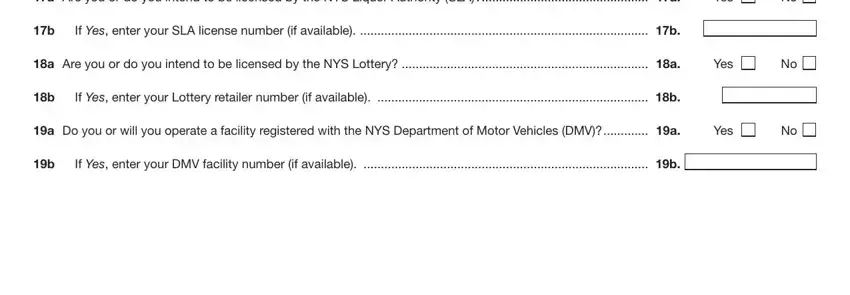

End by analyzing the following fields and submitting the suitable data: a Are you or do you intend to be, Yes, If Yes enter your SLA license, a Are you or do you intend to be, Yes, If Yes enter your Lottery retailer, a Do you or will you operate a, Yes, and If Yes enter your DMV facility.

Step 3: As soon as you choose the Done button, your prepared file can be simply transferred to each of your devices or to electronic mail indicated by you.

Step 4: Prepare duplicates of the file. This would prevent future misunderstandings. We cannot check or publish your data, therefore you can relax knowing it will be secure.