You can easily create the nys 45 tax form for the 4th quarter of 2020 file using this PDF editor. The following steps will allow you to immediately prepare your document.

Step 1: Press the orange button "Get Form Here" on the following website page.

Step 2: Right now, you can modify the nys 45 tax form for the 4th quarter of 2020. Our multifunctional toolbar allows you to include, get rid of, modify, highlight, and undertake several other commands to the content and areas within the document.

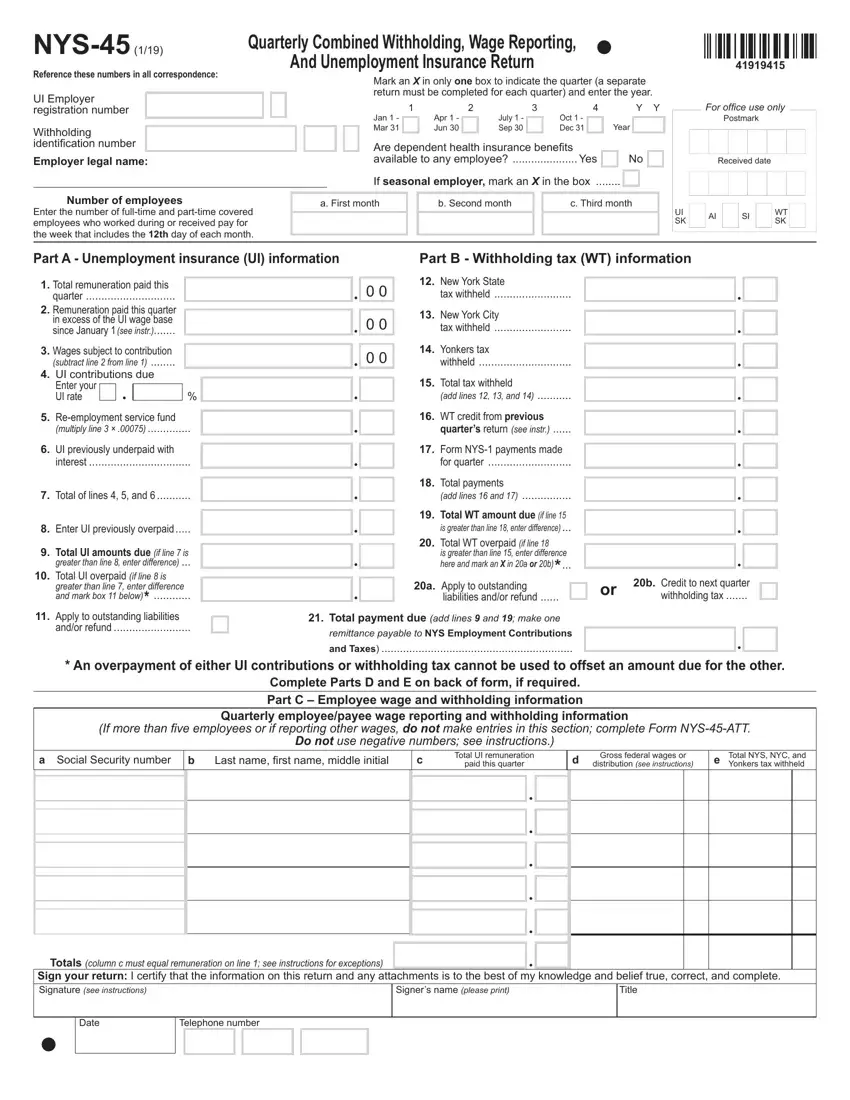

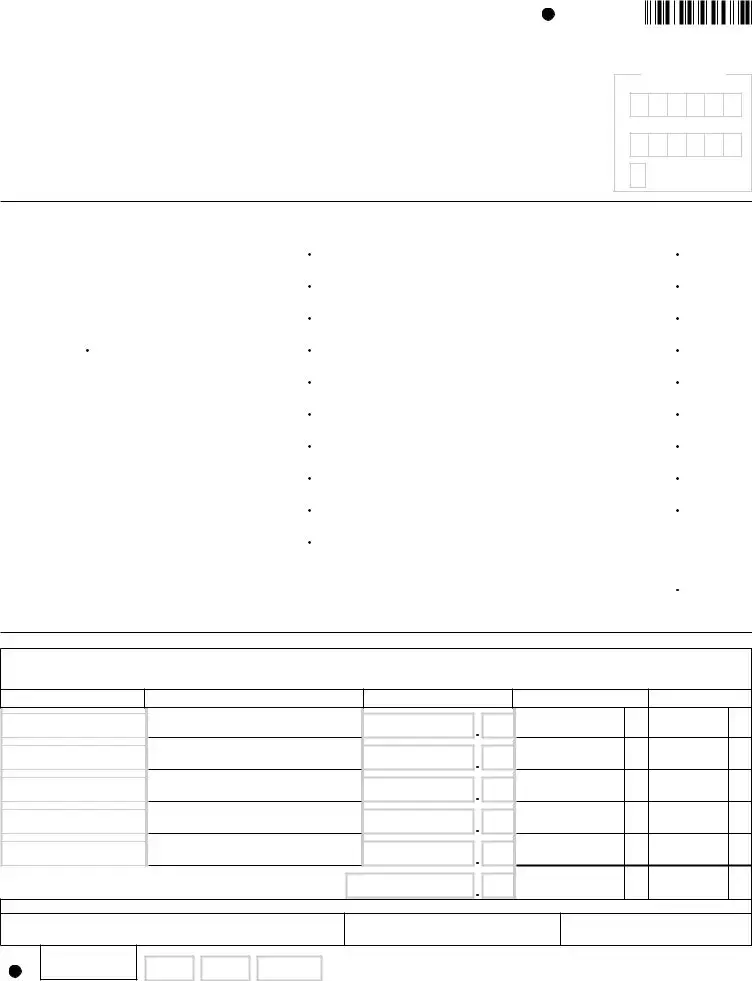

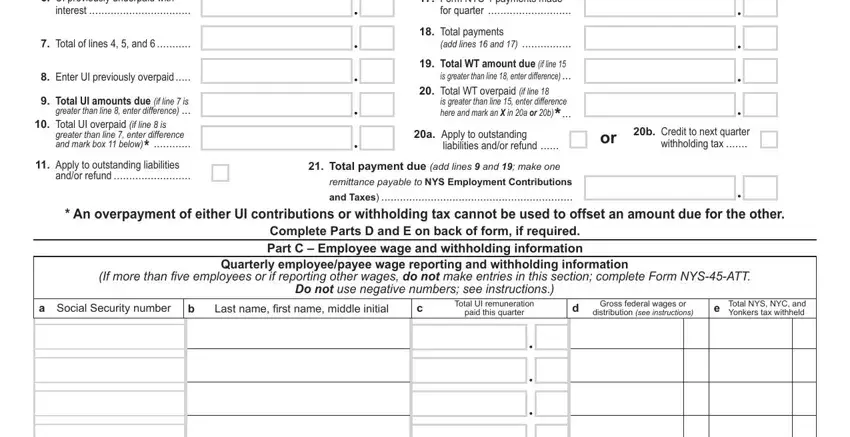

The next segments will compose the PDF document that you'll be filling out:

Remember to insert the data inside the part UI previously underpaid with, interest, Total of lines and, Enter UI previously overpaid, Total UI amounts due if line is, Total UI overpaid if line is, greater than line enter, andor refund, Form NYS payments made, for quarter, Total payments, add lines and, Total WT amount due if line is, Total WT overpaid if line, and is greater than line enter.

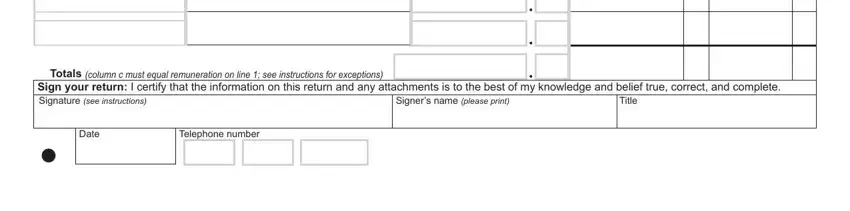

The system will ask you for data to instantly submit the section Totals column c must equal, Sign your return I certify that, Signers name please print, Title, Date, and Telephone number.

