Dealing with PDF documents online is definitely very simple with our PDF editor. You can fill out 706 form et here painlessly. To have our tool on the cutting edge of convenience, we strive to put into action user-driven capabilities and enhancements regularly. We are routinely happy to get suggestions - play a pivotal role in revampimg how you work with PDF forms. To get the ball rolling, consider these easy steps:

Step 1: Click the "Get Form" button at the top of this page to open our editor.

Step 2: As soon as you start the PDF editor, there'll be the document made ready to be filled in. Besides filling in various blank fields, you may also do various other actions with the PDF, that is writing custom text, editing the original text, inserting images, putting your signature on the form, and much more.

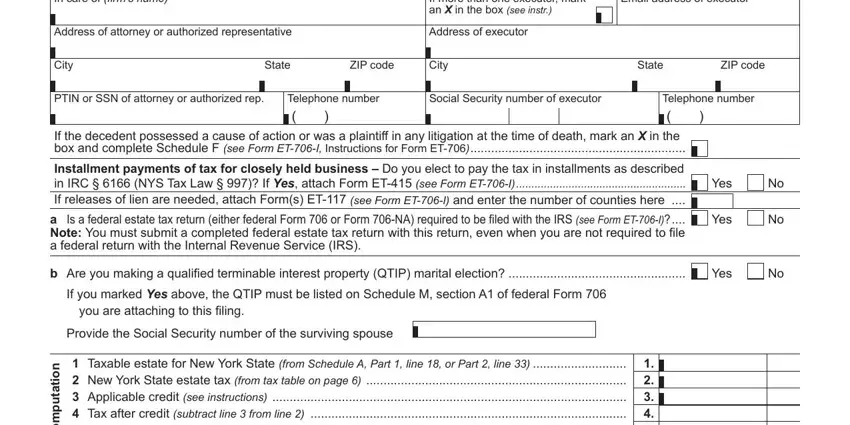

This PDF form will need you to provide some specific details; in order to guarantee accuracy and reliability, make sure you heed the following tips:

