Sick Leave Credit Escrow Application

Wis. Stat. § 40.05 (4) (b)

Wisconsin Department

of Employee Trust Funds

PO Box 7931

Madison WI 53707-7931

1-877-533-5020 (toll free) Fax 608-267-4549 etf.wi.gov

To escrow means to preserve or bank your sick leave credits for use at a later date. See the next page for additional important information and application deadlines. Make a copy for your records and return the original to ETF.

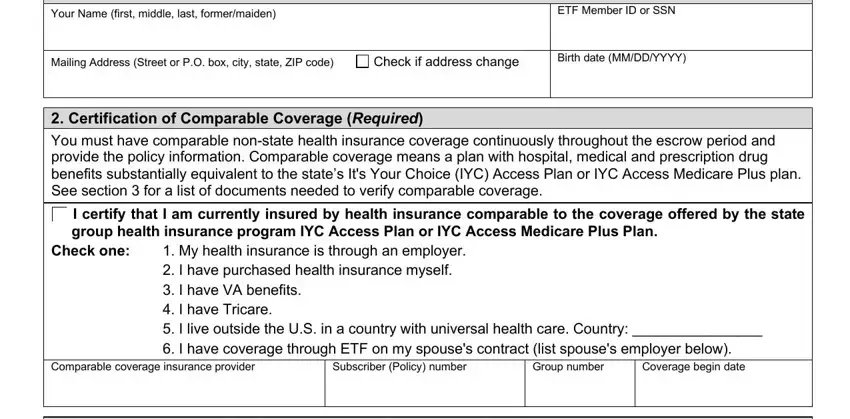

1. Information About You

Your Name (first, middle, last, former/maiden)

Mailing Address (Street or P.O. box, city, state, ZIP code)

2. Certification of Comparable Coverage (Required)

You must have comparable non-state health insurance coverage continuously throughout the escrow period and provide the policy information. Comparable coverage means a plan with hospital, medical and prescription drug benefits substantially equivalent to the state’s It's Your Choice (IYC) Access Plan or IYC Access Medicare Plus plan. See section 3 for a list of documents needed to verify comparable coverage.

I certify that I am currently insured by health insurance comparable to the coverage offered by the state group health insurance program IYC Access Plan or IYC Access Medicare Plus Plan.

Check one: 1. My health insurance is through an employer.

2.I have purchased health insurance myself.

3.I have VA benefits.

4.I have Tricare.

5.I live outside the U.S. in a country with universal health care. Country: ________________

6.I have coverage through ETF on my spouse's contract (list spouse's employer below).

Comparable coverage insurance provider

Subscriber (Policy) number

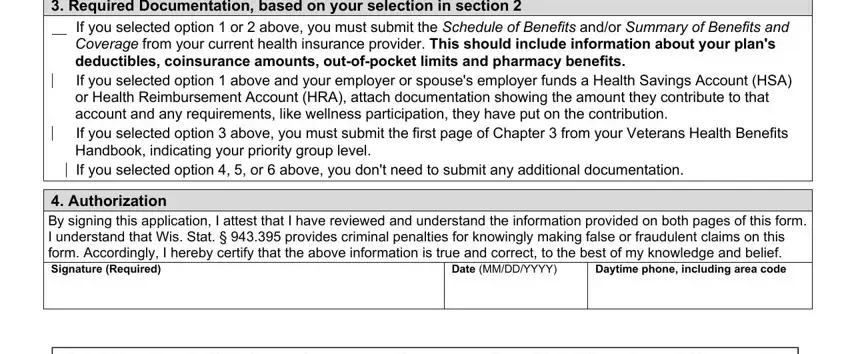

3. Required Documentation, based on your selection in section 2

If you selected option 1 or 2 above, you must submit the Schedule of Benefits and/or Summary of Benefits and Coverage from your current health insurance provider. This should include information about your plan's deductibles, coinsurance amounts, out-of-pocket limits and pharmacy benefits.

If you selected option 1 or 2 above, you must submit the Schedule of Benefits and/or Summary of Benefits and Coverage from your current health insurance provider. This should include information about your plan's deductibles, coinsurance amounts, out-of-pocket limits and pharmacy benefits.

