Form ST3 instructions (continued)

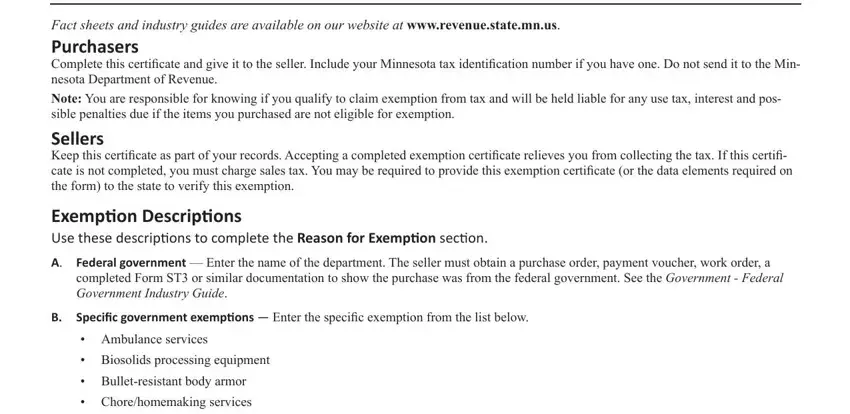

G.Religious organizations — Churches and other religious organizations operated exclusively for religious purposes can use Form ST3 without exempt status authorization or may apply for exempt status authorization from the department. This exemption may not be used for the purchase of lodging or prepared food. See the Nonprofit Organizations Industry Guide.

H.Resale — Items or services must be purchased for resale in the normal course of business. You may not use this exemption if the vendor is restricted by federal or state law from selling certain products for resale. Liquor retailers cannot sell alcoholic beverages exempt for resale. M.S.340A.505

I.Qualifying Capital Equipment — Machinery and equipment purchased or leased primarily for manufacturing, fabricating, mining, or refining tangible personal property to be sold ultimately at retail if the machinery and equipment are essential to the integrated production process.

Additional information needs to be provided when the CE exemption is claimed for a construction project that would normally be consid- ered an improvement to real property. The purchaser must provide documentation to the contractor to identify the exempt portion of the project.

See Fact Sheet 103, Capital Equipment and Fact Sheet 128, Contractors.

J.Agricultural production — Materials and supplies used or consumed in agricultural production of items intended to be sold ultimately at retail. Does not cover furniture, fixtures, machinery, tools (except qualifying detachable tools and special tooling) or accessories used to produce a product. See the Agricultural and Farming Industry Guide.

K.Industrial production — Materials and supplies used or consumed in industrial production of items intended to be sold ultimately at retail. Does not cover furniture, fixtures, machinery, tools (except qualifying detachable tools and special tooling) or accessories used to produce a product. See Fact Sheet 145, Industrial Production.

L.Direct pay — Allows the buyer to pay sales tax on certain items directly to the state instead of to the seller. Applicants must be registered to collect sales tax in order to qualify and must apply for and receive direct pay authorization from the department. The State of Minne- sota (all state agencies) has direct pay authorization. This means state agencies pay sales tax directly to the department, rather than to the seller. Direct pay authorization may not be used for meals and drinks; lodging or related lodging services; admissions to places of amuse- ment or athletic events, or use of amusement devices; motor vehicles; certain services; or memberships to sports and athletic facilities. If you sell any of the excluded items, you should charge sales tax.

M.Multiple points of use — Taxable services, digital goods, or electronically delivered computer software that is concurrently available for use in more than one taxing jurisdiction at the time of purchase. Purchaser is responsible for apportioning and remitting the tax due to each taxing jurisdiction.

N.Direct mail —Allows the buyer to pay sales tax on direct mail directly to the state instead of to the seller. Direct mail is printed material that meets the three following criteria:

•It is delivered or distributed by U.S. Mail or other delivery service.

•It is sent to a mass audience or to addresses on a mailing list provided by the purchaser or at the direction of the purchaser.

•The cost of the items is not billed directly to recipients.

O.Other exemptions —

1.Aggregate delivered by a third party hauler to be used in road construction. Charges for delivery of aggregate materials by third party haulers are exempt if the aggregate will be used in road construction.

2.Airflight equipment. The aircraft must be operated under Federal Aviation Regulations, parts 91 and 135. See the Aircraft Industry Guide.

3.Ambulance services — privately owned (leases of vehicles used as an ambulance or equipped and intended for emergency re- sponse). Must be used by an ambulance service licensed by the EMS Regulatory Board under section 144E.10. See Fact Sheet 135, Fire Fighting, Police, and Emergency Equipment.

4.Aquaculture production equipment. Qualifying aquaculture production equipment, and repair or replacement parts used to main- tain and repair it. See the Agricultural and Farming Industry Guide.

5.Automatic fire-safety sprinkler systems. Fire-safety sprinkler systems and all component parts (including waterline expansions and additions) are exempt when installed in an existing residential dwelling, hotel, motel or lodging house that contains four or more dwelling units.

6.Coin-operated entertainment and amusement devices are exempt when purchased by retailers who (1) sell admission to places of amusement, or (2) make available amusement devices. See Fact Sheet 158, Vending Machines and Other Coin-Operated Devices.