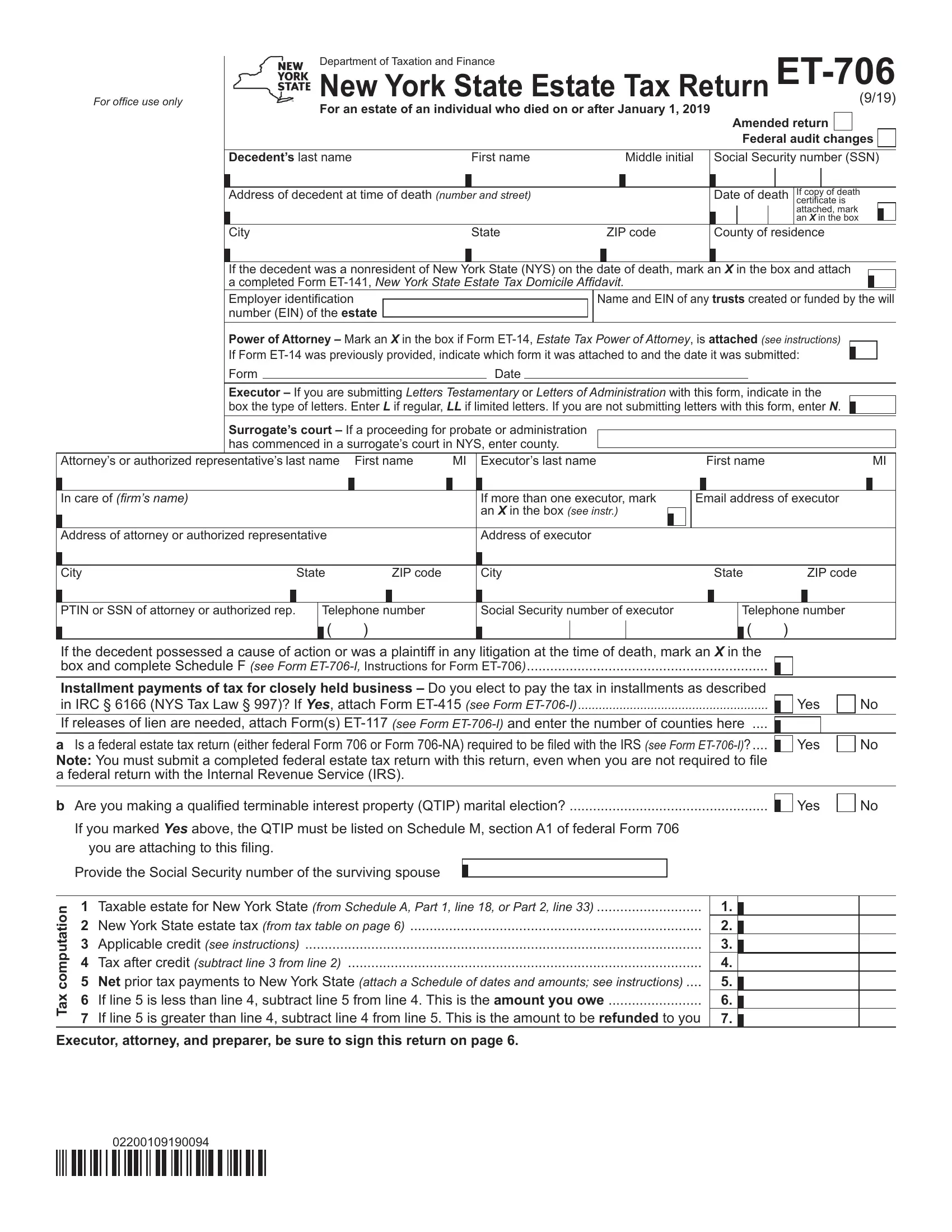

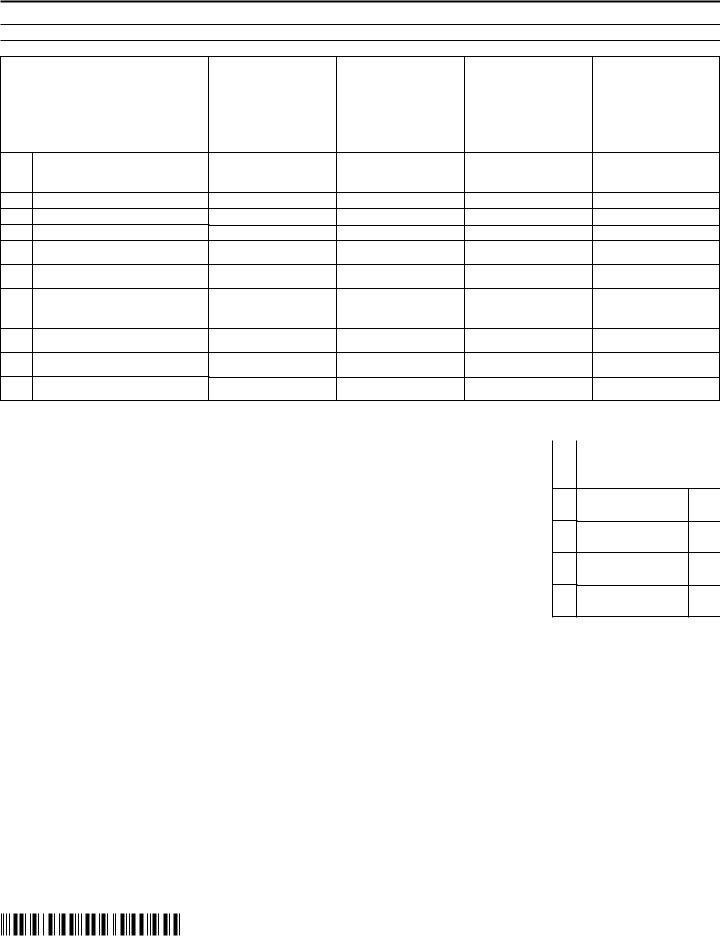

1. To start off, when filling in the 706 form et, begin with the part that has the next fields:

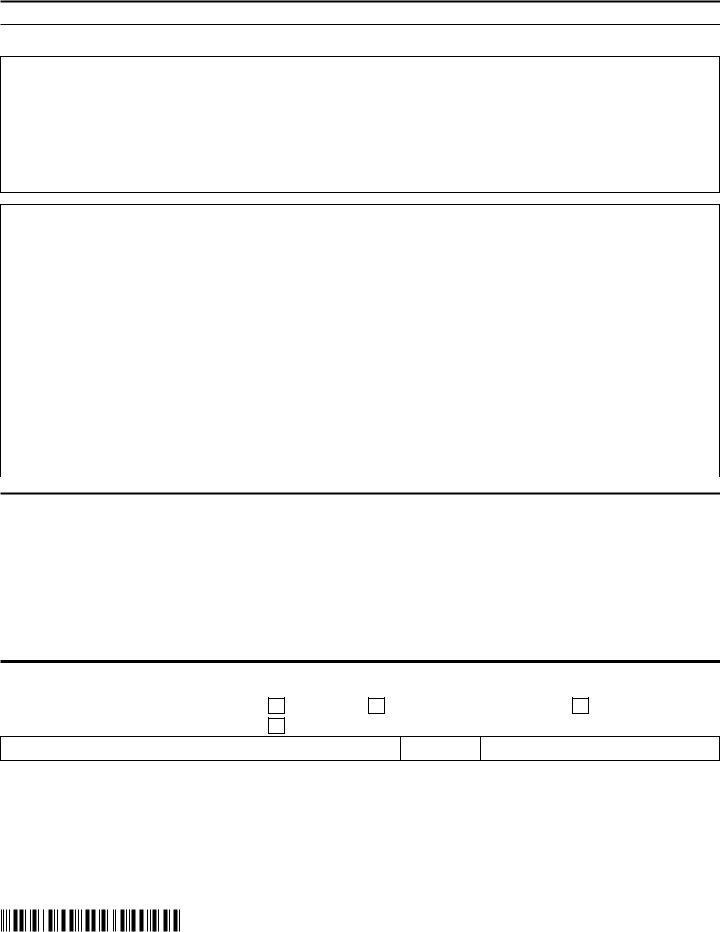

2. Immediately after this array of blank fields is completed, go on to type in the relevant details in these: In care of firms name, If more than one executor mark an, Email address of executor, Address of attorney or authorized, Address of executor, City, State, ZIP code, City, State, ZIP code, Telephone number, Social Security number of executor, PTIN or SSN of attorney or, and Telephone number.

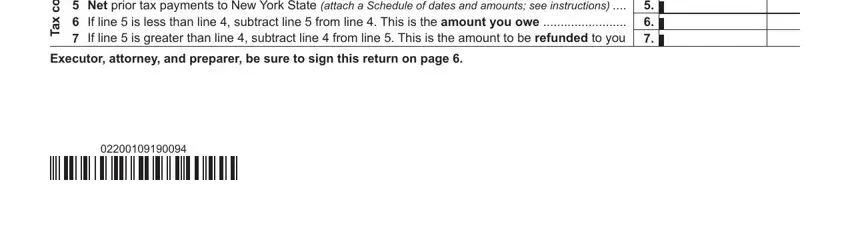

3. This next part is generally simple - fill out all of the empty fields in n o i t a t u p m o c x a T, Taxable estate for New York State, and Executor attorney and preparer be to conclude the current step.

Always be extremely careful when completing n o i t a t u p m o c x a T and Executor attorney and preparer be, since this is where many people make a few mistakes.

