Dealing with PDF files online can be very simple using our PDF editor. Anyone can fill in emp5604 fillable form here within minutes. In order to make our tool better and simpler to utilize, we continuously come up with new features, considering suggestions from our users. To get the process started, take these simple steps:

Step 1: First of all, open the pdf editor by pressing the "Get Form Button" at the top of this site.

Step 2: When you open the PDF editor, you will notice the form ready to be completed. Other than filling in different fields, you might also do other sorts of things with the Document, specifically putting on custom text, changing the initial text, adding images, placing your signature to the document, and a lot more.

With regards to the fields of this precise form, here's what you should know:

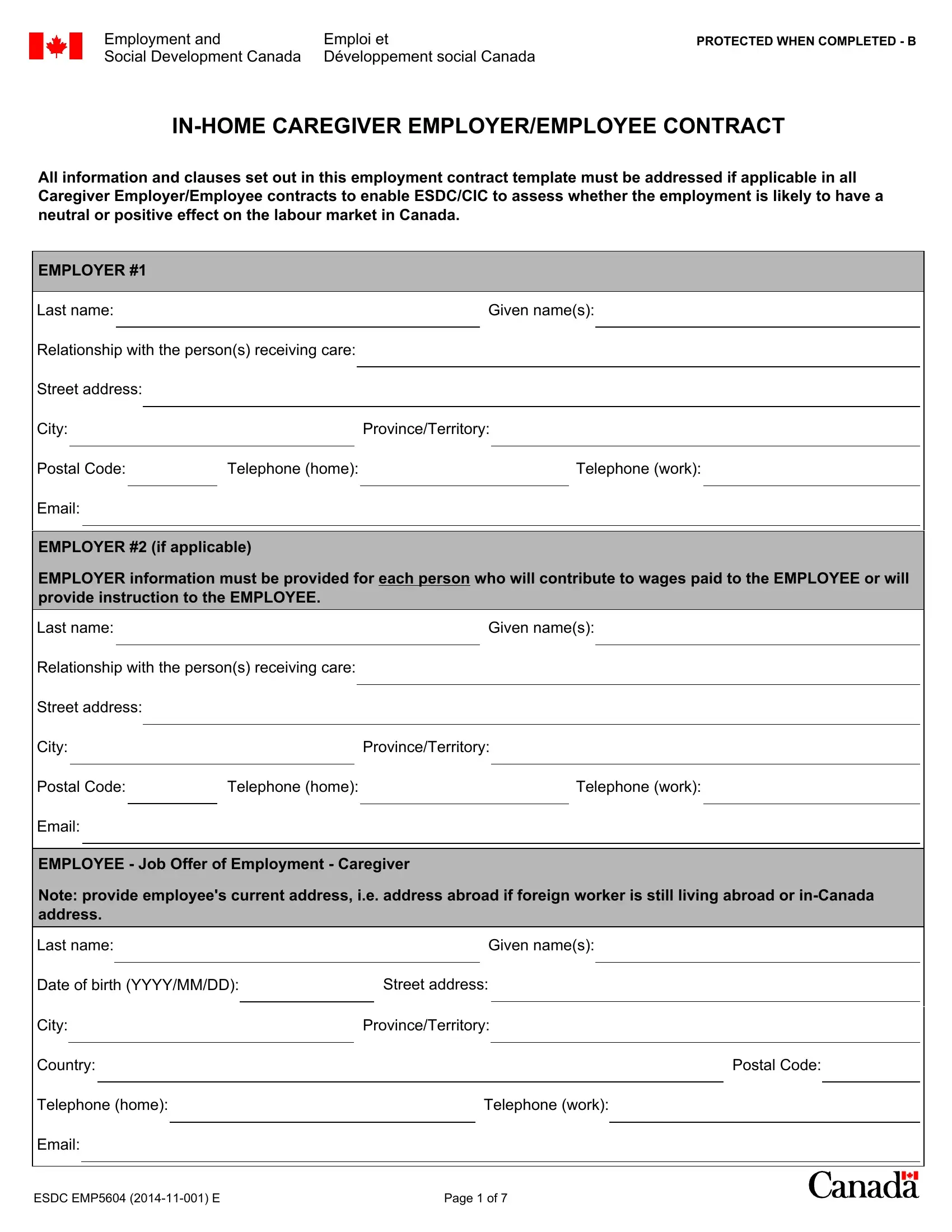

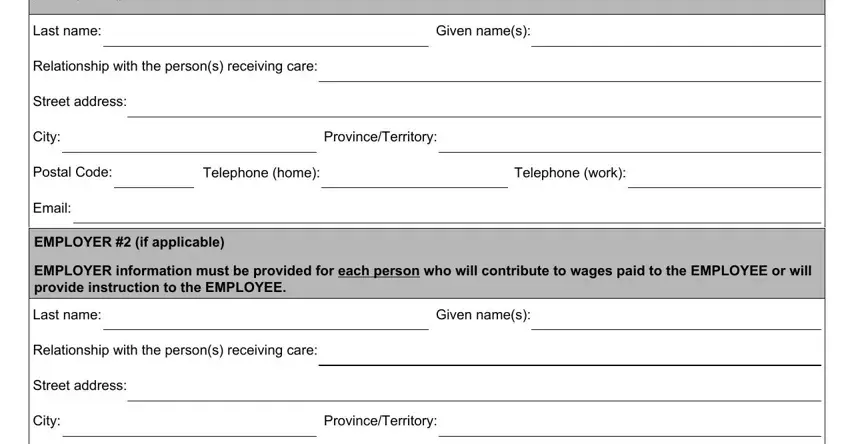

1. While submitting the emp5604 fillable form, be sure to include all of the important blank fields in their corresponding form section. This will help to hasten the process, allowing your information to be processed promptly and accurately.

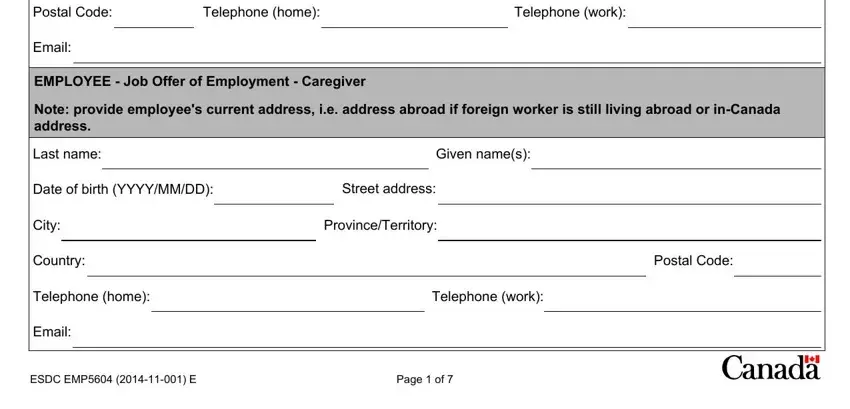

2. Just after this section is filled out, go to type in the applicable details in these - Postal Code, Telephone home, Telephone work, Email, EMPLOYEE Job Offer of Employment, Note provide employees current, Last name, Given names, Date of birth YYYYMMDD, Street address, City, Country, Telephone home, Email, and ProvinceTerritory.