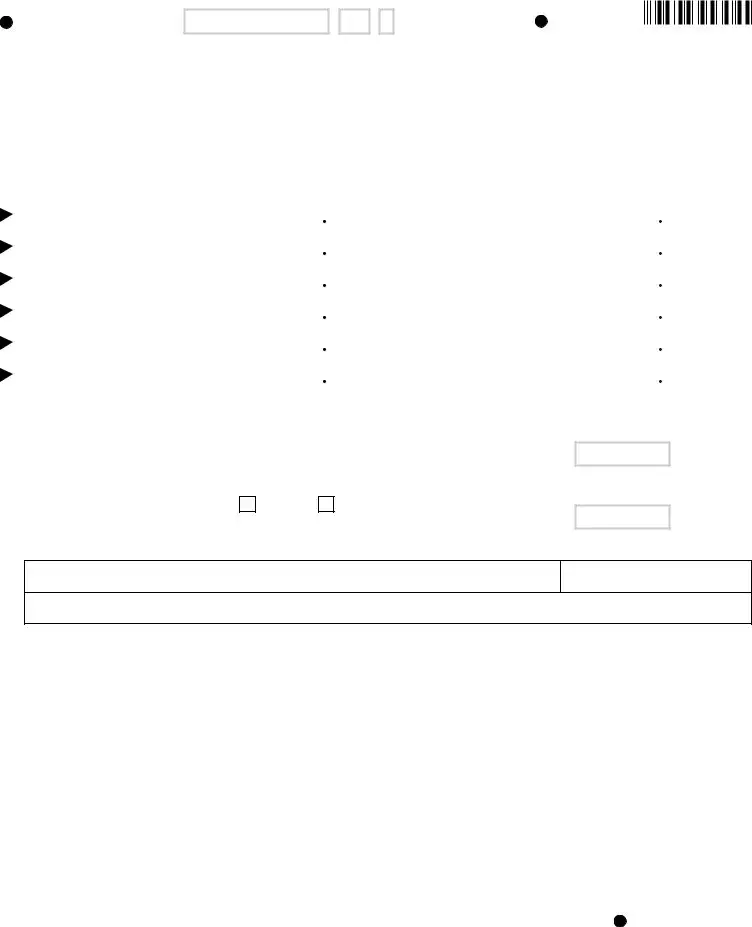

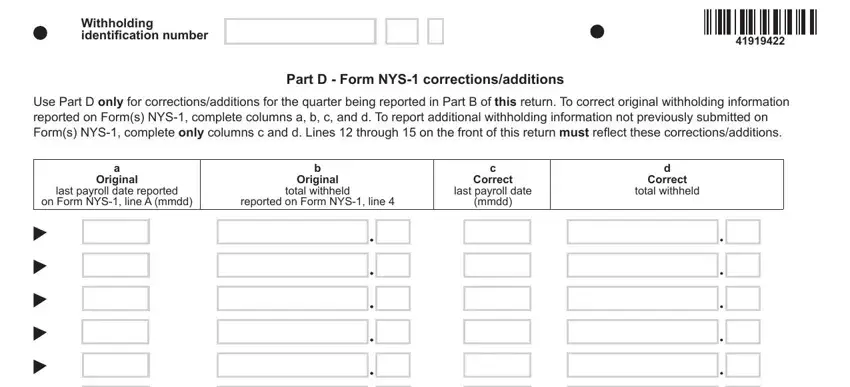

It's essential to indicate the rights and obligations of both sides in space Withholding identification number, Use Part D only for, Part D Form NYS, a Original last payroll date, b Original total withheld reported, c Correct last payroll date mmdd, and d Correct total withheld.

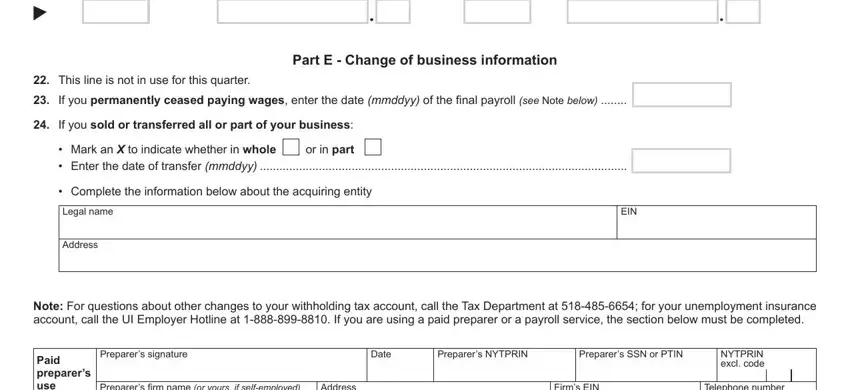

End by reading these areas and writing the required information: This line is not in use for this, If you permanently ceased paying, Part E Change of business, If you sold or transferred all or, Mark an X to indicate whether in, Complete the information below, Legal name, Address, EIN, Note For questions about other, Paid preparers use, Preparers signature, Date, Preparers NYTPRIN, and Preparers SSN or PTIN.

Step 3: Hit the "Done" button. You can now transfer your PDF file to your electronic device. Aside from that, you can send it by means of electronic mail.

Step 4: Make sure you keep away from forthcoming challenges by preparing as much as 2 duplicates of your document.