Using PDF forms online is certainly very simple using our PDF tool. You can fill in North_Carolina here painlessly. FormsPal team is aimed at making sure you have the absolute best experience with our tool by consistently releasing new features and upgrades. Our editor is now even more helpful thanks to the latest updates! At this point, working with PDF documents is simpler and faster than ever. All it requires is several basic steps:

Step 1: First of all, open the pdf editor by clicking the "Get Form Button" at the top of this site.

Step 2: With this handy PDF file editor, it is easy to do more than simply fill in blanks. Express yourself and make your forms appear high-quality with custom textual content added in, or optimize the file's original content to perfection - all comes along with an ability to insert stunning pictures and sign it off.

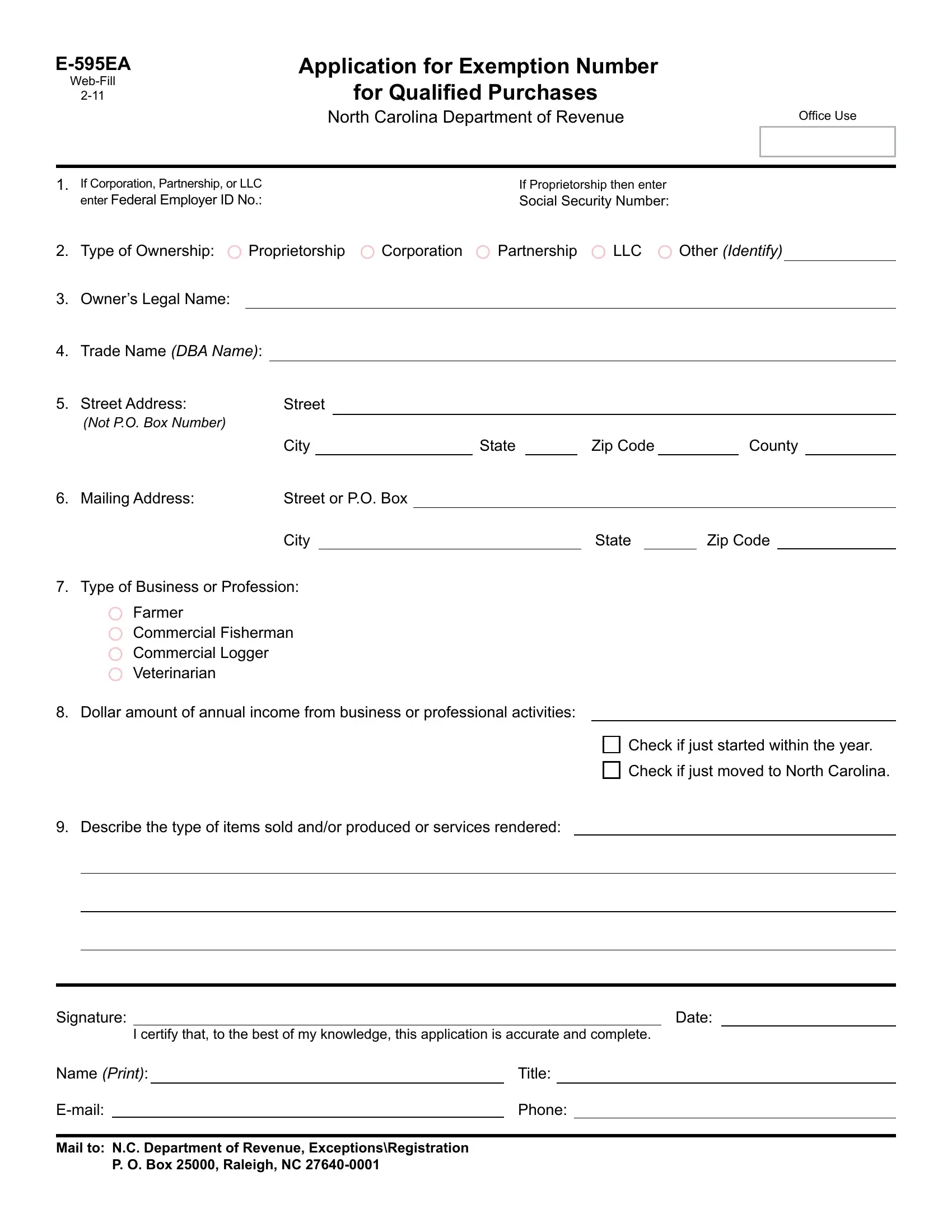

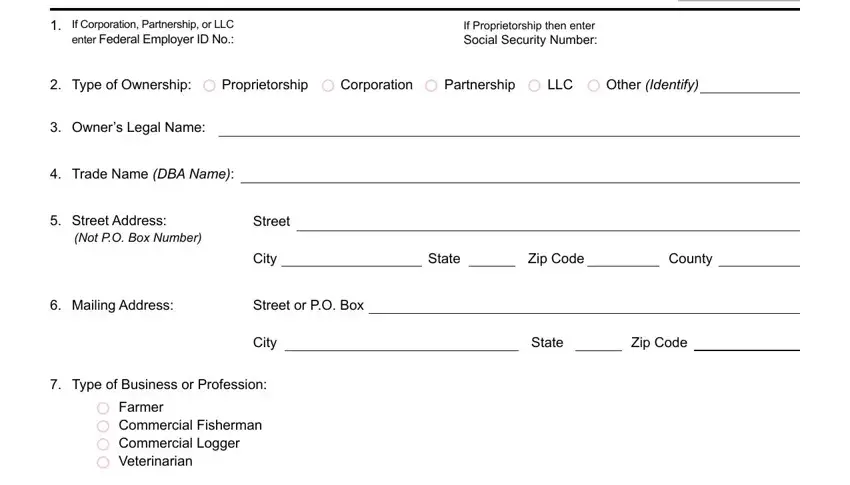

For you to finalize this form, be certain to provide the required details in each area:

