The Form ET-14, known as the Estate Tax Power of Attorney, serves as a crucial document for individuals managing estate tax matters in New York State. This form allows executors to designate representatives who are authorized to handle estate tax-related issues on their behalf with the Department of Taxation and Finance. The specificity of Form ET-14 sets it apart, as it is solely for estate tax matters, advising against its use for other tax-related issues where Form POA-1 is recommended. Notably, filing this form does not invalidate any previously filed powers of attorney for the estate, but may alter the recipient of mail communications. It is emphasized that this form should be submitted only once unless there is a change, thereby not requiring submission with each estate tax form filed. The form requests detailed information about the executor and the decedent, including Social Security numbers and addresses, and similarly detailed information about the appointed representative(s). It also provides options for directing where mailings should be sent and outlines the scope of authority granted to the representative, with the option for the executor to place limitations on this authority. Completion and accurate signing by the executor, who must clarify their capacity and relationship to the decedent, are imperative for the form's processing. Additionally, the form highlights the process for revoking a filed Power of Attorney and specifies detailed instructions for both the executor and their representatives. Ultimately, Form ET-14 is an essential document for efficiently managing estate tax matters, offering a structured way to delegate authority while ensuring compliance with New York State regulations.

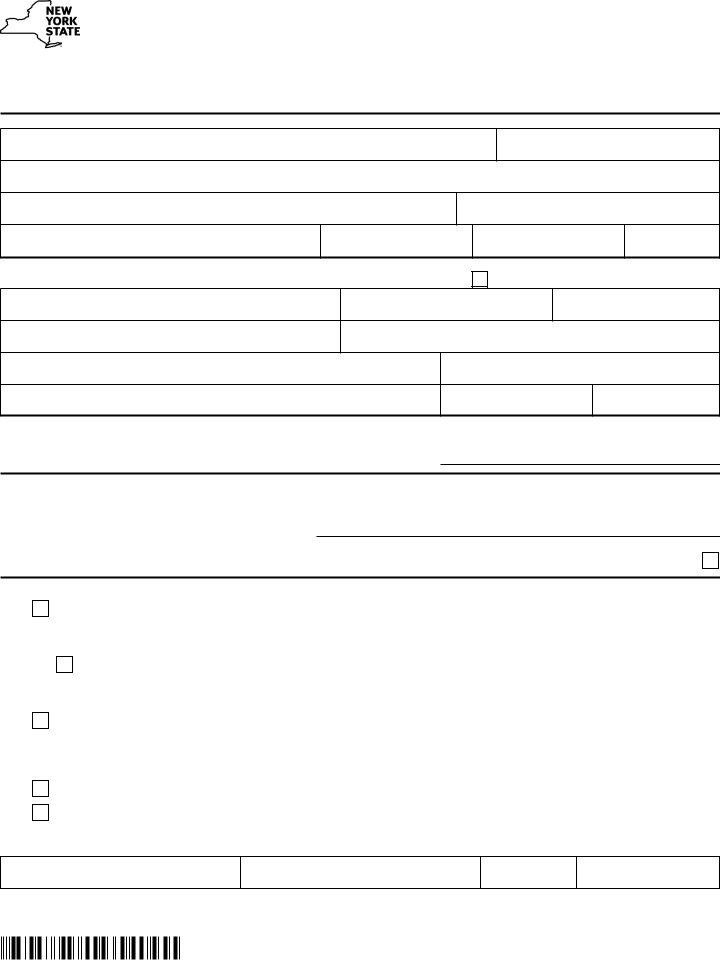

| Question | Answer |

|---|---|

| Form Name | Form Et 14 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 145 9 advisory circular, faa ac 145 online, maintenance performed, maintenance performed print |

Department of Taxation and Finance |

||

Estate Tax Power of Attorney |

||

(6/19) |

Read the instructions before completing this form. Form

Department of Taxation and Finance for the estate listed below but may affect who receives mailings. Note: Unless a change is being made, Form

1.Executor’s and decedent’s information (executor must sign and date this form in section 5)