If you selected option 1 above and your employer or spouse's employer funds a Health Savings Account (HSA)

If you selected option 1 above and your employer or spouse's employer funds a Health Savings Account (HSA)

or Health Reimbursement Account (HRA), attach documentation showing the amount they contribute to that account and any requirements, like wellness participation, they have put on the contribution.

If you selected option 3 above, you must submit the first page of Chapter 3 from your Veterans Health Benefits Handbook, indicating your priority group level.

If you selected option 4, 5, or 6 above, you don't need to submit any additional documentation.

If you selected option 4, 5, or 6 above, you don't need to submit any additional documentation.

4. Authorization

By signing this application, I attest that I have reviewed and understand the information provided on both pages of this form. I understand that Wis. Stat. § 943.395 provides criminal penalties for knowingly making false or fraudulent claims on this form. Accordingly, I hereby certify that the above information is true and correct, to the best of my knowledge and belief.

Daytime phone, including area code

Note: Failure to notify ETF when you lose comparable coverage will result in forfeiture of your sick leave credits.

ET-4305 (Rev 5/12/2021) |

* E T - 4 3 0 5 * |

Page 1 of 3 |

Escrow Eligibility Requirements

You must have been covered by the state group health insurance program on the day you terminated state employment either as the subscriber or as a covered dependent and be eligible to convert sick leave credits to pay state health insurance premiums. See the Sick Leave Conversion Credit Program (ET-4132) brochure for more information on eligibility in the Accumulated Sick Leave Conversion Credit Program and examples of comparable coverage.

Application Submission Timeline

•Retiring state employees: You must submit this application to ETF at the same time you submit your retirement application.

•Retired state employees: ETF must receive your escrow application at least 30 days before you wish to cancel your state health insurance coverage. Your sick leave credits will be escrowed at the beginning of the month after ETF receives your signed escrow form if the application was received after the escrow date you specified on the form.

•Survivors of deceased active or retired state employees at the time of the employee’s death: In order to immediately escrow the deceased employee’s sick leave credits and not have them used for the payment of your state health insurance premiums at this time, ETF must receive this escrow application within 90 days after the date of death, or within 30 days of notification by ETF, whichever is later.

Escrow Effective Date

No health insurance premiums are deducted from your sick leave account while it is escrowed. Comparable coverage must be in effect the entire time your coverage is escrowed.

Sick leave credits will be escrowed (banked) as follows:

•State employees in the process of retiring: On the first of the month following the last month your employer paid coverage ended.

•Survivors of deceased active and retired state employees at the time of the employee’s death: On the first of the month following the date of death.

•Retired state employees and survivors of deceased active and retired state employees with state coverage: On the first of the month following the date the escrow application is received by ETF or a later date if specified.

Re-enrollment

You may escrow your sick leave credits at any time during the year, but you can only re-enroll for state health insurance coverage during the annual health benefits open enrollment period unless you have an involuntary loss of your comparable non-state coverage. (See Involuntary Loss of Coverage.) You must also have continuously maintained comparable non-state health insurance coverage while your sick leave credits were in escrow.

ETF annually notifies annuitants, surviving spouses and dependents with escrowed sick leave credits of the fall open enrollment period so that application materials can be obtained. If you do not receive notice and wish to re- enroll, contact ETF in early October. Application materials must be postmarked no later than the last day of the It’s Your Choice open enrollment period.

You can re-enroll for coverage to be effective the first of any month in the following year. You can elect single or family coverage, and choose any plan in the State Group Health Insurance Program without waiting periods or exclusions for pre-existing conditions. You must be re-enrolled before your comparable non-state coverage ceases.

Failure to re-enroll before your comparable non-state coverage ceases will result in forfeiture of your sick leave credits. Once you have re-enrolled, you may escrow your credits again in the future if comparable non-state coverage becomes available to you. You can escrow and re-enroll no more than one time per year.