1. To start with, while filling in the North_Carolina, start in the area that contains the next blank fields:

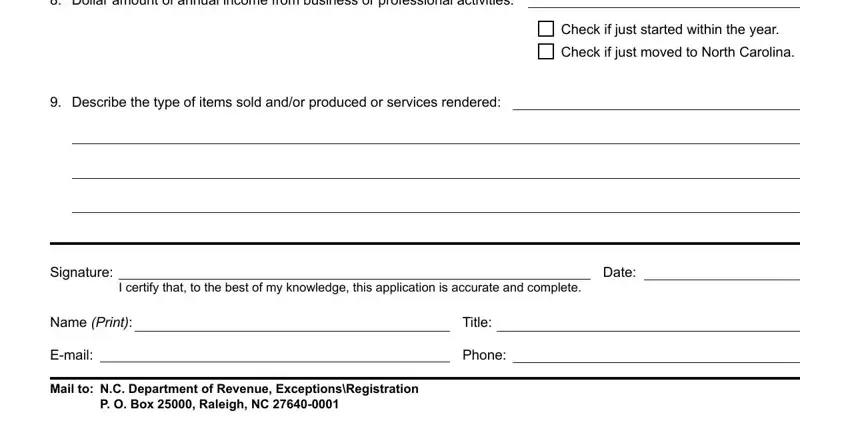

2. Soon after performing this part, go to the next part and enter all required particulars in these fields - Dollar amount of annual income, Describe the type of items sold, Check if just started within the, Signature, I certify that to the best of my, Date, Name Print, Email, Title, Phone, Mail to NC Department of Revenue, and P O Box Raleigh NC.

Always be extremely attentive when completing Check if just started within the and Date, as this is the part where most users make some mistakes.

Step 3: Reread what you've entered into the blanks and press the "Done" button. Make a 7-day free trial plan with us and gain immediate access to North_Carolina - with all adjustments saved and available in your FormsPal account page. FormsPal is devoted to the personal privacy of all our users; we always make sure that all information entered into our editor continues to be secure.