7.Construction exemption for special projects under M.S. 297A.71. Certain purchases for the construction of a specific project or facility are exempt under M.S. 297A.71, such as waste recovery facilities. This exemption does not apply to projects for which you must pay sales or use tax on qualifying purchases and then apply for a refund.

8.Exempt publications. Materials and supplies used or consumed in the production of newspapers and publications issued at average intervals of three months or less. Includes publications issued on CD-ROM, audio tape, etc. See Fact Sheet 109, Printing Industry.

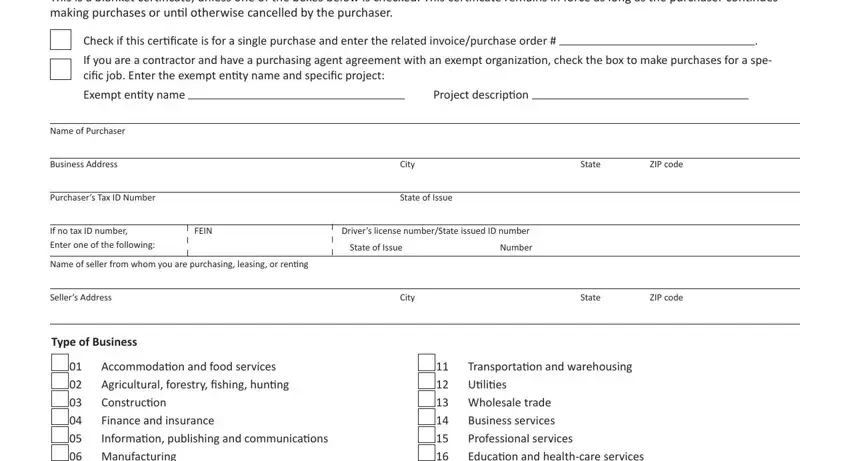

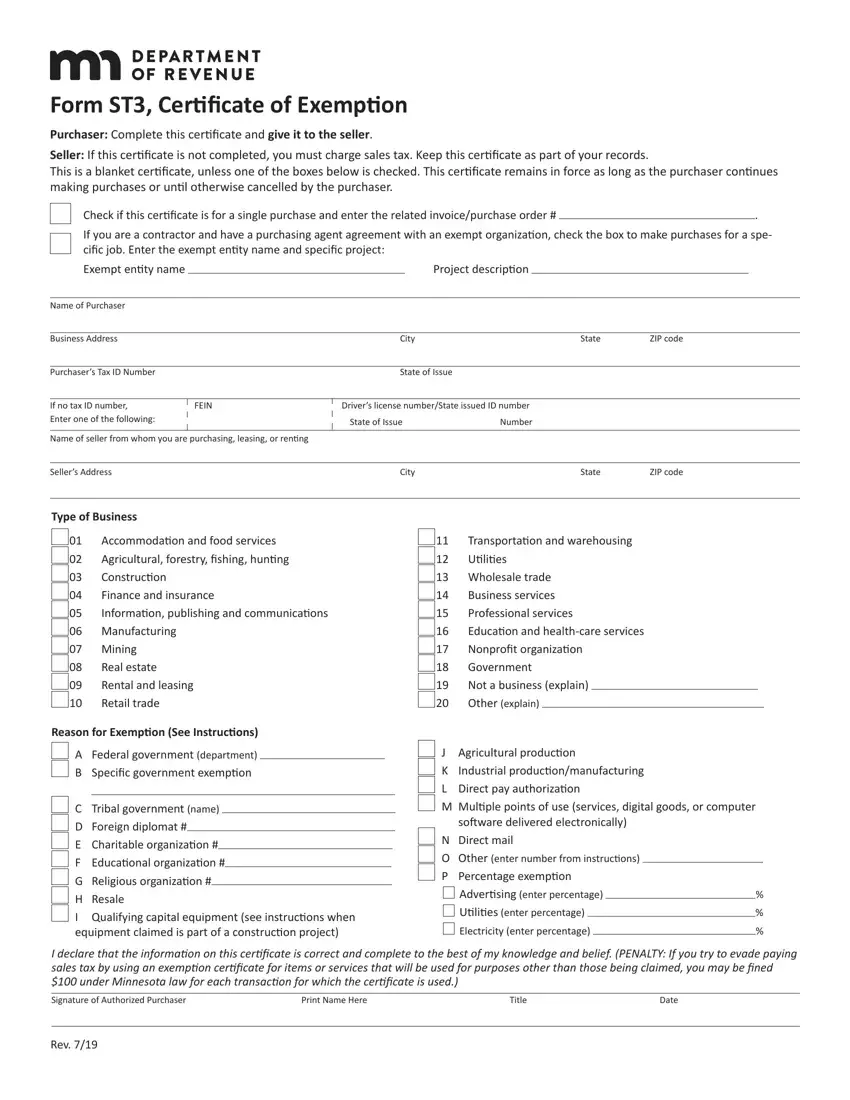

01 Accommodation and food services

01 Accommodation and food services 02 Agricultural, forestry, fishing, hunting

02 Agricultural, forestry, fishing, hunting

03 Construction

03 Construction

04 Finance and insurance

04 Finance and insurance

05 Information, publishing and communications

05 Information, publishing and communications

06 Manufacturing

06 Manufacturing

07 Mining

07 Mining

08 Real estate

08 Real estate 09 Rental and leasing

09 Rental and leasing

10 Retail trade

10 Retail trade