Once you open the online editor for PDFs by FormsPal, you'll be able to fill out or change study guides for ff el 101 here and now. FormsPal team is continuously working to develop the tool and enable it to be even faster for clients with its cutting-edge features. Take your experience one step further with continually developing and exciting options we provide! All it takes is just a few simple steps:

Step 1: Open the PDF doc inside our editor by clicking on the "Get Form Button" above on this page.

Step 2: With the help of this online PDF editing tool, you could do more than merely complete blank form fields. Edit away and make your forms seem sublime with custom text put in, or modify the original input to excellence - all that comes along with an ability to incorporate your personal images and sign the document off.

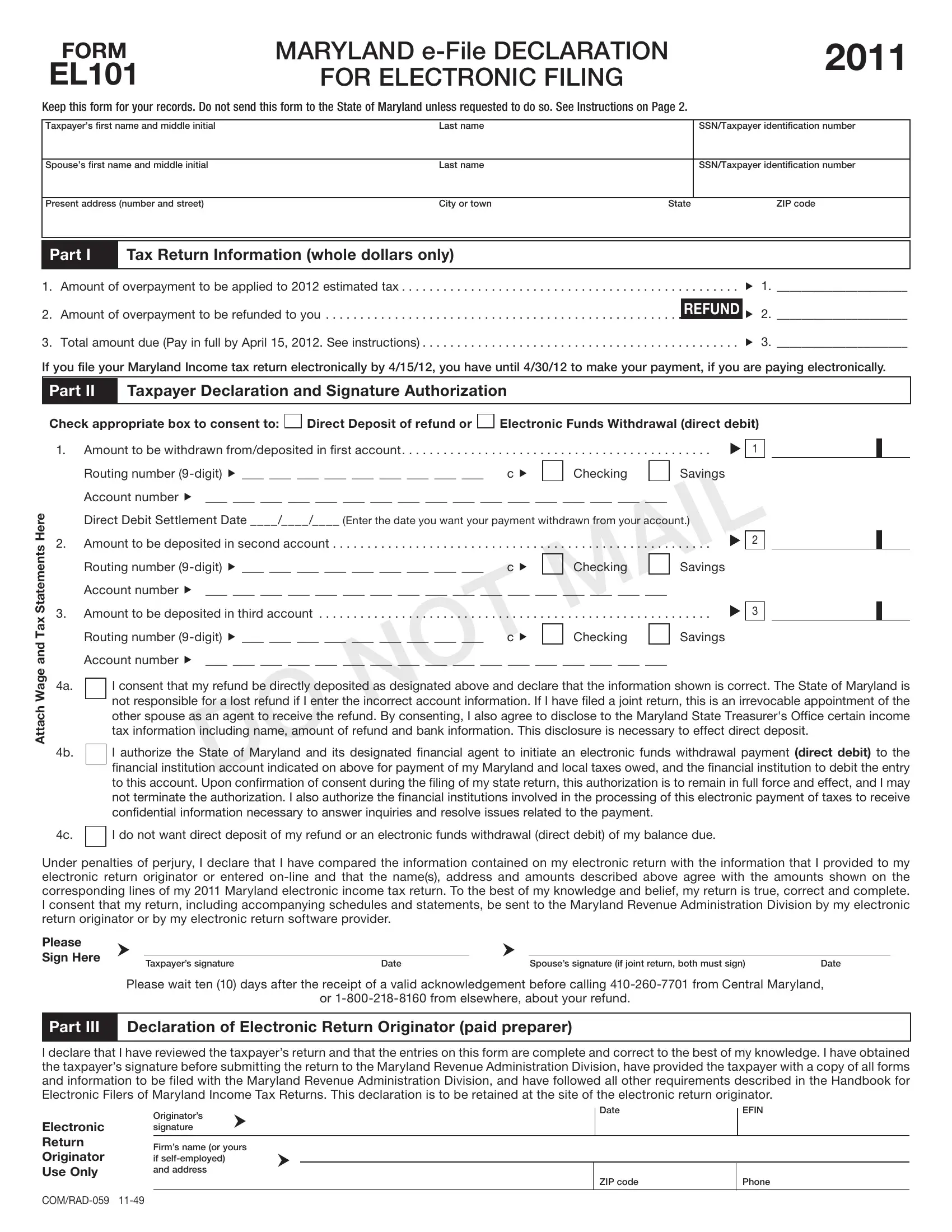

This form requires some specific information; to ensure accuracy and reliability, remember to take heed of the tips down below:

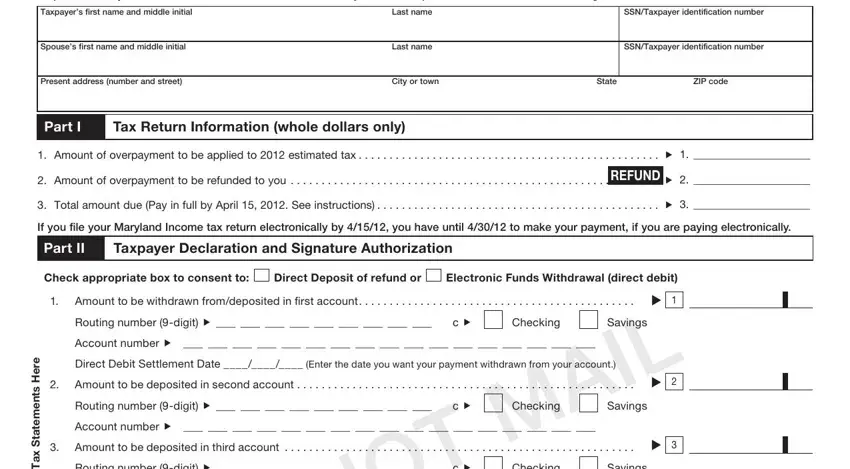

1. To start off, when filling in the study guides for ff el 101, start with the form section that contains the next fields:

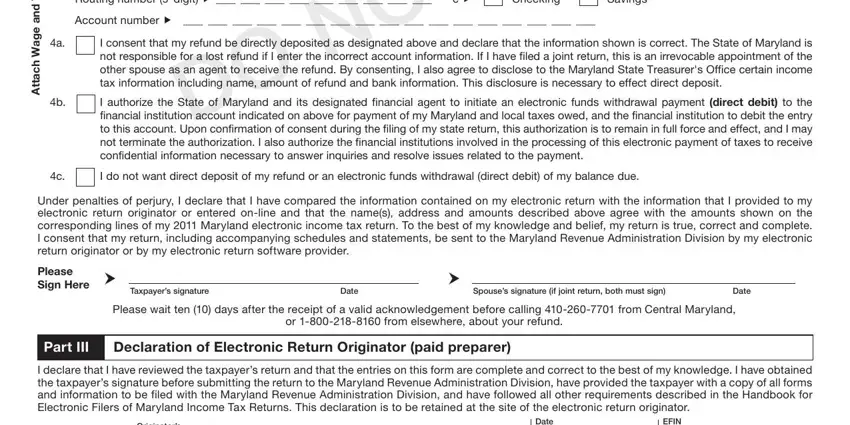

2. Just after the previous part is filled out, go on to enter the applicable details in these - Amount to be deposited in third, Routing number digit, Checking, D O N O T M A I L, Savings, I consent that my refund be, I authorize the State of Maryland, e r e H s t n e m e t a t S x a T, d n a, e g a W h c a t t A, I do not want direct deposit of my, Under penalties of perjury I, Please Sign Here, Taxpayers signature, and Date.

A lot of people frequently make some mistakes when filling out Taxpayers signature in this area. Remember to read again everything you type in here.

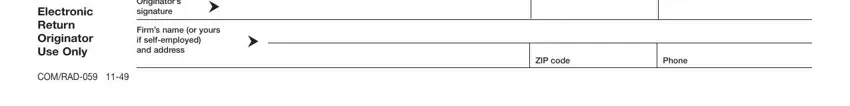

3. This third section is fairly simple, Originators signature, Firms name or yours if, Electronic Return Originator Use, COMRAD, Date, EFIN, ZIP code, and Phone - these form fields is required to be filled out here.

Step 3: Check what you have entered into the blanks and click on the "Done" button. Acquire the study guides for ff el 101 the instant you sign up for a 7-day free trial. Instantly view the pdf form from your personal cabinet, together with any edits and adjustments being conveniently preserved! When using FormsPal, it is simple to fill out forms without having to be concerned about information leaks or data entries getting shared. Our secure platform ensures that your private data is stored safely.