EF-60AH-R01-1013-0

BOE-60-AH (P2) REV. 15 (05-13)

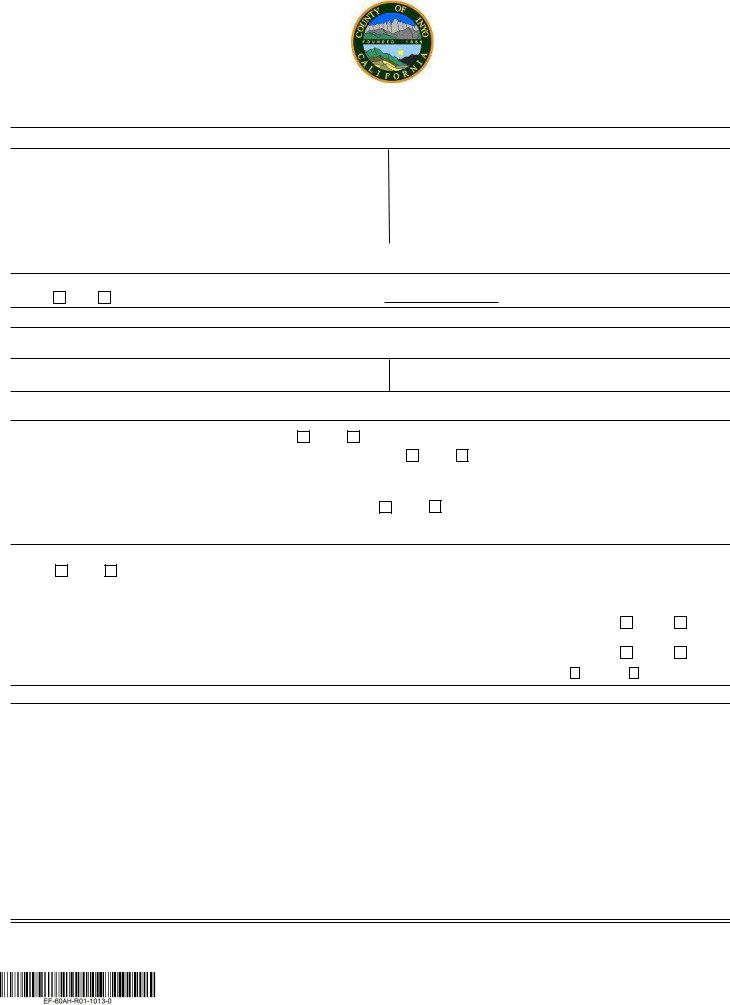

GENERAL INFORMATION

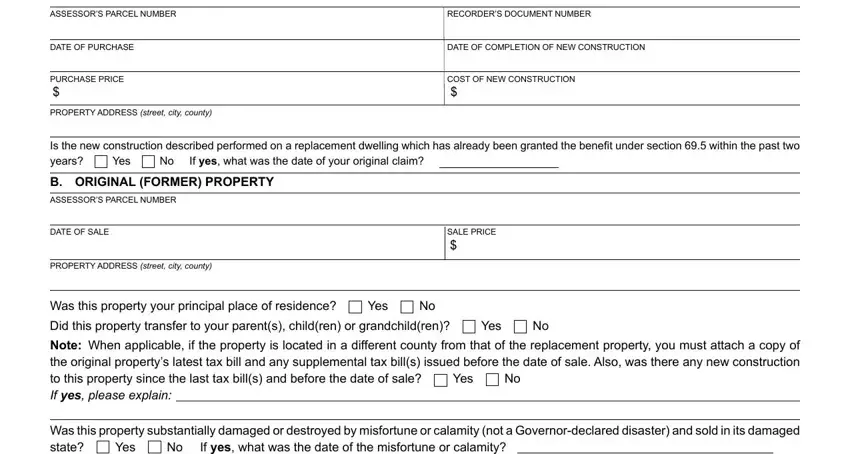

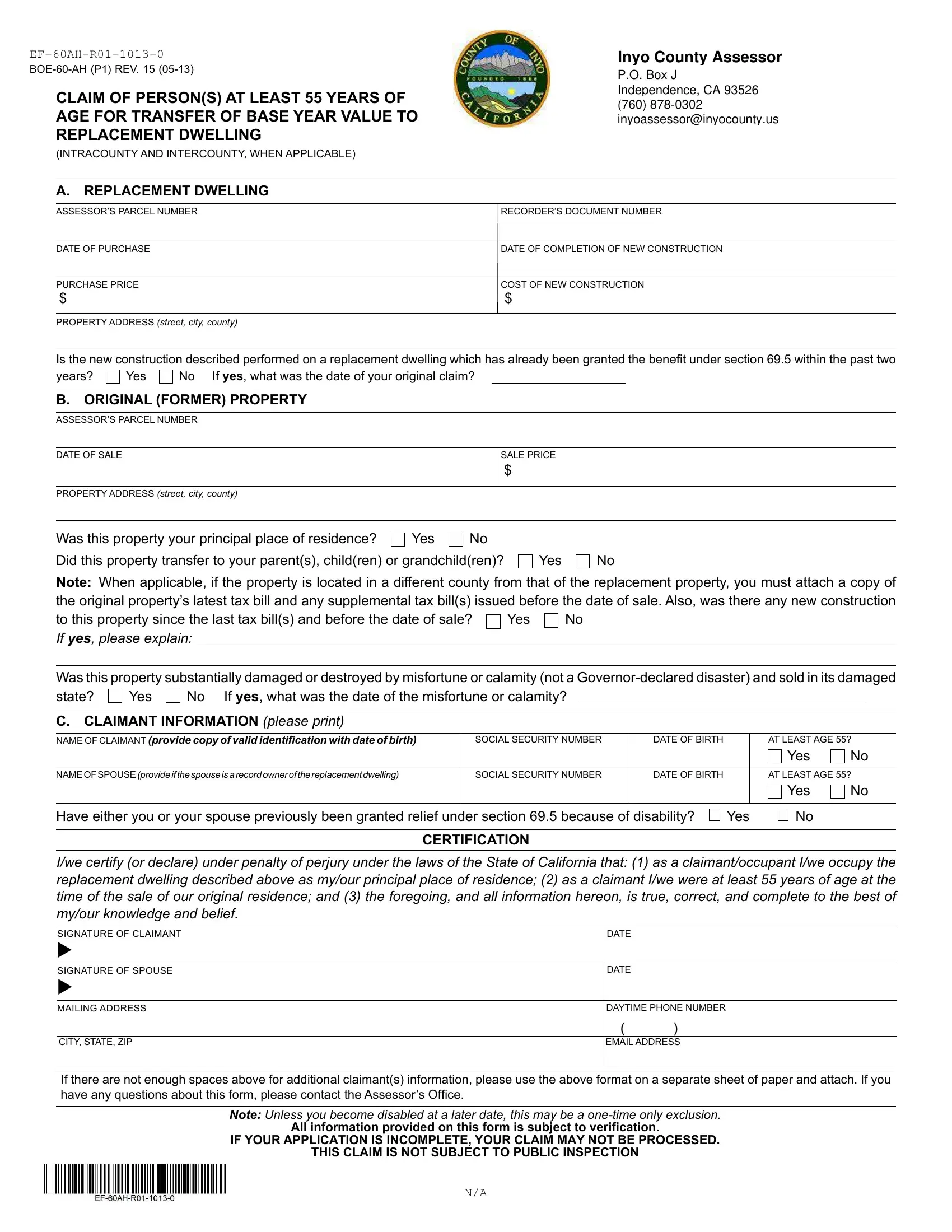

California law allows any person who is at least 55 years of age (at the time of sale of original/former property) who resides in a property eligible for the Homeowners’ Exemption (place of residence) or currently receiving the Disabled Veterans’ Exemption to transfer the base year value of the original property to a replacement dwelling of equal or lesser value within the same county. For purposes of this exclusion, original property and replacement dwelling mean a building, structure, or other shelter constituting a place of abode which is owned and occupied by a claimant as his or her principal place of residence, and land eligible for the Homeowners’ Exemption. If an original property is a multi-unit dwelling, each unit shall be considered a separate original property.

In addition, to qualify for transfer of a base year value to a replacement dwelling all the following requirements must be met: (1) the replacement dwelling must be purchased or newly constructed within two years of the sale of the original property; (2) the original property must be subject

to reappraisal at its current fair market value in accordance with sections 110.1 or 5803 of the Revenue and Taxation Code or must receive a transferred base year value as determined in accordance with sections 69, 69.3 or 69.5 of the Revenue and Taxation Code, because the property qualiies as a replacement residence; and (3) a claim for relief must be iled within 3 years of the date a replacement dwelling is purchased or new construction of that replacement dwelling is completed. If you ile your claim after the 3-year period, relief will be granted beginning with the calendar year in which you ile your claim. If you sold the original property to your parent, child, or grandchild and that person iled a claim for the parent-child or grandparent-grandchild change in ownership exclusion, then you may not transfer your base year value under section 69.5.