Involuntary Loss of Coverage

If your eligibility for your non-state comparable coverage is lost, you may re-enroll at that time in any plan in the state group health insurance program. If your coverage was lost as the result of an event such as loss of

If you involuntarily lose your comparable coverage, you may be offered continuation rights for that coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA). You may choose to elect to exercise your COBRA

ET-4305 (Rev 5/12/2021)* E T - 4 3 0 5 *Page 2 of 3

employment or divorce, or your employer’s contribution toward your premium ceases, ETF coverage will be effective on the date your lost coveragezyxwvutsrterminated. Involuntary loss of coverage does not include voluntary cancellation or coverage lost due to fraud, misrepresentation or delinquent premium payments.

• reason eligibility for coverage was terminated, and

• Subscriber name/number and a list of who was covered under the policy.

continuation rights. However, please be aware that if you do not apply to re-enroll in the State of Wisconsin Group Health Insurance Program within 30 days after your (pre COBRA) comparable coverage ends, your re-enrollment is restricted to enrolling during the annual health benefits open enrollment (referenced in number 1). There is no enrollment period available at the time that your COBRA coverage ends.

Your re-enrollment application must be received within 30 days of the date your non-state coverage ends. You must also send a letter from the employer or organization providing the health insurance coverage. ETF requires documentation including the following items on letterhead from the previous insurer and/or the former employer where at least the insurer’s document is dated and issued after termination of coverage. You may also submit a COBRA notice received from your former employer.

• name of organization formerly providing coverage,

• name of the insurance group,

•date coverage terminated,

Important Medicare Information

Upon re-enrolling, you and/or your insured dependents must be enrolled for both portions of Medicare (Hospital Part A and Medical Part B), when first eligible. This is required by state statute, as the program is designed to integrate with, rather than duplicate, Medicare benefits.

If your Medicare Parts A and B coverage are not effective on or before the first of the month in which you are required to be enrolled in Medicare, you may be liable for the claims that Medicare would have paid.

It is your responsibility to notify us when other family members covered under your policy become eligible for Medicare or become covered under an employer group health plan as a result of active employment and that policy is the primary payer for Parts A and B charges. This will ensure that your coverage and premium amount remain correct.

You may contact ETF at 1-877-533-5020 to speak with a specialist regarding your retirement benefits.

ET-4305 (Rev 5/12/2021) zyxwvutsr* E T - 4 3 0 5 *Page 3 of 3

Nondiscrimination and Language Access

42 U.S. Code § 18116

ETF complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability or sex.

ETF provides free aids and services to people with disabilities to communicate effectively with us, such as qualified sign language interpreters and written information in other formats (large print, audio, accessible electronic formats and others). ETF provides free language services to people whose primary language is not English, such as qualified interpreters and information written in other languages.

If you need these services, contact ETF at 1-877-533- 5020; TTY: 711.If you believe that ETF has failed to provide these services or discriminated in another way on the basis of race, color, national origin, age, disability or sex, you can file a grievance with:

ETF Office of Policy, Privacy & Compliance

P.O. Box 7931

Madison, WI 53707-7931

1-877-533-5020; TTY: 711

Fax: 608-267-4549

Email: ETFSMBPrivacyOfficer@etf.wi.gov

If you need help filing a grievance, ETF’s Office of Policy, Privacy & Compliance is available to help you. You can also file a civil rights complaint with the U.S. Department of Health and Human Services, Office for Civil Rights, electronically through the Office for Civil Rights Complaint Portal at crportal.hhs.gov/ocr/portal/lobby.jsf or by mail or phone:

U.S. Department of Health and Human Services

200 Independence Avenue, SW

Room 509F, HHH Building

Washington, D.C. 20201

1-800-368-1019; 1-800-537-7697 (TDD)

Complaint forms are available at hhs.gov/ocr/office/file/index.html.

The Wisconsin Department of Employee Trust Funds is a state agency that administers the Wisconsin Retirement System pension, health insurance and other benefits offered to eligible government employees, former employees and retirees.

Spanish – ATENCIÓN: si habla español, tiene a su disposición servicios gratuitos de asistencia lingüística. Llame al 1-877-533-5020 (TTY: 711).