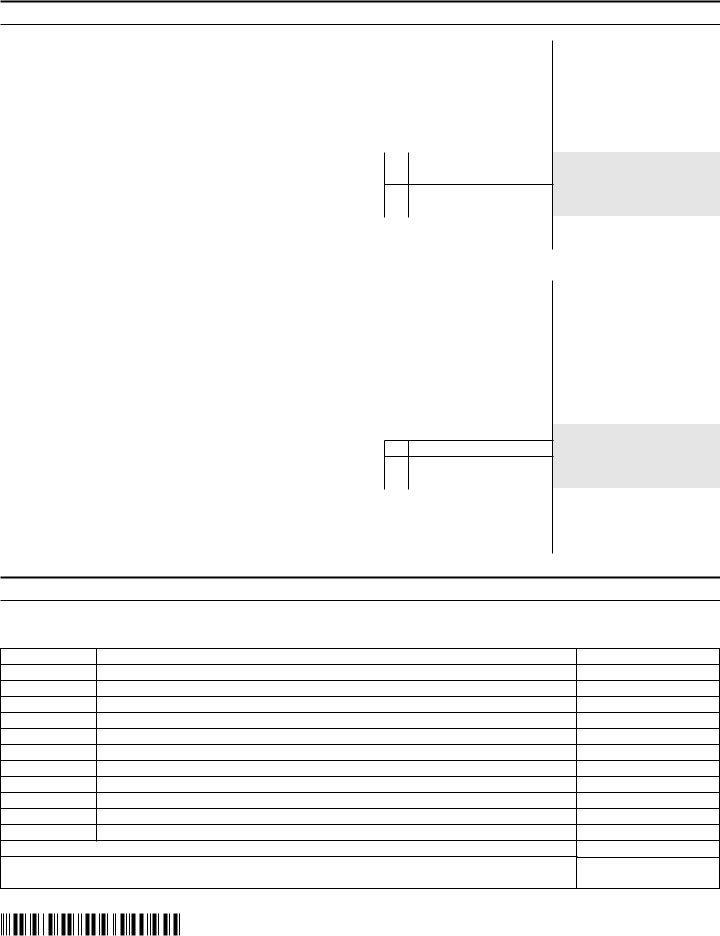

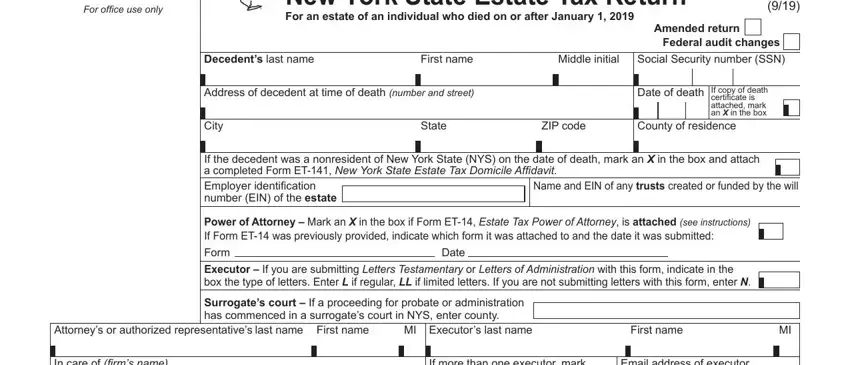

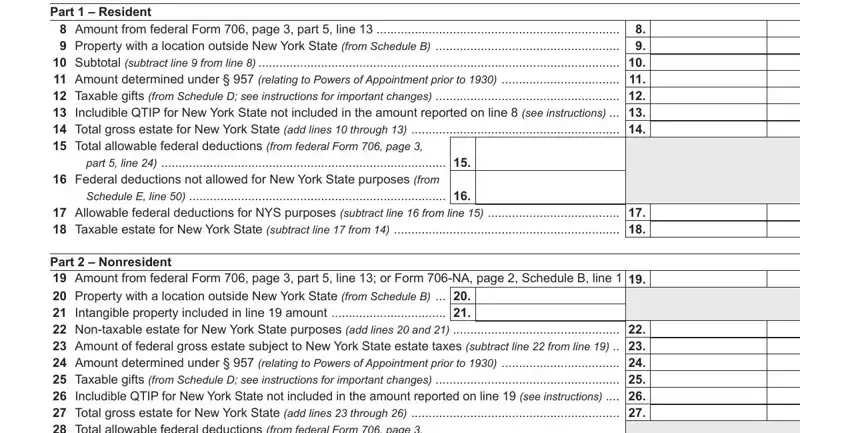

4. This next section requires some additional information. Ensure you complete all the necessary fields - Part Resident Amount from, Schedule E line, part line, and Part Nonresident Amount from - to proceed further in your process!