In general, equal or lesser value means that the fair market value of a replacement property on the date of purchase or completion of construction does not exceed 100 percent of market value of original property as of its date of sale if a replacement dwelling is purchased before an original property is sold; 105 percent of market value of original property as of its date of sale if a replacement dwelling is purchased within one year after the sale of the original property; 110 percent of market value of the original property as of its date of sale if a replacement dwelling is purchased within the second year after the sale of the original property.

If the original property was substantially damaged or destroyed by misfortune or calamity (not a Governor-declared disaster) and sold in its damaged state, the fair market value of the property immediately preceding the damage or destruction is used for purposes of the equal or lesser value test. A property is "substantially damaged or destroyed" if either land or improvements sustain physical damage amounting to more than 50 percent of its full cash value immediately prior to the misfortune or calamity.

If you are iling a claim for additional treatment under section 69.5 as the result of new construction performed on a replacement dwelling which has already been granted the beneit, you must complete the reverse side of this form. You may be eligible if the new construction is completed within two years of the date of sale of the original property; you have notiied the Assessor in writing of the completion of new construction within 6 months after completion; and the fair market value of the new construction (as conirmed by the Assessor) on the date of completion, plus the full cash value of the replacement dwelling at the time of its purchase/date of completion of new construction (as conirmed by the Assessor) does

not exceed the market value of the original property as of its date of sale.

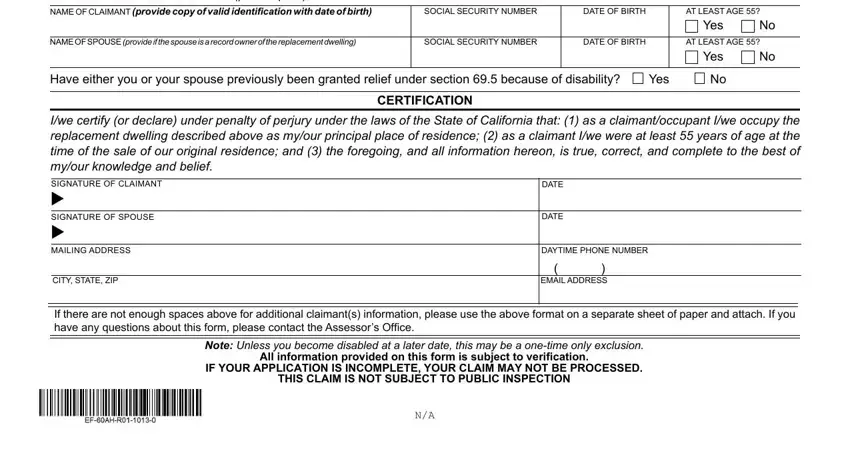

The disclosure of social security numbers by all claimants of a replacement dwelling is mandatory as required by Revenue and Taxation Code section 69.5. [See Title 42 United State Code, section 405(c)(2)(C)(i) which authorizes the use of social security numbers for identiication purposes in the administration of any tax.] The numbers are used by the Assessor to verify the eligibility of persons claiming this exclusion and by the state to prevent multiple claims in different counties. This claim is not subject to public inspection.

If you feel you qualify for this exclusion, you must provide evidence that you are at least 55 years old and declare under penalty of perjury (see reverse) that you are at least 55, and complete the reverse side of this form. Generally, claimants will be granted property tax relief under section

69.5 of the Revenue and Taxation Code only once. However, the Legislature created an exception to this one-time-only clause. If a person becomes

disabled after receiving the property tax relief for age, the person may transfer the base year value a second time because of the disability. A separate form for disability must be iled. Contact the Assessor.

If your claim is approved, the base year value will be transferred to the replacement dwelling as of the latest qualifying event — the sale of the original property, the purchase of the replacement dwelling, or the completion of construction of the replacement dwelling. This means that if you purchase or construct your replacement dwelling irst and sell your original property second, you will be responsible for the increased taxes on your replacement dwelling until your original property is sold.

Please Note: Transfers between counties are allowed only if the county in which the replacement dwelling is located has passed an authorizing ordinance. The acquisition of the replacement dwelling must occur on or after the date speciied in the county ordinance.

(Please complete applicable information on reverse side.)