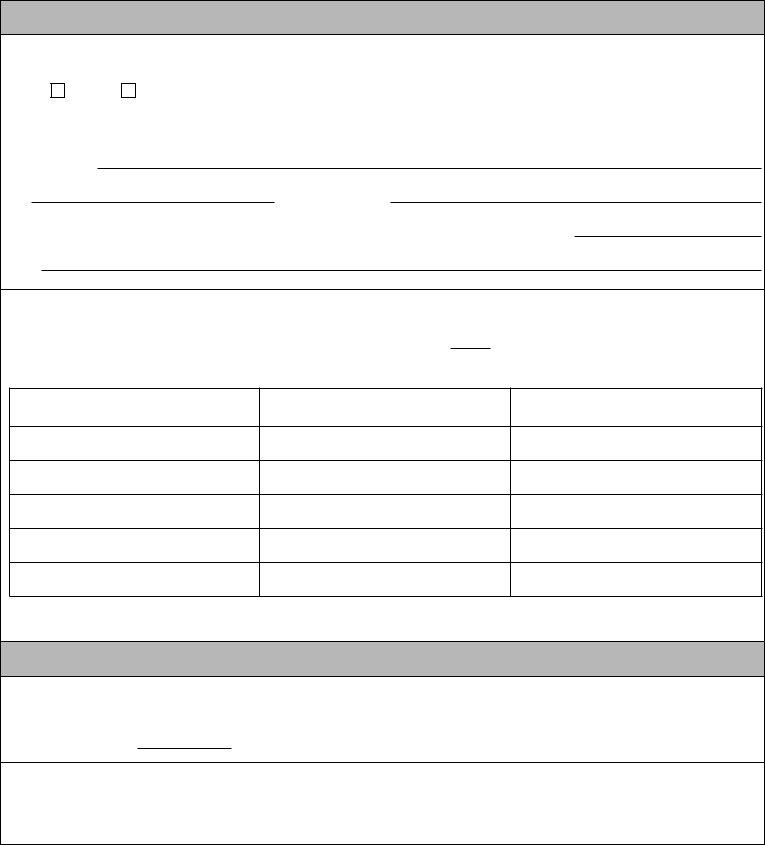

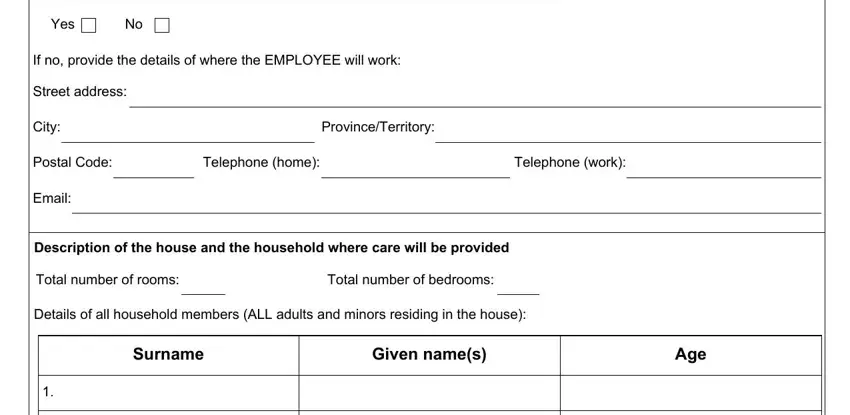

3. In this particular step, look at Will the EMPLOYEE work at, Yes, If no provide the details of where, Street address, City, ProvinceTerritory, Postal Code, Telephone home, Telephone work, Email, Description of the house and the, Total number of rooms, Total number of bedrooms, Details of all household members, and Surname. These should be taken care of with highest attention to detail.