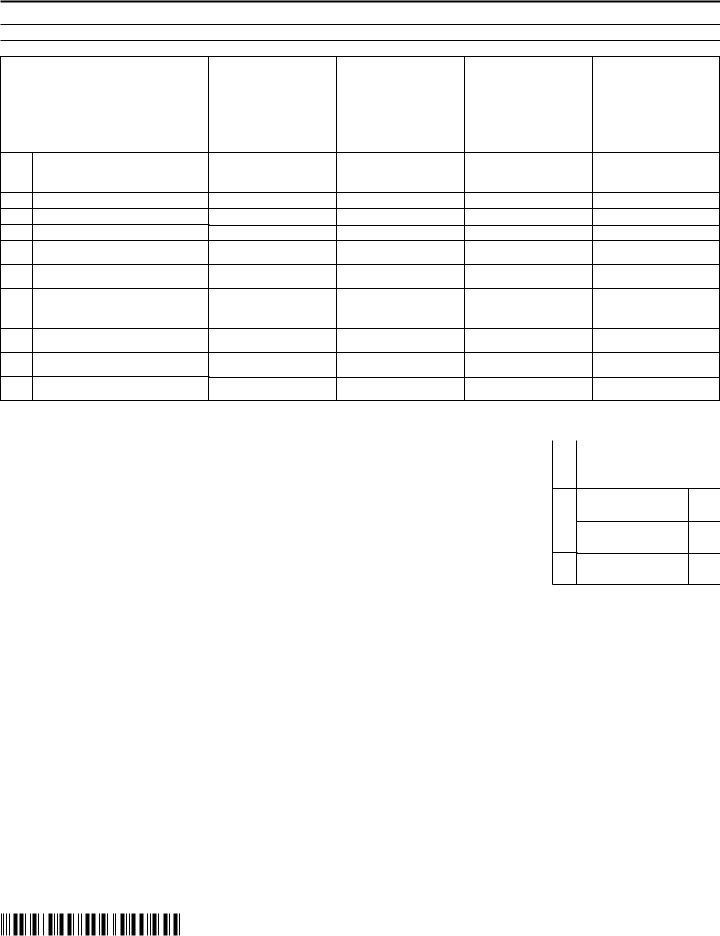

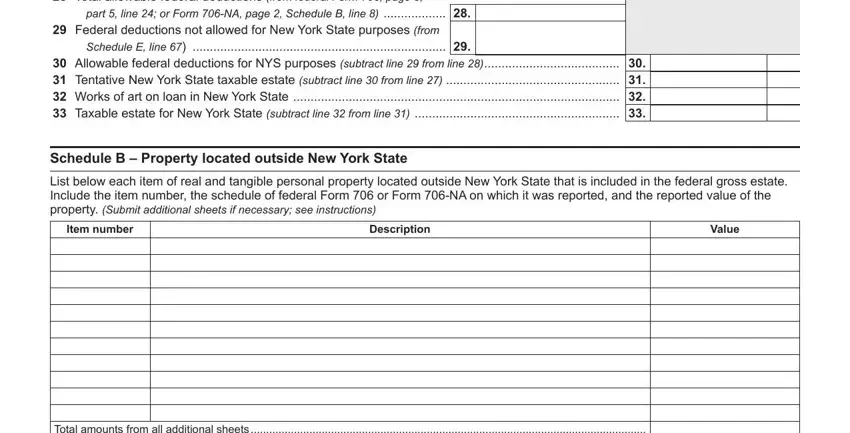

5. Because you near the end of this form, there are a few more things to undertake. Mainly, Part Nonresident Amount from, Schedule E line, part line or Form NA page, Schedule B Property located, List below each item of real and, Item number, Description, Value, and Total amounts from all additional must all be done.

Step 3: Right after double-checking the entries, press "Done" and you are all set! Download your 706 form et once you register online for a free trial. Instantly gain access to the pdf inside your FormsPal account page, along with any edits and changes all preserved! When you use FormsPal, you'll be able to complete documents without needing to worry about database incidents or records being distributed. Our protected system makes sure that your private data is maintained safe.