The ET-5351 form, a crucial document managed by the Department of Employee Trust Funds (ETF), possesses significant importance for both employers and employees within the context of Income Continuation Insurance (ICI) claims. This form serves a dual purpose: it not only facilitates the application process for employees seeking ICI benefits but also ensures that employers provide essential employment and salary details to the ETF. Specific elements such as the employee's name, social security number, occupation, salary details, and the nature of their employment status are meticulously captured to assess eligibility and compute benefits accurately. Furthermore, the form addresses various scenarios, including changes in appointment, salary adjustments, and eligibility for worker's compensation, which can influence the calculation of ICI benefits. Employers are also instructed to report sick leave accruals, premium payments, and any elected supplemental ICI coverage, thereby offering a comprehensive view of the employee's situation. By meticulously adhering to the instructions and submitting accurate information, employers play a pivotal role in ensuring their employees can access the financial support offered by ICI benefits during times of need.

| Question | Answer |

|---|---|

| Form Name | Form Et 5351 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | et5351 wt7 form |

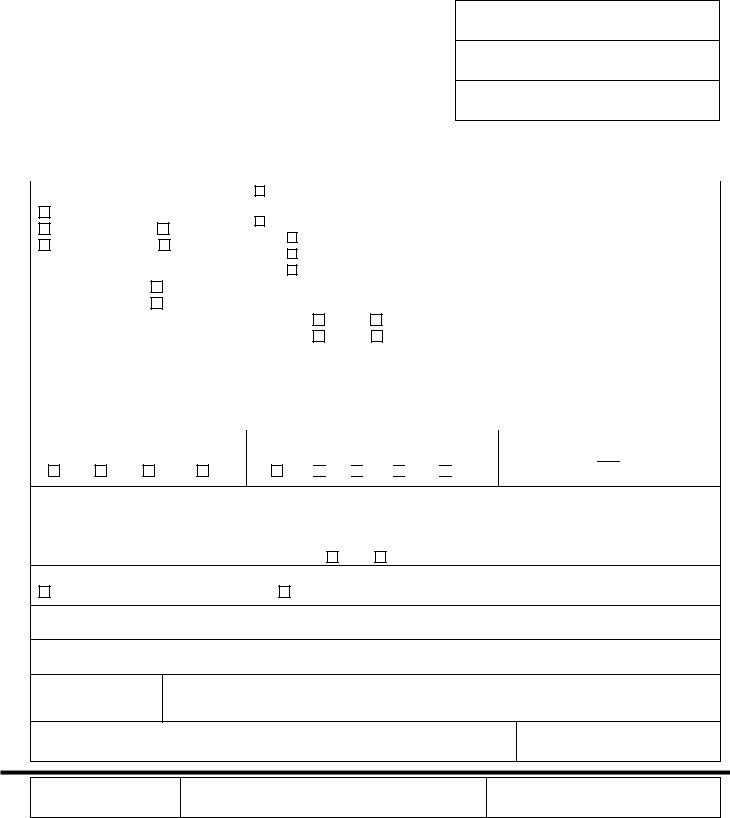

Department of Employee Trust Funds (ETF)

INCOME CONTINUATION INSURANCE (ICI)

EMPLOYER STATEMENT

Wis. Stat. § 40.61 and 40.62

INSTRUCTIONS TO EMPLOYER:

Employee Name

Social Security Number

Employer Identification Number

The employee named below is applying for an ICI benefit. Please follow

the detailed instructions on the back of this form and return it to the Department of Employee Trust Funds (ETF) promptly. Benefits cannot be computed until this form is received and processed.