Executor’s name

Executor’s Social Security number (SSN)

Mailing address (number and street with apartment or suite number, or PO Box)

City |

State |

ZIP code |

Country (if not United States)

Decedent’s name

Decedent’s SSN

County of residence

Date of death

2.Representative information (if you are appointing multiple representatives, mark an X in the box and attach a sheet that provides all the

information requested in section 2 and is signed and dated by the executor named in section 1)

Primary individual representative name

Firm name (if any)

Telephone number

Mailing address (number and street with apartment or suite number, or PO Box)

City |

State |

ZIP code |

Country (if not United States)

Email address

Title or profession (see instructions)

PTIN, SSN, or EIN

NYTPRIN (if applicable)

3.Mailings – We will send copies of notices and other communications related to estate tax matters to the representative listed above. If you want them sent to a different representative who has an estate tax POA on file for the same estate, enter that individual’s name below.

Name of representative to receive copies of notices and other communications:

4.Authority granted – The executor named in section 1 appoints the individual(s) named in section 2 to act as the executor’s representative with full authority to receive confidential information and to perform any and all acts that the executor can perform, unless limited below, with respect to estate tax matters.

I want to limit the authority granted by this POA as follows:

I have other POAs on file for estate tax matters for this estate and want to revoke all of these POAs..................................................

5.Executor signature (mark an X in box A or B and sign below)

A. |

I have been formally appointed by a court as executor or administrator of this estate. I have been issued Letters |

||

Testamentary or Letters of Administration that are valid and in effect, and (mark an X in the appropriate box below): |

|||

|

|||

|

|

I am including a copy of the Letters Testamentary or Letters of Administration, or |

|

|

|

||

|

|

|

|

I have already provided a copy of the Letters Testamentary or Letters of Administration to the New York State Tax

|

Department (included with Form |

|

|

previously filed on |

|

). |

|

||||

|

|

|

(form number) |

(specify date) |

|

||||||

B. |

No executor or administrator has been appointed, qualified, and acting within the United States (see instructions). I am in actual |

||||||||||

or constructive possession of property of the decedent. I agree to provide evidence of same upon request. |

|

||||||||||

|

|

||||||||||

|

Specify your relationship to the decedent and the property you possess: |

|

|

|

|

|

|||||

C. |

This is the first |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. |

This is a revised |

|

|

filed on |

|

|

|

||||

|

|

|

|

|

(form number) |

(specify date) |

|||||

|

|

|

|

|

|

||||||

Signature

Print or type name (and title, if applicable)

Date

Telephone number

► IF NOT SIGNED AND DATED, THIS POWER OF ATTORNEY WILL NOT BE PROCESSED. See instructions on page 2 for Where to send Form

07500106190094

Instructions

Important information

Note: Unless a change is being made, Form

in once. You do not have to send in this form with every estate tax filing or additional forms.

General information for executor

Use Form

one or more individuals the authority to obligate, bind, or appear on your behalf before the New York State Department of Taxation and Finance (the

department) with respect to estate tax matters. For all other tax matters related to the estate or decedent, use Form

You may only appoint individuals (not a firm) to represent you.

Note: Authorizing someone to represent you by a power of attorney (POA) does not relieve you of your tax obligations.

Unless you limit the authority you grant (see section 4), your appointed

representatives may perform any and all acts you can perform, including

but not limited to: receiving confidential information concerning your

taxes, agreeing to extend the time to assess tax, agreeing to a tax adjustment, and establishing an installment payment agreement for taxes owed.

You do not need Form

Only certain types of professionals may act on your behalf before the

NYS Bureau of Conciliation and Mediation Services (BCMS). Visit the

Tax Department’s POA webpage (at www.tax.ny.gov/poa) for more information.

Revocation and withdrawal – New: This POA will remain active until you (the executor) revoke it or your representative withdraws from representing you. Representatives may not revoke a POA.

For information on ways to revoke a POA, or how a representative

can withdraw, see the Tax Department’s POA webpage (at www.tax.ny.gov/poa).