Hmong – LUS CEEV: Yog tias koj hais lus Hmoob, cov kev pab txog lus, muaj kev pab dawb rau koj. Hu rau 1-877-533- 5020

(TTY: 711).

Chinese– 注意:如果您使用繁體中文,您可以免費獲得

語言援助服務。請致電 1-877-533-5020 (TTY:711)

German – ACHTUNG: Wenn Sie Deutsch sprechen, stehen Ihnen kostenlos sprachliche Hilfsdienstleistungen zur Verfügung. Rufnummer: 1-877-533-5020 (TTY: 711).

Pennsylvania Dutch – Wann du [Deitsch (Pennsylvania German / Dutch)] schwetzscht, kannscht du mitaus Koschte ebber gricke, ass dihr helft mit die englisch Schprooch. Ruf selli Nummer uff: Call 1-877-533-5020 (TTY: 711).

ໂປດຊາບ ຖ້າວ່າ ທ່ານເວ້າພາສາ ລາວ ການບໍ

Laotian/Lao – : ົ ,

ິລການຊວຍເຫ່ ືຼອດານພາສາ້ , ໂດຍບ່ໍເສັຽຄາ່, ແມນມີ່ພ້ອມໃຫ້ ທ່ານ. ໂທຣ 1-877-533-5020 (TTY: 711).

French – ATTENTION : Si vous parlez français, des services d'aide linguistique vous sont proposés gratuitement. Appelez le 1-877-533-5020 (ATS : 711).

Polish – UWAGA: Jeżeli mówisz po polsku, możesz skorzystać z bezpłatnej pomocy językowej. Zadzwońpod

numer 1-877-533-5020 (TTY: 711).

Arabicﺔﺣﺎﺘﻣ ةﺪﻋﺎﺴﻣ– ﺔﻣﺪﺧ كﺎﻨﮭﻓ ،ﺔﯿﺑﺮﻌﻟا ﺔﻐﻠﻟا ثﺪﺤﺘﺗ ﺖﻨﻛ اذإ :ﺔﻈﺣﻼﻣ ﻢﻗﺮﻟﺎﺑ ﻞﺼﺗا :ﻒﯾرﺎﺼﻣ يأ نود ﻚﺘﻐﻠﺑ

(711 :ﻢﻜﺒﻟاو ﻢﺼﻟا ﺔﻣﺪﺧ) 1-877-533-5020

Russian – ВНИМАНИЕ: Если вы говорите на русском языке, то вам доступны бесплатные услугиперевода. Звоните 1-877-533-5020 (телетайп: 711).

Korean – 주의: 한국어를 사용하시는 경우, 언어 지원 서비스를 무료로 이용하실 수 있습니다.

1-877-533-5020 (TTY: 711)번으로 전화해 주십시오.

Vietnamese – CHÚ Ý: Nếu bạn nói Tiếng Việt, có các dịch vụ hỗ trợ ngôn ngữ miễn phí dành cho bạn. Gọi số 1-877-533-5020 (TTY: 711).

Hindi – �ान द�:यिद आप िहदींबोलते ह� तो आपके �लए मु� म� भाषा सहायता सेवाएं उपल�1-ह877�।-533-5020 (TTY:

711) पर कॉल कर�।

Albanian – KUJDES: Nëse flitni shqip, për ju ka në dispozicion shërbime të asistencës gjuhësore, papagesë. Telefononi në 1-877-533-5020 (TTY: 711).

Tagalog – PAUNAWA: Kung nagsasalita ka ng Tagalog, maaari kang gumamit ng mga serbisyo ng tulong sa wika nang walang bayad. Tumawag sa 1-877-533-5020 (TTY:

711).

ET-8108 (REV 7/23/2020) |

Page 1 of 1 |

If you selected option 1 or 2 above, you must submit the

If you selected option 1 or 2 above, you must submit the  If you selected option 1 above and your employer or spouse's employer funds a Health Savings Account (HSA)

If you selected option 1 above and your employer or spouse's employer funds a Health Savings Account (HSA) If you selected option 4, 5, or 6 above, you don't need to submit any additional documentation.

If you selected option 4, 5, or 6 above, you don't need to submit any additional documentation.