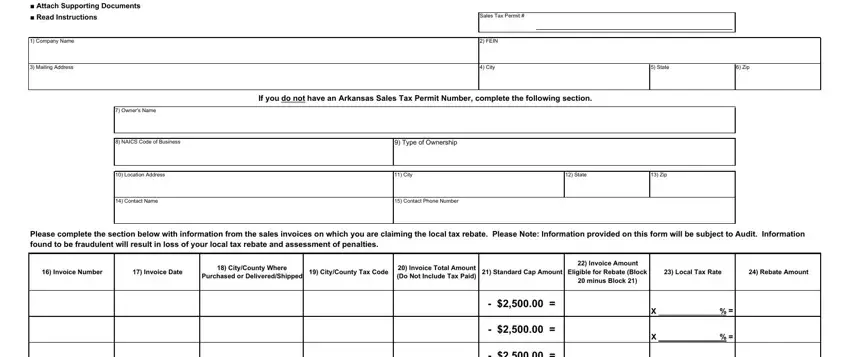

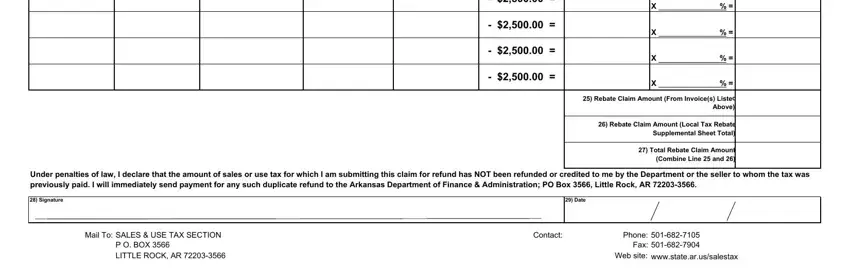

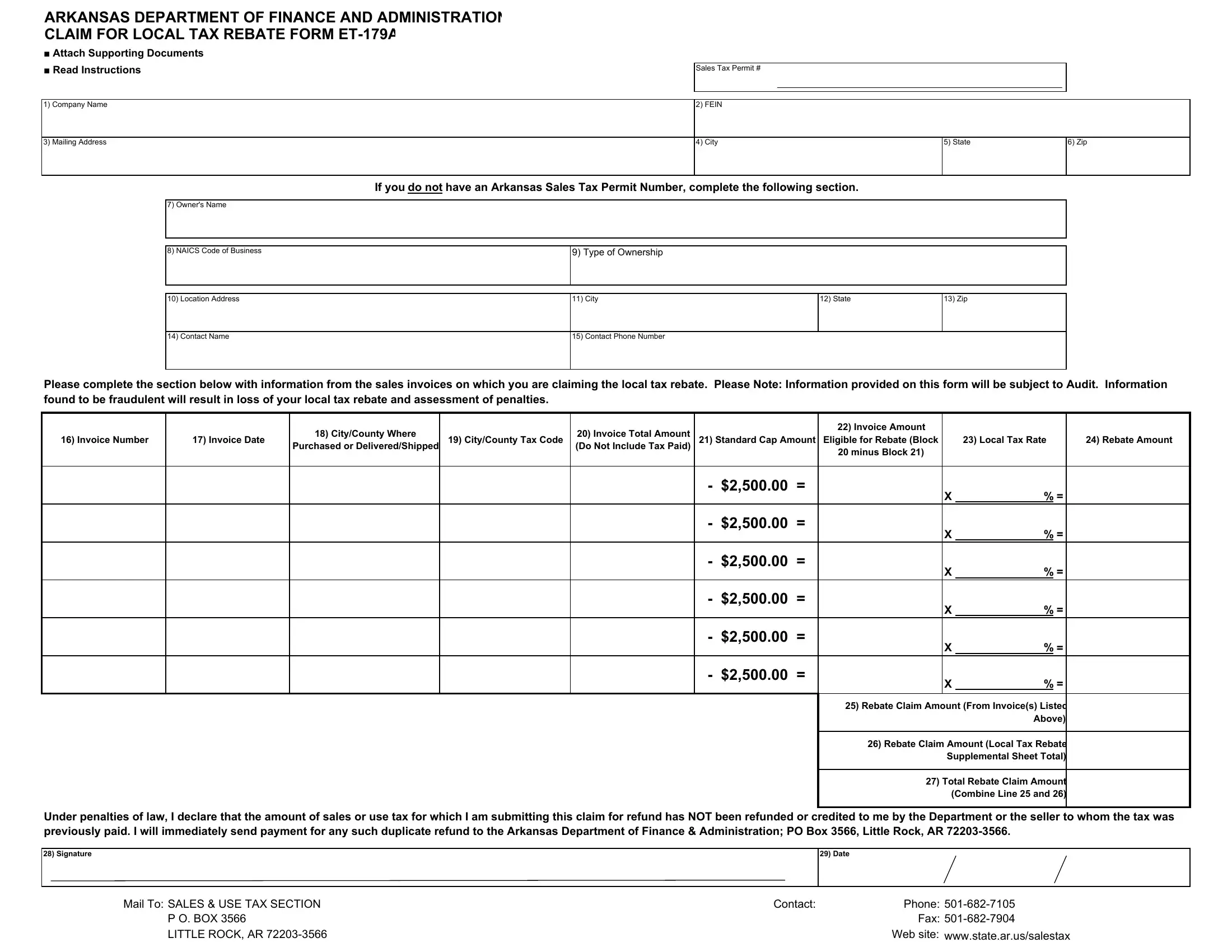

ARKANSAS DEPARTMENT OF FINANCE AND ADMINISTRATION CLAIM FOR LOCAL TAX REBATE FORM ET-179A

■Attach Supporting Documents

■Read Instructions

If you do not have an Arkansas Sales Tax Permit Number, complete the following section.

7) |

Owner's Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8) |

NAICS Code of Business |

9) Type of Ownership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10) |

Location Address |

11) |

City |

12) State |

13) Zip |

|

|

|

|

|

|

14) |

Contact Name |

15) |

Contact Phone Number |

|

|

|

|

|

|

|

|

|

Please complete the section below with information from the sales invoices on which you are claiming the local tax rebate. Please Note: Information provided on this form will be subject to Audit. Information found to be fraudulent will result in loss of your local tax rebate and assessment of penalties.

|

|

18) City/County Where |

|

20) Invoice Total Amount |

22) Invoice Amount |

|

|

16) Invoice Number |

17) Invoice Date |

19) City/County Tax Code |

21) Standard Cap Amount Eligible for Rebate (Block |

23) Local Tax Rate |

24) Rebate Amount |

|

|

Purchased or Delivered/Shipped |

|

(Do Not Include Tax Paid) |

20 minus Block 21) |

|

|

|

|

|

|

|

|

|

- $2,500.00 =

- $2,500.00 =

- $2,500.00 =

- $2,500.00 =

- $2,500.00 =

- $2,500.00 =

X% =

X% =

X% =

X% =

X% =

X% =

25) Rebate Claim Amount (From Invoice(s) Listed

Above)

26) Rebate Claim Amount (Local Tax Rebate

Supplemental Sheet Total)

27) Total Rebate Claim Amount

(Combine Line 25 and 26)

Under penalties of law, I declare that the amount of sales or use tax for which I am submitting this claim for refund has NOT been refunded or credited to me by the Department or the seller to whom the tax was previously paid. I will immediately send payment for any such duplicate refund to the Arkansas Department of Finance & Administration; PO Box 3566, Little Rock, AR 72203-3566.