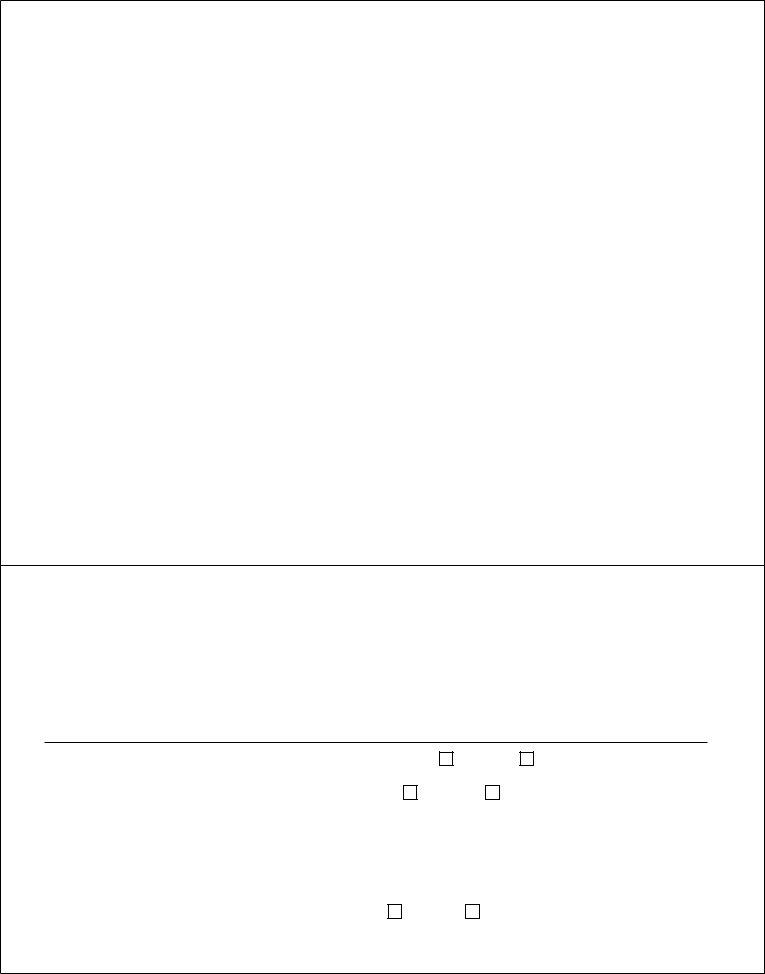

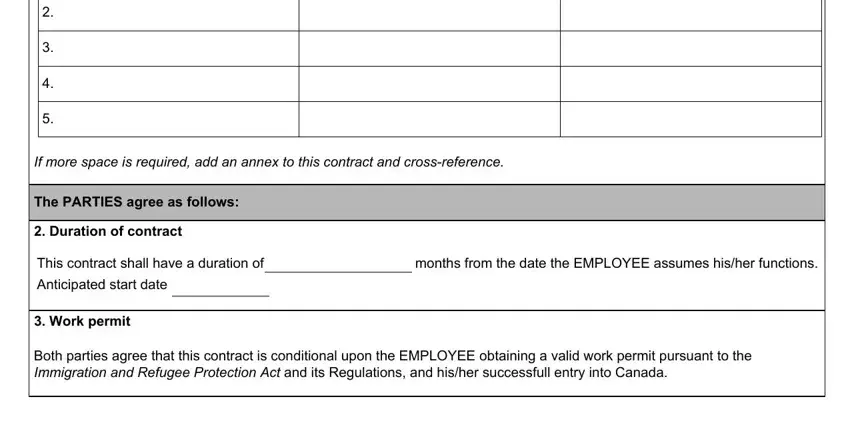

4. The subsequent part needs your involvement in the subsequent parts: If more space is required add an, The PARTIES agree as follows, Duration of contract, This contract shall have a, months from the date the EMPLOYEE, Anticipated start date, Work permit, and Both parties agree that this. Make sure that you fill in all of the needed information to move forward.

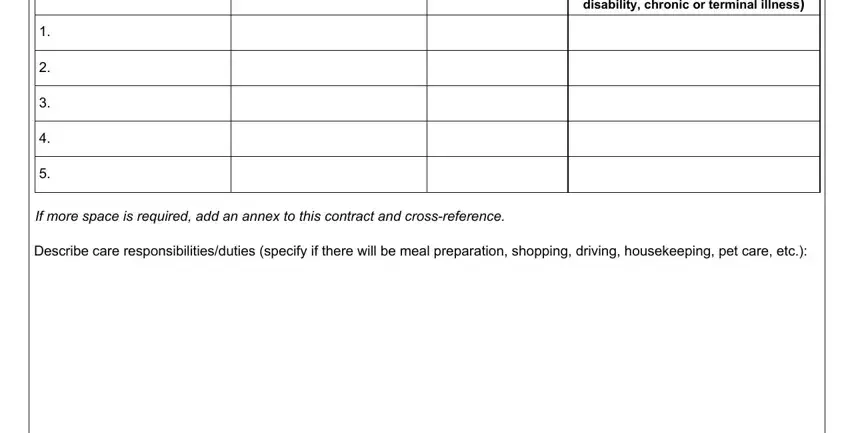

5. This document has to be completed by going through this segment. Here there's an extensive list of form fields that need appropriate information for your form submission to be complete: disability chronic or terminal, If more space is required add an, and Describe care.

Those who work with this form frequently make some mistakes while completing If more space is required add an in this section. Be certain to go over everything you enter here.

Step 3: Make sure your details are accurate and simply click "Done" to conclude the task. Right after registering afree trial account with us, it will be possible to download emp5604 fillable form or send it through email promptly. The document will also be available in your personal account menu with all your edits. We don't share any information you type in whenever completing forms at our website.