Specific instructions

Section 1 – Executor’s and decedent’s information

If no executor or personal representative is appointed, qualified, and acting within the United States, executor means any person in actual

or constructive possession of any property of the decedent. It includes, among others, a surviving spouse or other relative, trustee, or custodian

of the property. A person who is not formally appointed executor by a court may be required to furnish evidence at any time that substantiates

his or her authority to sign the power of attorney (for example, death certificate, kinship affidavit, fiduciary relationship, copy of trust

instrument, etc.).

Section 2 – Representative information

If you are appointing more than one representative, attach a sheet that provides all the information requested in section 2 and that is signed and

dated by the executor named in section 1.

Caution: This POA cannot be partially revoked or withdrawn. If you

appoint more than one representative on this POA and later choose to revoke one representative or one representative withdraws, the

revocation or withdrawal will apply to all representatives, and none will have ongoing authority to represent you. You must file a new POA to

appoint the representatives that you want to continue representing you.

All representatives are deemed as authorized to act separately unless you explain that all representatives are required to act jointly on the line

in section 4 that allows you to limit the authority granted by this POA.

For each appointed representative, enter the title or profession or, if

your representative is not a professional, enter the representative’s relationship to you. If the representative is not licensed in NYS, also

include the state where licensed (for example, Florida attorney). Enter each representative’s federal preparer tax identification number (PTIN), SSN, or EIN. If applicable, also enter each representative’s New York tax preparer registration identification number (NYTPRIN).

07500206190094

Section 3 – Mailings

If you want copies of notices and other communications sent to someone other than the primary individual representative listed in section 2 of this POA, enter the name of that representative on the line provided. This

representative must be someone who is listed as a representative for the matters covered by this POA on this or another valid POA on file for

estate tax matters.

Example: On 2/1/2016, you appoint Mr. Smith as your representative for all estate tax matters. Mr. Smith will receive copies of all mailings for these matters. On 8/15/2016, you appoint Ms. Jones as your representative for all estate tax matters. This is in addition to Mr. Smith, since you did not revoke his power of attorney. Ms. Jones will now receive copies of mailings for these matters, not Mr. Smith. However, if you want Mr. Smith to continue to receive the mailings and not Ms. Jones, you must list Mr. Smith’s name in section 3 of the Form

Section 4 – Authority granted

This power of attorney authorizes the representatives you appointed to act for you without any restrictions for the estate indicated. If you want to

limit your representative’s authority, explain the limitation. For example, you can limit your representative’s authority to only receive confidential information, but make no binding decisions for you. If you need more

space to explain the limitation, attach a sheet. The attached sheet must be signed and dated by the executor named in section 1.

Section 5 – Executor signature, and definition of executor

Form

executor includes executrix, administrator, administratrix, or personal representative of the decedent’s estate. If no one is appointed, qualified and acting within the United States, executor means any person in

actual or constructive possession of any property of the decedent (see

section 1). The NYS Tax Department requires an executor who has been

formally appointed by a court, or his or her representative, to submit a copy of the Letters Testamentary or the Letters of Administration as evidence of the executor’s authority to execute this power of attorney.

You must submit a copy of one of these letters (whichever applies)

with this Form

Where to send Form

Form

Application for Release(s) of Estate Tax Lien, Form

York State Estate Tax, Form

FAX to:

Mail to: NYS TAX DEPARTMENT

POA CENTRAL

W A HARRIMAN CAMPUS

ALBANY NY

If not using U.S. Mail, see Publication 55, Designated Private Delivery

Services.

Need help?

Visit our website at www.tax.ny.gov

(for information, forms, and online services)

Estate Tax Information Center: |

|

To order forms and publications: |

Privacy notification

New York State Law requires all government agencies that maintain a system of records to provide notification of the legal authority for any request for personal information, the principal purpose(s) for which the

information is to be collected, and where it will be maintained. To view

this information, visit our website, or, if you do not have Internet access, call

Need help? for the Web address and telephone number.