Mail To: SALES & USE TAX SECTION |

Contact: |

Phone: 501-682-7105 |

P O. BOX 3566 |

|

Fax: 501-682-7904 |

LITTLE ROCK, AR 72203-3566 |

|

Web site: www.state.ar.us/salestax |

State of Arkansas

Department of Finance and Administration

Claim for Additional Local Tax Eligible for Rebate

Instructions

Qualifying businesses may be eligible for a rebate or refund of the additional local tax paid on qualifying business purchases on purchase invoices that exceed $2500.00. A qualifying business purchase means a purchase of tangible personal property or a taxable service for which a business may claim a business expense deduction or depreciation deduction for federal income tax purposes. The purchase will be eligible even though the business purchaser may not be required to file an income tax return. Some examples are governmental agencies (including schools and colleges or universities) and non-profit organizations (including churches).

For purposes of determining the rebate or refund amount a uniform single transaction definition has been adopted effective January 1, 2008:

“Single transaction shall mean any sale of tangible personal property or taxable service reflected on a single invoice, receipt, or statement for which an aggregate sales or use tax amount has been reported or remitted to the state for a single local taxing jurisdiction.”

Refunds or rebates will no longer be issued by the city or county for purchases made on or after January 1, 2008.

There is a six month time limit on requesting a rebate which begins on the date of the purchase or from the date of payment of the tax to the seller, whichever is later.

To request a refund the customer will complete a Claim for Local Tax Rebate form which requires a listing of invoices on which the city and county sales and use tax was paid in the state of Arkansas. The completed form shall be submitted by the customer to the Sales and Use Tax Section along with photocopies of each of the invoices.

WHO MAY FILE A CLAIM FOR LOCAL TAX REBATES

In order to request a refund of the local sales and use tax for qualifying purchases, the purchaser should complete Form Number ET-179A and the supplemental schedule Form Number ET-179B, if needed. The form requires a listing of the invoices on which the local tax has been paid to the seller and a determination of the amount of refund owed to the purchaser as well as photocopies of the invoices for which the refund is being requested. The completed form and copies of the invoices should be mailed to:

DFA Local Tax Rebate Unit

P O Box 3566

Little Rock, AR 72203 3566

Photocopies of all invoices to support the claim for refund must be attached before the request will be processed The invoice should provide an invoice date, invoice number, seller name and address, items or materials purchased, purchase price of items or materials purchased, and the amount of city and county sales and use tax paid.

Questions regarding local tax rates, or the local tax rebates in general may be addressed to the Sales and Use Tax Section at (501) 682-7105.

INSTRUCTIONS FOR COMPLETING LOCAL TAX REBATE FORM ET-179A

Blocks (1) - (6) Company Information

Enter the name, federal ID, and mailing address of the business that is requesting the local cap rebate.

Blocks (7) - (15) Complete this section if you do not have a current Arkansas Sales Tax or Use Tax Permit

Enter the owner’s name and business NAICS code (NAICS codes are listed on our web page at www.state.ar.us/salestax. Select the business type. Enter the business location address and a business contact name and telephone number.

Blocks (16) – (19) Invoice Information

Enter the invoice number, the invoice date, and the city and county listed on the invoice. Enter each city or county on a separate line. A complete list of Arkansas local city and county rates and local city and county codes are listed on our web page at www.state.ar.us/salestax.

Additional invoices may be listed on supplemental form ET-179B.

Blocks (20) – (27) Local Cap Rebate Calculations

Block 20: Invoice Amount: Enter the invoice total amount less tax paid.

Block 21: Standard Cap Amount: $2,500.00 per local per invoice.

Block 22: Invoice Amount Less Cap: Subtract block 21 from block 20 and

Enter the difference in Block 22

Block 23: Local Tax Rate: Enter the local tax rate.

Block 24: Rebate Amount: Multiply block 22 times block 23. Enter the result.

Block 25: Rebate Claim Amount: Enter total of rebate claim amount(s) listed in block 24.

Block 26: Rebate Claim Amount Sub-Total: Enter total of rebate claim amount from supplemental sheet.

Block 27: Total Rebate Claim Amount:- Add blocks 25 and 26

Enter total rebate claim amount.

Blocks (28) – (29) Signature and Date Signature of person authorized to request refund on behalf of the business submitting claim and date of claim.

Photocopies of all invoices must be attached to the request before the request will be processed.