Occupation (Title) |

|

|

|

|

|

Previous Calendar Years Salary |

|

Last Day Worked |

|

|

|

Last Day Paid |

|||||||||||||||||||||||

|

Seasonal/Academic Yr |

|

|

|

|

|

|

|

|

|

|

(MM/DD/CCYY) |

|

|

|

(MM/DD/CCYY) |

|||||||||||||||||||

|

|

Projected Salary: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Permanent |

|

|

Project |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

New Hire |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

LTE |

|

|

Per Diem |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

Change in Appointment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Change in Hourly Rate* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Monthly Salary |

|

Full Time |

|

|

|

|

Has claim been filed for |

Worker’s Comp. Effective |

Weekly Worker’s |

||||||||||||||||||||||||||

|

|

|

|

|

Part Time |

|

|

|

|

Worker’s Comp? |

Date |

|

|

|

|

|

|

|

|

|

|

|

Comp Amount |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

$ |

|

|

|

Part Time Percent |

% |

|

Yes |

No |

Paid Thru |

|

$ |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

Denied |

Pending |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

(State Only) Total Sick Leave Shown to hundredths of |

|

(State Only) Date Sick Leave is |

Premium Category/Elimination Period |

||||||||||||||||||||||||||||||||

an |

|

|

|

|

Exhausted (MM/DD/CCYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

Year |

|

|

|

|

Year |

|

Year |

|

Current Year |

||||||||||||||||||||||

Accumulated Hrs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Earned Hours |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total Hours |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elimination Period- Calendar Days

30 |

90 |

125 |

180 |

(Locals Only)

Elimination

30 60 90 120 180

Premiums are Paid Through (MM/DD/CCYY)

(Locals Only) Percentage of Premium Paid by Employer in Prior Years:

20 |

|

20 |

|

|

|

20 |

|

|

|

Current Year |

|||||||

|

|

|

|

% |

|

|

|

|

% |

|

|

|

|

% |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Claimant has elected the supplemental ICI Coverage. |

Yes |

No |

|

|

|

||||||||||||

(State Only) Claimant Has Elected To: Use a Max. of 130 Days of Sick Leave

Bank All Sick Leave After: |

|

(MM/DD/CCYY) |

Employer (CIRCLE: STATE OR LOCAL) |

Division (STATE) |

Central Payroll Code Number (STATE) |

I understand Wis. Stat. § 943.395 provides penalties for knowingly making false or fraudulent claims on this form and hereby certify that, to the best of my knowledge and belief, the above information is true and correct.

Date (MM/DD/CCYY)

Authorized Employer Signature

Employer contact

Employer Telephone No.

()

Date Sent to Employer:

Sent by:

Telephone Number:

FAX:

Employer Instructions

1.Complete this form as quickly as possible and

2.For State or Local employees, report the last day paid for any vacation, holiday or compensatory time paid after the elimination period. For Local employees only, report last day paid for any sick leave paid in addition to any vacation, holiday or compensatory time paid after the elimination period.

3.Monthly Salary –

To determine benefits as of the date of disability, the average monthly salary is determined by using the:

Previous calendar year salary, rounded to the next higher thousand and divide by 12.

OR

If there is a new hire or a permanent change in appointment, estimate the base salary (including

* NOTE: If the employee has received a permanent change in the hourly rate (and is not a new hire or did not have a change in appointment), report the higher of:

Previous calendar year salary. OR

Projected salary.

4.For State employees, report the accumulated sick leave hours as of the employee’s last day worked, plus any additional sick leave earned while continuing in pay status. Report sick leave in hours and hundredths of hours (2 decimal places), not minutes.

5.For most State employees who work a standard Monday – Friday work week, sick leave is not utilized on paid legal holidays and thus extends the date sick leave is exhausted.

6.For State employees, an ICI claimant who has applied for a Wisconsin Retirement System disability, Long Term Disability Insurance (LTDI) benefit, or duty disability benefit may convert (bank) sick leave to pay for health insurance premiums and begin ICI benefits at an earlier date. Determine, with the employee, the date through which sick leave is to be used. If the permanent disability is not approved, the date through which sick leave was used will have to be adjusted. Attach written documentation to this form, which verifies the employee’s decision to bank sick leave after a specified date.

7.Continue to collect premiums, for eligible employees, until you receive written notice of approval of the claim. Note that no premiums can be accepted after employment is terminated.

8.Under “Premium Category,” fill in the premium category or selected elimination period for the year in which the disability began (current year) as well as the previous three calendar years.

9.Indicate whether the employee is enrolled in the supplemental ICI coverage.

10.After completion, please make a copy of this form for your records for future reference.

11.Please include your